In the most recent article for Control Engineering Magazine, Bundy Group recounts the ten notable automation transactions for the month of April, citing the growth-oriented nature nature and various consolidation opportunities within the industry as key driving factors for increased activity.

The automation market continues to experience a tremendous amount of mergers & acquisitions (M&A) and capital markets activity. Drivers of this activity include the growth-oriented nature of the automation market, the consolidation opportunities within the industry, and the strength of many of the companies operating within it. Furthermore, the automation market has attracted a critical mass of strategic buyers and financial sponsors (i.e. private equity groups, family offices, institutional investors) that are looking to own or invest in companies in the industry. From such, Bundy Group closed automation transactions as Ultimation and MR Systems, our team continues to see strong interest from a range of qualified buyers in the automation segment. Further evidence of the robust M&A and capital placement activity in automation is provided in the below list of transactions.

Bundy Group’s current engagements and owner relationships include control system integration, robotics, automated material handling, automation distribution, artificial intelligence, and cybersecurity. This serves as a leading indicator for submarkets our team anticipates closed transactions in over the coming months. We look forward to providing these relevant updates and transaction announcements to Control Engineering magazine readers.

4/21/24

Siemens AG has signed an agreement to acquire the industrial drive technology (IDT) business of ebm-papst. The business, which employs around 650 people, includes intelligent, integrated mechatronic systems in the protective extra-low voltage range and innovative motion control systems. The planned acquisition will complement the Siemens Xcelerator portfolio and strengthen Siemens’ position as a leading solutions provider for flexible production automation. Learn more.

4/11/24

Graham Partners, an investment firm focusing on advanced manufacturing, has acquired E Tech Group. Based in West Chester, Ohio, E Tech is an industrial automation systems integrator serving various end markets, including life sciences, data centers, consumer packaged goods, and industrial sectors. E Tech collaborates with customers for integration and ongoing operational support of automation solutions in regulated environments. Learn more.

4/8/24

Industrial Device Investments, LLC has initiated a strategic partnership with Wasik Associates, LLC, a leading manufacturer of Electron Beam Processing Systems in Dracut, Massachusetts. Under the leadership of Tom Wasik, the third-generation owner, this collaboration aims to drive technological advancement and market expansion. Learn more.

4/1/24

Lincoln Electric Holdings, Inc. has acquired RedViking, a privately held automation system integrator based in Plymouth, Michigan, U.S. RedViking specializes in the development and integration of state-of-the-art autonomous guided vehicles (AGVs) and mobile robots, custom assembly and dynamic test systems, and proprietary manufacturing execution system (MES) software. Learn more.

3/28/24

Orchard Robotics, the company enabling precision crop management with robots and AI, announced their $3.8M raise, across a seed round led by General Catalyst, and a pre-seed led by Contrary. In this oversubscribed round, they are joined by Humba Ventures, Soma Capital, Correlation Ventures, and VU Venture Partners. Learn more.

3/26/24

VINCI Energies acquires Premiere Automation LLC., an Industrial Controls and Robotics specialist in the USA with their office in Charleston, South Carolina. Premiere Automation provides Project Management, Controls and Robotics Integration and Training Services for clients in the Automotive Industry. Learn more.

3/21/24

SER, a leading global Intelligent Content Automation software vendor in the Enterprise Content Management market, announced that TA Associates, a leading global private equity firm, has agreed to make a strategic growth investment in the Company. SER and Carlyle, an investor in SER since 2018, welcome TA as the new lead investor. Learn more.

3/20/24

Sonepar has entered into an agreement to acquire the Michigan-based distributors, Madison Electric Company and Standard Electric Company. Family-owned and operated since Madison’s founding in 1914, and Standard’s in 1929, Madison and Standard are full-line distributors of electrical and industrial products and services to its contractor and industrial customers, and distribute into, and service, the HVAC and plumbing markets. Learn more.

3/18/24

Fortifi Food Processing Solutions, a leading platform of food processing equipment and automation solutions, has completed its acquisition of REICH Thermoprozesstechnik GmbH, a leader in thermoprocessing systems for red meat, fish, poultry, cheese, pet food, and other food markets. REICH joins a platform that includes other leading brands, such as Bettcher Industries, Frontmatec, and MHM Automation. Learn more.

3/11/24

John Henry Foster Minnesota, Inc. a strategic collection of engineers, support and service teams, compressed air experts, and automation and robotics solutions provider, acquired HTE Technologies, a leading automation supplier operating in Kansas, Missouri, and Illinois. To be run as an independent division of JHFOSTER, the company will continue to serve its existing customer base, operate under its existing brand, and remain at its headquarters in St. Louis. Learn more.

