In this article for Practical Dermatology, Clint Bundy, Managing Director of Bundy Group, discusses how a deal's structure is the foundation to determine the total valuation of a transaction.

When a practice owner and advisors discuss a business sale or recapitalization, the starting topic is often transaction value. After all, the value is often the easiest component of a transaction to understand and compare against other deals in the market. Furthermore, the transaction value represents the “headline number,” which is easiest to understand and often the most marketable.

However, experienced transaction professionals recognize that the foundation of transaction value is the structure of the deal. A famous saying among mergers and acquisitions (M&A) professionals is, “You name the price; I’ll name the terms. I will win every time.” The structure of a deal can take on many forms, and its composition has a significant impact on the ultimate outcome that a client will realize. As practice owners begin analyzing offers, it is critical for them to understand the unique relationship of both value and structuring, and how the deal structure is the foundation of the offer.

The transaction value is the total consideration to the owners in a merger or acquisition. This total consideration have many different components, and each individual piece has its own attributes and value. The sum of each of the values for each of these individual structuring pieces is the total transaction value. While many assume that total transaction value equals upfront cash paid to the seller at transaction close, that is not always the case.

A transaction’s structure refers to how the buyer and seller organize the different forms of consideration to comprise the total valuation. The essential transaction structure elements are defined as follows:

When evaluating the various structures in an offer, an owner will find that the timing of payments, the probability of receiving these payments, and his own goals can collide, creating a great deal of complexity for the seller. Furthermore, there are numerous other factors to consider, including the role of the owners and employees post-closing and implementation of a practice’s strategic plan. An owner and his advisors should be thoughtful in their review and analysis of ideally multiple offers to determine the optimal structure.

Practice Net Income

+ Interest Expense

+ Income Taxes

+ Depreciation Expense

+ Amortization Expense

+ Excessive Physician Owner’s Compensation: Represents the difference between a physician owner’s current compensation and market compensation that the physician will be paid under a new owner

+ Non-Recurring Practice Expenses

+ Extraordinary Practice Expenses

+ Synergies with a Buyer’s Platform

Adjusted EBITDA For Practice

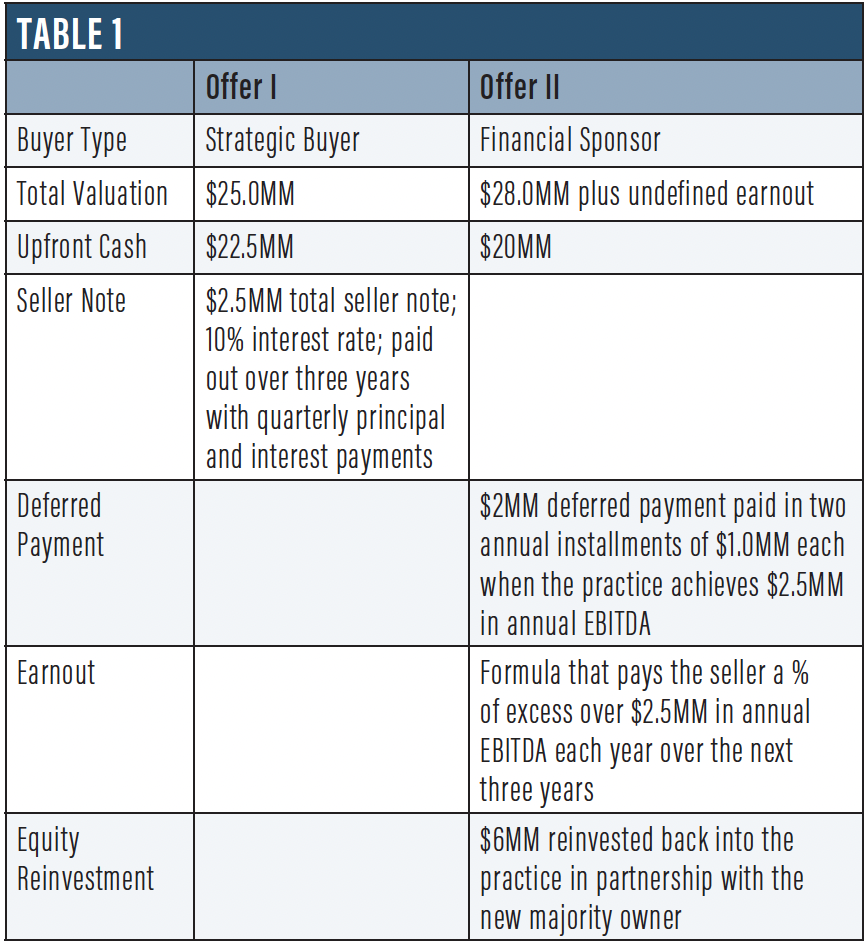

Because a decision on the optimal transaction structure is very situational dependent, we wanted to offer a scenario use (see Table 1).

