When a company and its advisors discuss a business sale or recapitalization, the starting topic is often transaction value. After all, the value is often the cleanest result in a transaction to understand and compare against other deals in the market. Furthermore, the transaction value represents the “headline number,” which is easiest to understand and often the most marketable.

However, experienced transaction professionals recognize that the foundation of transaction value is the structure of the deal. A famous saying among M&A professionals is “You name the price; I’ll name the terms. I will win every time.” The structure can take on many forms, and its composition has a significant impact on the ultimate outcome that a client will realize. As business owners begin analyzing offers, it is critical for them to understand the unique relationship of both value and structuring...and how the deal structure is the foundation of the offer.

The transaction value is the total consideration to the owners in a merger or acquisition. This total consideration can be comprised of many different components, and each individual piece has its own attributes and associated value. The sum of each of the values for each of these individual structuring pieces is the total transaction value. While many assume that total transaction value equals upfront cash paid to the seller at transaction close, that is not always the case.

A transaction’s structure refers to how the buyer and seller organize the different forms of consideration to comprise the total valuation.

The essential transaction structure elements are defined as follows:

When evaluating the various structures in an offer, an owner will find that the timing of payments, the probability of receiving these payments, and his own goals can collide, creating a great deal of complexity for the seller. Furthermore, there are numerous other factors to consider, including the role of the owners and employees post-closing and implementation of a company’s strategic plan. An owner and his advisors should be thoughtful in their review and analysis of ideally multiple offers to determine the optimal structure.

Because a decision on the optimal transaction structure is very situational dependent, we wanted to offer a scenario use.

Transaction Scenario: The selling company has been marketed by an investment banking representative to a group of buyers in a competitive process. The company generated $3MM in EBITDA (1) in its most recent fiscal year, and management has projected revenue and EBITDA growth for the next three years. The owner of the business is at a stage where he needs to obtain liquidity for his shares and find a buyer that will best support company management in growing the organization. He is in his mid-fifties and is very open to future performance returns so long as he doesn’t have to significantly sacrifice safer forms of consideration (i.e. upfront cash and seller note).

| Offer I | Offer II | |

| Buyer Type | Strategic Buyer | Financial Sponsor |

| Total Valuation | $25.0MM | $28.0MM plus undefined earnout |

| Upfront Cash | $22.5MM | $20MM |

| Seller Note | $2.5MM total seller note; 10% interest rate; paid out over three years with quarterly principal and interest payments | |

| Deferred Payment | $2MM deferred payment paid in two annual installments of $1.0MM each when the company achieves $3MM in annual EBITDA | |

| Earnout | Formula that pays the seller a % of excess over $3MM in annual EBITDA each year over the next three years | |

| Equity Reinvestment | $6MM reinvested back into the company in partnership with the new majority owner |

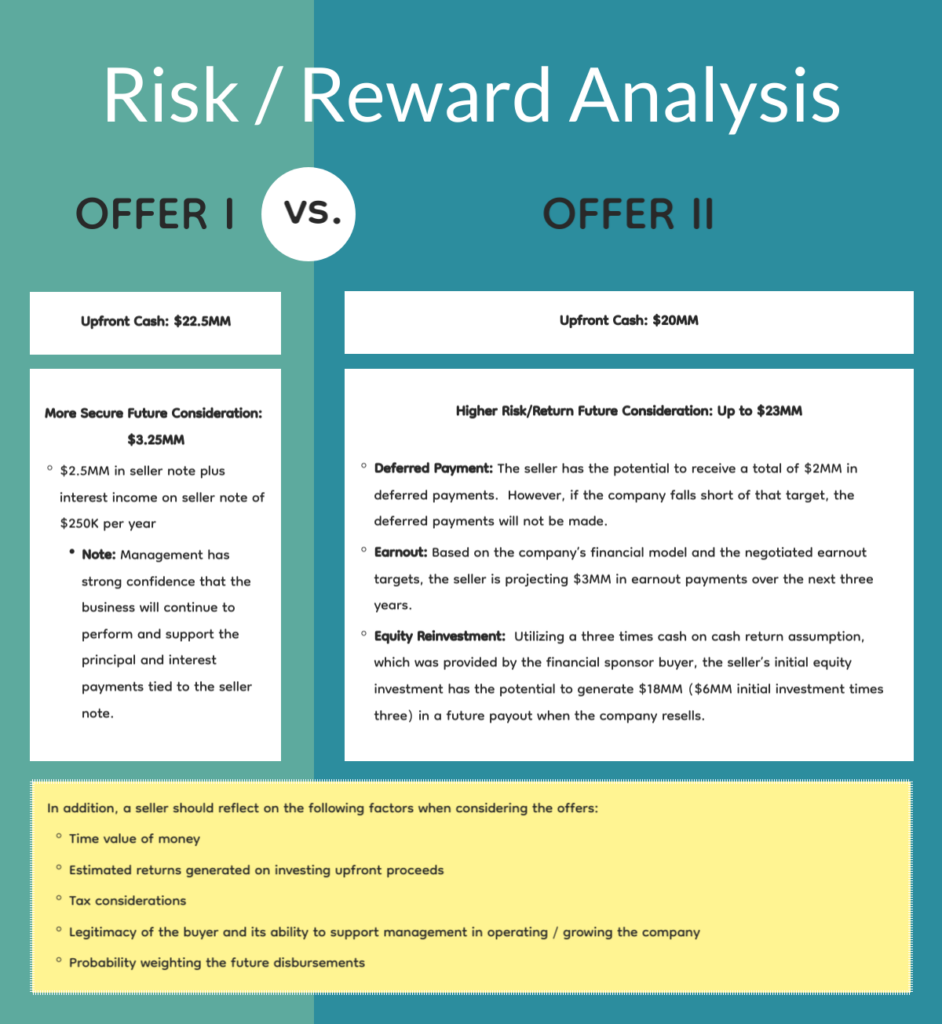

If an owner is prioritizing upfront cash, has a lower risk tolerance, and wants a relatively clean break at transaction close, then Offer I (combo of upfront cash and seller note) could be the optimal choice for the seller. It has $25MM in relatively low risk consideration due to the seller, and there are additional returns associated with the interest income payments. However, if an owner is more focused on total transaction returns and has a willingness to accept more risky structures like equity reinvestment or earnout, then Offer II might be worthy of consideration.