Bundy Group is a boutique investment bank that specializes in representing controls and automation, Internet of Things, and cybersecurity companies in business sales, capital raises, and acquisitions. Over the past 33 years, Bundy Group has advised and closed on over 250 transactions, which includes numerous automation-related transactions. You can learn more at www.bundygroup.com or by contacting Clint Bundy.

In the world of mergers and acquisitions (M&A), the competitive business sale process is a complex yet essential part of the journey. If you're a business owner or a part of a management team considering a business sale or capital raise, understanding this process is crucial. In this piece, the competitive business sale process will be analyzed, the key stages defined, and insights offered to help a business owner better position for a sale or capital raise and a successful outcome.

Goals of a Competitive Sale or Capital Raise: In any M&A transaction, there are two primary objectives that an owner and his advisors should seek.

Transaction Structure: The transaction structure refers to how the buyer and seller organize the different forms of consideration to comprise the total valuation. To learn more, please visit the BG Insights article entitled “Structure: The Backbone of a Mergers & Acquisitions Transaction.”

What is an Investment Banker? Investment bankers play a vital role in M&A transactions. They facilitate the entire process, including advising a company how to best prepare a business for a sale and managing buyer conversations and negotiations to lead to a successfully closed deal. To learn more, please visit the Bundy Group Insights video titled "Why Hire an Investment Banker."

Sellside Quality of Earnings Report: A Sellside Quality of Earnings analysis and report is an in-depth financial audit of the seller’s financials for the purpose of facilitating a transaction. The seller hires an independent transaction accounting firm to complete the analysis and report, and that accounting firm is also in place as a seller advisor throughout the transaction. While the transaction accounting firm focuses on validating historical financials, the investment banking advisor focuses on the future and maximizing value and negotiating leverage. This can be another mechanism to drive value and increase the certainty of a closed deal. To learn more, please visit the Bundy Group Insights video and article titled "The Sellside Quality of Earnings Report."

Unsolicited Offer: An unsolicited offer is an unexpected proposal from a potential buyer who initiates contact without prior engagement from the seller. To learn more, please visit the BG Insights video and article entitled “What is an Unsolicited Offer?”

Business Sale vs. Capital Raise: A competitive sale typically involves selling over 50% of your company’s equity to an outside party, while a capital raise often involves selling less than 50% of a company’s equity or using debt for financing.

The business sale process can be broken down into four distinct phases. Each phase is centered around creating a position of negotiating strength for the seller and driving competition. There are very few strategic buyers or financial sponsors that will put their best foot forward unless they are pushed to do so.

The entire process can typically take 6 to 12 months. However, the process timeline depends on a variety of factors such as the complexity of the business, the quality and accessibility of financial data, the extent of due diligence required, and the intensity of the negotiation phase. Furthermore, hiring an experienced investment banker that understands the best pool of buyers for that industry and can best position the company in a process will have a substantial impact on both the transaction terms and the timeline to close.

Navigating the competitive business sale process in M&A transactions involves a series of well-defined stages, from preparation to closing. A business owner is highly recommended to focus on the following in a competitive process:

A business sale, or capital raise, is a complicated process that could yield tremendous gains for a seller or result in significant amounts of money being left “on the table.” Furthermore, the outcome could produce a quality long-term partner or a new owner that tarnishes the reputation of the company. The best way for an owner to ensure a strong outcome is to run a competitive process, ideally managed by an experienced investment banker, which delivers multiple options to drive an educated decision-making process that minimizes risk and maximizes the quality of the outcome.

In this article for Plant Engineering Magazine, Bundy Group provides a status update on the state of the automation, industrial technology, and plant management sectors during March, reporting seven notable automation transactions.

The automation and industrial technology markets continue to experience a tremendous amount of mergers & acquisitions (M&A) and capital markets activity. Drivers of this activity include the growth-oriented nature of the automation and industrial technology markets, the consolidation opportunities within these industries, and the strength of many of the companies operating within them. Furthermore, the automation and industrial technology sectors have attracted a critical mass of strategic buyers and financial sponsors (i.e. private equity groups, family offices, institutional investors) that are looking to own or invest in companies in the industries. From such, Bundy Group closed transactions as Ultimation and Industrial Electric Machinery, our team continues to see strong interest from a range of qualified buyers in the automation, industrial technology and plant management segments. Further evidence of the robust M&A and capital placement activity is provided in the below list of transactions.

Bundy Group’s current engagements and owner relationships include control system integration, automated material handling, automation distribution, industrial services, and electrical services. This serves as a leading indicator for industries our team anticipates closed transactions in over the coming months. We look forward to providing these relevant updates to Plant Engineering magazine readers.

3/11/24

Walter has acquired PushCorp, Inc., a USA-based, industry-leading manufacturer of robotic end-of-arm-tools for material removal applications, marking a significant stride in its quest to become the leader in productivity solutions for the metalworking industry. This strategic move underscores Walter’s dedication to expanding its capabilities and offerings, ensuring it remains at the forefront of technological advancements within the sector. Learn more.

