In the world of mergers and acquisitions (M&A), the competitive business sale process is a complex yet essential part of the journey. If you're a business owner or a part of a management team considering a business sale or capital raise, understanding this process is crucial. In this piece, the competitive business sale process will be analyzed, the key stages defined, and insights offered to help a business owner better position for a sale or capital raise and a successful outcome.

Goals of a Competitive Sale or Capital Raise: In any M&A transaction, there are two primary objectives that an owner and his advisors should seek.

Transaction Structure: The transaction structure refers to how the buyer and seller organize the different forms of consideration to comprise the total valuation. To learn more, please visit the BG Insights article entitled “Structure: The Backbone of a Mergers & Acquisitions Transaction.”

What is an Investment Banker? Investment bankers play a vital role in M&A transactions. They facilitate the entire process, including advising a company how to best prepare a business for a sale and managing buyer conversations and negotiations to lead to a successfully closed deal. To learn more, please visit the Bundy Group Insights video titled "Why Hire an Investment Banker."

Sellside Quality of Earnings Report: A Sellside Quality of Earnings analysis and report is an in-depth financial audit of the seller’s financials for the purpose of facilitating a transaction. The seller hires an independent transaction accounting firm to complete the analysis and report, and that accounting firm is also in place as a seller advisor throughout the transaction. While the transaction accounting firm focuses on validating historical financials, the investment banking advisor focuses on the future and maximizing value and negotiating leverage. This can be another mechanism to drive value and increase the certainty of a closed deal. To learn more, please visit the Bundy Group Insights video and article titled "The Sellside Quality of Earnings Report."

Unsolicited Offer: An unsolicited offer is an unexpected proposal from a potential buyer who initiates contact without prior engagement from the seller. To learn more, please visit the BG Insights video and article entitled “What is an Unsolicited Offer?”

Business Sale vs. Capital Raise: A competitive sale typically involves selling over 50% of your company’s equity to an outside party, while a capital raise often involves selling less than 50% of a company’s equity or using debt for financing.

The business sale process can be broken down into four distinct phases. Each phase is centered around creating a position of negotiating strength for the seller and driving competition. There are very few strategic buyers or financial sponsors that will put their best foot forward unless they are pushed to do so.

The entire process can typically take 6 to 12 months. However, the process timeline depends on a variety of factors such as the complexity of the business, the quality and accessibility of financial data, the extent of due diligence required, and the intensity of the negotiation phase. Furthermore, hiring an experienced investment banker that understands the best pool of buyers for that industry and can best position the company in a process will have a substantial impact on both the transaction terms and the timeline to close.

Navigating the competitive business sale process in M&A transactions involves a series of well-defined stages, from preparation to closing. A business owner is highly recommended to focus on the following in a competitive process:

A business sale, or capital raise, is a complicated process that could yield tremendous gains for a seller or result in significant amounts of money being left “on the table.” Furthermore, the outcome could produce a quality long-term partner or a new owner that tarnishes the reputation of the company. The best way for an owner to ensure a strong outcome is to run a competitive process, ideally managed by an experienced investment banker, which delivers multiple options to drive an educated decision-making process that minimizes risk and maximizes the quality of the outcome.

When a company and its advisors discuss a business sale or recapitalization, the starting topic is often transaction value. After all, the value is often the cleanest result in a transaction to understand and compare against other deals in the market. Furthermore, the transaction value represents the “headline number,” which is easiest to understand and often the most marketable.

However, experienced transaction professionals recognize that the foundation of transaction value is the structure of the deal. A famous saying among M&A professionals is “You name the price; I’ll name the terms. I will win every time.” The structure can take on many forms, and its composition has a significant impact on the ultimate outcome that a client will realize. As business owners begin analyzing offers, it is critical for them to understand the unique relationship of both value and structuring...and how the deal structure is the foundation of the offer.

The transaction value is the total consideration to the owners in a merger or acquisition. This total consideration can be comprised of many different components, and each individual piece has its own attributes and associated value. The sum of each of the values for each of these individual structuring pieces is the total transaction value. While many assume that total transaction value equals upfront cash paid to the seller at transaction close, that is not always the case.

A transaction’s structure refers to how the buyer and seller organize the different forms of consideration to comprise the total valuation.

The essential transaction structure elements are defined as follows:

When evaluating the various structures in an offer, an owner will find that the timing of payments, the probability of receiving these payments, and his own goals can collide, creating a great deal of complexity for the seller. Furthermore, there are numerous other factors to consider, including the role of the owners and employees post-closing and implementation of a company’s strategic plan. An owner and his advisors should be thoughtful in their review and analysis of ideally multiple offers to determine the optimal structure.

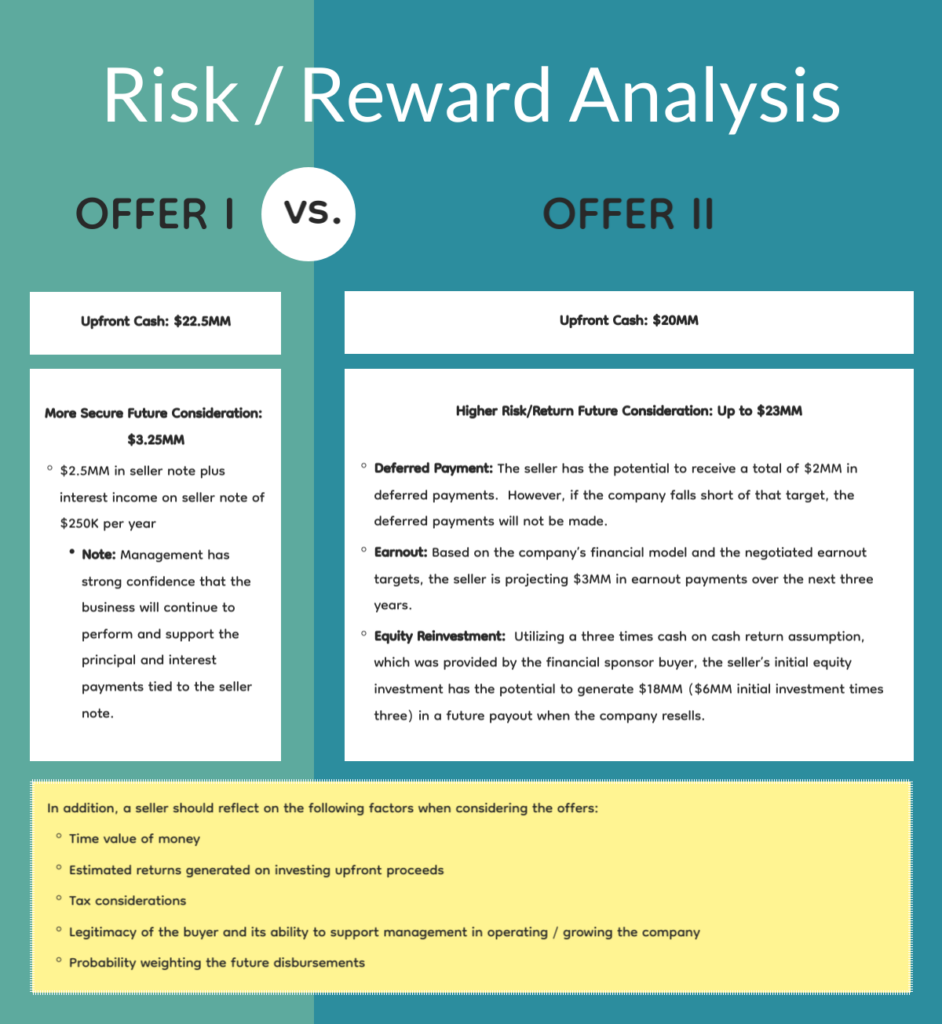

Because a decision on the optimal transaction structure is very situational dependent, we wanted to offer a scenario use.