The selling practice has been marketed by an investment banking representative to a group of buyers in a competitive process. The practice generated $2.5MM in adjusted EBITDA in its most recent fiscal year (earnings before interest expense, taxes, depreciation, and amortization), and management has projected revenue and EBITDA growth for the next three years.1 The owner of the practice is at a stage where he needs to obtain liquidity for his shares and find a buyer that will best support practice providers in growing the organization. He is in his mid-50s and is very open to future performance returns so long as he doesn’t have to significantly sacrifice safer forms of consideration (ie, upfront cash and seller note).

If an owner is prioritizing upfront cash, has a lower risk tolerance, and wants a relatively clean break at transaction close, then Offer I (combo of upfront cash and seller note) could be the optimal choice for the seller. It has $25MM in relatively low-risk consideration due to the seller, and there are additional returns associated with the interest income payments. However, if an owner is more focused on total transaction returns and has a willingness to accept more risky structures like equity reinvestment or earnout, then Offer II might be worthy of consideration.

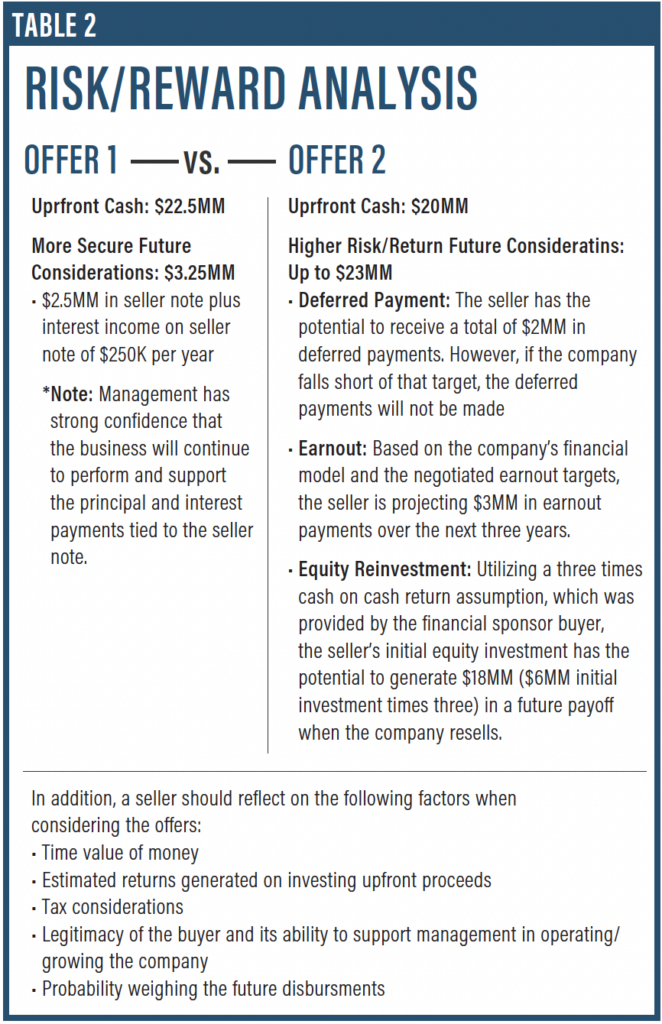

A more detailed analysis of the risk / reward profiles can be seen in Table 2.

For this situation, what is the best offer to take? The seller will have to be the final decision maker based on personal and business objectives and interpretation of the above offers and associated risks and returns. The job of a good investment banking advisor is to ensure that the client has the best quality, market-driven information available to make the most educated decision. Based on our experience with practice owners that fit the transaction scenario outlined above, it wouldn’t be surprising to see a client preference for Offer II over Offer I. From a macro perspective, sacrificing $5.75MM in more secure consideration could be worthwhile for the seller in exchange for the potential to realize an additional $15MM ($3MM of earnout and an estimated gain on equity reinvested of $12MM) in higher risk future consideration.

Once a seller has a full understanding of both value and structure, the next natural question is: how can you use deal structuring to make the deal even more seller friendly? This is a more complex, nuanced topic that can’t be addressed in one article or hypothetical transaction situation. There are two key mechanisms for a seller to ensure the optimal deal structure: competitive process and a client advisory team.

Competitive process creates multiple offers, which then offers the seller the opportunity to understand how the market would value and structure a deal for their practice. Furthermore, with competitive pressure, a seller can push the pool of buyers to the outer limits on optimal deal terms.

Because deal structuring is such an evolving landscape, it’s critical to have a client advisory team that fully understands trends in the current market, are experienced in evaluating scenarios and can coordinate and communicate with the seller client.

These concepts of value and structuring work hand-in-hand with one another, not as separate concepts. As multiple offers are submitted for a practice, and numerous structure components are included in the respective offers, the calculations can get more complicated, and the risk/reward analysis can become clouded. Each transaction is practice-specific and there are numerous ways to structure a deal, which is why it’s in the stakeholder’s best interest to use experienced advisors who can assist in evaluating the transaction structures and help the owner understand what best fits with their objectives.