3/5/24

IPS, a North American leader in the service, engineering, and remanufacturing of electrical, mechanical, and power management assets, has acquired Electric Motor Service Limited. Headquartered in Edmonton, Alberta, EMSL has sold and serviced industrial electric motors and generators in western Canada since 1945. An EASA member, the company also sells, services, and remanufactures industrial and residential water and wastewater pumps. Learn more.

2/27/24

ChampionX Corporation has acquired Artificial Lift Performance Limited, a provider of advanced analytics solutions for enhancing oil and gas production performance. Based in Edinburgh, Scotland, ALP has extensive expertise in developing artificial lift optimization software designed to maximize production and extend the life of artificial lift equipment. Learn more.

2/26/24

Kele, Inc., a portfolio company of The Stephens Group, LLC, acquired AC Controls and AC Technical Services, a distributor and rep of industrial process and combustion applications. The acquisition continues to expand Kele’s footprint within the industrial automation market. ACC will become an integral part of the industrial offerings of The Kele Companies, which includes Lesman Instrument Company (Bensenville, IL) and A-tech Inc. (Tulsa, OK). Learn more.

2/23/24

Wesco International has entered into a definitive agreement to sell its Wesco Integrated Supply business to Vallen Distribution, Inc., a portfolio company of Nautic Partners, LLC, for a purchase price of $350 million. The Company expects to use the proceeds to reduce debt and repurchase shares. The sale will include predominately all of Wesco’s industrial maintenance, repair and operations (MRO) integrated supply business in North America and Europe. Learn more.

2/22/24

Levine Leichtman Capital Partners, a Los Angeles-based private equity firm, has acquired USA Water from Warren Equity Partners in partnership with management. Headquartered in Rosenberg, Texas, USA Water is a leading provider of operations and maintenance (“O&M”) services for water and wastewater systems across the Southeast United States. Learn more.

2/27/24

Duravant LLC, a global engineered equipment and automation solutions provider to the food processing, packaging and material handling sectors, has acquired Ferdinand Henneken GmbH, a leading manufacturer of protein processing solutions headquartered in Bad Wünnenberg, Germany. Learn more.

2/22/24

Levine Leichtman Capital Partners, a Los Angeles-based private equity firm, has acquired USA Water from Warren Equity Partners in partnership with management. Headquartered in Rosenberg, Texas, USA Water is a leading provider of operations and maintenance (“O&M”) services for water and wastewater systems across the Southeast United States. Learn more.

2/22/24

Cadre Holdings, Inc., a global leader in the manufacturing and distribution of safety and survivability equipment, has entered into a definitive agreement to acquire Alpha Safety Intermediate, LLC, the operating parent of Alpha Safety, a leading nuclear safety solutions company for $106.5 million (excluding working capital and certain other adjustments upon closing). Learn more.

In a recent article for Control Engineering Magazine, Bundy Group revisits the seven automation transactions for March, paying close attention to key drivers of increased market activity such as persistent growth and consolidation opportunities along with rising strength of companies within the manufacturing and plant management fields.

The automation market continues to experience a tremendous amount of mergers & acquisitions (M&A) and capital markets activity. Drivers of this activity include the growth-oriented nature of the automation market, the consolidation opportunities within the industry, and the strength of many of the companies operating within it. Furthermore, the automation market has attracted a critical mass of strategic buyers and financial sponsors (i.e. private equity groups, family offices, institutional investors) that are looking to own or invest in companies in the industry. From such, Bundy Group closed automation transactions as Ultimation and MR Systems, our team continues to see strong interest from a range of qualified buyers in the automation segment. Further evidence of the robust M&A and capital placement activity in automation is provided in the below list of transactions.

Bundy Group’s current engagements and owner relationships include control system integration, robotics, automated material handling, automation distribution, artificial intelligence, and cybersecurity. This serves as a leading indicator for submarkets our team anticipates closed transactions in over the coming months. We look forward to providing these relevant updates and transaction announcements to Control Engineering magazine readers.

3/11/24

Walter has acquired PushCorp, Inc., a USA-based, industry-leading manufacturer of robotic end-of-arm-tools for material removal applications, marking a significant stride in its quest to become the leader in productivity solutions for the metalworking industry. This strategic move underscores Walter’s dedication to expanding its capabilities and offerings, ensuring it remains at the forefront of technological advancements within the sector. Learn more.

2/27/24

Duravant LLC, a global engineered equipment and automation solutions provider to the food processing, packaging and material handling sectors, has acquired Ferdinand Henneken GmbH, a leading manufacturer of protein processing solutions headquartered in Bad Wünnenberg, Germany. Learn more.