Transaction Scenario: The selling company has been marketed by an investment banking representative to a group of buyers in a competitive process. The company generated $3MM in EBITDA (1) in its most recent fiscal year, and management has projected revenue and EBITDA growth for the next three years. The owner of the business is at a stage where he needs to obtain liquidity for his shares and find a buyer that will best support company management in growing the organization. He is in his mid-fifties and is very open to future performance returns so long as he doesn’t have to significantly sacrifice safer forms of consideration (i.e. upfront cash and seller note).

| Offer I | Offer II | |

| Buyer Type | Strategic Buyer | Financial Sponsor |

| Total Valuation | $25.0MM | $28.0MM plus undefined earnout |

| Upfront Cash | $22.5MM | $20MM |

| Seller Note | $2.5MM total seller note; 10% interest rate; paid out over three years with quarterly principal and interest payments | |

| Deferred Payment | $2MM deferred payment paid in two annual installments of $1.0MM each when the company achieves $3MM in annual EBITDA | |

| Earnout | Formula that pays the seller a % of excess over $3MM in annual EBITDA each year over the next three years | |

| Equity Reinvestment | $6MM reinvested back into the company in partnership with the new majority owner |

If an owner is prioritizing upfront cash, has a lower risk tolerance, and wants a relatively clean break at transaction close, then Offer I (combo of upfront cash and seller note) could be the optimal choice for the seller. It has $25MM in relatively low risk consideration due to the seller, and there are additional returns associated with the interest income payments. However, if an owner is more focused on total transaction returns and has a willingness to accept more risky structures like equity reinvestment or earnout, then Offer II might be worthy of consideration.

A more detailed analysis of the risk / reward profiles can be found below.

For the above situation, what is the best offer to take? The seller will have to be the final decision maker based on personal and business objectives and interpretation of the above offers and associated risks and returns. The job of a good investment banking advisor in this decision is to ensure that the client has the best quality, market-driven information available in order to make the most educated decision. Based on our experience with owners that fit the transaction scenario outlined above, it wouldn’t be surprising to see a client preference for Offer II over Offer I. From a macro perspective, sacrificing $5.75MM in more secure consideration could be worthwhile for the seller in exchange for the potential to realize an additional $15MM ($3MM of earnout and an estimated gain on equity reinvested of $12MM) in higher risk future consideration.

Once a seller has a full understanding of both value and structure, the next natural question is how can you use deal structuring to make it even more seller-friendly? This is actually a more complex, nuanced topic that can’t be addressed in one article or hypothetical transaction situation. There are two key mechanisms for a seller to ensure the optimal deal structure:

These concepts of value and structuring work hand in hand with one another, not as separate concepts. As multiple offers are submitted, and numerous structure components are included in the respective offers, the calculations can get more complicated, and the risk / reward analysis can become clouded. Each transaction is company-specific and there are numerous ways to structure a deal, which is why it’s in the stakeholder’s best interest to use experienced advisors who can assist in evaluating the transaction structures and help the owner understand what best fits with his objectives.

Bundy Group, a 33-year-old, industry-focused investment bank, announces that it has advised Avanceon, a leading industrial automation systems integration firm, in a sale to VINCI Energies, an international operator of energy technology dedicated to accelerating energy transition and digital transformation. The transaction was led by Clint Bundy, Managing Director with Bundy Group.

Avanceon, founded in 1984, is a full-service industrial automation systems integrator with a diverse background in successful system implementation for a broad spectrum of industries. The firm employs a wide range of control, computing, network, and software technologies, which include project management, controls system design, system integration, and manufacturing IT services.

“For the past 38 years, Bob Zeigenfuse and his management team have built an outstanding organization, which has serviced clients across the globe, and the Bundy Group team was pleased to advise Avanceon in a sale,” said Clint Bundy. “Under the VINCI Energies umbrella, Avanceon will have the opportunity to further accelerate its growth and expand its proprietary technology offerings to an even broader geographic customer base.”

“I engaged Clint and the Bundy Group team because of our long-time relationship and their 15-year track record in the automation, system integration, and technology sectors,” said Bob Zeigenfuse, President and Owner of Avanceon. “Clint’s thoughtful, objective advice and knowledge of the automation M&A market were invaluable to me from the beginning of the process through to transaction close. I feel fortunate to have had the Bundy Group team as my investment banking advisor.”

Bundy Group has significant experience in the automation, technology, and business services sectors, and has previously advised clients including MR Systems, GrayMatter, Dorsett Controls, and Custom Controls Unlimited, among others. For more information about our industry expertise and other recent transactions, visit Controls & Automation - Bundy Group.

About Bundy Group

Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The team of highly experienced investment bankers leverages extensive industry knowledge and experience to provide hands-on guidance to clients through every phase of the transaction. With more than 250 closed deals over the past 33 years, Bundy Group’s primary goals are to provide high quality options and actionable insights and to deliver an optimal strategic fit at a premium value for our clients.

Bundy Group Securities, LLC, is a registered broker-dealer and member of FINRA and SIPC. Check the background of Bundy Group Securities, LLC at FINRA's BrokerCheck. Testimonials may not be representative of the experience of other customers and are no guarantee of future performance or success.

In this article for Plant Engineering Magazine, Bundy Group provides an update on mergers & acquisitions and capital placement activity for companies that address the manufacturing and plant management fields.

With great uncertainty in the global economy today, there is a common question we are on the receiving end of from business owners in the industrial technology and automation sectors: “What impact is this economy having on the mergers & acquisitions market and the value of my business?” Our response to owners is often broken into two parts: A) the effect on the overall automation and industrial technology markets B) the effect at the individual company level.

While numerous industries are experiencing difficulties due to economic challenges, the Bundy Group team sees no signs of slowing industrial technology market growth over the next few years. In a June 2022 report, HFS pointed out that “COVID-19 was a wake-up call for firms that had not yet implemented Industry 4.0” solutions. In addition, HFS added that these industrial technology solutions “emerged as a key driver in helping companies survive the pandemic.” To further this market validation, Fortune Business Insights indicated in a March 2022 report that the global industrial automation market is projected to increase from $205 billion in 2022 to $395 billion by 2029.