A more detailed analysis of the risk / reward profiles can be found below.

For the above situation, what is the best offer to take? The seller will have to be the final decision maker based on personal and business objectives and interpretation of the above offers and associated risks and returns. The job of a good investment banking advisor in this decision is to ensure that the client has the best quality, market-driven information available in order to make the most educated decision. Based on our experience with owners that fit the transaction scenario outlined above, it wouldn’t be surprising to see a client preference for Offer II over Offer I. From a macro perspective, sacrificing $5.75MM in more secure consideration could be worthwhile for the seller in exchange for the potential to realize an additional $15MM ($3MM of earnout and an estimated gain on equity reinvested of $12MM) in higher risk future consideration.

Once a seller has a full understanding of both value and structure, the next natural question is how can you use deal structuring to make it even more seller-friendly? This is actually a more complex, nuanced topic that can’t be addressed in one article or hypothetical transaction situation. There are two key mechanisms for a seller to ensure the optimal deal structure:

These concepts of value and structuring work hand in hand with one another, not as separate concepts. As multiple offers are submitted, and numerous structure components are included in the respective offers, the calculations can get more complicated, and the risk / reward analysis can become clouded. Each transaction is company-specific and there are numerous ways to structure a deal, which is why it’s in the stakeholder’s best interest to use experienced advisors who can assist in evaluating the transaction structures and help the owner understand what best fits with his objectives.

In this article for Industrial Cybersecurity Pulse, Bundy Group provides an update on mergers & acquisitions and capital placement activity in the cybersecurity market.

Year to date 2023 is continuing to demonstrate activity and resiliency in the mergers and acquisitions and capital placement markets for cybersecurity companies. Transactions to note through August include Thales’ acquisition of Imperva, Honeywell’s acquisition of SCADAfence and Coro’s acquisition of Privatise. This credible list of buyers and investors highlights the attractiveness and strength of the cybersecurity market in 2023. Bundy Group’s current engagements and upcoming client opportunities include cybersecurity, managed service providers and control system integration, all of which are centered around the field of information security. We look forward to providing relevant updates and closed deal announcements to the Industrial Cybersecurity Pulse audience in the future.

8/17/23

Fastly, Inc. (NYSE: FSLY), a leader in global edge cloud platforms, announced two major developments in its domain name API and Transport Layer Security (TLS) capabilities: the acquisition of Domainr, an ICANN-accredited real-time domain availability API provider, as well as general availability of Certainly, Fastly’s publicly-trusted TLS Certification Authority (CA). Learn more.

8/16/23

Converged Security Solutions LLC (CSS), a leading holding company in the IT transformation and security sectors, acquired Solutions By Design II, LLC (SBD), a highly regarded federal government contractor specializing in cybersecurity, application development and cloud solutions. SBD will be integrated into CSS’ Evolver LLC, a market leader in IT transformation and cybersecurity. Learn more.

8/8/23

Seceon, the pioneer of the first cybersecurity platform that augments and automates security operations services for MSPs and MSSPs, with an AI and ML-powered aiSIEM, aiXDR and aiMSSP platform, has acquired Helixera, a real-time big data analytics company, and its founder Waldek Mikolajczyk will join Seceon as the VP of cybersecurity solutions architecture. Learn more.

8/8/23

Israeli cloud security startup Laminar has been acquired by U.S. company Rubrik for an estimated amount of $200-$250 million, Calcalist has learned. This marks a significant exit for Laminar, a 3-year-old company that has raised $67 million to date. Learn more.

8/3/23

Partner One, one of the fastest growing software conglomerates in the world, has acquired Fidelis Cybersecurity software, intellectual property, equipment, inventory and customer and reseller contracts. Fidelis software is a leader in the cybersecurity industry, with innovative eXtended Detection and Response (XDR) and Cloud Native Application Protection Platform (CNAPP). Learn more.

7/31/23

Dynatrace (NYSE: DT), the leader in unified observability and security, announced it has signed a definitive agreement to acquire Rookout, a provider of enterprise-ready and privacy-aware solutions that enable developers to quickly troubleshoot and debug actively running code in Kubernetes-hosted cloud-native applications. Learn more.

7/25/23

Coro, which develops a cybersecurity platform for mid-market organizations, acquired Privatise, an Israeli supplier of network security solutions for in-office and remote work. The deal is estimated at several million dollars. Privatise, which was founded in 2020, has a team of eight people, who are expected to remain at Coro. Learn more.

7/25/23

Thales has reached an agreement with Thoma Bravo, a major software investment firm, for the acquisition of 100% of Imperva, a leading U.S.-based data and application cybersecurity company, for an enterprise value of $3.6 billion. Learn more.

7/12/23

Safe Security, the AI-driven cyber risk management company, has acquired RiskLens, the pioneer of the cyber risk quantification standard – FAIR. By combining RiskLens and Safe Security, the two companies are bringing together the world’s most advanced cyber risk quantification based on factor analysis of information risk, with the world’s most advanced AI-powered automated cyber risk management platform. Learn more.

7/10/23

Honeywell acquired SCADAfence, a leading provider of operational technology (OT) and Internet of Things (IoT) cybersecurity solutions for monitoring large-scale networks. SCADAfence brings proven capabilities in asset discovery, threat detection and security governance, which are key to industrial and buildings management cybersecurity programs. Learn more.