2/26/24

Kele, Inc., a portfolio company of The Stephens Group, LLC, acquired AC Controls and AC Technical Services, a distributor and rep of industrial process and combustion applications. The acquisition continues to expand Kele’s footprint within the industrial automation market. ACC will become an integral part of the industrial offerings of The Kele Companies, which includes Lesman Instrument Company (Bensenville, IL) and A-tech Inc. (Tulsa, OK). Learn more.

2/22/24

Levine Leichtman Capital Partners, a Los Angeles-based private equity firm, has acquired USA Water from Warren Equity Partners in partnership with management. Headquartered in Rosenberg, Texas, USA Water is a leading provider of operations and maintenance (“O&M”) services for water and wastewater systems across the Southeast United States. Learn more.

2/22/24

Cadre Holdings, Inc. ,a global leader in the manufacturing and distribution of safety and survivability equipment, has entered into a definitive agreement to acquire Alpha Safety Intermediate, LLC, the operating parent of Alpha Safety, a leading nuclear safety solutions company for $106.5 million (excluding working capital and certain other adjustments upon closing). Learn more.

2/21/24

Eyelit Technologies, a leader in Manufacturing Operations Management, Manufacturing Execution, Quality Management, and Factory Automation solutions, has acquired Optessa, a pioneer in optimization and AI-powered advanced planning and scheduling software. The acquisition extends Eyelit Technologies’ footprint into the automotive sector, where Optessa solutions are in use at four of the top 10 automotive original equipment manufacturers. Learn more.

12/11/23

HMS Networks AB, a global provider of industrial information and communication technology, has acquired the Red Lion Controls business, a well-established US-based provider of industrial automation solutions, through the acquisition of 100 percent of the shares in Red Lion Controls Inc. and Red Lion Europe GmbH as well as certain assets in other jurisdictions (“Red Lion”), significantly expanding HMS’ presence in the North American market. Learn more.

Bundy Group is a boutique investment bank that specializes in representing controls and automation, Internet of Things, and cybersecurity companies in business sales, capital raises, and acquisitions. Over the past 33 years, Bundy Group has advised and closed on over 250 transactions, which includes numerous automation-related transactions. You can learn more at www.bundygroup.com or by contacting Clint Bundy.

In this article for Automation World, Clint Bundy, Managing Director at Bundy Group, delves into the current macroeconomic landscape and summarizes the key automation trends and M&A insights detailed at a recent presentation to the Measurement, Control and Automation Association (MCAA) with Bundy Group's Director of Analytics and Consulting, Alex Chausovsky.

Despite initial concerns and varied opinions, 2023 proved to be a strong year with GDP reaching record highs. Based on this, Alex urged MCAA members to focus on the business investment category, particularly in assessing U.S. industrial production. Though a potential decline in the industrial sector is expected over the next few quarters, he expressed optimism for a recovery by the latter part of 2024 and into 2025.

Alex noted that strategic opportunities exist in specific sectors, such as electric vehicles and batteries, semiconductors, food and beverage, life sciences and renewable energy. He advised businesses to leverage this period to prepare for the next growth phase, emphasizing the need for resilience in supply chains and strategic planning.

Other issues addressed in our presentation included:

Insights into the automation M&A market: In 2023, nearly 200 closed transactions were tracked, showcasing a consistent monthly deal flow. This robust activity highlights a high demand for automation companies from both strategic buyers and financial sponsors, making it an opportune time for owners contemplating sales or capital raises. With more $3 trillion in capital seeking investment opportunities in privately held companies, owners have the flexibility to explore a full sale, a majority equity sale, a minority equity sale, or a debt capital raise. The current buyer demand-seller supply imbalance is driving valuations for quality automation firms into a positive direction.

From a buyer's standpoint, there is an attraction towards value-added service providers in the automation sector. The fragmented nature of the automation market provides buyers with opportunities to acquire and consolidate firms by leveraging scale benefits and generating synergies. This will ultimately help investment-minded groups achieve their returns objectives when they eventually sell their automation platforms.

Workforce shortages and the role of automation: Regardless of the sector, a scarcity of talent is a universal concern for business owners. Automation emerges as a key solution to tackle this challenge, with increased digitization and the incorporation of Internet of Things (IoT) technologies playing a corresponding role for resolving this business dilemma. These underlying demand drivers are helping to accelerate the growth of the automation market.

2024 is expected to be a mix of predictable uncertainty with the presidential election and the ongoing maneuvering by the Fed for a post pandemic soft landing. While these factors are likely to have a cooling effect on businesses, investor interest in industrial automation businesses will continue to drive M&A activity. These conflicting drivers make strategic planning more difficult and critically important to the success of your business.