Bundy Group maintains continual discussions with industrial technology companies of many types, including system integrators, consulting firms, software providers, and manufacturers. Nearly all of these owners and executives indicate that their industrial end-user clients are demanding industrial technology solutions as much as ever for the plant floor and its equipment + systems. In addition, the pace of phone calls to our organization from strategic and financial sponsor buyers seeking acquisitions and investments in the industrial technology market has not slowed over the past year. In comparison, the key public equity market indexes have experienced an investor pullback with “the Dow, S&P and Nasdaq” decreasing by “21%, 25% and 33% year-to-date, respectively.”

Company-specific: While residing in the attractive industrial technology industry is a huge asset for a company, the individual fundamentals of an organization are critical for demonstrating value. When Bundy Group provides insights to owners on company valuation ranges before we are engaged to sell a firm or assist in raising capital, we assess numerous features (example – profit margins, stickiness of client relationships, management team, etc….) For instance, if an industrial technology company continues to realize growth and profitability, or it generates new client contracts, in today’s an uncertain environment, then it could be argued that a firm’s value has gone up!

Jim Beretta, president of Customer Attraction, a boutique marketing consultancy with a focus on robotics, automation and advance manufacturing, offered insights on how individual company dynamics are a major driver of business value for an organization. Beretta said, “Even in this uncertain economic environment, companies are still seeking growth by acquisition in the automation sector.” He further adds that “seasoned buyers put a great deal of emphasis on attributes such as resilient end-user industries, attractive geographies, and differentiated capabilities when evaluating acquisition opportunities. If an Industry 4.0 solutions provider can demonstrate that it has strong clients, industries, contracts, expertise, etc… then it could demand a premium value in this buyer-rich automation mergers & acquisitions market.”

In summary, Bundy Group continues to monitor the performance of the automation market as well as individual organizations within this attractive segment. While no business or industry is completely immune to economic downswings, most performance indicators for the industrial technology market and firms within this industry continue to be positive. The owner of an industrial technology solutions firm should stay attuned to market trends, as well as his or her own firm’s appeal to the mergers & acquisitions market, as these are major determinants of a company’s valuation.

2/2/23

Italia Technology Alliance (ITA Holding) continues its strategic development and welcomes Taiprora S.r.l. into its social structure, a consolidated Abruzzo-based company that has been creating software and automation systems for production and logistics for 30 years. Learn more.

1/31/23

Addtronics, LLC (“Addtronics”), a mission-driven holding company dedicated to acquiring, empowering, and growing leading robotic automation solution providers, has acquired Missouri Tooling & Automation, LLC. (“MTA”). MTA is a leading custom robotic automation systems provider based in Lebanon, Missouri. Learn more.

1/27/23

Galco Industrial Electronics, Inc. (Galco) has acquired Zesco, Inc., a regional automation solutions provider located in Brecksville, Ohio. “The acquisition of Zesco further positions Galco as a global leader in the industrial automation and motion control industry,” said Allison Sabia, president and CEO of Galco. Learn more.

1/24/23

Built Robotics, the inventor of the robotic Exosystem and leader in construction autonomy, acquired Roin Technologies, the makers of the first automated concrete power trowel. The acquisition will grow the capabilities of Built’s engineering team and accelerate key technological developments. Learn more.

12/20/22

IPS, a North American leader in single-source solutions for industrial and commercial power and mechanical processes, has acquired Evans Enterprises, Inc (Evans). The sale includes all eight Evans locations, servicing customers across the South and Central United States. For IPS, these additional locations add services to underserved markets and further enhance its industry-leading network of 64 locations. Learn more.

Bundy Group is a CFE Media and Technology content partner.

In this article for Control Engineering Magazine, Bundy Group provides an update on mergers & acquisitions and capital placement activity in the automation market for the month of February.

This exciting event took place in Orlando, Florida, in January 2023. Domestic and international industry experts and leaders attended the multi-day event with the goal of discussing the automation market today, the key drivers behind this growing segment, and how businesses can capitalize on the energy. Clint Bundy, Managing Director with Bundy Group, attended the conference, where he met with multiple business executives, owners, private equity professionals, and strategic buyers. As industry specialists in automation for more than 15 years, Bundy Group enjoys the opportunity to keep our rolodex and industry knowledge fresh. The A3 Forum validated the optimism and strength of the automation industry and its various subsegments. Bundy Group is as bullish as our team has ever been on this industry from a mergers & acquisitions (“M&A”) and capital placement perspective. Below are our major takeaways from the A3 conference.

The Business Forum further showcased how the automation M&A momentum continues. The automation market is in high demand from both strategic buyers and financial sponsors, which includes private equity groups and family offices. Bundy met with several financial sponsor professionals in Orlando that were networking with the intent of finding a company to invest in as a new platform. Furthermore, strategic buyers, such as Brooks Automation, Robex and ETECH, made it known they are aggressively looking for add-on acquisitions to accomplish inorganic growth. For automation business owners today, it continues to be a seller’s market, especially if they know how use a competitive process to their advantage and not fall prey to buyers seeking proprietary conversations.

The momentum in automation is driven by numerous factors, and the robotics solutions segment is a key contributor. To further the point, North American companies ordered robots valued at $2.3 billion in 2022, an 18% increase from 2021, and the total number of robots ordered in 2022 was 44,196, an impressive 11% increase from the prior year. As one executive pointed out, the lengthy list of robotics attendees at the Business Forum was a sign of the direction the automation market was gravitating. End users are clearly utilizing these solutions to run their operations, solve the talent gap issues and best position their companies for the future.

The warehouse automation segment is rivaling robotics for its contributions to the overall automation market. Current Bundy Group industry work and client engagements show vigorous demand for warehouse automation solutions, and this was further supported by industry presentations and conversations at the Business Forum. Examples of warehouse automation solutions include automated sortation systems, automated storage systems, automated forklifts, and Autonomous Mobile Robots, or AMRs. In one Business Forum presentation, Blake Griffin with Interact Analysis, an international market research firm, provided insights on warehouse automation trends. Interact Analysis projected the warehouse automation market, which was $36 billion in 2021, to reach $77 billion by 2027, a robust 13% compounded annual growth rate. Griffin further added that his team, which is in constant dialogue with many of the international automation players, believes that warehouse automation will become increasingly important to automation vendor strategies.

Interact Analysis projected the warehouse automation market, which was $36 billion in 2021, to reach $77 billion by 2027. Courtesy: Interact Analysis

Another lucrative automation segment to note from the Business Forum is the Machine Vision market. Machine vision technology offers equipment the ability to see what it is doing and then make prompt decisions based on what it has seen. Examples of machine vision components include cameras, lighting, optics, imaging boards, and software. Alex Shikany, VP for Business Intelligence for A3, provided relevant data regarding the Machine Vision market at the Business Forum. The North American Machine Vision market is valued at $3.1 billion for 2022, according to Alex, and 62% of respondents in a recent A3 survey said they expect orders to increase for these solutions over the next 12 months. The Bundy Group team shares the enthusiasm for the Machine Vision segment, and we see M&A and capital placement activity validate the attractiveness of this robust sector.

