When a company and its advisors discuss a business sale or recapitalization, the starting topic is often transaction value. After all, the value is often the cleanest result in a transaction to understand and compare against other deals in the market. Furthermore, the transaction value represents the “headline number,” which is easiest to understand and often the most marketable.

However, experienced transaction professionals recognize that the foundation of transaction value is the structure of the deal. A famous saying among M&A professionals is “You name the price; I’ll name the terms. I will win every time.” The structure can take on many forms, and its composition has a significant impact on the ultimate outcome that a client will realize. As business owners begin analyzing offers, it is critical for them to understand the unique relationship of both value and structuring...and how the deal structure is the foundation of the offer.

The transaction value is the total consideration to the owners in a merger or acquisition. This total consideration can be comprised of many different components, and each individual piece has its own attributes and associated value. The sum of each of the values for each of these individual structuring pieces is the total transaction value. While many assume that total transaction value equals upfront cash paid to the seller at transaction close, that is not always the case.

A transaction’s structure refers to how the buyer and seller organize the different forms of consideration to comprise the total valuation.

The essential transaction structure elements are defined as follows:

When evaluating the various structures in an offer, an owner will find that the timing of payments, the probability of receiving these payments, and his own goals can collide, creating a great deal of complexity for the seller. Furthermore, there are numerous other factors to consider, including the role of the owners and employees post-closing and implementation of a company’s strategic plan. An owner and his advisors should be thoughtful in their review and analysis of ideally multiple offers to determine the optimal structure.

Because a decision on the optimal transaction structure is very situational dependent, we wanted to offer a scenario use.

Transaction Scenario: The selling company has been marketed by an investment banking representative to a group of buyers in a competitive process. The company generated $3MM in EBITDA (1) in its most recent fiscal year, and management has projected revenue and EBITDA growth for the next three years. The owner of the business is at a stage where he needs to obtain liquidity for his shares and find a buyer that will best support company management in growing the organization. He is in his mid-fifties and is very open to future performance returns so long as he doesn’t have to significantly sacrifice safer forms of consideration (i.e. upfront cash and seller note).

| Offer I | Offer II | |

| Buyer Type | Strategic Buyer | Financial Sponsor |

| Total Valuation | $25.0MM | $28.0MM plus undefined earnout |

| Upfront Cash | $22.5MM | $20MM |

| Seller Note | $2.5MM total seller note; 10% interest rate; paid out over three years with quarterly principal and interest payments | |

| Deferred Payment | $2MM deferred payment paid in two annual installments of $1.0MM each when the company achieves $3MM in annual EBITDA | |

| Earnout | Formula that pays the seller a % of excess over $3MM in annual EBITDA each year over the next three years | |

| Equity Reinvestment | $6MM reinvested back into the company in partnership with the new majority owner |

If an owner is prioritizing upfront cash, has a lower risk tolerance, and wants a relatively clean break at transaction close, then Offer I (combo of upfront cash and seller note) could be the optimal choice for the seller. It has $25MM in relatively low risk consideration due to the seller, and there are additional returns associated with the interest income payments. However, if an owner is more focused on total transaction returns and has a willingness to accept more risky structures like equity reinvestment or earnout, then Offer II might be worthy of consideration.