6/28/23

Node4, a cloud-led digital transformation Managed Services Provider (MSP), acquired ThreeTwoFour, an award-winning information security and technology risk specialist. The acquisition is Node4’s third significant growth purchase in the last 18 months, having also bought risual, an IT managed services and solutions provider and Tisski, a leading U.K.-based independent Microsoft Business applications partner. Learn more.

6/28/23

Bitdefender, a global cybersecurity leader, has entered into a definitive agreement to acquire Horangi Cyber Security. Joining forces with Bitdefender aligns with their vision of being a trusted cybersecurity partner for customers worldwide. Learn more.

6/28/23

GraVoc anounced acquired Security Management Partners (SMP), a leading Massachusetts-based information security consulting company. Founded in 2001, SMP has built a comprehensive portfolio of information security solutions to help clients navigate the ever-changing cybersecurity and regulatory compliance landscapes. Learn more.

6/28/23

GraVoc announced acquired Security Management Partners (SMP), a leading Massachusetts-based information security consulting company. Founded in 2001, SMP has built a comprehensive portfolio of information security solutions to help clients navigate the ever-changing cybersecurity and regulatory compliance landscapes. Learn more.

6/27/23

HashiCorp acquired BluBracket, a startup that enables its customers to easily scan, identify and address secrets hidden in their source code, development environments, internal websites, chat services, ticketing systems and other locations. This secret-scanning functionality helps companies deliver secure code without compromising speed or innovation. Learn more.

6/21/23

Dataprise, a premier provider of managed IT, cybersecurity and cloud solutions, acquired RevelSec, a security-first managed service provider headquartered in Texas. The acquisition will further expand Dataprise’s national footprint and add high-value vertical expertise while providing RevelSec clients access to Dataprise’s broad portfolio of powerhouse services. Learn more.

6/20/23

Exacom, a leading provider of mission-critical communication recording solutions, has acquired SecuLore Solutions, a company specializing in cybersecurity solutions for public safety, critical infrastructure and local governments. Exacom adds security services to its portfolio to ensure public safety customers are protected from cyberattacks through monitoring and proactive recommendations. Learn more.

6/20/23

DNV, the global risk management and quality assurance provider, will fully acquire Helsinki-headquartered cybersecurity services firm Nixu following a public tender offer which resulted in DNV taking ownership of more than 93% of Nixu’s shares. Learn more.

6/15/23

Leading consulting and managed services provider for cloud infrastructure and cybersecurity announced their strategic partnership with 424 Capital. This joint venture represents the next step in Neovera’s business growth and expansion initiatives that will include the introduction of new services and technological capabilities. Learn more.

6/14/23

Informatica, the enterprise cloud data management leader, acquired Privitar, bringing advanced access controls and remediation for data privacy and security to Informatica’s AI-powered Intelligent Data Management Cloud (IDMC) platform. Privitar is a U.K.-based data management access and privacy software provider that powers organizations to democratize the ethical and safe use of data across enterprises. Learn more.

6/13/23

Melbourne-based cybersecurity firm Tesserent was acquired by French multinational Thales, in a $176 million share scheme recommended unanimously by the Tesserent board. The Australian company, which provides cybersecurity solutions to more than 1,200 midsized government, enterprise and critical infrastructure clients, will continue to be known as Tesserent. Learn more.

6/6/23

Blattner Tech, leaders in data analytics, artificial intelligence and machine learning, acquired Jigsaw Security Enterprise, a provider of threat intelligence capabilities. With this acquisition, Blattner Tech aims to enhance its cybersecurity capabilities and expand into the machine learning security space. Learn more.

In this article for Practical Dermatology, Clint Bundy, Managing Director for Bundy Group, reflects on the emerging trends and insights in the dermatology and aesthetics industries this year.

As we progress through 2023, the dermatology and aesthetics industries operate and evaluate in a macroeconomic landscape facing developing headwinds. We continue to get questions from independent practice owners about these conditions, the strength of the dermatology and aesthetics M&A markets, and practice valuations. From our current pipeline of clients who are selling their practices, we have identified a few trends:

To further understand what is happening in the dermatology and aesthetics market, Bundy Group obtained insights from four industry experts. The experts interviewed include:

The macroeconomic market has experienced shifting dynamics over the past year, which includes inflation, rising interest rates, and the threat of recession. What impact are these macroeconomic headwinds having on the dermatology and aesthetics markets and your practice’s operations and growth?

Alex Chausovsky: The US economy is firmly on the back side of the business cycle and a mild recession is likely on the horizon because of aggressive interest rate policy decisions by the Fed. But not all is doom and gloom. Inflationary pressure is easing, and consumers remain willing and able to spend money due to a remarkably resilient job market. This should help any recession be mild and relatively short lived.

The unemployment rate rose to 3.7% last month, which is actually a good thing. It means more people are coming back into the labor market and looking for work. The number of job openings is currently above 10 million, suggesting employers remain committed to growth despite fears of a recession.

Bill Butler: Similar to other medical specialties, the most significant impact on our business operations has been employee wage inflation. Ongoing wage inflation has led us to focus our efforts on continuing to optimize clinical operations from an efficiency perspective which we believe will benefit the organization over the long-term. Organic growth at DOCS remains strong amidst the challenging economic climate as demand for dermatological services is exceptionally resilient. Further, we pride ourselves on providing the highest level of patient care in an accessible and friendly environment, which has continued to generate benefits for the organization’s organic growth and ability to recruit top-tier providers within our markets.

Joe Musumeci: ADCS is not immune to these same headwinds and we are being impacted similarly to many of the small practices we evaluate for acquisition. Profit margins are being squeezed due to increasing wages, as well as operating costs and turnover, although turnover is showing signs of stabilization. Additionally, payer reimbursement has been under pressure, so our specialty is experiencing a revenue squeeze alongside the cost pressures. Cost of capital (borrowing) has become significantly more expensive due to rising interest rates, which has slowed overall deal volumes, delayed expansion plans and impacted valuations. Fortunately, ADCS is uniquely positioned to weather these macroeconomic headwinds due to our infrastructure, operating dashboards, economies of scale, and stable business mix.