The session “Building and Realizing Business Value: Headwinds and Opportunities Ahead”—to be held at the Control System Integrators Association 2024 Conference in Dallas, TX, April 15-19—will combine insights from a team of experts who have advised numerous system integration business owners on growing and realizing the maximum value from their business with the hands-on experience of other system integrator owners and business leaders.

Topics to be addressed include:

Attendees will walk away from the session with the following actionable insights:

Register at: https://na.eventscloud.com/ereg/newreg.php?eventid=778474&

In this article for Plant Engineering Magazine, Bundy Group details key transactions from February emphasizing the ongoing interest from qualified buyers and continued M&A and capital placement activity in the automation, industrial technology, and plant management sectors.

The automation and industrial technology markets continue to experience a tremendous amount of mergers & acquisitions (M&A) and capital markets activity. Drivers of this activity include the growth-oriented nature of the automation and industrial technology markets, the consolidation opportunities within these industries, and the strength of many of the companies operating within them. Furthermore, the automation and industrial technology sectors have attracted a critical mass of strategic buyers and financial sponsors (i.e. private equity groups, family offices, institutional investors) that are looking to own or invest in companies in the industries. From such, Bundy Group closed transactions as Ultimation and Industrial Electric Machinery, our team continues to see strong interest from a range of qualified buyers in the automation, industrial technology and plant management segments. Further evidence of the robust M&A and capital placement activity is provided in the below list of transactions.

Bundy Group’s current engagements and owner relationships include control system integration, automated material handling, automation distribution, industrial services, and electrical services. This serves as a leading indicator for industries our team anticipates closed transactions in over the coming months. We look forward to providing these relevant updates to Plant Engineering magazine readers.

2/9/24

BBH Capital Partners, the private equity arm of Brown Brothers Harriman & Co. (BBH), completed a minority equity investment in Wolter Inc. Founded in 1962 and headquartered in Brookfield, WI, Wolter specializes in material handling and industrial productivity equipment. Known for its commitment to enhancing client operations, Wolter’s partnership with BBHCP aims to fuel further growth and innovation. Learn more.

2/7/24

Trystar has acquired Wisconsin-based Macromatic Industrial Controls, Inc. to enhance its monitoring and control portfolio offerings and access to additional industrial customers. Headquartered in Waukesha, Wisconsin, Macromatic engineers and manufactures industrial controls, monitoring, and protection products designed to maintain productivity. Learn more.

1/31/24

Blackford Capital, a leading lower middle market private equity firm, has acquired Data Science Automation, an automation engineering services and training firm with operations in Pittsburgh, Pennsylvania and Cleveland, Ohio, that collaborates with its clients to digitally transform and automate laboratory, product, manufacturing, and test systems and applications. Learn more.

1/29/24

Hollysys Automation Technologies Ltd. has agreed to be acquired by a buyer controlled by Ascendent Capital Partners, a Hong Kong-based investment firm. The Special Committee of Hollysys unanimously recommended shareholders vote in favor of the acquisition due to Ascendent’s compelling offer and fully financed proposal. This acquisition reflects Ascendent’s strategic interest in investing in the technology sector. Learn more.

1/25/24

Dynamysk Automation Ltd., a leading provider of instrumentation, controls, and electrical solutions, is pleased to announce its acquisition by Allnorth Consultants Limited, known as Allnorth. Dynamysk, a Canadian company, specializes in delivering fully integrated lifecycle solutions in industrial instrumentation, controls, and electrical disciplines. Learn more.

1/24/24

Rhino Tool House, a leading value-added distributor of intelligent fastening solutions, customized material handling solutions and calibration services to OEMs, has acquired Power Tools & Supply, Inc. Based in Walled Lake, Michigan, Power Tools & Supply has been providing a wide range of assembly tools and material handling solutions to automotive and automation integration customers since 1989. Learn more.

1/23/24

Angeles Equity Partners LLC, a middle-market private equity investment firm focused on the industrial sector, has acquired Acieta LLC, a Waukesha, Wis.-based robotics manufacturer and integrator, from Mitsui & Co. Inc. The terms of the transaction weren’t disclosed. Learn more.

In this article for Control Engineering Magazine, Bundy Group notes the nine notable transactions for the month of February, highlighting the positive market trends and acknowledging the various opportunities and strengths within the automation industry.

The automation market continues to experience a tremendous amount of mergers & acquisitions (M&A) and capital markets activity. Drivers of this activity include the growth-oriented nature of the automation market, the consolidation opportunities within the industry, and the strength of many of the companies operating within it. Furthermore, the automation market has attracted a critical mass of strategic buyers and financial sponsors (i.e. private equity groups, family offices, institutional investors) that are looking to own or invest in companies in the industry. From such, Bundy Group closed automation transactions as Ultimation and MR Systems, our team continues to see strong interest from a range of qualified buyers in the automation segment. Further evidence of the robust M&A and capital placement activity in automation is provided in the below list of transactions.

