The resilience of the dermatology and aesthetics market, coupled with growth opportunities, continues to fuel the M&A trend. Clint Bundy, Managing Director with Bundy Group, shares key market insights in this article for Practical Dermatology.

PD0322_CF_MergersAcquisitionsBundy Group, a 32-year-old, industry-focused investment bank, announces that it has advised SuperHero Fire Protection (“SuperHero”) and its private equity owner, Hidden Harbor Capital Partners, in the acquisition of Twin City Sprinkler, a market-leading provider of fire, life, and safety solutions to commercial and industrial customers. Twin City Sprinkler has a long history of superior customer service, a reputation for excellence, and will continue to be led by its CEO, Darrell Inman. The transaction was led by Jim Mullens, Managing Director with Bundy Group.

SuperHero is the regional leader in fire, life, and safety services to multifamily and commercial end markets, primarily in the Southeastern United States. Headquartered in Lawrenceville, Georgia, SuperHero is led by President Don Mackey, Vice President Dustin Dean, and Vice President Josh Stephens.

Jim Mullens commented, “Twin City Sprinkler has been an industry standard in the fire protection segment for its clients since 1979, and the company’s impressive growth further validates the organization’s strength and value proposition to its clients.” Jim added, “The partnership with SuperHero Fire Protection, a well-respected market leader, will offer Twin City Sprinkler substantial new resources and opportunities as the company continues to grow.”

Ben Koch from Hidden Harbor, stated, “This acquisition strengthens our position in the North Carolina market by expanding our reach and deepening our capabilities. Twin City Sprinkler is an ideal fit with SuperHero given its long-tenured customer relationships and history of strong execution.” Regarding Bundy Group, Ben added, “We sought Bundy Group’s advice and assistance on this transaction because of the outstanding reputation and industry relationships that this leading investment bank has developed in the fire, security & safety market. The Hidden Harbor team appreciates Bundy Group’s support on the Twin City Sprinkler transaction.”

Bundy Group has an extensive track record in in the fire, security, & safety sector, which includes advising such clients as Templeton-Vest, Commercial Fyr-Fyters, and Systems Electronics. For more information about our industry expertise and other recent transactions, visit Fire, Security & Safety - Bundy Group.

About Bundy Group

Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The team of highly experienced investment bankers leverages extensive industry knowledge and experience to provide hands-on guidance to clients through every phase of the transaction. With over 250 closed deals over the past 32 years, Bundy Group’s primary goals are to provide high quality options and actionable insights and to deliver an optimal strategic fit at a premium value for our clients.

Bundy Group Securities, LLC, is a registered broker-dealer and member of FINRA and SIPC. Check the background of Bundy Group Securities, LLC at FINRA's BrokerCheck. Testimonials may not be representative of the experience of other customers and are no guarantee of future performance or success.

New York, New York - Bundy Group, a 32-year-old investment bank, announces that it has advised Systems Electronics, Inc. (“Systems Electronics”), a communications, safety, and security systems integrator for mission-critical organizations, in a sale to Corbett Technology Solutions, Inc. (“CTSI”), a global systems integrator of critical communications, fire, and security systems. CTSI is a portfolio company of Wind Point Partners, a Chicago-based private equity investment firm.

Founded in 1970 and headquartered in Knightdale, N.C., Systems Electronics helps healthcare facilities improve patient care and financial performance through clinical workflow process improvement, nurse call integration, resource tracking, reporting, and analytics. The company also delivers fire, security, and other systems integration solutions across its customer base of healthcare facilities, education facilities, and corporations.

Stewart Carlin, Managing Director with Bundy Group, stated, “Systems Electronics is recognized as one of the premier providers of system integration services for many of the leading healthcare systems in the Mid-Atlantic. The company’s long-term relationships with the region’s branded healthcare systems, combined with growth opportunities in fire, security & safety, will allow CTSI to further strengthen its position in the Southeast.” Stewart added, “Our team worked diligently in this transaction to deliver options that would accomplish shareholder goals and to find a buyer that would preserve the culture and business Mike Strickland and his team have spent the last 50 years cultivating. CTSI has made an outstanding investment in Systems Electronics, and we look forward to watching the two organizations grow together.”

Mike Strickland, President of Systems Electronics, said, “Bundy Group went to extraordinary lengths to explain each step of the sale process and to serve as a sounding board for our team at all inflection points. Bundy Group's senior team provided sound advice and genuinely had our best interests in mind.” Mike added, “The professionalism of the process, coupled with Bundy Group's dedication to our team, led to an outcome that exceeded our expectations. Without reservation, I would recommend Bundy Group to any business owner considering a sale.”

The transaction was led by Stewart Carlin, Clint Bundy, and Jim Mullens, Managing Directors with Bundy Group. Lorenc Biqiku and Megan Hagemann, Vice Presidents with Bundy Group, also worked on the transaction team.

Bundy Group has significant experience in the healthcare, systems integration, automation, and fire, security & safety sectors, and has previously advised such clients as MR Systems, Commercial Fyr-Fyters, Catawba Research, and Dorsett Controls. For more information about our industry expertise and other recent transactions, visit Industry Expertise - Bundy Group.

About Bundy Group

Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The team of highly experienced investment bankers leverages extensive industry knowledge and experience to provide hands-on guidance to clients through every phase of the transaction. With over 250 closed deals over the past 32 years, Bundy Group’s primary goals are to provide high quality options and actionable insights and to deliver an optimal strategic fit at a premium value for our clients.

Bundy Group Securities, LLC, is a registered broker-dealer and member of FINRA and SIPC. Check the background of Bundy Group Securities, LLC at FINRA's BrokerCheck. Testimonials may not be representative of the experience of other customers and are no guarantee of future performance or success.

