In this article for Modern Aesthetics, Bundy Group assesses how medical spas, as well as dermatology, plastic surgery and cosmetic practices, can utilize a consortium sale with complementary practices to increase overall business value.

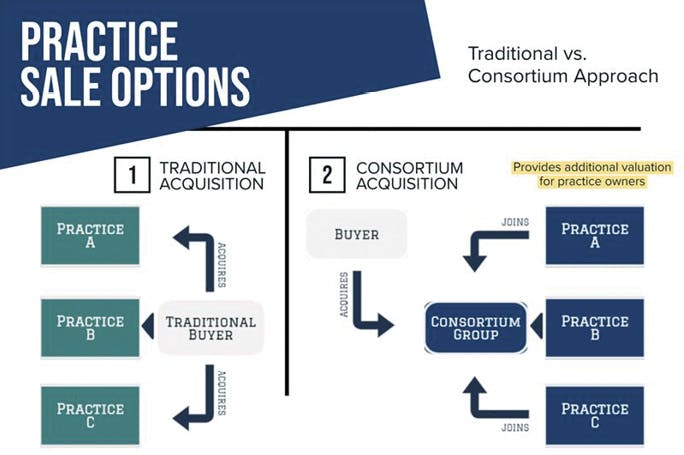

As an investment banking advisory firm, Bundy Group specializes in representing practices, which includes dermatology, medical spa, plastic surgery and cosmetic, in business sales and capital raises. It is common for the Bundy Group team to be in confidential discussions with multiple owners in this same healthcare segment at the same time. These owners are contemplating hiring our firm to represent them in a sale and often ask how they, as sellers, can drive the utmost value in a sale process. In certain situations, the team proposes a consortium sale to capture enhanced value. In short, this occurs by partnering with at least one other practice in a sale and engaging an experienced investment banking advisor to manage the consolidated sale process.

A consortium sale is taking two or more businesses in the same industry and presenting them together to the market of buyers. On the surface, presenting two or more practices in a sale can appear straightforward and simple. However, a material amount of preparation, communication, and vision are required of all key parties to execute on this strategy. As an investment banking advisor that has successfully executed this playbook, we understand these key steps and wanted to outline them below.

First, candidates need to be selected for the consortium. In our prior transactions, consortiums were formed not just along industry lines but also based on pre-existing relationships that owners had with one another. It is easier to get excited about teaming up with another practice in a sale if you, as an owner, have a lot of respect and affection for the other consortium candidate(s) and have a complementary, not competitive, fit with the other practice(s). It is certainly possible to have practices of different profiles partner up for a consortium. For example, a medical spa practice can join with plastic surgery or cosmetic-focused dermatology practice in pursuing a consortium sale.

While we might suggest a strong candidate based on our experience and knowledge of the situation, the consortium parties decide who is included in the collective sale. It is important to note that in a consortium sale the candidates will not formally merge or integrate prior to a transaction. Instead, they will be presented together as one platform acquisition opportunity that could be formally merged and integrated after the close of a consortium transaction.

To successfully execute and deliver enhanced value in a consortium sale, the following key positioning points must be addressed:

To answer this question, we will reference the typical financial sponsor playbook for acquisitions. A financial sponsor’s goal is to buy a platform (ie, first investment) at a buyer-friendly valuation and to complete add-on acquisitions at even lower valuation multiples. This arbitrage strategy allows financial sponsors to create enhanced returns, though at the expense of the sellers.

With a consortium strategy, we are flipping the financial sponsor approach on its head to benefit both business owners and sellers in the following ways:

In 2023, two dermatology and aesthetic practices based in the Western US formed a consortium with the goal of a consolidated sale. As highlighted earlier, these practices fit the recommended rule of thumb: they had complementary service offerings, operated in a similar region through multiple locations, and did not compete. In addition, each of the practices had similar organizational cultures and values. The owners of each practice had a long-time relationship and had profound respect for each other’s business. Individually, these practices were being frequently approached by buyers already active in the dermatology and aesthetics industry.

These two consortium members, operating under the same organizational structure post-close, would realize a tremendous amount of growth, revenue, and cost cooperation. The story of why these practices made sense together was very compelling.

Bundy Group had existing relationships with both practices through our tenured experience in the dermatology and aesthetics sector. In 2023, our team started a comprehensive sale process with the consortium members, which included strategic buyer and financial sponsors in the pool of buyers. The goals of the transaction have been to focus on a group of strong-fit buyers, which the practice owners approve of, and to obtain a premium valuation for all consortium members. As of October 2023, we have generated strong interest and offers from a range of quality buyers. We are targeting a closed transaction in the first quarter of 2024.

With proprietary experience in the consortium approach and successful client transactions of this structure, we are focusing on executing on the following goals:

In summary, our end goals are to fully represent the consortium clients and their interests, to drive value, and to find a best-fit buyer for the consortium’s future benefit.

While the consortium approach may not be a reliable opportunity for every practice, there are many healthcare practices that could benefit from this strategy. It can be a tremendous way for a practice owner that is considering a sale to obtain a significantly enhanced value. Give thought to other practices that may be candidates for a consortium partnership with you, consider contacting those owners to begin a conversation, and schedule an informal discussion with an experienced investment banker to explore this potential opportunity.