Bundy Group’s current engagements and owner relationships include control system integration, robotics, automated material handling, automation distribution, artificial intelligence, and cybersecurity. This serves as a leading indicator for submarkets our team anticipates closed transactions in over the coming months. We look forward to providing these relevant updates and transaction announcements to Control Engineering magazine readers.

2/13/24

Coesia, through its Company FlexLink, has closed the acquisition of 100% of the share capital of Automation & Modular Components. Automation & Modular Components, LLC. is a manufacturer of material handling automation systems with integrated controls, as well as conveyors for integration into assembly systems and production lines, headquartered in Davinsburg, Mich. Learn more.

2/12/24

HSL Compliance enhances its water safety services with the acquisition of Durham-based technology firm Plexus Innovation. Plexus specializes in IoT technology for remote monitoring solutions in the water safety industry, allowing HSL to promptly detect and resolve issues with expert precision. This acquisition strengthens HSL’s leadership in water safety, ensuring prompt issue resolution and regulatory compliance. Learn more.

2/9/24

BBH Capital Partners, the private equity arm of Brown Brothers Harriman & Co. (BBH), completed a minority equity investment in Wolter Inc. Founded in 1962 and headquartered in Brookfield, WI, Wolter specializes in material handling and industrial productivity equipment. Known for its commitment to enhancing client operations, Wolter’s partnership with BBHCP aims to fuel further growth and innovation. Learn more.

2/7/24

Trystar has acquired Wisconsin-based Macromatic Industrial Controls, Inc. to enhance its monitoring and control portfolio offerings and access to additional industrial customers. Headquartered in Waukesha, Wisconsin, Macromatic engineers and manufactures industrial controls, monitoring, and protection products designed to maintain productivity. Learn more.

1/31/24

Blackford Capital, a leading lower middle market private equity firm, has acquired Data Science Automation, an automation engineering services and training firm with operations in Pittsburgh, Pennsylvania and Cleveland, Ohio, that collaborates with its clients to digitally transform and automate laboratory, product, manufacturing, and test systems and applications. Learn more.

1/29/24

Hollysys Automation Technologies Ltd. has agreed to be acquired by a buyer controlled by Ascendent Capital Partners, a Hong Kong-based investment firm. The Special Committee of Hollysys unanimously recommended shareholders vote in favor of the acquisition due to Ascendent’s compelling offer and fully financed proposal. This acquisition reflects Ascendent’s strategic interest in investing in the technology sector. Learn more.

1/25/24

Dynamysk Automation Ltd., a leading provider of instrumentation, controls, and electrical solutions, is pleased to announce its acquisition by Allnorth Consultants Limited, known as Allnorth. Dynamysk, a Canadian company, specializes in delivering fully integrated lifecycle solutions in industrial instrumentation, controls, and electrical disciplines. Learn more.

1/24/24

Rhino Tool House, a leading value-added distributor of intelligent fastening solutions, customized material handling solutions and calibration services to OEMs, has acquired Power Tools & Supply, Inc. Based in Walled Lake, Michigan, Power Tools & Supply has been providing a wide range of assembly tools and material handling solutions to automotive and automation integration customers since 1989. Learn more.

1/23/24

Angeles Equity Partners LLC, a middle-market private equity investment firm focused on the industrial sector, has acquired Acieta LLC, a Waukesha, Wis.-based robotics manufacturer and integrator, from Mitsui & Co. Inc. The terms of the transaction weren’t disclosed. Learn more.

Bundy Group is a boutique investment bank that specializes in representing controls and automation, Internet of Things, and cybersecurity companies in business sales, capital raises, and acquisitions. Over the past 33 years, Bundy Group has advised and closed on over 250 transactions, which includes numerous automation-related transactions. You can learn more at www.bundygroup.com or by contacting Clint Bundy.

Clint Bundy welcomes Alex Chausovsky to Bundy Group, highlighting his advisory expertise. Alex shares his career path, emphasizing his roles in market research, economics, and labor market analysis. They discuss the 2024 macroeconomic outlook, noting the positive economic performance in 2023, the influence of interest rates on manufacturing, and anticipated slower growth in 2024. Alex advises focusing on interest rate policies over political events, and expresses optimism for the industrial technology and automation sector. He also stresses the importance of talent acquisition and retention in healthcare.

About Bundy Group

Established in 1989, Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The team of highly experienced investment bankers leverages extensive industry knowledge and skill to provide hands-on guidance to clients through every phase of the business transaction. Bundy Group has been a trusted partner in more than 250 closed deals over the past 34 years, providing high quality options, actionable insights, and delivery of optimal strategic fit at a premium value for our clients.

Bundy Group Securities, LLC is a registered broker-dealer and member of FINRA and SIPC. More information on the background of Bundy Group Securities, LLC is available at FINRA's BrokerCheck.