Charlotte, NC - Bundy Group, a 32-year-old investment bank, announces that it has advised a consortium of three Western U.S.-based companies (collectively known as “Pacific”) in a consolidated sale to Integrated Power Services (“IPS”), a North American leader in service, repair, and engineering for electric motors and generators. IPS is a portfolio company of Searchlight Capital Partners, a global private equity group. A+ Electric Motor (“A+” or the “Company”), owned by Joe and Chuck Perry, was a member of Pacific. Industrial Electric Machinery and Reed Electric & Field Service were Pacific participants as well.

Founded in 1999, A+ offers complete pump and motor repair services through repair facilities in Billings and Butte, Montana. The Company‘s client end markets include power generation, industrials, oil & gas, and agriculture. In addition, A+ services clients across a five-state region, which includes Montana, Wyoming, Idaho, and the Dakotas.

As a member of the Pacific consortium and IPS, A+ joins a group of complementary electrical apparatus, automation, industrial equipment repair, and field services organizations that deliver solutions across the Western U.S. Pacific includes a total of seven facilities, over 100 employees, and a service region covering 12 states.

Joe Perry, General Manager of A+, further commented, “Bundy Group was thorough in all phases of the sale process, worked non-stop, and had a relentless focus on delivering value for its clients.” Joe further elaborated, “The Pacific sale provided A+ shareholders a substantial premium relative to offers we had received before hiring Bundy Group, and it gave us the opportunity to reinvest into IPS and realize additional future gains.”

Clint Bundy stated, “Bundy Group is a specialist in the energy & power, automation, and industrial services industries, and the success of the Pacific engagement is a major achievement for our firm.” Clint further added, “A+ is the dominant electrical apparatus solutions provider within a five-state region, and the Company’s management team is second to none. Bundy Group appreciated the opportunity to represent A+, and we are excited to see the A+ leadership team grow in partnership with Pacific and IPS.”

Stewart Carlin with Bundy Group said, “Our work on behalf of the Pacific clients, including A+, involved Bundy Group helping to articulate the vision of what a combined Pacific entity could look like and the steps to integrate the entities, all with the goal of demonstrating to the market that A+ and the other Pacific members demanded a platform-sized valuation.” Stewart added, “We enjoyed working in collaboration with the A+ team to achieve such an outstanding outcome.”

Regarding A+’s new partnership, Joe Perry stated, “The rapidly growing market in this part of the country has always been challenging for us to stay on pace with—to provide the level of service to our customers that they demand. By partnering with the Pacific team and IPS, we’ll be able to accelerate the customer-focused growth that our customers have come to know and expect.”

“Rarely does a company have an opportunity to acquire three well-run companies at once, with such distinguished records, that share the IPS goal of becoming their customers’ trusted advisor,” said John Zuleger, IPS President and CEO. “Adding these businesses to IPS will accelerate offering our industry-leading services to the Western U.S. and advance our reach as the highest quality, closest provider of power, electro-mechanical, and rotating equipment services in North America.”

The A+ transaction was led by Clint Bundy and Stewart Carlin, Managing Directors with Bundy Group. Lorenc Biqiku and Megan Hagemann, Vice Presidents with Bundy Group, also worked on the Pacific transaction team.

Bundy Group has significant experience in the energy & power, automation, industrial services, and business services sectors, and has previously advised clients including MR Systems, RAM Industrial Services, Koontz-Wagner, and Dorsett Controls. For more information about our industry expertise and other recent transactions, visit Industry Expertise - Bundy Group.

About Bundy Group

Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The team of highly experienced investment bankers leverages extensive industry knowledge and experience to provide hands-on guidance to clients through every phase of the transaction. With more than 250 closed deals over the past 32 years, Bundy Group’s primary goals are to provide high quality options and actionable insights and to deliver an optimal strategic fit at a premium value for our clients.

Bundy Group Securities, LLC, is a registered broker-dealer and member of FINRA and SIPC. Check the background of Bundy Group Securities, LLC at FINRA's BrokerCheck. Testimonials may not be representative of the experience of other customers and are no guarantee of future performance or success.

Charlotte, NC - Bundy Group, a 32-year-old investment bank, announces that it has advised a consortium of three Western U.S.-based companies (collectively known as “Pacific”) in a consolidated sale to Integrated Power Services (“IPS”), a North American leader in service, repair, and engineering for electric motors and generators. IPS is a portfolio company of Searchlight Capital Partners, a global private equity group. Reed Electric & Field Service (“Reed Electric” or the “Company”), owned by the Richard family, was a member of Pacific. Other members of Pacific included A+ Electric Motor (“A+”) and Industrial Electric Machinery (“IEM”).

Founded in 1929, Reed Electric & Field Service is a fourth-generation, family-owned company and is the longest-running electrical apparatus repair business in California. The Company, which has facilities in Los Angeles and Reno, specializes in the repair and sale of AC, DC, and synchronous motors up to 10,000HP/13.8 kV, as well as pumps and generators. Reed Electric’s client end markets include power generation, renewables, water & wastewater, and industrials. In addition, the Company services clients across a six-state region.

As a member of the Pacific consortium and IPS, Reed Electric joins a group of complementary electrical apparatus, automation, industrial equipment repair and field services organizations that deliver solutions across the Western U.S. Pacific includes a total of seven facilities, over 100 employees, and a service region covering 12 states.

Roy Richard, President of Reed Electric, commented, “The Reed team has had great respect for IEM, A+, and Bundy Group for many years, and we were excited to join the Pacific consortium. Bundy Group did an outstanding job of coordinating all Pacific members from beginning to end and treating the collective group as one team, which created fluid decision-making and an outstanding result.” Roy continued, “The value delivered for the shareholders by Bundy Group was phenomenal, and the team at Reed Electric will have an ideal future partner in IPS.”