For those business owners and executives who are interested in learning more about the automation M&A market and ways to increase value in their company, please consider attending our Building Value & Realizing Value workshop in New Orleans in May 2023. It will be held the day before the Control System Integrators Association Conference. See registration details for more. It will be an action packed, fun-filled day!

The Bundy Group team was excited not only to participate in the jam-packed informative A3 Business Forum, but to see firsthand the drive behind the current momentum in the automation industry. The Bundy Group team will be at the Control System Integrators Association Conference and the Automate Conference, both of which are in May, and looks forward to continued conversations with automation owners and executives. We also look forward to providing updates on the state of the industry and the automation M&A and capital market to the Control Engineering readers in our future monthly pieces.

2/8/23

M-Files, a global leader in information management, has acquired Ment (formerly Contract Mill Oy), a leading no-code document automation technology company based in Espoo, Finland. With this acquisition, M-Files now delivers robust document automation capabilities that enable new and existing customers to quickly automate their own documents. Learn more.

2/2/23

Italia Technology Alliance (ITA Holding) continues its strategic development and welcomes Taiprora S.r.l. into its social structure, a consolidated Abruzzo-based company that has been creating software and automation systems for production and logistics for 30 years. Learn more.

2/1/23

Redwood Software, the industry leader in full stack automation, announced its acquisition of Cerberus, a leading secure file transfer provider that serves some of the largest global organizations. Learn more.

1/31/23

Addtronics, LLC (“Addtronics”), a mission-driven holding company dedicated to acquiring, empowering, and growing leading robotic automation solution providers, has acquired Missouri Tooling & Automation, LLC. (“MTA”). MTA is a leading custom robotic automation systems provider based in Lebanon, Missouri. Learn more.

1/27/23

Galco Industrial Electronics, Inc. (Galco) has acquired Zesco, Inc., a regional automation solutions provider located in Brecksville, Ohio. “The acquisition of Zesco further positions Galco as a global leader in the industrial automation and motion control industry,” said Allison Sabia, president and CEO of Galco. Learn more.

1/24/23

Built Robotics, the inventor of the robotic Exosystem and leader in construction autonomy, acquired Roin Technologies, the makers of the first automated concrete power trowel. The acquisition will grow the capabilities of Built’s engineering team and accelerate key technological developments. Learn more.

Bundy Group is a CFE Media and Technology content partner.

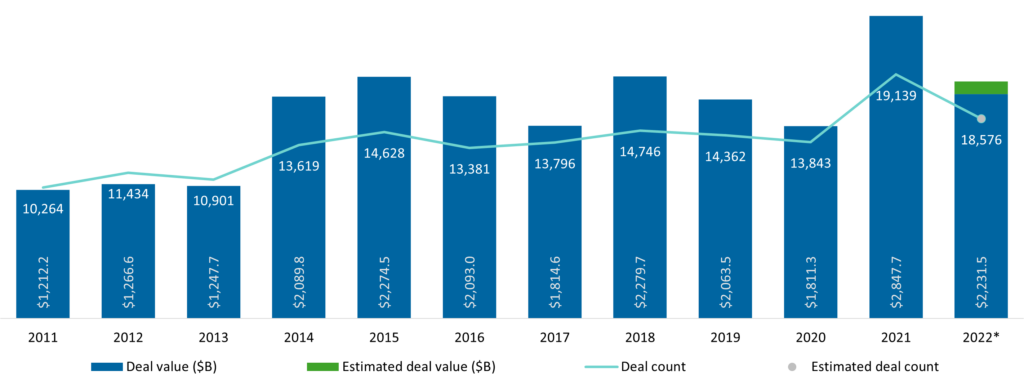

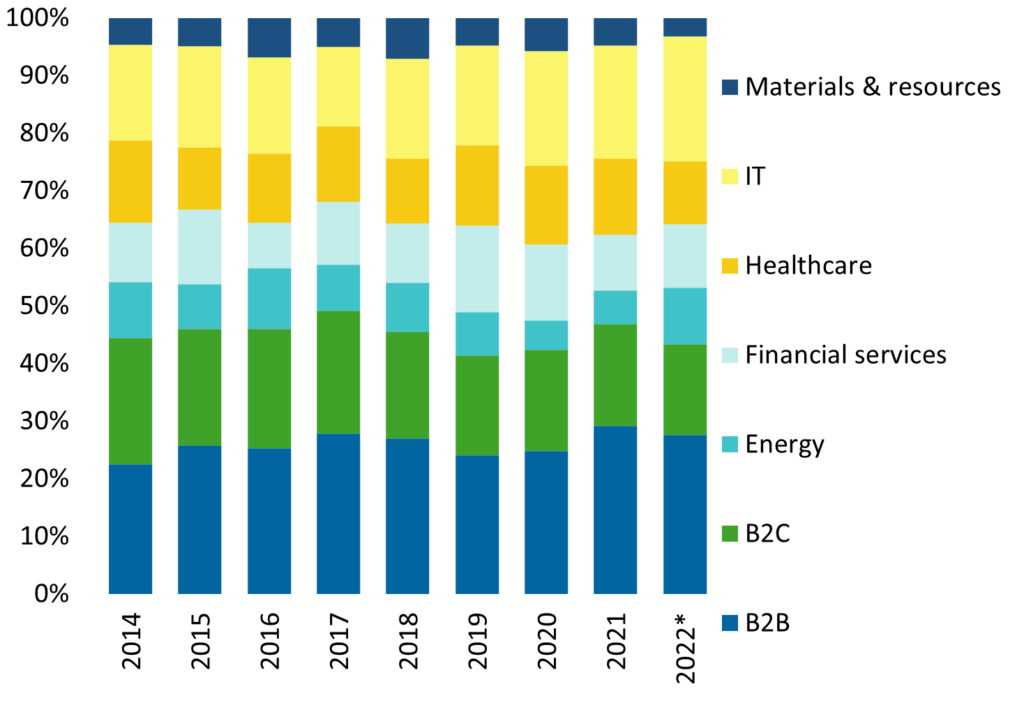

From 2014 – 2021, the U.S. mergers & acquisitions (M&A) market experienced a tremendous amount of activity relative to the years immediately following the Great Recession (2009 – 2013). In 2022, the M&A market experienced a pullback relative to 2021’s performance, however, by historical standards, M&A activity held strong and remained on solid footing. Over the past 12 months, the global economy has experienced new challenges, which included supply chain bottlenecks, torrid inflation, rising interest rates and the looming threat of a recession. While Bundy Group’s clients continued to perform in 2022, they are very aware of these headwinds, and our team is frequently on the receiving end of questions from owners and executives regarding the future for the economy and M&A markets.

