As we quickly progress towards summer 2021, business owners have many reasons to be encouraged about the future, with pandemic recovery progressing and business valuations for many companies booming. With the future business environment looking much more positive than it has at any point in the past two years, many owners are subsequently facing critical decisions regarding whether or not 2021 is the year they want to realize liquidity from their business. A partial or full business sale process, or a leveraged recapitalization, can take six months or longer to achieve, which means that owners have a rapidly closing window to make a decision if they are focused on an outcome in 2021. As owners review a path forward for this year, there are a number of factors to consider.

MOTIVATION

It is critical and fundamentally significant for owners to realistically assess their desire to engage in and actively participate in a transaction process. Without active motivation from an owner, other factors driving a successful sale become less relevant. However, if an owner can sincerely justify exploring a transaction in the next 12 to 24 months, then it might be worthwhile to consider selling or completing a recapitalization in 2021.

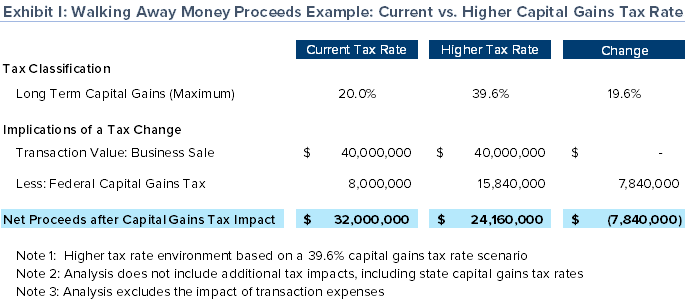

THREAT OF TAX RATE INCREASES

Whether or not a tax rate increase occurs in 2022, we are in an historically low tax rate environment, which is highly likely to change at some point in the future. The Biden administration and Congress continue to signal a desire to raise personal and business taxes. Proceeds available to an owner after taxes and transaction expenses, otherwise known as “walking away money” proceeds, could be massively impacted if, for instance, capital gains tax rates rise. The following scenario (Exhibit I) highlights both the potential and material impact on an owner’s “walking away money” should a tax rate increase incur.

CONFIDENCE IN THE ECONOMY

On April 11, 2021, ‘60 Minutes’ interviewed Federal Reserve Chairman Jerome Powell, and he stated that the U.S. economy is “at an inflection point” and is ready to “start growing much more quickly.” Furthermore, Powell added that the economy could grow at “6.0% or 7.0% in 2021,” which is the highest growth rate in “30 years.” From a market-timing standpoint, owners traditionally want to transact when both the economy and individual business performance are increasing and not when they are at their peaks or are declining. While the economic boom could continue well into 2022 and beyond, the remainder of 2021 appears to have the makings of a rebounding, strong economy.

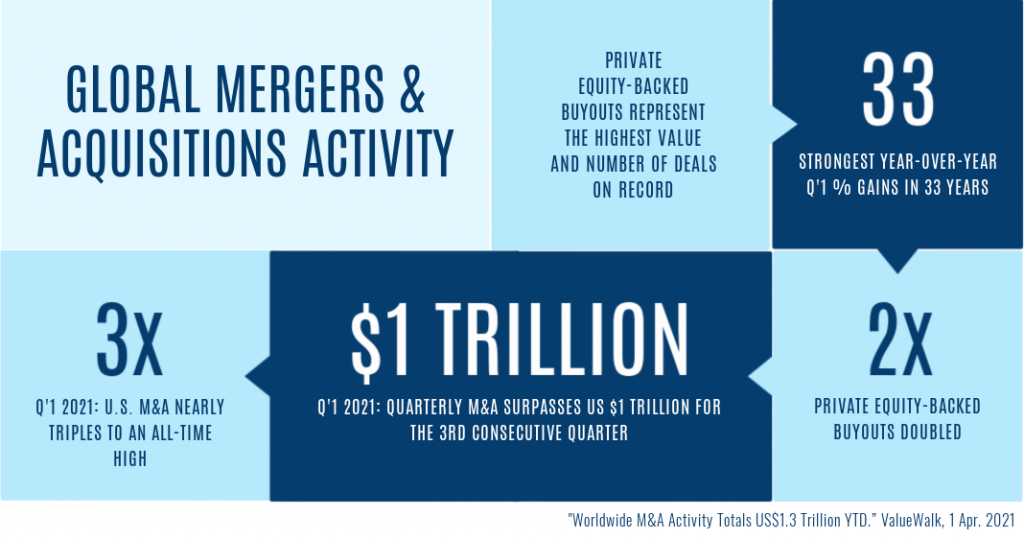

CAPITAL AVAILABILITY

Whether capital is for acquisition financing or for a dividend recapitalization, there is a significant amount of equity and a low interest rate debt in the market. With over $1.45 trillion in unused private equity capital, and with private lenders eager to provide acquisition financing, there is no shortage of financial horsepower to consummate transactions in 2021.1 Due to missed investment targets in 2020, financing sources have tremendous pressure to put money to work, and the fertile economic recovery creates an additional stimulant to boost capital deployment.

COVID IMPACT

Many businesses have experienced an impact on their financial and operational profiles as a result of the pandemic. Owners frequently ask Bundy Group how the M&A market will respond to their COVID-impacted businesses. The answer primarily depends on the specific industry, the fundamentals of the sector, and the changes tied to the individualized company. That being said, many strategic buyers and private equity groups are prepared to treat the pandemic as an extraordinary event and not discount a company’s valuation for a COVID impact. The onus will certainly be on the business and its advisors to articulate how a company is either back to normalized performance, or on its way back, in order to maximize a valuation.

BUYER COMPETITION

Owners across many industries, including technology, automation, healthcare, life sciences, industrials, and business services, continue to receive unsolicited calls from strategic buyers and private equity groups. Inbound calls from buyers do not always translate into quality discussions, but this is yet another indication that we are in an active seller’s market in 2021. A business owner, or an owner’s advisors, who knows how to drive and manage buyer competition will be able to maximize value, as well as strategic fit, for a company and its shareholders.

As owners evaluate strategic alternatives, possibilities for monetizing value, and maximizing “walking away money” from a business transaction, there are opportunities for the remainder of 2021 to earnestly consider and explore. The Bundy Group team is happy to further discuss options and opportunities with business owners regarding optimal ways valuation and “walking away money” proceeds can be maximized.

SOURCES:

(1) Sraders, Anne. “Private equity firms are sitting on $1.5 trillion in unspent cash, and looking to raise more.” Fortune January 2020.

Securities offered through Bundy Group Securities, LLC, Member FINRA

Check the background of Bundy Group Securities, LLC at FINRA's BrokerCheck