Clint Bundy stated, “Bundy Group is a specialist in the energy & power, automation, and industrial services industries, and the success of the Pacific engagement is a major achievement for our firm.” Clint further added, “Reed Electric is one of the most storied electromechanical services organizations in the Western U.S., and the Richard family has done an outstanding job of developing a first-class management team. Bundy Group has enjoyed building the relationship with Roy and John Richard over the past decade, and we are excited for the Reed management team as those executives will be a critical component for IPS’ Western U.S. growth strategy.”

Stewart Carlin with Bundy Group said, “Our work on behalf of the Pacific clients, including Reed Electric, involved Bundy Group helping to articulate the vision of what a combined Pacific entity could look like and the steps to integrate the entities, all with the goal of demonstrating to the market that Reed Electric and the other Pacific members demanded a platform-sized valuation.” Stewart added, “We enjoyed working in collaboration with the Reed Electric team to achieve such an outstanding outcome.”

Regarding Reed Electric’s new partnership, Roy stated, “Reed Electric has a rich, 93-year history of providing high-quality electromechanical services while delivering excellent customer service. IPS has demonstrated that they hold these same core values. Those values, combined with their marketplace strength, mean we couldn’t be more excited to join the IPS network.”

“Rarely does a company have an opportunity to acquire three well-run companies at once, with such distinguished records, that share the IPS goal of becoming their customers’ trusted advisor,” said John Zuleger, IPS President and CEO. “Adding these businesses to IPS will accelerate offering our industry-leading services to the Western U.S. and advance our reach as the highest quality, closest provider of power, electro-mechanical, and rotating equipment services in North America.”

The transaction was led by Clint Bundy and Stewart Carlin, Managing Directors with Bundy Group. Lorenc Biqiku and Megan Hagemann, Vice Presidents with Bundy Group, also worked on the Pacific transaction team.

Bundy Group has significant experience in the energy & power, automation, industrial services, and business services sectors, and has previously advised clients including MR Systems, RAM Industrial Services, Koontz-Wagner and Dorsett Controls. For more information about our industry expertise and other recent transactions, visit Industry Expertise - Bundy Group.

About Bundy Group

Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The team of highly experienced investment bankers leverages extensive industry knowledge and experience to provide hands-on guidance to clients through every phase of the transaction. With over 250 closed deals over the past 32 years, Bundy Group’s primary goals are to provide high quality options and actionable insights and to deliver an optimal strategic fit at a premium value for our clients.

Bundy Group Securities, LLC, is a registered broker-dealer and member of FINRA and SIPC. Check the background of Bundy Group Securities, LLC at FINRA's BrokerCheck. Testimonials may not be representative of the experience of other customers and are no guarantee of future performance or success.

Charlotte, NC - Bundy Group, a 32-year-old investment bank, announces that it has advised a consortium of three Western U.S.-based companies (collectively known as “Pacific”) in a consolidated sale to Integrated Power Services (“IPS”), a North American leader in service, repair, and engineering for electric motors and generators. IPS is a portfolio company of Searchlight Capital Partners, a global private equity group. Industrial Electric Machinery (“IEM” or the “Company”), owned by the IEM management team, was a member of Pacific. A+ Electric Motor and Reed Electric & Field Service were Pacific participants as well.

Founded in 1988, IEM is one of the leading electrical apparatus repair providers in the Pacific Northwest. The Company is headquartered in Longview, WA with branch operations in Visalia and Carson, CA. IEM’s client end markets include pulp & paper, water & wastewater, renewables, power utilities, and industrials. In addition, IEM services clients across a nine-state region.

As a member of the Pacific consortium and IPS, IEM joins a group of complementary electrical apparatus, automation, industrial equipment repair, and field services organizations that deliver solutions across the Western U.S. Pacific includes a total of seven facilities, over 100 employees, and a service region covering 12 states.

Spencer Wiggins commented about Bundy Group, “After Clint Bundy and I developed the idea of the Pacific consortium, the Bundy Group team worked flawlessly and in a collaborative fashion with the respective Pacific firms to manage a highly competitive sale process.” Spencer added, “The end-result from the process was a great new partner in IPS and a realized IEM valuation that was superior to what we would have received had we sold the Company as a standalone. We could not have been happier with the outcome that the Bundy Group team delivered.”

Clint Bundy stated, “Bundy Group is a specialist in the energy & power, automation, and industrial services industries, and the success of the Pacific engagement is a major achievement for our firm.” Clint further added, “IEM is one of the leading solutions providers in the Western U.S., and the Company’s progressive management team is among the very best in the industry. Bundy Group has enjoyed building the relationship with Spencer and his partners over the past few years, and we are excited for the IEM management team as those executives will be the foundation for IPS’ Western U.S. growth strategy.”

Stewart Carlin with Bundy Group said, “Our work on behalf of the Pacific clients, including IEM, involved Bundy Group helping to articulate the vision of what a combined Pacific entity could look like and the steps to integrate the entities, all with the goal of demonstrating to the market that IEM and the other Pacific members demanded a platform-sized valuation.” Stewart added, “We enjoyed working in collaboration with the IEM team to achieve such an outstanding outcome.”

Regarding IEM’s new partnership, Spencer stated, “Industrial Electric Machinery has a longstanding reputation as a leader in power and rotating equipment services.” He further elaborated, “IPS shares our desire to be world-class, to be a destination for customers and employees, and to be thought leaders in the space. It was evident immediately that IPS is a great fit, and we’re excited to join the IPS team!”