What is your firm’s view on acquisitions in today’s environment and how M&A plays into your longer-term growth playbook? Are you treating transactions any differently from a diligence, structuring, or valuation standpoint relative to 12 to 24 months ago?

Kevin Robb: First, an appetite for acquisitions. Acquisitions are still a key and critical part of our long term strategy, as we operate with a balance of acquisitions and same-store growth. Second, diligence. Diligence breadth (areas reviewed, including HR/IT/Compensation) and depth (level of detail reviewed) have increased noticeably. Finally, structure. More focus is being placed on long-term alignment with non-owner providers and building incentives for those individuals into deals on the front end.

Joe Musumeci: Acquisitions will still play a large role in our growth strategy going forward, despite the currently sluggish market. Deal terms have become more conservative with regards to valuations, increased equity rollover and reduced interest in sellers who are nearing retirement. Additionally, with the potential elimination of non-compete enforceability, we expect that equity rollover and employment agreement covenants will become more heavily negotiated. The most noticeable difference today versus 12 to 24 months ago is that valuations have been under pressure and are on the decline (from very high levels), notably in smaller-to-midsized practices (< $3mm EBITDA). Larger, more premier practices ($5mm+ EBITDA) continue to fetch higher, premium valuations. Similar to what have seen in the residential real estate market, prices are still elevated due to a 10+ year favorable economic market, but we are treating growth via acquisition as a sustainable, attractive way to continue executing lucrative partnerships in dermatology.

While valuations have retreated from the peak, on a historical basis pricing is still very attractive for potential sellers, so with that being said, the benefit of having a no expectations discussion and going through an initial analysis with a buyer is of great importance as we are finding that current valuations continue to be very compelling.

Bill Butler: Even with the current market environment and level of existing consolidation within dermatology, DOCS is continuing to pursue an active M&A strategy and remains committed to generating a significant amount of our overall growth targets from partnerships with growth-oriented providers who believe in the DOCS vision. With the cost of capital on the rise, we have become increasingly focused on ensuring that each partnership opportunity is not only a good fit from a cultural perspective, but also illustrates a clear path to future growth. Our diligence process remains competent and methodical, but we are deploying increasingly creative deal structures in order to optimize post-close alignment with our partners. On valuations, we anticipate these will continue to revert back to normalized levels relative to what we were seeing 12 to 24 months ago. With that being said, DOCS is willing to offer highly competitive valuations and structures to potential partners who demonstrate a strong strategic fit with our model.

Are we are in the early, mid or late stages of dermatology consolidation? If we are in the mid or later phases of dermatology practice consolidations, is your platform beginning to consider other ancillary add-on acquisition areas (such as medical spas or plastic surgery)?

Bill Butler: Given the history of consolidation within dermatology over the years, it would be challenging to arrive at the conclusion that we are in the early stages of dermatology consolidation. With that said, we still see plenty of “runway” left and are not hastily attempting to gain scale via acquisitions at the expense of strategic fit and quality. Dermatology is a rapidly evolving specialty which does open the door for additional avenues of growth and consolidation, but at the end of the day, we remain a medically focused group. DOCS has added plastic surgery service offerings to its portfolio in select markets where it strategically made sense, but a more near-term focus is expanding the cosmetics portion of the portfolio in order to complement our existing medical and surgical offerings.

Joe Musumeci: Our thesis is that we are in the middle of consolidation. Dermatology has been “consolidating” for more than 10 years now, which is much longer than many other specialties; however, we still have a long way to go in terms of platform mergers. The specialty is still rather fragmented with 30+ private equity platforms in operation.

There is opportunity in adjacent areas (eg, med spas and plastic surgery). However, this is not a key focus area at this time. We view those as too afield from our business, as our core competency is medical and surgical dermatology. There continues to be significant opportunity within the pure-play dermatology sector which we would rather spend time growing.

Kevin Robb: We are in the 5th or 6th inning of consolidation in the dermatology sector, but we have lots of room to run.

In this article for Control Engineering Magazine, Bundy Group reflects on the notable automation transactions in the month of August and what they mean for the increasing demand of acquisitions in the industry.

The mergers & acquisitions and capital markets for the automation market shows no signs of a slowdown as we progress through the back half of the year. Bundy Group successfully closed yet another transaction in the automation sector, as Ultimation was sold to Motion & Control Enterprises, a strategic buyer backed by Frontenac. The sale process was representative of the heightened demand for acquisitions in the automation sector, as Bundy Group generated numerous offers on behalf of our client.

Learn more about the transaction here.

Furthermore, the outcome far surpassed original seller expectations, and the management team has a strong partner in MCE to help accelerate growth.

Bundy Group’s current engagements and owner relationships include control system integration, robotics, automated material handling, automation distribution, artificial intelligence, and cybersecurity. This serves as a leading indicator for submarkets our team anticipates closed transactions in over the coming months. We look forward to providing these relevant updates and transaction announcements to Control Engineering magazine readers.

8/18/23

Motion & Control Enterprises has acquired Ultimation Industries LLC, its fourth acquisition of 2023. Headquartered in Roseville, MI, Ultimation provides highly engineered automation and material handling solutions as well as quick-ship distribution of material handling equipment products offered through a robust e-commerce platform to customers across the U.S., Latin America, and Europe. Learn more.

8/16/23

Duravant LLC, a global engineered equipment and automation solutions provider to the food processing, packaging, and material handling sectors, has acquired National Presort, LP (“NPI”), a leading manufacturer of automated parcel sortation systems headquartered in Fort Worth, TX. For 45+ years, NPI boosts e-commerce, courier, and warehouse efficiency with tailored equipment, cutting fulfillment time. Learn more.

8/7/23

Renesas Electronics Corporation, a premier supplier of advanced semiconductor solutions, and Sequans Communications S.A. a leader in 5G/4G cellular IoT chips and modules, announced that the two companies have signed a memorandum of understanding on a proposed acquisition valued at $249 million. Learn more.