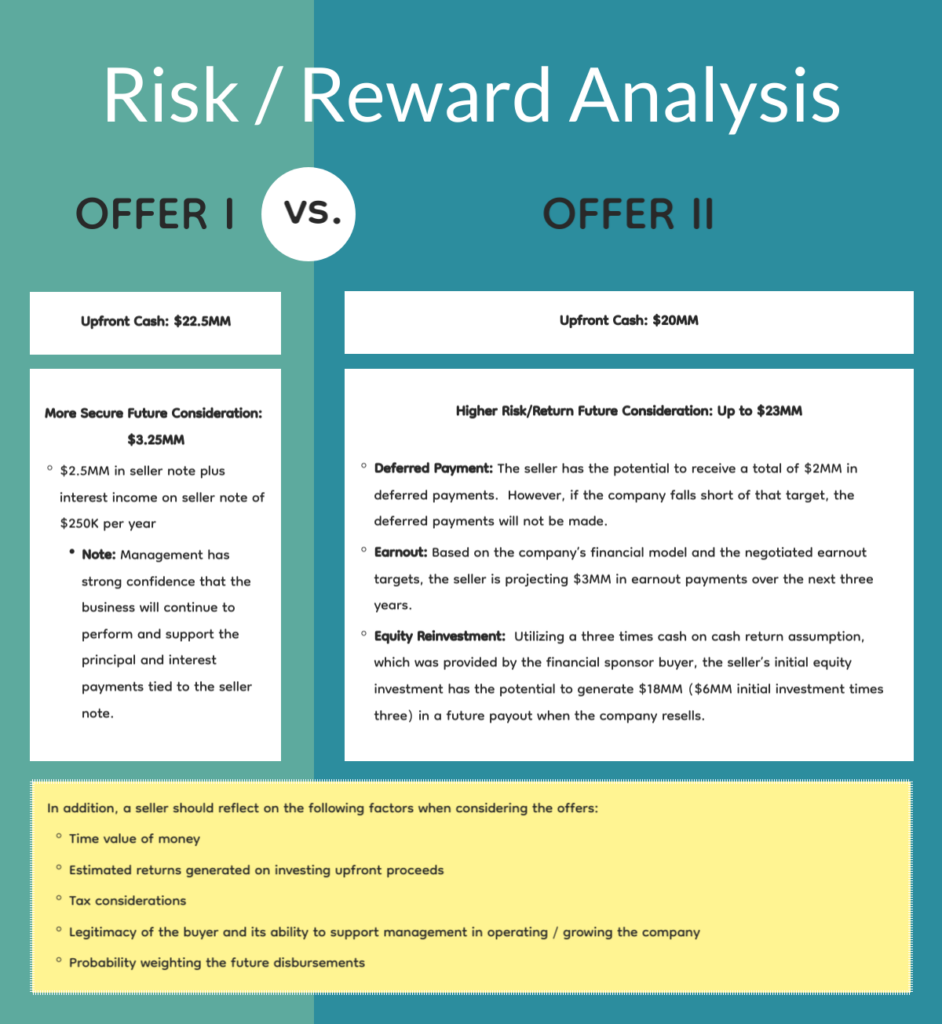

A more detailed analysis of the risk / reward profiles can be found below.

For the above situation, what is the best offer to take? The seller will have to be the final decision maker based on personal and business objectives and interpretation of the above offers and associated risks and returns. The job of a good investment banking advisor in this decision is to ensure that the client has the best quality, market-driven information available in order to make the most educated decision. Based on our experience with owners that fit the transaction scenario outlined above, it wouldn’t be surprising to see a client preference for Offer II over Offer I. From a macro perspective, sacrificing $5.75MM in more secure consideration could be worthwhile for the seller in exchange for the potential to realize an additional $15MM ($3MM of earnout and an estimated gain on equity reinvested of $12MM) in higher risk future consideration.

Once a seller has a full understanding of both value and structure, the next natural question is how can you use deal structuring to make it even more seller-friendly? This is actually a more complex, nuanced topic that can’t be addressed in one article or hypothetical transaction situation. There are two key mechanisms for a seller to ensure the optimal deal structure:

These concepts of value and structuring work hand in hand with one another, not as separate concepts. As multiple offers are submitted, and numerous structure components are included in the respective offers, the calculations can get more complicated, and the risk / reward analysis can become clouded. Each transaction is company-specific and there are numerous ways to structure a deal, which is why it’s in the stakeholder’s best interest to use experienced advisors who can assist in evaluating the transaction structures and help the owner understand what best fits with his objectives.