“Rarely does a company have an opportunity to acquire three well-run companies at once, with such distinguished records, that share the IPS goal of becoming their customers’ trusted advisor,” said John Zuleger, IPS President and CEO. “Adding these businesses to IPS will accelerate offering our industry-leading services to the Western U.S. and advance our reach as the highest quality, closest provider of power, electro-mechanical, and rotating equipment services in North America.”

The transaction was led by Clint Bundy and Stewart Carlin, Managing Directors with Bundy Group. Lorenc Biqiku and Megan Hagemann, Vice Presidents with Bundy Group, also worked on the Pacific transaction team.

Bundy Group has significant experience in the energy & power, automation, industrial services, and business services sectors, and has previously advised clients including MR Systems, RAM Industrial Services, Koontz-Wagner and Dorsett Controls. For more information about our industry expertise and other recent transactions, visit Industry Expertise – Bundy Group.

About Bundy Group

Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The team of highly experienced investment bankers leverages extensive industry knowledge and experience to provide hands-on guidance to clients through every phase of the transaction. With over 250 closed deals over the past 32 years, Bundy Group’s primary goals are to provide high quality options and actionable insights and to deliver an optimal strategic fit at a premium value for our clients.

Bundy Group Securities, LLC, is a registered broker-dealer and member of FINRA and SIPC. Check the background of Bundy Group Securities, LLC at FINRA's BrokerCheck. Testimonials may not be representative of the experience of other customers and are no guarantee of future performance or success.

Charlotte, NC - Bundy Group, a 32-year-old investment bank, announces that it has advised a consortium of three Western U.S.-based companies (collectively known as “Pacific”) in a consolidated sale to Integrated Power Services (“IPS”), a North American leader in service, repair, and engineering for electric motors and generators. IPS is a portfolio company of Searchlight Capital Partners, a global private equity group. The three companies are Industrial Electric Machinery (“IEM”), Reed Electric & Field Service (“Reed Electric”), and A+ Electric Motor ("A+"). The Pacific transaction was led by Clint Bundy and Stewart Carlin, Managing Directors with Bundy Group. Lorenc Biqiku and Megan Hagemann, Vice Presidents with Bundy Group, also worked on the Pacific transaction team.

Pacific consists of complementary electrical apparatus, automation, industrial equipment repair, and field services organizations that deliver solutions across the Western U.S. Furthermore, it includes seven facilities, over 100 employees, a service region covering 12 states, and client end markets that include the wind, solar, hydro, and geothermal renewables segments.

Founded in 1988, IEM, headquartered in Longview, WA with branch operations in Visalia and Carson, CA, is a leading provider of electrical apparatus repair, control systems integration, and distribution solutions. Reed Electric, a 93-year-old, fourth-generation family-owned company that specializes in the repair and sale of motors, pumps, and generators, has facilities in Los Angeles, CA and Reno, NV. Founded in 1999, A+ Electric Motor offers complete pump and motor repair services for clients in Montana, Wyoming, Idaho, and the Dakotas through its two repair facilities in Billings and Butte, MT.

Spencer Wiggins, President of IEM, stated, “After Clint Bundy and I developed the idea of the Pacific consortium, the Bundy Group team worked flawlessly and in a collaborative fashion with respective Pacific firms to manage a highly competitive sale process.” Spencer added, “The end result was a great new partner in IPS and a Pacific valuation that was higher for each shareholder as a result of selling as a group versus selling the companies individually. We could not have been happier with the outcome that the Bundy Group team delivered.”

Roy Richard, President of Reed Electric, commented, “The Reed team has had great respect for IEM, A+, and Bundy Group for many years, and we were excited to join the Pacific consortium. Bundy Group did an outstanding job of coordinating all Pacific members from beginning to end and treating the collective group as one team, which created fluid decision-making and an outstanding result.” Roy continued, “The value delivered for the shareholders by Bundy Group was phenomenal, and the team at Reed Electric will have an ideal future partner in IPS.”

Joe Perry, General Manager of A+, stated, “Bundy Group was thorough in all phases of the sale process, worked non-stop, and had a relentless focus on delivering value for its clients.” Joe elaborated, “The Pacific sale provided A+ shareholders a premium value, and it gave us the opportunity to reinvest into IPS and realize additional gains.”

Clint Bundy stated, “Bundy Group is a specialist in the energy & power, automation, and industrial services industries, and the success of the Pacific engagement is a major achievement for our firm.” Clint further added, “This was a complex engagement, due, in no small part, to our coordinating three separate companies with the goal of acting as one group. We could not have executed and closed on this transaction without outstanding clients and a Bundy Group team that is among the best in the investment banking profession.”

Stewart Carlin with Bundy Group said, “Our work on behalf of the three clients included helping to articulate the vision of what a combined Pacific entity could look like and the steps to integrate the entities, all with the goal of demonstrating to the market that Pacific demanded a platform-worthy valuation.” Stewart added, “We enjoyed working in partnership with the Pacific clients to achieve such an outstanding outcome.”

Bundy Group has significant experience in the energy & power, automation, industrial services, and business services sectors, and has previously advised clients including MR Systems, RAM Industrial Services, and Dorsett Controls. For more information about our industry expertise and other recent transactions, visit Industry Expertise - Bundy Group.

About Bundy Group

Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The team of highly experienced investment bankers leverages extensive industry knowledge and experience to provide hands-on guidance to clients through every phase of the transaction. With over 250 closed deals over the past 32 years, Bundy Group’s primary goals are to provide high quality options and actionable insights and to deliver an optimal strategic fit at a premium value for our clients.

Bundy Group Securities, LLC, is a registered broker-dealer and member of FINRA and SIPC. Check the background of Bundy Group Securities, LLC at FINRA's BrokerCheck. Testimonials may not be representative of the experience of other customers and are no guarantee of future performance or success.