8/3/23

ADP, a global technology company providing human capital management (HCM) solutions, has acquired Honu HR, Inc. DBA Sora (Sora), a low-code intelligent workflow automation and data integration tool that unifies disparate business applications such as HR, IT and other systems and data sets to create a smarter, easier-to-use experience for employees, business owners and HR professionals. Learn more.

8/2/23

Arlington Capital Partners, a Washington, DC-based private equity firm, has acquired Integrated Data Services, Inc. IDS’ co-founders Jerome Murray and James Truhe retained a minority stake in the Company as part of the transaction. Founded in 1997 and headquartered in El Segundo, CA, IDS is a leading provider of software and technology-enabled support and development for federal government customers. Learn more.

8/1/23

Benford Capital Partners had acquired BSC Industries, Inc. in partnership with brothers Jim and Peter Fitzpatrick, who have owned and led the Company for over 30 years. The acquisition of BSC represents the third platform investment in Benford Capital Partners II, LP. Learn more.

7/27/23

Clark-Reliance has acquired John C. Ernst & Co., Inc, a leader in the manufacture and distribution of engineered measurement solutions and process observation equipment for liquid and steam applications. John C. Ernst, headquartered in Sparta, New Jersey, manufactures and distributes sight flow indicators, sight windows, liquid level gauges and flow meter products used by customers in demanding applications across a broad range of end markets. Learn more.

7/27/23

HC Private Investments, a Chicago-based family office private equity firm, successfully acquired QEI, Inc. in partnership with the Company’s former owner and CEO, Normand Lavoie. Headquartered in Springfield, NJ, QEI offers automation products, SCADA software solutions, distribution management systems and related services to its customers in the mass transit, utility and water/wastewater industries. Learn more.

7/24/23

Duravant LLC, a global engineered equipment and automation solutions provider to the food processing, packaging, and material handling sectors, has acquired PPM Technologies from Stonehenge Partners. PPM, based in Newberg, OR, is a top manufacturer of conveyance, coating, and thermal equipment. Learn more.

7/18/23

Parsec Automation Corp, a trailblazer in Manufacturing Operations Management (MOM) software, announced a major recapitalization led by BVP Forge, designed to fuel future growth. Parsec forms dynamic partnerships with manufacturing entities worldwide, sparking pivotal transformations to boost efficiency and drive their ongoing enhancement goals. Learn more.

In this article for Plant Engineering Magazine, Bundy Group highlights key transactions in the automation industry as the sector preps for the final quarter of the year.

The mergers & acquisitions and capital markets for the industrial technology and services markets show no signs of a slowdown as we progress through the back half of the year. Bundy Group successfully closed yet another transaction in the industrial technology and material handling sectors, as Ultimation was sold to Motion & Control Enterprises, a strategic buyer backed by Frontenac.

The sale process was representative of the heightened demand for acquisitions in the industrial technology sector, as Bundy Group generated numerous offers on behalf of our client. Furthermore, the outcome far surpassed original seller expectations, and the management team has a strong partner in MCE to help accelerate growth.

Learn more here about the transaction.

In addition to the Ultimation transaction, Bundy Group represented Metal Tech, an industrial equipment repair and services firm, in a sale to Keswick Partners, an investment firm.

Bundy Group’s current engagements and owner relationships include control system integration, automated material handling, automation distribution, industrial services, and electrical services. This serves as a leading indicator for industries our team anticipates closed transactions in over the coming months. We look forward to providing these relevant updates to Plant Engineering readers.

8/21/23

Atlas Copco has agreed to acquire Sykes Group Pty Ltd. from Seven Group Holdings Ltd., a company listed on the Australian Securities Exchange. Sykes is a global manufacturer of dewatering pumps, predominantly used for transferring water with solids and abrasive nature within the mining and wastewater sectors. Learn more.

8/18/23

Motion & Control Enterprises has acquired Ultimation Industries LLC, its fourth acquisition of 2023. Headquartered in Roseville, MI, Ultimation provides highly engineered automation and material handling solutions as well as quick-ship distribution of material handling equipment products offered through a robust e-commerce platform to customers across the U.S., Latin America, and Europe. Learn more.

8/18/23

Keswick Partners, an industrials and specialty services-focused investment firm, recapitalized Metal Tech of Murfreesboro. Metal Tech provides equipment maintenance and repair services to a diverse set of end markets, including pulp and paper, steel, chemicals, signing, food and beverage, infrastructure, and other general manufacturing industries. Learn more.

8/1/23

Benford Capital Partners had acquired BSC Industries, Inc. in partnership with brothers Jim and Peter Fitzpatrick, who have owned and led the Company for over 30 years. The acquisition of BSC represents the third platform investment in Benford Capital Partners II, LP. Learn more.

7/27/23

Clark-Reliance has acquired John C. Ernst & Co., Inc, a leader in the manufacture and distribution of engineered measurement solutions and process observation equipment for liquid and steam applications. John C. Ernst, headquartered in Sparta, New Jersey, manufactures and distributes sight flow indicators, sight windows, liquid level gauges and flow meter products used by customers in demanding applications across a broad range of end markets. Learn more.

7/27/23

HC Private Investments, a Chicago-based family office private equity firm, successfully acquired QEI, Inc. in partnership with the Company’s former owner and CEO, Normand Lavoie. Headquartered in Springfield, NJ, QEI offers automation products, SCADA software solutions, distribution management systems and related services to its customers in the mass transit, utility and water/wastewater industries. Learn more.

7/18/23

Parsec Automation Corp, a trailblazer in Manufacturing Operations Management (MOM) software, announced a major recapitalization led by BVP Forge, designed to fuel future growth. Parsec forms dynamic partnerships with manufacturing entities worldwide, sparking pivotal transformations to boost efficiency and drive their ongoing enhancement goals. Learn more.