To further the point, key questions that our team receives include:

These questions are relevant, and we wanted to provide some thoughts as we progress in 2023:

No one knows for certain if a recession will happen in 2023. We often advise clients to plan for the worst and hope for the best, therefore, we are recommending companies to prepare for a recession in 2023. During down periods, the market fleshes out which services and solutions are of greatest importance to businesses and consumers. Industries and companies that provide “must have” offerings, such as healthcare, automation, energy and mission critical industrial services, are expected to maintain quality momentum over the next 12 months. Companies that reside in the discretionary offerings category, or that are embedded in more cyclical industries, could be more negatively impacted during a recession.

Even in strong economies, buyers are focused on finding quality companies to buy at lower valuations. A recessionary environment gives strategic buyers and financial sponsors (i.e. private equity, family office, institutional investment funds) a more powerful excuse to extend their due diligence, create doubt about the selling company and ultimately try to acquire the business at a lower valuation. For those organizations that are seeking to sell or raise capital in 2023, the owners and executives should focus even further on developing and maintaining an optimal position of strength to protect and drive value.

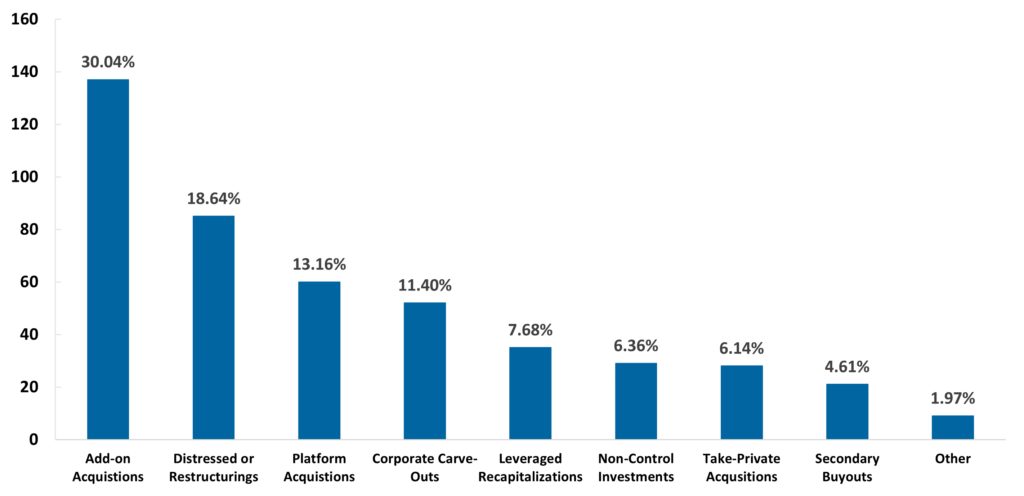

Financial sponsors will continue to seek platform investments to build, however, a recession environment could slow down the pace of these larger transactions. Add-on acquisitions for existing platform investments will accelerate further in 2023, which will be due to several key reasons:

A potential recessionary environment, coupled with higher costs of capital (i.e. driven by higher interest rates), can negatively impact valuations. However, a company can retain value through such avenues as:

There continues to be an enormous pool of capital in the market available to invest in the private markets. To be specific, there is approximately $3.3 trillion in cumulative global overhang, or capital committed by investors for private company investments that has not yet been invested. (1) The financial sponsors managing this pool of capital would much prefer to put these funds to work instead of giving them back to investors. In addition, debt capital providers are numerous, but 2023 will see lenders be selective in deals they pursue and will likely require higher equity contributions by strategic and financial sponsor buyers for transactions.

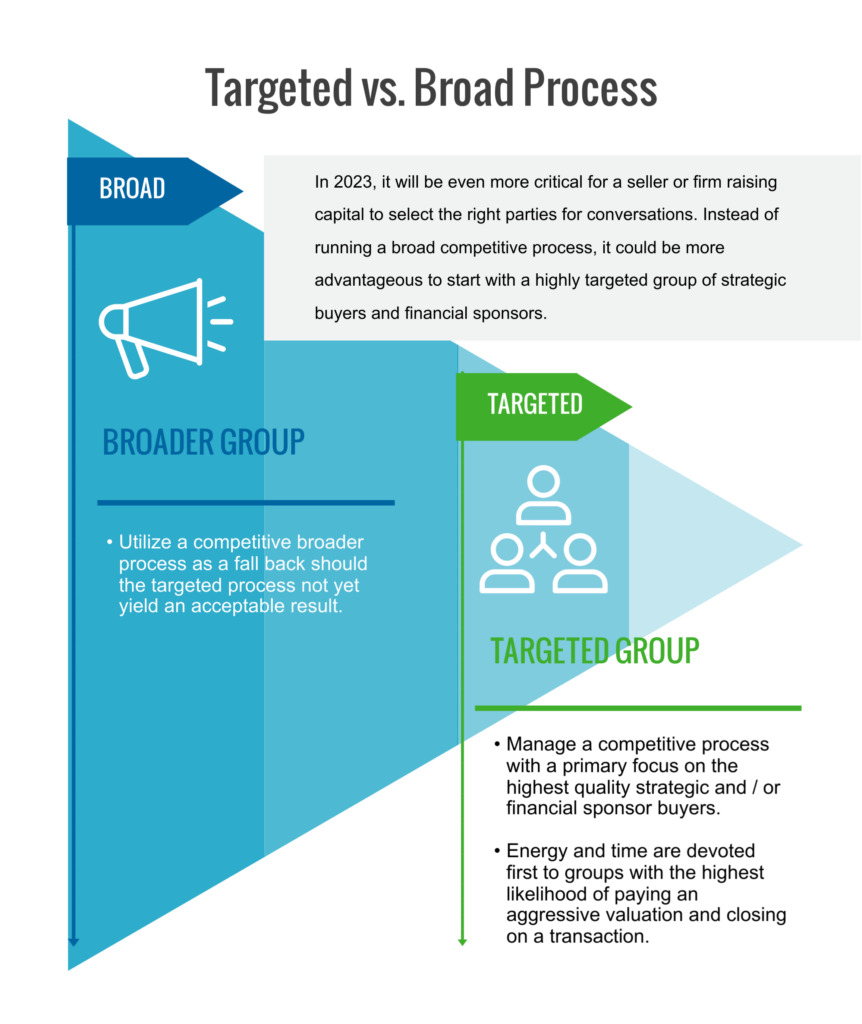

In 2023, it will be even more critical for a seller or firm raising capital to select the right parties for conversations. Instead of running a broad competitive process, which involves talking to a large number of parties, it could be more advantageous to start with a highly targeted group of strategic buyers and financial sponsors. This contingent should have a deep understanding of the seller’s industry, a track record of closing transactions in the segment, be well capitalized and demonstrate an aggressive acquisition / investment focus for 2023.

Companies may not be interested in a full or majority equity liquidity event today, but the owners may require capital for such goals as funding growth, partner buyout, refinancing debt, or paying the owners a dividend. In addition, these organizations may desire a capital provider that can offer additional resources, such as strategic and administrative support and board-level advice.