In this article for Control Engineering, Bundy Group provides an update on mergers & acquisitions and capital placement activity in the automation market.

The second half of 2021 has continued to witness a tremendous amount of mergers and acquisition and capital raise activity in the automation sector. Strategic buyers, private equity groups, family offices and fundless sponsors have been attracted to the industry segment for a variety of reasons. This includes the projected growth of the automation market, the opportunity for consolidation in the segments, and the ability to own proprietary hardware and software systems.

A supporting statistic from the recent J.P. Morgan report on the automation industry indicates that approximately 88% of control system integrators surveyed anticipate growth in demand for automation solutions over the next 12 months [ J.P. Morgan – Automation Industry Report; November 12, 2021]. As demonstrated by the plethora of transactions that occurred in 2021, buyers and investors are bullish about the trajectory of the automation space, and there are no signs of letting up for the buying and selling of, or investing in, automation companies.

Two representative transactions to note are Inframark’s acquisition of MR Systems and Sverica Capital Management’s investment in Automated Control Concepts (“ACC”). MR Systems, a leading automation and cybersecurity solutions provider focused on the water and wastewater sector, was acquired by Inframark, an industry leader in the operations, maintenance, and management of water and wastewater facilities (see below case study). Sverica, a private equity investment firm, acquired a majority position in ACC, a systems integrator specializing in process control, manufacturing intelligence and cyber security & industrial networking.

Greg Hylant, Vice President with Sverica, stated, “The systems integration ecosystem within the industrial automation space is extremely fragmented, with only a small handful of players having reached national scale. We identified ACC as a high-growth regional platform that could benefit from our capital and expertise in business-building to take full advantage of the wave of American manufacturers embracing the power of Industry 4.0.”

These two transactions capture the range of M&A and capital raise events that are occurring across automation, robotics, control system integration, software and Industrial Internet of Things (IIoT). A total of 19 automation transactions were made in the fourth quarter of 2021.

12/2/21

Yokogawa Electric Corporation (TOKYO: 6841) announces it has acquired all of the outstanding shares of PXiSE Energy Solutions LLC, a San Diego-based developer of software that enables utilities and other grid operators to deliver reliable and stable power by managing renewables and distributed energy resources (DERs) in real time. Through this acquisition, Yokogawa will build on its capabilities in the monitoring and control of power generation facilities and assist customers in the power transmission and distribution sectors to meet their clean energy goals. Learn more

11/23/21

Regal Rexnord, a global provider in the engineering and manufacturing of industrial powertrain solutions, power transmission components, electric motors and electronic controls, and specialty electrical components and systems, has announced that it has completed the strategic acquisition of Arrowhead Systems (“Arrowhead”), based in Oshkosh, Wis. Learn more.

11/16/21

Circonus, the full-stack monitoring and analytics platform built for the modern-day enterprise, today announced it has secured $10 million in Series B funding led by Baird Capital with participation from existing investors NewSpring Capital, Osage Venture Partners, and Bull City Venture Partners. The new funding will be used to accelerate growth, scale product innovation, and build upon the company’s record-setting performance in 2021. Learn more.

11/10/21

Middle market private equity firm One Equity Partners (OEP) has completed the acquisition of USNR, the world’s most comprehensive supplier of equipment and technologies for the wood processing industry, and Wood Fiber Group, a manufacturer and supplier of sawmill consumables, parts, and services. Learn more.

11/7/21

ATS Automation Tooling Systems Inc. (TSX: ATA) (“ATS” or the “Company”), an industry-leading automation solutions provider, announced it has entered into a definitive agreement to acquire SP Industries, Inc. (“SP”), a designer and manufacturer of high-grade biopharma processing equipment, life sciences equipment, and lab apparatus products for US$445 million (~C$550 million), subject to customary post-closing adjustments, representing 15.3x SP’s trailing 12 month adjusted EBITDA or 11.9x post synergies. Learn more.

11/4/21

Inframark, LLC, an industry leader in the operations, maintenance, and management of water and wastewater facilities, is pleased to announce that it has acquired MR Systems, Inc., an Atlanta-based company that specializes in providing automation, process controls, instrumentation, and supervisory control and data acquisition (SCADA) systems for the municipal water and wastewater market. The addition of MR Systems to Inframark’s existing SCADA division brings a level of scale that will enable Inframark and MR Systems to create an embedded SCADA offering throughout the Inframark portfolio, primarily consisting of water and wastewater contract operations and municipal utility district operations and maintenance (O&M) clients, in addition to their commercial and industrial customer base. Learn more.

11/3/21

Audax formed EIS in September 2019 through the carveout of a collection of distribution assets from Genuine Parts Company (NYSE: GPC) with the vision of creating a value-added distributor of process materials and supply chain solutions to customers that support critical electrical and power transmission infrastructure. Audax will continue to work with the EIS management team to drive further organic growth and accelerate its acquisition strategy to expand its distribution footprint, customer base, and portfolio of value-add offerings. Learn more.

11/2/21

Inphase is a complete E&I construction, commissioning and maintenance service provider with a strong customer base and presence across southern Alberta and Saskatchewan. They are a full-service electrical contractor for large industrial Solar projects and were the first electrical contractor to install an industrial-size solar farm in Western Canada. Learn more.

11/1/21

H.I.G. Capital, a leading global alternative investment firm with over $45 billion of equity capital under management, announced that its portfolio company, United Flow Technologies, a platform established to invest in the municipal and industrial water and wastewater market, has completed the acquisitions of Tesco Controls, Inc. (“TESCO”) and The Henry P. Thompson Company (“HPT”). TESCO and HPT represent UFT’s second and third acquisitions, respectively, following its initial acquisition of MISCOwater in July 2021. Learn more.