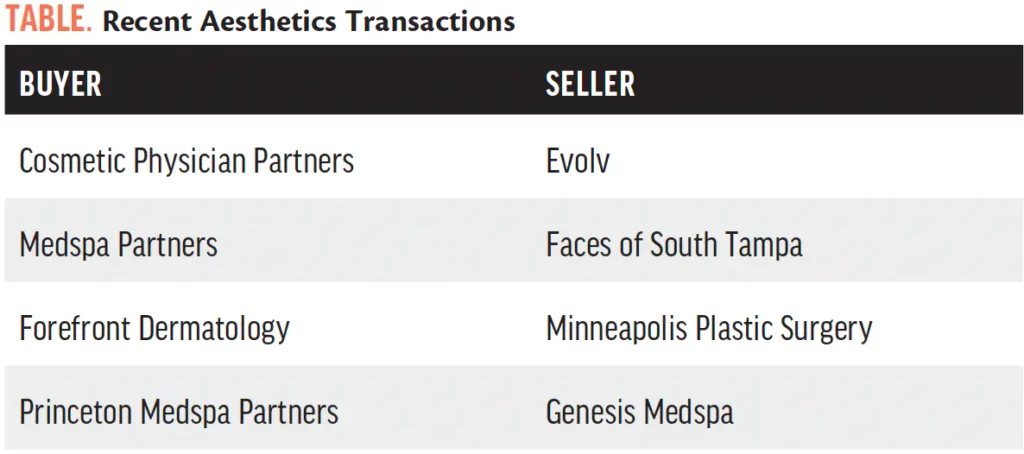

In this article for Modern Aesthetics, Bundy Group shares a survey of some of the most seasoned buyers and experts in the industry and gathers their sentiments on the industry, mergers and acquisitions (M&A) activity, and the state of the economy today.

As we progress in 2023, the aesthetics industry is managing a number of different dynamics, including macroeconomic headwinds that have evolved over the past 18 months. We continue to get questions from independent practice owners about these conditions, the strength of the aesthetics M&A market, and practice valuations. From our current pipeline of clients that are selling their practices, we have observed the following trends:

To further understand what is happening in the aesthetics market, Bundy Group obtained insights from five industry experts.

The experts interviewed include:

THE ECONOMY AND THE AESTHETICS MARKET TODAY (AN ADVISOR’S PERSPECTIVE)

Clint Bundy: The macroeconomic market has experienced shifting dynamics over the past year, which includes inflation, rising interest rates and the threat of recession. What is the prognosis for the rest of the year?

Alex Chausovsky: The US economy is firmly on the back side of the business cycle and a mild recession is likely on the horizon because of aggressive interest rate policy decisions by the Fed. But not all is doom and gloom. Inflationary pressure is easing, and consumers remain willing and able to spend money due to a remarkably resilient job market. This should help any recession be mild and relatively short-lived.

The unemployment rate rose to 3.7% last month, which is actually a good thing. It means more people are coming back into the labor market and looking for work. The number of job openings is currently above 10 million, suggesting employers remain committed to growth despite fears of a recession.

CB: Why do you think the aesthetics industry has become more attractive over the past few years? Do you anticipate the consolidation and investment activity to accelerate in the next few years, and, if so, why or why not?

Brad Adatto: The driver to the aesthetics boom, at its roots, is that aesthetics is an efficient health care delivery system. We noticed a boom in elective medicine after health care reform in 2009, as reimbursements for health insurance related care were on a downward spiral. This forced physicians and other health care providers to adapt. At the same time, the concept of people investing in how they look started emerging, and the patients were happy to share their results on social media. The aesthetic retail meets health care market exploded and, of course, this attracted investment activity and consolidation. Even with the rapidly increasing volume of acquisition transactions we are handling at ByrdAdatto in aesthetics, we believe consolidation is in the infancy stage.

THE AESTHETICS M&A MARKET TODAY (A BUYER’S PERSPECTIVE)

CB: Strategic buyers and financial sponsors (i.e. investment groups) have had an evolving view of the aesthetics market over the past ten years, including during and after the pandemic. That is translating to increased M&A and investment activity. Why do you think the aesthetics industry has become more attractive over the past few years? Do you anticipate the consolidation and investment activity to accelerate in the next few years, and, if so, why or why not?

Sean Walsh: Improving technology and growing overall awareness has provided the industry with strong tailwinds, and growth is forecasted to continue. The expected result is more and more investment and M&A activity in the aesthetic space. As for consolidation, in Canada the aesthetic space is already largely consolidated, we think this is a forecast for what to expect in the U.S. Barring any major changes, we anticipate consolidation will continue and even accelerate in the next few years.

Craig Neville: There certainly has been a lot of investment interest in the industry, and that interest is continuing to grow for several reasons:

We believe that M&A consolidation and investment will continue to accelerate over the next couple of years. The industry is continuing to evolve and becoming more complex. The important reminder for every practice is to ensure that they are finding a partner that is right for their goals, there is lots of capital available for practices, but the question should be asked: what are you getting in addition to that capital? Does the partner have the support they are promising? Do they have a track record? Do they have similar partners to you who have had a positive experience?

AESTHETICS TRANSACTIONS: DYNAMICS, VALUATIONS AND STRUCTURE

CB: Please explain challenges and dynamics you face in completing an aesthetics acquisition that you might not find with a dermatology acquisition/transaction. How do you view valuation and structuring for aesthetics acquisitions?

Sean Walsh: Many practices in the MedSpa space are not run day to day by an MD, which may pose issues when ensuring that the clinic is respecting all state regulations. When joining a larger group, it’s critical that the practice be buttoned up legally and could cause issues if is not.

Structurally, the biggest difference between CPP and most investors in the aesthetic space is we are a partnership. For our partners, this means a material ownership stake in CPP and a longer hold period before subsequent liquidity events. On a longer time horizon however, we have provided our partners with greater returns than other considered alternatives. When CPP evaluates a practice, it looks at over a dozen considerations ranging from size to number of locations number and providers to geographic location.