As 2023 quickly moves through its first quarter, it is certain to be an interesting and dynamic year. The macroeconomic environment could create a wider gulf between companies in terms of business performance, value retention, and ability to sell or raise capital. As investment banking advisors, the Bundy Group team sees numerous opportunities and options for companies, but we advise owners and executives to stay attuned to market trends and to look for opportunities to maintain and grow in the face of possible economic headwinds.

Bundy Group Securities, LLC, is a registered broker-dealer and member of FINRA and SIPC. Check the background of Bundy Group Securities, LLC at FINRA's BrokerCheck. This content is for informational purposes only and is not intended as investment advice or a recommendation to buy or sell any security.

Sources:

(1) Wiek, Hilary. “Global Private Market Fundraising Report.” Pitchbook. November 30, 2022.

In this article for Control Engineering Magazine, Bundy Group provides an update on mergers & acquisitions and capital placement activity in the automation market for the month of January.

With 2023 now in full swing, the automation solutions segment is well positioned for another robust year in terms of M&A and capital placement activity. While existing macroeconomic headwinds present some challenges, the Bundy Group team continues to be very optimistic about the growth of the automation market and the M&A and capital activity tied to the segment.

Some interesting points to note as we begin 2023:

The Bundy Group team is excited to continue our relationship with Control Engineering magazine in 2023 and providing its readers with updates on market trends and latest transactions. We anticipate a healthy number of business sale and capital raise transactions that will be announced in the coming months. Keep an eye out on future Control Engineering publications.

1/19/23

Barcoding, Inc., the leader in supply chain efficiency, accuracy, and connectivity, announced its acquisition of FRED Automation, Inc., an automated guided vehicle (AGV) company. This acquisition represents continued expansion and investment in industrial automation for Barcoding, Inc. Learn more.

1/13/23

GrayMatter is excited to announce the expansion of its Industrial Intelligence Platform of premiere industrial technology solution providers with the strategic merger of Columbus, Ohio-based Phantom Technical Services, Inc. Learn more.

1/10/23

Triad Technologies, LLC completed the acquisition of Industrial Service Products, LLC on December 30, 2022. ISP is a value-added distributor of custom fabricated hose, valves, fittings and other related products for the safe, efficient transfer of liquid and dry goods to a wide array of industrial customers. Learn more.

1/5/23

VINCI Energies is acquiring the Norwegian company Otera AS and its subsidiaries from Roadworks AS and Å Energi AS. This transaction will enable VINCI Energies to strengthen and expand its offer and expertise in Norway through its Omexom brand, with ownership of one of the leading companies in the sector. Learn more.

1/4/23

Cloud-based data warehouse company Snowflake has agreed to acquire artificial intelligence-based time series forecasting platform provider Myst AI. Learn more.

1/3/23

Lundquist Consulting was acquired by Stellex Capital Management for an undisclosed amount. Developer of bankruptcy process automation software intended for the mortgage, auto, bankcard, enterprise financial, fintech, cable/telecom and debt-buying industries. Learn more.

12/19/22

Supply Chain Equity Partners (“SCEP”) announced the sale of its portfolio company Air Hydro Power (“AHP”) to Houchens Industries, a diversified holding company. SCEP was a minority investor in AHP. AHP’s management team had majority control. Learn more.

12/15/22

Photonis, a global leader of highly differentiated technology for defence and industrial markets, held by HLD since 2021, has signed a definitive agreement to acquire Xenics, a specialist developer and manufacturer of leading-edge infrared solutions. Learn more.

11/30/22

Carlson Private Capital Partners (“CPC”),has made a significant investment in founder-owned Thermo Systems based in East Windsor, NJ. Thermo Systems is a global automation control systems integrator for applications across the data center, life sciences and district energy end markets. Learn more.

11/11/22

Thomson Reuters Corporation (“Thomson Reuters”) (NYSE / TSX: TRI) has signed a definitive agreement to acquire SurePrep, LLC (“SurePrep”), a US-based leader in 1040 tax automation software and services, for $500 million in cash (the “Proposed Transaction”). Learn more.

Bundy Group is a CFE Media and Technology content partner.

In this article for Control Engineering Magazine, Bundy Group provides an update on mergers & acquisitions and capital placement activity in the automation market for the month of December.

To finish out 2022, we wanted to highlight the latest mergers & acquisitions (M&A) and capital placement transactions for the automation segment (see below). From the beginning of 2022 to today, automation solutions-driven organizations were highly sought after by both strategic buyers and financial sponsors (i.e. investment groups; private equity groups; family offices). This robust activity, which occurred during a challenging macroeconomic period, further demonstrates the resilience and energy of the automation market.

With 2023 soon to start, we wanted to offer some observations and predictions for the automation market:

While the above observations are forecasts and not facts, the automation industry fundamentals are strong, and we remain as optimistic as ever regarding this segment. Automation industries can retain and realize attractive valuations, especially when buyers and financial sponsors are pushed to do so in the form of a competitive process. Bundy Group is excited to continue to provide Control Engineering readers with M&A and capital raise market updates for next year.

12/6/22

Synoptek, a leading global business and technology consulting firm, has acquired Optistar Technology Consultants. Optistar is the technology services business division of The Vertex Companies, LLC. The acquisition will be instrumental in expanding Synoptek’s footprint and advancing its capabilities. Learn more.

12/1/22

Epiroc, a leading productivity and sustainability partner for the mining and infrastructure industries, has completed the acquisition of Remote Control Technologies Pty Ltd, an Australian company that provides automation and remote-control solutions for mining customers around the world. Learn more.

12/1/22

Carenet Health, a leading provider of 24/7 and on-demand patient engagement and automation solutions, acquired Stericycle Communication Solutions, an industry leader in patient engagement technology and solutions and a service of Stericycle, Inc. (Nasdaq: SRCL), as part of its strategic vision to create a cohesive patient experience and provide better healthcare for all. Learn more.

12/1/22

Lincoln Electric Holdings, Inc. (Nasdaq: LECO) has signed a definitive agreement to acquire Fori Automation, Inc. Fori Automation was founded in 1984 and is a leading manufacturer of complex, multi-armed automated welding systems. Learn more.

11/30/22

ProMach acquired Ferlo, a manufacturer of automated product handling systems, on Nov. 30. The acquisition will help expand ProMach’s international presence and strengthen its capacity and supply chain partnerships. Learn more.

11/30/22

Zetwerk Manufacturing, the global source of manufacturing across industrial and consumer products, has acquired Unimacts, a leading manufacturing services company operating within various industries including industrial products, material handling, and renewable energy segments. Learn more.

11/30/22

Bentley Systems, Incorporated (Nasdaq: BSY), the infrastructure engineering software company, Cohesive Group digital integrator business has acquired Vetasi, a leading international consultancy specializing in enterprise asset management (EAM) solutions, with a strong focus on IBM Maximo. Learn more.

11/29/22

Tempo Automation, Inc., a leading software-accelerated electronics manufacturer, completed its business combination with ACE Convergence Acquisition Corp. (“ACE”) (Nasdaq: ACEV), a special purpose acquisition company traded on Nasdaq. Learn more.