10/27/21

Sverica Capital Management LP (“Sverica”), a private equity investment firm, today announced that on October 22 it acquired a majority position in Automated Control Concepts, LLC (“ACC” or the “Company”), a systems integrator specializing in process control, manufacturing intelligence and cyber security & industrial networking. Learn more.

10/26/21

Fabric announced that it has closed a $200 million Series C funding round led by existing investor Temasek, with participation from Koch Disruptive Technologies, Union Tech Ventures, Harel Insurance & Finance, Pontifax Global Food and Agriculture Technology Fund (Pontifax AgTech), Canada Pension Plan Investment Board (CPP Investments), KSH Capital, Princeville Capital, Wharton Equity Ventures, and others. Learn more.

10/21/21

Industrial Flow Solutions, an industrial pumping solutions provider headquartered in New Haven, Conn., recently announced that it will acquire Clearwater Controls Ltd, a wastewater solutions provider based in Glasgow, Scotland. Clearwater Controls offers a broad line of wastewater products, including deragging intelligent and process advanced monitoring technology. Terms of the acquisition were not disclosed, but Clearwater Controls will retain its company name and brand. Learn more.

10/14/21

Kaman Distribution Group (“KDG”) announced that it has acquired Integro Technologies Corporation. Based in Salisbury, North Carolina, Integro Technologies is a nationally recognized and industry-leading vision integrator and inspection company. With over 50 employees and 30 degreed engineers, Integro develops turn-key productivity solutions through machine vision and robotics. Learn more.

10/13/21

Dexterity, the creators of intelligent robotic systems for logistics, warehouses, and supply chain, today announced that it raised an additional US$140M in Series B equity funding and debt. Major existing investors Lightspeed Venture Partners and Kleiner Perkins greatly expanded their commitment to Dexterity by leading the Series B, with additional participation from Obvious Ventures, B37 Ventures and Presidio Ventures. Dexterity will use the new capital to support the growth of the company as its first thousand robots are deployed into production. Learn more.

10/13/21

HBM Holdings (“HBM”) announced it has acquired Control Devices, LLC of Fenton, MO. Control Devices, a portfolio company of Goldner Hawn founded in 1963, is a leading designer and manufacturer of highly engineered flow-control products utilized in niche applications across a diverse array of end markets. The acquisition expands HBM’s portfolio in the industrial components space, adding Control Devices to the existing roster of Mississippi Lime Company, Aerofil Technology, HarperLove, and Schafer Industries. Learn more.

10/11/21

Emerson to Receive 55% Stake of New AspenTech. AspenTech Shareholders to Receive Approximately $87 Per Share in Cash and 0.42 Shares of New AspenTech for each AspenTech Share, Providing Upside through 45% Stake. New AspenTech Expected to Drive Double-Digit Annual Spend Growth, Best-in-Class Profitability, Strong Free Cash Flow and Be Positioned to Pursue and Complete Strategic Transactions. Learn more.

10/6/21

IES Holdings, Inc. (“IES”) (NASDAQ: IESC) announced that it has invested in Automation Intellect, a Charlotte, NC-based Software as a Service (“SaaS”) company that provides machine performance analytics to manufacturing companies. Automation Intellect’s leading Industrial Internet of Things (“IIoT”) platform provides actionable insights to plant managers to help to reduce downtime and increase manufacturing efficiency and throughput. Learn more.

10/5/21

Nintex, the global standard for process management and automation, announced a definitive agreement to sell a majority stake in the company to TPG Capital, the private equity platform of global alternative asset firm TPG. Across its platforms, TPG has invested in leading software companies including C3 AI, Planview, ThycoticCentrify, WellSky, and Zscaler. Nintex’s current majority investor, Thoma Bravo, a leading software investment firm, plans to make a new equity investment in the company and maintain a significant minority interest. The transaction is expected to be completed by the end of 2021, subject to customary closing conditions. Learn more.

10/1/21

ECS Solutions, Inc. founded in 1977, and dedicated to performance improvement and innovation in batch manufacturing, has acquired the assets of LPR Automation, LLC of Bowling Green, KY. LPR Automation, founded in 2003, specialized in a wide range of control engineering and automation services. Learn more.

Bundy Group is a CFE Media and Technology content partner.

Bundy Group, a 32-year-old, industry-focused investment bank, announces that it has advised MR Systems, a leading automation and cybersecurity solutions provider, in a sale to Inframark, an industry leader in the operations, maintenance, and management of water and wastewater facilities. Inframark is a portfolio company of New Mountain Capital, a New York-based private equity group. The transaction was led by Clint Bundy and Stewart Carlin, Managing Directors with Bundy Group. Lorenc Biqiku and Megan Hagemann, Vice Presidents with Bundy Group, also worked on the MR Systems transaction team.

MR Systems has been a services leader in the water and wastewater segment for nearly 30 years, and it maintains a first-class organization in the form of a skilled base of employees and multiple locations throughout the Eastern U.S. Key solutions offered by MR Systems include control system integration, cybersecurity, process controls, artificial intelligence, and process visualization.

Clint Bundy commented, “MR Systems has been the industry standard in the automation and cybersecurity solutions segment for municipal water and wastewater operations since 1994, and the company’s impressive growth over the past few years further validates the strength and value-proposition to its clients.” Clint added, “The partnership with Inframark, one of the largest water and wastewater operators in North America, will offer MR Systems substantial new resources and opportunities as the company continues to grow.”