Craig Neville: Any business acquisition is a complex and emotional journey for the owner who is selling. This is true regardless of medical specialty. A major part of any deal that we do is working with our prospective partners to help them understand what their life will look like after closing and to align on expectations. For MSP, it’s choosing the right partners and being able to nurture the relationship with our partners not only after the closing, but before closing to foster collaboration and harmony going forward.

Valuations are attractive right now, but every deal is different so it is important for sellers to understand the differences. Most deals will comprise of both a cash and equity component. The cash is straightforward to compare, but the equity can be more complicated. Understanding the actual value of the equity and more importantly, the security that the company is going to be healthy so you can realize the value on the equity. Also, terms are important and you should be asking a lot of questions – are you getting the same equity terms as previous sellers? Does the financial group have preferred returns? Has there already been a liquidity event for the shareholders? All of these questions help you to better understand the potential upside and value you are receiving.

Michael Byrd: As an attorney and advisor active in the space, I will first start by acknowledging that medical spa, plastic surgery, and dermatology acquisitions are more similar to each other than not. The biggest difference buyers may face with plastic surgery is that larger elective cases and reconstructive cases are often performed at ambulatory surgery centers and hospital settings. This affects the dynamics of the operations of the practice and the cash flow. Most dermatology surgical procedures (and smaller plastic surgery cases) are conducted in an in-office surgical suites. The valuations are higher for the medical spa practices than the surgical practices. We will often see a mixed practice acquisition have a separate lower valuation for the surgical side of the practice than the valuation for the medical spa side of the practice.

Bundy Group, an industry-focused investment bank, is pleased to announce that it has successfully advised Ultimation Industries, LLC, a leading automation and direct-to-consumer conveyor solutions firm serving the food processing, vertical farming, heavy equipment, warehousing, and fulfillment and delivery industries, in a sale to Motion & Control Enterprises (MCE), a supplier of automation products and repair services. The transaction highlights Bundy Group's continued advisory work and closed deal experience in the automation and material handling sectors, with an emphasis on quality advice and a competitive edge to drive value for clients.

Ultimation Industries was founded in 1988 and services a broad range of end-markets spanning across the United States, Latin America, and Europe. Headquartered in Roseville, MI, the company specializes in highly engineered automation and material handling solutions, proprietary automation systems, as well as quick-ship distribution of products through a robust e-commerce platform, making it an ideal addition to MCE's growing automation and material handling services portfolio.

"Ultimation is a leader in their industry, and the company's impressive historical and projected growth, including within its e-commerce division, was one of many reasons why there was significant interest in the acquisition opportunity throughout the sale process," said Clint Bundy, Managing Director at Bundy Group. "We had the good fortune of building a strong relationship with the Ultimation team prior to our engagement, and it was an honor to represent shareholders Richard and Jackie Canny, as well as the rest of Ultimation management, through to the successful close of the transaction."

"We selected the Bundy Group team after evaluating a number of other investment banks. It was a wise decision to select a bank that really knew our industry well and had a reputation for first class client service," said Richard Canny, shareholder and executive at Ultimation Industries. "From the day we made that decision, they've been with us by our side helping us build and grow the company. Once we moved into the market stage of the process, Bundy Group was able to create a great many options for us. The final results were well beyond our initial value projections. As an entrepreneur, you're building and growing your company, while wanting to be sure that you're looking out for your people. Preparing it for the next phase of its growth with Bundy Group, alongside the management team, has helped us do that."

The transaction was led by Clint Bundy and Stewart Carlin, Managing Directors with Bundy Group. Jordan Frickle and Megan Hagemann with Bundy Group also worked on the Ultimation transaction team.

This transaction underscores Bundy Group's continued success and significant experience in the automation, technology, and business services sectors. The investment bank has previously advised clients, including MR Systems, GrayMatter, Avanceon, Dorsett Controls, and Custom Controls Unlimited, among others. For more information about Bundy Group's industry expertise and recent transactions, visit bundygroup.com.

About Bundy Group

Established in 1989, Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The team of highly experienced investment bankers leverages extensive industry knowledge and skill to provide hands-on guidance to clients through every phase of the business transaction. Bundy Group has been a trusted partner in more than 250 closed deals over the past 33 years, providing high quality options, actionable insights, and delivery of optimal strategic fit at a premium value for our clients.

Bundy Group Securities, LLC is a registered broker-dealer and member of FINRA and SIPC. More information on the background of Bundy Group Securities, LLC is available at FINRA's BrokerCheck.

In this article for Automation World, Clint Bundy of Bundy Group provides insight into strategic buyer and investor interest in the automation industry and macroeconomic effects on the automation market.

Bundy Group is an investment bank and advisory firm specializing in the automation market, which includes such sub-markets as control system integration, warehouse automation, robotics and the Industrial Internet of Things (IIoT). Following is an update on our key takeaways around the trends in this segment from a mergers and acquisitions (M&A) and capital placement perspective.

To start, the automation industry continues to draw a tremendous amount of strategic buyer and investor (i.e., financial sponsor or private equity) interest, which is driving consolidation activity in the automation market. At the recent a3 Business Forum, Control System Integrators Association Conference and Automate events, I held numerous meetings with executives and corporate development directors to better understand buyer sentiment for the automation sector in the current economic climate. After attending these conferences, Bundy Group conducted a survey of the most active buyers and financial sponsors in the segment. Respondents expressed enthusiasm over the state of the market and continued growth in the automation sector, but there are some considerations to note.

One of the key topics today in the M&A community is the current macroeconomic environment, including continued concerns about a recession and how it might impact the automation market today. Owners and seasoned buyers are watchful of the potential negative impact on companies due to the recent credit market challenges and the consequences from the Silicon Valley Bank and First Republic Bank failures.