Clint Bundy and Stewart Carlin of Bundy Group delve into 2023's market trends, their company's robust performance, and a case study on Ultimation. Despite a dip in transaction volume in 2023 due to higher financing costs and recession fears, Bundy Group thrived, boasting higher revenue and a 50% valuation premium for clients. They spotlight Ultimation, where a complex value proposition and e-commerce focus doubled the valuation. Bundy Group anticipates a promising M&A market in 2024, with stabilized capital costs and emphasis on healthcare, technology, and business services sectors.

About Bundy Group

Established in 1989, Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The team of highly experienced investment bankers leverages extensive industry knowledge and skill to provide hands-on guidance to clients through every phase of the business transaction. Bundy Group has been a trusted partner in more than 250 closed deals over the past 34 years, providing high quality options, actionable insights, and delivery of optimal strategic fit at a premium value for our clients.

Bundy Group Securities, LLC is a registered broker-dealer and member of FINRA and SIPC. More information on the background of Bundy Group Securities, LLC is available at FINRA's BrokerCheck.

The aesthetics market is ripe with opportunities for practice owners. Whether it's building value in anticipation of a future sale or engaging in a consortium sale for immediate benefits, understanding the market dynamics is key. With the right guidance and strategic approach, practice owners can navigate this landscape to realize the full potential of their life’s work.

About Bundy Group

Established in 1989, Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The team of highly experienced investment bankers leverages extensive industry knowledge and skill to provide hands-on guidance to clients through every phase of the business transaction. Bundy Group has been a trusted partner in more than 250 closed deals over the past 34 years, providing high quality options, actionable insights, and delivery of optimal strategic fit at a premium value for our clients.

Bundy Group Securities, LLC is a registered broker-dealer and member of FINRA and SIPC. More information on the background of Bundy Group Securities, LLC is available at FINRA's BrokerCheck.

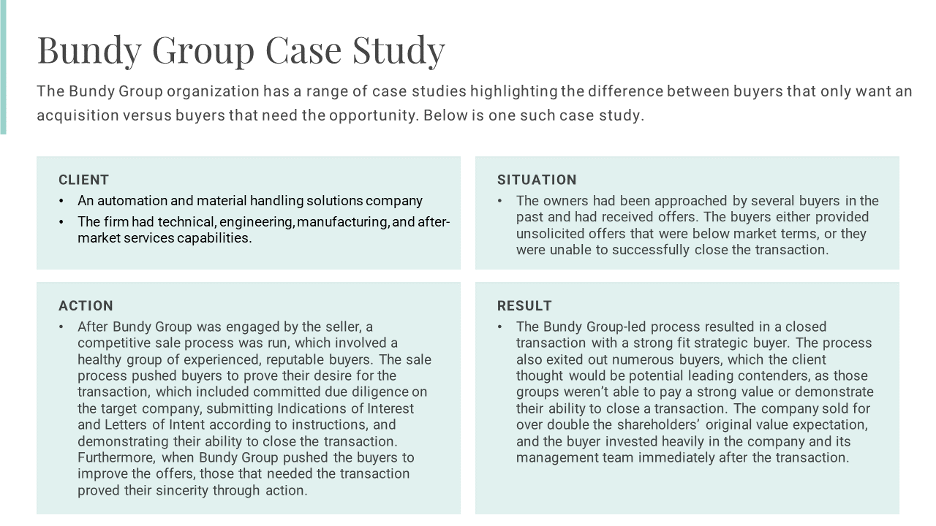

In a well-orchestrated business sale or capital raise, an owner should be able to attract buyers that demonstrate their intense demand for the company, including through paying a robust value and closing on those deal terms. However, while nearly all strategic buyers and investors (i.e. financial sponsors) will try to convince owners of their sincere interest, the reality is that not all of them fit into a leading contender category. Therefore, it is critical for business owners to understand the distinction between buyers and sponsors who want a company and those who genuinely need it. Selecting the best party through the right process can be the difference in millions of dollars in value, a smooth versus rough integration period, and a successfully closed transaction versus a blown deal.

The Supply of Strategic Buyers and Financial Sponsors Today

Most business owners today are well aware of the overabundance of strategic buyers and financial sponsors and their interest in acquiring or investing in privately held companies. Market data supports this trend, with over a trillion dollars of capital targeting acquisitions and investments in privately held businesses. Therefore, owners and executives are frequently inundated with phone calls, emails, and even visits from potential buyers and financial sponsors, expressing a keen interest in their companies.