11/29/22

SMA Technologies (“SMA”), a leading provider of automation solutions for financial services, announced the acquisition of VisualCron, an automation, integration and task scheduling tool for Windows environments. Learn more.

11/29/22

Open Systems, a leading provider of next-gen managed detection and response (MDR) services and winner of the 2022 Microsoft Security MSSP Partner of the Year award, acquired Tiberium, a U.K.-based provider of highly automated managed security services based on Microsoft security solutions. Learn more.

11/18/22

Lear Corporation (NYSE: LEA), a global automotive technology leader in Seating and E-Systems, announced the strategic acquisition of InTouch Automation, a supplier of Industry 4.0 technologies and complex automated testing equipment critical in the production of automotive seats. Learn more.

10/5/22

DroneDeploy has acquired Rocos, a New Zealand-based robotics software company. The acquisition will enable DroneDeploy customers in construction, energy, agriculture, and more to deploy and orchestrate both aerial and ground robots on their job sites. Learn more.

10/5/22

Two autonomous mobile robot (AMR) vendors have merged into a single unit, saying that the combination of Chelmsford, Massachusetts-based AutoGuide Mobile Robots and the Danish industrial automation firm Mobile Industrial Robots ApS (MiR) will expand both firms’ product portfolios and simplify customer automation projects. Learn more.

Bundy Group is a CFE Media and Technology content partner.

In this article for Plant Engineering Magazine, Bundy Group provides an update on mergers & acquisitions and capital placement activity for companies that address the manufacturing and plant management fields.

After a busy year in the industrial, automation and plant maintenance sectors, we wanted to provide observations on activities and trends occurring in these rapidly evolving industries. The foundation for our feedback includes:

As we begin 2023, the Bundy Group team continues to see strong buyer interest for independently-owned businesses that address the manufacturing and plant maintenance markets. The executives and owners that are affiliated with these organizations should monitor these trends. The result of these market activities could be enormous value creation opportunities for companies that provide industrial, plant maintenance and automation solutions.

11/14/22

Tri Tech Automation, a turnkey industrial automation systems integrator in Moscow Mills, Mo., purchased Integrity Control Solutions (ICS), a panel fabrication and installation firm in Broken Arrow, Okla. Learn more.

11/11/22

The Middleby Corporation (NASDAQ: MIDD) acquired Escher Mixers, a designer and manufacturer of highly-engineered spiral and planetary mixers for the industrial baking industry. Learn more.

11/10/22

Electrical solutions provider Feyen Zylstra announces that its Industrial Tech division has been acquired by ATS Global, an international smart digital transformation company headquartered in Michigan, USA and Haarlem, The Netherlands. Learn more.

11/9/22

Krones, a leading manufacturer of filling and packaging solutions, has acquired a majority stake of R+D Custom Automation LLC (R+D). Based in Trevor, Wisconsin, R+D supplies machinery and equipment for the production and filling of containers for the pharmaceutical industry. Learn more.

11/3/22

RōBEX LLC (“RōBEX”), an innovative provider of robotics and industrial automation solutions, has acquired Vantage Corporation (“Vantage”), a Michigan-based industrial robotics manufacturer and integrator. Learn more.

11/2/22

Watlow, a designer and manufacturer of complete industrial thermal systems, has completed its acquisition of Eurotherm from Schneider Electric Company, the global leader in the digital transformation of energy management and automation. Learn more.

11/2/22

WiseTech Global (ASX:WTC), developer of leading logistics execution software CargoWise, acquired Shipamax, an industry-leading provider of data entry automation software for the logistics industry. Learn more.

10/21/22

Dorsett Controls, an industrial technology company and industry leader that manufactures advanced supervisory control and data acquisition (SCADA) systems software and hardware, has acquired Sunapsys, a Virginia-based system integrator who specializes in the design and implementation of controls and information systems in the water and wastewater market for municipalities, manufacturers, and OEMs. Learn more.

10/5/22

Leadec, the leading global service specialist for factories, has acquired Elmleigh Electrical Systems Limited as of 09/30/2022. Elmleigh is a process automation specialist and systems integrator for blue chip customers, including some of the largest operators in the food and beverage and parcel distribution sectors throughout the UK and Europe. Learn more.

7/6/22

IPS, a North American leader of single-source solutions for industrial and commercial power and mechanical processes, has acquired Tampa Armature Works, Inc. (TAW). The sale includes all eleven TAW locations serving customers in the Southeastern U.S., Caribbean, South America, and internationally. Learn more.

6/28/22

Downey Engineering in Toowoomba has been acquired by SAFEgroup Automation. Downey Engineering are the leading system integrator on the Darling Downs, with an incredible depth of experience in Rockwell, Schneider, Siemens, Omron automation platforms and Ignition SCADA. They are the leading provider of solutions to Agriculture, Mining, Manufacturing, Food & Bev, Energy, Infrastructure and Water clients across the region and beyond. Learn more.

6/22/22

CORE Industrial Partners (“CORE”), a manufacturing, industrial technology, and industrial services-focused private equity firm, announced today the acquisition of GoProto (“GoProto” or the “Company”), a provider of custom manufacturing services with a comprehensive suite of both additive and traditional manufacturing technologies. The acquisition combines GoProto with CORE portfolio company RE3DTECH to form an additive manufacturing platform focused on production parts utilizing Industry 4.0 capabilities. Learn more.

5/24/22

Bettcher Industries (“Bettcher”), a leading manufacturer of protein processing equipment and owned by private equity fund KKR, announced the signing of a definitive agreement under which it will acquire Frontmatec (the “Company”) from Axcel. Headquartered in Kolding, Denmark, Frontmatec is a global manufacturer of end-to-end automated solutions for pork and beef processing, with world-class robotics and vision system capabilities. The Company serves as a full line supplier of processing equipment, parts and services, instruments, and software, which help solve key issues around food and worker safety. Learn more.

Bundy Group is a CFE Media and Technology content partner.

In the December 2022 issue of Firewatch, a magazine published by the National Association of Fire Equipment Distributors (NAFED), Jim Mullens analyzes the positives and considerations of accepting an unsolicited offer versus running a competitive process managed by an investment banker.

FWDec22_UnsolicitedOffersIn this article for Industrial Cybersecurity Pulse, Bundy Group provides an update on mergers & acquisitions and capital placement activity in the cybersecurity market. After a busy year in the cybersecurity sector, we wanted to provide observations on activities and trends occurring in this rapidly evolving industry. The foundation for our feedback includes:

As we finish out 2022 and begin 2023, the Bundy Group team is witnessing numerous positive fundamentals that will continue to impact cybersecurity companies. The 2023 Gartner CIO and Technology Executive Survey, which gathered data from more than 2,000 CIO respondents around the world, reported that, of these respondents, 66% planned to increase their investment in cybersecurity. The executives and shareholders that are affiliated with these organizations should monitor these trends. The result of these market activities could be enormous value creation opportunities for cybersecurity organizations.

11/3/22

HUMAN Security, Inc. (formerly White Ops) — the global leader in safeguarding enterprises from digital attacks with modern defense — announced the acquisition of clean.io, the industry leader in protection against malvertising and e-commerce fraud. Learn more.