Stewart Carlin stated, “Tom Hopkins and the MR Systems leadership team were outstanding to work with throughout the process.” Stewart further added, “From the start, we developed a strong collaborative relationship that enabled us to clearly articulate and support MR System’s unique value proposition, inclusive of developing new analytical tools that will benefit management in the long-term. Bundy Group’s experience working with companies at the forefront of innovation, coupled with our deep industry relationships, allowed us to deliver an outcome that will be transformative for both MR Systems and Inframark.”

Tom Hopkins, Chief Executive Officer and Chairman of the Board of Directors for MR Systems, commented, “We engaged Clint and the Bundy Group team because of their relationship building efforts with the MR Systems team and impressive track record in the automation, cybersecurity, and technology segments. The Bundy Group team provided a full commitment to MR Systems, delivered a full rolodex of highly attractive buyers, and managed a competitive sales process, all of which resulted in our selecting a strong-fit partner and receiving an outstanding outcome for the shareholders.” Furthermore, Tom added, “Simply put, we could not have been happier with Bundy Group as our investment banking advisor.”

Bundy Group has significant experience in the automation, technology and business services sectors and has previously advised clients including GrayMatter, Dorsett Controls, and Custom Controls Unlimited, among others. For more information about our industry expertise and other recent transactions, visit Controls & Automation - Bundy Group.

About Bundy Group

Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The team of highly experienced investment bankers leverages extensive industry knowledge and experience to provide hands-on guidance to clients through every phase of the transaction. With over 250 closed deals over the past 32-years, Bundy Group’s primary goals are to provide high quality options and actionable insights and to deliver an optimal strategic fit at a premium value for our clients.

Bundy Group Securities, LLC, is a registered broker-dealer and member of FINRA and SIPC. Check the background of Bundy Group Securities, LLC at FINRA's BrokerCheck. Testimonials may not be representative of the experience of other customers and are no guarantee of future performance or success.

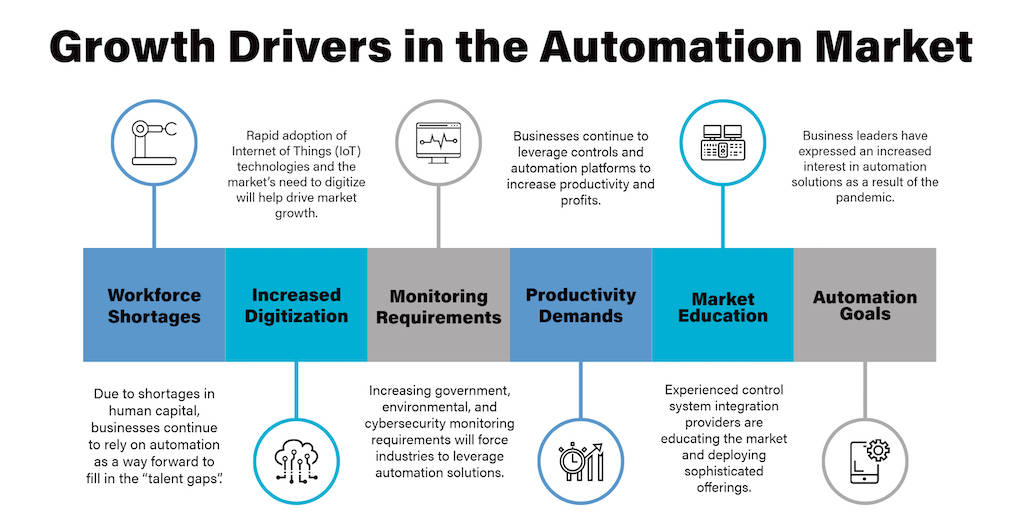

Global automation is expected to expand 51% from 2020 to 2025, driven by personal shortages, remote monitoring and increased records requirements and productivity demands. Robust mergers and acquisition investments to enhance margins validate the growth, explains the Bundy Group in this article for Control Engineering.

Automation markets, investments and mergers and acquisitions are hot globally to meet personnel shortages, monitoring requirements and productivity needs. Bundy Group, an investment bank and advisory firm, has followed robust mergers and acquisitions and capital placement activities in the automation market.

The automation sector is experiencing significant expansion, and the business community is noticing. A report on the dynamic industrial automation and market-compelling investment opportunities, Florian Funke, L.E.K. Consulting and Harris Williams said the global automation market is projected to increase 51% from $175 billion in 2020 to $265 billion in 2025.

Numerous drivers for the growth include companies filling in the void created by a shortage of personnel, managing monitoring requirements driven by regulation, and generating productivity improvements to enhance margins. This sizable and growing automation market’s value has been further validated by the robust mergers and acquisitions (M&A) activity in industrial automation markets.

While the automation market has experienced a significant amount of M&A and investment activity over the past decade, this continued pace of acquisitions and capital placements since the beginning of the COVID-19 pandemic has demonstrated the resilience of the industry. The pandemic reinforced the mission-critical nature of the automation market as controls and automation markets prepare for growth in the post-pandemic age. Automation end-users as well as buyers and investors are realizing opportunities.

Strategic buyers and financial sponsors (private equity, family offices and growth equity firms) have recognized the vital role the automation market plays in the global economy, which is further driving an appetite to acquire and invest in businesses that provide automation services, products and solutions.

Aggressive buyer and investor demands place automation-related business owners in a preferred category, and automation companies positioned in a sale or capital raise process maximize chances for significant interest and premium valuations.

Business sale and capital placement transactions through August 2021 are reflective of heightened interests in the automation industry.

An August 2021 control system integration transaction to note is Revere Control Systems’ acquisition of Florida-based Curry Controls, which solidifies Revere as an automation leader in the Southeast. A recent series of 2021 automation manufacturing acquisitions was led by Audax, a Boston-based financial sponsor, which started with the acquisition of SJE followed then by the immediate add-on acquisition of control systems manufacturer LW Allen.