The strategic buyer and financial sponsor demand outweighs the supply of quality companies, which can provide an amazing position of strength for business owners...if utilized appropriately. However, buyers are in the business of acquiring companies for the best terms possible. The buyers who desire an acquisition but are willing to walk away instead of paying full market value will use every tool and tactic available to obtain this arbitrage benefit. As a result, an owner and the company’s advisors need to be able to proactively evaluate a buyer’s closed deal track record, motivations, diligence process, and reputation to determine who is worth selecting and focusing on through to close of a transaction. Equally importantly, a selling business must introduce an element of competition as the premier buyers will put their best foot forward when pushed to do so.

Distinguishing Between Buyer Wants and Needs

Actions speak louder than words, including in the field of mergers and acquisitions (M&A). A company seeking to sell or raise capital can effectively use information and a well-managed process to not only solicit interest but separate the “best from the rest” before deciding the best partner fit.

Takeaways

In the realm of M&A, distinguishing between buyers who want a business and those who genuinely need an acquisition is both an art and a science. The competitive process, due diligence, and evaluation of certainty to close play a pivotal role in making this distinction. Business owners should recognize that taking the time to discern these critical subtleties can lead to securing the best possible outcome for their business. Hiring a seasoned investment banker can provide an immense advantage to a seller, as that experienced advisor can not only run the process but also bring proprietary intelligence that can be utilized to narrow down the pool of buyers.

Even in M&A markets that have challenges and macroeconomic headwinds, buyers who truly need a business are willing to pay competitive multiples and close on a transaction. As long as businesses take the necessary steps to differentiate between buyer and investor wants and needs, then the probabilities substantially increase that the owners will close a transaction at a strong valuation. The world of business sales and capital raises might appear complex, but when approached methodically and with expert guidance, owners can feel confidence that they didn’t leave money on the table or didn’t see a quality universe of options.

In this article for Plant Engineering Magazine, Bundy Group kicks off the new year by recounting the seven automation transactions of January and analyzing key driving forces behind the continued increase in capital market activity.

The automation and industrial technology markets continue to experience a tremendous amount of mergers & acquisitions (M&A) and capital markets activity. Drivers of this activity include the growth-oriented nature of the automation and industrial technology markets, the consolidation opportunities within these industries, and the strength of many of the companies operating within them. Furthermore, the automation and industrial technology sectors have attracted a critical mass of strategic buyers and financial sponsors (i.e. private equity groups, family offices, institutional investors) that are looking to own or invest in companies in the industries. From such, Bundy Group closed transactions as Ultimation and Industrial Electric Machinery, our team continues to see strong interest from a range of qualified buyers in the automation, industrial technology and plant management segments. Further evidence of the robust M&A and capital placement activity is provided in the below list of transactions.

Bundy Group’s current engagements and owner relationships include control system integration, automated material handling, automation distribution, industrial services, and electrical services. This serves as a leading indicator for industries our team anticipates closed transactions in over the coming months. We look forward to providing these relevant updates to Plant Engineering magazine readers.

1/9/24

Hastings Equity Partners, a preferred capital partner to founders of lower middle market businesses has acquired JSET Automated Technologies.Founded in 2020 by Eric Tyo and John Sloan, JSET specializes in building automation systems, installation and repairs, and electronic engineering services for data centers. Learn more.

1/9/24

Investcorp, a leading global alternative investment firm, acquired Best in Class Technology Services. BCTS is a leading provider of HVAC, electrical and plumbing maintenance, repair and replacement services for critical end markets including industrial, medical, education and commercial. Learn more.

1/8/24

GenNx360 Capital Partners announced GenServe’s acquisition of the commercial division of Austin Welder & Generator Service, Inc. In addition to the commercial division, the Company has a residential division, which was excluded from the transaction. GenServe is a portfolio company of GenNx360 Capital Partners, a New York-based private equity firm investing in middle market business services and industrial companies. Learn more.

1/8/24

V2X pioneer Danlaw has acquired Australia-based competitor Cohda Wireless, marking a significant milestone in Danlaw’s global expansion initiative, aimed at advancing connected vehicle safety and smart city solutions. Learn more.

1/8/24

Card-Monroe Corp. has acquired Greenville, South Carolina-based automation company Everworks Automation in what proves to be a strategic step forward for both companies. Card-Monroe Corp, based out of Chattanooga, Tennessee, is a leader in tufting technology. Learn more.

12/19/23

First Reserve, a leading global private equity investment firm exclusively focused on investing across diversified energy, infrastructure, and general industrial end-markets, has acquired AP Group LLC a global full-service provider of critical power plant and turbomachinery maintenance services. Financial terms of the transaction were not disclosed. Learn more.

12/1/23

Argosy Private Equity, a lower middle market private equity firm, acquired a controlling interest in Wize Solutions. Wize is a full-service warehouse racking, automation, and lock & door installation company. Founded in 2007 and based in Salt Lake City, Utah, Wize serves manufacturers and distributors across all 50 states as well as Canada, Mexico, Japan and Australia. Learn more.