11/3/22

Passage, a leader in modern authentication technology, is joining the 1Password team to help accelerate the adoption of passkeys for developers, businesses, and their customers. Learn more.

11/3/22

11:11 Systems (“11:11”), a managed infrastructure solutions provider, announced the completion of both the acquisition of Sungard Availability Services’ (“Sungard AS”) Recovery Services business and Sungard AS Cloud and Managed Services (CMS) business. Learn more.

11/2/22

Intel 471, the premier provider of cyber threat intelligence for leading intelligence, security and fraud teams across the globe, announced the acquisition of SpiderFoot, a best-in-class provider of open-source intelligence, attack surface management and digital investigations. Learn more.

10/27/22

OPSWAT, a leading provider of critical infrastructure protection cybersecurity solutions, has acquired all assets of FileScan.IO, a free next-gen malware analysis platform with a focus on Indicators of Compromise extraction and related threat intelligence data. Learn more.

10/27/22

DMI, a global leader in digital transformation services, has acquired the Ambit Group LLC (“Ambit”), a leading provider of data analytics, cybersecurity and mission support services to the U.S. government. Learn more.

10/25/22

CyberRisk Alliance (CRA), a business intelligence company serving the cybersecurity sector, has acquired Cyber Security Summit (CSS) and TECHEXPO Top Secret, a leading provider of premium thought leadership and networking events for C-level leaders in cybersecurity and technology. Learn more.

10/20/22

J.S. Held, a Jericho, New York-based specialized global consulting firm, has acquired TBG Security, a cybersecurity consultancy that provides offensive and defensive cyber consulting services. Learn more.

10/18/22

NINJIO, a cybersecurity awareness company that leads the industry in customer satisfaction, has acquired DCOYA, an advanced behavior-centric cybersecurity solutions provider. Learn more.

10/17/22

Managed security service provider (MSSP) Security7 Networks announced it has joined Integris, a fast-growing national IT managed service provider (MSP). As a fully integrated team, Integris is now able to expand its existing talent base and enhance cybersecurity offerings to clients nationwide. Learn more.

10/13/22

KnowBe4, Inc. (the “Company” or “KnowBe4”) (Nasdaq: KNBE), the provider of the world’s largest security awareness training and simulated phishing platform, today announced that it has entered into a definitive agreement to be acquired by Vista Equity Partners (“Vista”) in an all-cash transaction valued at approximately $4.6 billion on an equity value basis. Learn more.

10/13/22

Email and brand protection provider Red Sift announced it has acquired attack surface management (ASM) provider Hardenize, after Red Sift raised $54 million in Series B funding earlier this year in an attempt to include email under the banner of the attack surface. Learn more.

10/11/22

ForgeRock (NYSE: FORG), a global digital identity leader, announced that it has entered into a definitive agreement to be acquired by Thoma Bravo, a leading software investment firm, for $23.25 per share, in an all-cash transaction valued at approximately $2.3 billion. Learn more.

10/10/22

Allurity has acquired the leading Danish service provider CSIS, taking yet another leap toward its goal of becoming Europe’s preferred provider of tech-enabled cybersecurity services. Learn more.

10/4/22

Deloitte Australia is acquiring Australia-based cybersecurity consultancy Hacktive in an effort to expand its managed security services offering and the capabilities of its Cyber Intelligence Centre. Learn more.

10/4/22

iC Consult Group, the world’s leading managed services and consulting company in the field of Identity & Access Management (IAM), has completed the acquisition of Kapstone Technologies LLC, a global provider of identity and security services. Learn more.

10/4/22

Infinigate Group, the pan-European value-added distributor (VAD) of cybersecurity solutions announced its merger with Dubai-based Starlink, the market-leading VAD in cybersecurity, secure cloud and secure networking in the Middle East and Africa. Learn more.

10/3/22

ASGN Incorporated (NYSE: ASGN), a leading provider of IT services and solutions, including technology and creative digital marketing across the commercial and government sectors, announced that it has acquired Iron Vine Security, a leading cybersecurity company that designs, implements and executes cybersecurity programs for federal customers. Learn more.

10/3/22

Kocho, UK-based provider of cybersecurity, identity, cloud transformation and managed services, announced that it has acquired Surrey-headquartered Mobliciti, the award-winning managed service provider (MSP) specializing in enterprise mobility, security and wireless connectivity solutions. Learn more.

Bundy Group is a CFE Media and Technology content partner.

In this article for Control Engineering Magazine, Bundy Group provides an update on mergers & acquisitions and capital placement activity in the automation market.

As 2022 comes to an end, I, as an investment banker, like to use this opportunity to remind business owners and executives of automation firms of an important action item they should take. That step is to work through an annual evaluation of the company, critically analyzing its fundamentals, strengths and weaknesses. A company should be thought of as an asset, and the foundation of that value is driven by numerous key business fundamentals. If shareholders and executives will commit to evaluating the firm’s business health on an annual basis, then it can have a profound effect on the value of the organization.

The above represents a sample of business health checklist items, however, it is by no means an exhaustive list. The end goal for any shareholder or executive when working through an annual checklist is to ensure those professionals understand the possible valuation range of their firm and action items they should take to build value. Bundy Group is available to further the conversation with owners who are exploring ways to build value, including in preparation for a sale or capital raise.

11/15/22

Roboyo Group, the world’s largest hyperautomation professional services company announces its acquisition of Procensol – a global powerhouse in low-code app development. Learn more.

11/15/22

Banyan Software, Inc., a company focused on acquiring, building, and growing great enterprise software businesses, has acquired Innovatum. Innovatum’s enterprise labeling software solutions enable the automation of product and package labeling and regulatory data upload in the life sciences industry. Learn more.

11/14/22

Tri Tech Automation, a turnkey industrial automation systems integrator in Moscow Mills, Mo., purchased Integrity Control Solutions (ICS), a panel fabrication and installation firm in Broken Arrow, Okla. Learn more.

11/11/22

The Middleby Corporation (NASDAQ: MIDD) acquired Escher Mixers, a designer and manufacturer of highly-engineered spiral and planetary mixers for the industrial baking industry. Learn more.

11/9/22

Krones, a leading manufacturer of filling and packaging solutions, has acquired a majority stake of R+D Custom Automation LLC (R+D). Based in Trevor, Wisconsin, R+D supplies machinery and equipment for the production and filling of containers for the pharmaceutical industry. Learn more.

11/9/22

Zelis, a company modernizing the business of healthcare, acquired Payspan, a leader in healthcare electronic payment and reimbursement automation services. The U.S. healthcare system is complex, with disjointed and often challenging financial processes. Learn more.

10/27/22

AdeptAg, the North American leader in controlled environment production solutions, acquired Bellpark Horticulture. With the addition of Bellpark, AdeptAg expands its product offerings, sales and support further into the automated horticulture systems industry. Learn more.

Bundy Group is a CFE Media and Technology content partner.