In the robotics industry, a subsegment of the broader automation space, Zebra Technologies acquired Fetch Robotics in a $290 million transaction. The transaction value / revenue multiple for the Fetch Robotics deal was 30.0x, which further validates the premium value assigned to many companies in the robotics market.

Some 2021 automation transactions follow, newest to oldest.

8/10/2021

Systems Controls, a designer and manufacturer of control panels owned by Comvest Partners, acquired Keystone Electrical Manufacturing, an Iowa-based control systems manufacturing firm.

8/5/21

SJE, an automation manufacturing firm owned by Audax, acquired LW Allen, a designer, manufacturer, distributor and installer of water and wastewater control systems and treatment pump systems to municipal and industrial customers.

7/1/2021

Zebra Technologies, an industrial software provider, acquired Fetch Robotics, a developer of autonomous mobile robots.

7/1/2021

enVista, a global software, consulting, managed services and automation solutions firm, acquired long-time partner HCM Systems, a systems integrator, specializing in customized, complex highly integrated conveyor and control systems for manufacturing and distribution-centric organizations.

6/28/21

Audax, a private equity group, acquired SJE, a manufacturer and system integrator of control solutions for the water and wastewater sector.

6/9/2021

Semios, the leading precision-farming platform for permanent crops, acquired Altrac, developers of an agriculture automation platform enabling farmers to monitor and control important agricultural systems required to produce high-value crops from their computer or mobile device.

6/2/2021

ATS Automation Tooling Systems, an automation solutions provider, acquired Control and Information Management, an industrial automation system integrator based in Ireland.

5/4/2021

Revere Controls, an engineering system integration and construction services firm, acquired Florida-based Curry Controls, an engineering, panel assembly, and installation services firm.

4/26/2021

Publicly-traded Brooks Automation acquired Precise Automation, a developer of collaborative robots and automation systems.

4/7/2021

Actemium, a division of international conglomerate Vinci Energies, has acquired Outbound Technologies, a Midwestern-based control systems integrator.

3/1/2021

Accenture, an international consulting firm, acquired Pollux, a Brazilian-based industrial robotics and automation solutions firm.

2/17/2021

Gray, a fully integrated service provider, acquired Stone Technologies, a control systems integrator that provides complete industrial automation and information services.

2/17/2021

KKR, an international private equity group, acquired Flow Control Group, a leading distributor of flow control and industrial automation solutions.

2021 continues as a robust year for M&A and capital placement activity in the automation segment. Additional closed transaction announcements are expected through the end of the year and into 2022, and the Bundy Group team sees buyer and investor demand continuing to build for automation firms. Independent companies are in an enviable position for strategic options to consider and attractive business valuations to realize.

Author Bio: Clint Bundy is managing director, Bundy Group, which helps with mergers, acquisitions and raising capital. Bundy Group is a Control Engineering content partner. Edited by Mark T. Hoske, content manager, Control Engineering, CFE Media and Technology, mhoske@cfemedia.com.

KEYWORDS: Automation mergers and acquisitions

CONSIDER THIS

How are you advising your company to fill in its automation, controls and instrumentation needs?

Through the late summer of 2021, mergers & acquisitions (M&A) and capital markets activity in the automation industry has continued to demonstrate the strength and attractiveness of this rapidly growing segment. The resilience of the industry through the COVID-19 pandemic further reinforced the mission-critical nature of the automation market (see the Bundy Group article entitled “The Controls & Automation Market: Preparing for Growth in the Post-Pandemic Age”). Furthermore, strategic buyers and financial sponsors (i.e. private equity, family offices, growth equity) have recognized the vital role the automation market plays in the global economy, which is driving their appetite to acquire and invest in businesses that provide automation services, products, and solutions. This aggressive buyer and investor demand places business owners in a preferred category, and automation companies that are positioned correctly in a sale or capital raise process maximize their chances for significant interest and premium valuations.

Business sale and capital placement transactions that have occurred through August 2021 are reflective of the heightened interest in the automation industry. An August 2021 control system integration transaction to note is Revere Control Systems’ acquisition of Florida-based Curry Controls, which solidifies Revere as an automation leader in the Southeast. A recent series of 2021 automation manufacturing acquisitions was led by Audax, a Boston-based financial sponsor, which started with the acquisition of SJE followed then by the immediate add-on acquisition of control systems manufacturer LW Allen. In the robotics industry, a subsegment of the broader automation space, Zebra Technologies acquired Fetch Robotics in a $290MM transaction. The transaction value / revenue multiple for the Fetch Robotics deal was an eye-popping 30.0x, which further validates the premium value assigned to many companies in the robotics market. For additional examples, please see below a list of noteworthy 2021 automation transactions.

In summary, 2021 has been a robust year for M&A and capital placement activity in the automation segment. Additional closed transaction announcements are expected through the end of the year and into 2022, and the Bundy Group team sees buyer and investor demand continuing to build for automation firms. The end-result is that independent companies are in an enviable position in terms of strategic options to consider and attractive business valuations to realize.

Bundy Group is a boutique investment bank that specializes in representing controls and automation, Internet of Things, and cybersecurity companies in business sales, capital raises, and acquisitions. Over the past 32 years, Bundy Group has advised and closed over 250 transactions, which includes numerous automation-related transactions.

From Bundy Group client engagements in the dermatology and aesthetics industries, we have seen firsthand the continued growth of these markets and the corresponding premium valuations that can accompany independent physician practices. Clint Bundy, Managing Director with Bundy Group, shares key market insights in this article for Practical Dermatology.

PD0921_CF_Retained-Value-1