In a well-orchestrated business sale or capital raise, an owner should be able to attract buyers that demonstrate their intense demand for the company, including through paying a robust value and closing on those deal terms. However, while nearly all strategic buyers and investors (i.e. financial sponsors) will try to convince owners of their sincere interest, the reality is that not all of them fit into a leading contender category. Therefore, it is critical for business owners to understand the distinction between buyers and sponsors who want a company and those who genuinely need it. Selecting the best party through the right process can be the difference in millions of dollars in value, a smooth versus rough integration period, and a successfully closed transaction versus a blown deal.

The Supply of Strategic Buyers and Financial Sponsors Today

Most business owners today are well aware of the overabundance of strategic buyers and financial sponsors and their interest in acquiring or investing in privately held companies. Market data supports this trend, with over a trillion dollars of capital targeting acquisitions and investments in privately held businesses. Therefore, owners and executives are frequently inundated with phone calls, emails, and even visits from potential buyers and financial sponsors, expressing a keen interest in their companies.

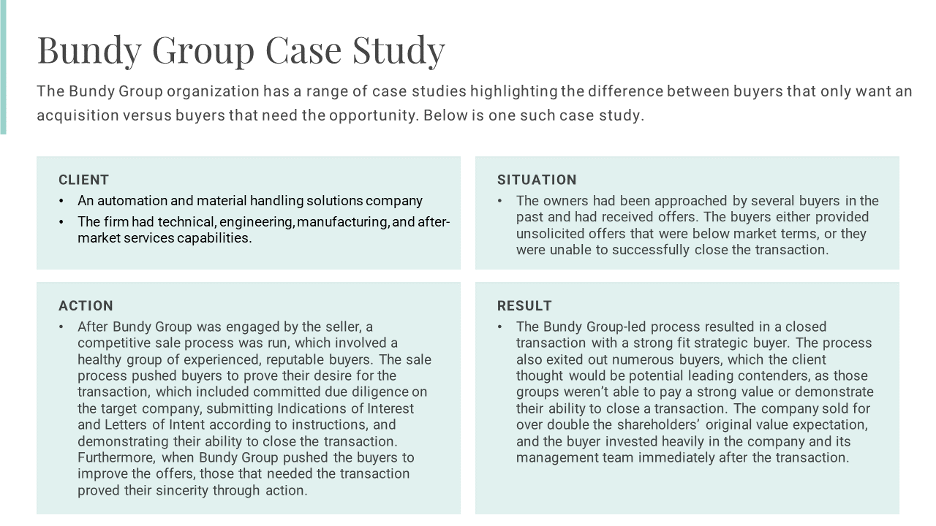

The strategic buyer and financial sponsor demand outweighs the supply of quality companies, which can provide an amazing position of strength for business owners...if utilized appropriately. However, buyers are in the business of acquiring companies for the best terms possible. The buyers who desire an acquisition but are willing to walk away instead of paying full market value will use every tool and tactic available to obtain this arbitrage benefit. As a result, an owner and the company’s advisors need to be able to proactively evaluate a buyer’s closed deal track record, motivations, diligence process, and reputation to determine who is worth selecting and focusing on through to close of a transaction. Equally importantly, a selling business must introduce an element of competition as the premier buyers will put their best foot forward when pushed to do so.

Distinguishing Between Buyer Wants and Needs

Actions speak louder than words, including in the field of mergers and acquisitions (M&A). A company seeking to sell or raise capital can effectively use information and a well-managed process to not only solicit interest but separate the “best from the rest” before deciding the best partner fit.

Takeaways

In the realm of M&A, distinguishing between buyers who want a business and those who genuinely need an acquisition is both an art and a science. The competitive process, due diligence, and evaluation of certainty to close play a pivotal role in making this distinction. Business owners should recognize that taking the time to discern these critical subtleties can lead to securing the best possible outcome for their business. Hiring a seasoned investment banker can provide an immense advantage to a seller, as that experienced advisor can not only run the process but also bring proprietary intelligence that can be utilized to narrow down the pool of buyers.

Even in M&A markets that have challenges and macroeconomic headwinds, buyers who truly need a business are willing to pay competitive multiples and close on a transaction. As long as businesses take the necessary steps to differentiate between buyer and investor wants and needs, then the probabilities substantially increase that the owners will close a transaction at a strong valuation. The world of business sales and capital raises might appear complex, but when approached methodically and with expert guidance, owners can feel confidence that they didn’t leave money on the table or didn’t see a quality universe of options.