As one executive stated: Rising interest rates and tightening lending restrictions will “make us more selective in what companies we buy, as we can’t have foot faults in these conditions.” This executive also said, “Our main lender is still supportive of our acquisition focus and growth efforts and will provide funding, but it has tightened our credit line from $50 million to $25 million over the past few months.”

Automation organizations continue to face difficulties in finding talented engineers and other technical talent. Alex Chausovsky, vice president of analytics and consulting at Miller Resource Group said that “while the overall unemployment rate was 3.7% in May, up slightly from the 50-year low of 3.4% in April, engineering roles had an unemployment rate of just 1.8%. This underscores the difficulty that many automation firms have in attracting, hiring and retaining top engineering talent. Even with a mild recession on the horizon for later this year, it’s critical for automation companies to continue to backfill roles and attract new talent to position themselves for the next macro rising trend, which will likely begin in the latter part of 2024.”

Bundy Group’s survey of 10 executives/investors with experience in automation industry acquisitions validated the insights heard at the automation conferences and added several new takeaways:

The economy and automation market. Despite continued concerns around a looming recession, the majority of survey respondents are not planning for a recession in the next 12 months. In addition, nine of 10 executives expect their own businesses to grow in the next year. These respondents’ confidence helps validate the strength and resiliency of the automation market.

Merger and acquisitions. The respondents universally signaled continued and strong interest in acquisitions, indicating the automation market still has plenty of runway left for consolidation. Most respondents said the industry is not even halfway through its aggregation cycle. Furthermore, on a 1 to 5 scale (1 = not looking for acquisitions; 5 = aggressively looking for acquisitions), the average response was a 4.4, indicating M&A is alive and well with the brand name buyers in the automation industry. Furthermore, all but one of the respondents stated that current events in the financing markets have not decreased their appetite for acquisitions. As one executive said, “Rising interest rates have resulted in our taking a more conservative approach to acquisitions, as we are now placing an increased emphasis on quality, growing companies.”

Business valuations and deal structure. Business owners often ask Bundy Group about the current valuation multiples for businesses, i.e., are they increasing or decreasing? Six out of 10 buyer and financial sponsor respondents revealed they do expect automation valuations to decrease over the next 12 months compared to current levels. One executive with a strategic buyer said, “High quality assets will fetch historical valuations, but less attractive or higher risk transactions will see valuations reduced and less demand overall.”

An equally important topic is what compromises a company’s valuation. Upfront cash from a buyer to a seller is an obvious component, but there is also creative structuring that can be utilized, which includes:

Buyers can, and sometimes do, utilize creative structuring to minimize risk and ensure the seller has a vested interest in future success of the business. As one respondent stated, “We are asking for higher equity rollover from sellers today, such as 25-30% versus 15-25% in the past.”

Based on what we’ve learned from the automation conferences and the survey, a strong level of enthusiasm remains among owners and buyers. The multi-billion-dollar automation market continues to thrive and evolve, and buyer and financial sponsor confidence is relatively strong in this uncertain macroeconomic environment. Judging by the robust performance of Bundy Group clients, coupled with the strong valuations we are receiving in our current client engagements, our team sees no momentum or value loss in the automation industry.

There's more to it than the dollar value. Stewart Carlin, Managing Director with Bundy Group, explains in the two part video series below how to analyze a buyer's presentation of business value and how it can be structured in an offer.

Webinar Details: Part I and Part II

Related Articles

About Bundy Group

Established in 1989, Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The team of highly experienced investment bankers leverages extensive industry knowledge and skill to provide hands-on guidance to clients through every phase of the business transaction. Bundy Group has been a trusted partner in more than 250 closed deals over the past 33 years, providing high quality options, actionable insights, and delivery of optimal strategic fit at a premium value for our clients. Bundy Group is headquartered in Charlotte, NC and has additional offices in New York and Virginia.

Bundy Group Securities, LLC, is a registered broker-dealer and member of FINRA and SIPC. More information on the background of Bundy Group Securities, LLC is available at FINRA's BrokerCheck.

In this article for Control Engineering Magazine, Bundy Group provides insight into the strengthening mergers & acquisitions and capital placement activity in the automation industry.

2023 is continuing to show strength and consistency in terms of mergers & acquisitions and capital placement activity in the automation market. We witnessed continued M&A activity by such seasoned buyers as GrayMatter and ATS, and new financial sponsors entered the space, which included Vance Street Capital and Ilion Capital Partners. Companies that were recently involved in transactions had such capabilities as control system integration, artificial intelligence, robotics and security monitoring solutions. The credible list of buyers and investors active in the below transactions highlights the strength and attractiveness of the automation market.

Bundy Group’s current engagements and owner relationships include control system integration, robotics, automated material handling, automation distribution, artificial intelligence (AI) and cybersecurity. This serves as a leading indicator for submarkets our team anticipates closed transactions in over the coming months. We look forward to providing these relevant updates and transaction announcements to Control Engineering magazine readers.

7/19/23

Vance Street Capital’s Micronics Engineered Filtration Group, a global provider of aftermarket and OEM filtration equipment and consumables, acquired AFT, a filter media division of FLSmidth. AFT was started by FLSmidth in 1999 and was known previously as Advanced Filtration Technologies. Learn more.

7/19/23

ATS Corporation acquired Odyssey Validation Consultants Limited, an Ireland-based provider of digitalization solutions for the life science industry. Odyssey will join ATS’ Process Automation Solutions (“PA”) business, a leading provider of automation and digitalization solutions for the process and manufacturing industries. Learn more.

7/18/23

Ventra Health, the leading business solutions provider for hospital-based clinicians, acquired ArcMed, an India-based billing and automation services organization. This acquisition will strengthen Ventra Health’s service performance and quality, optimize operational efficiencies, and provide added scale for automation and growth. Learn more.

7/13/23

Simbe Robotics, Inc., the company leveraging AI and robotics to elevate the performance of retailers with real-time insights into inventory and operations, announced a Series B equity financing round of $28 million, led by Eclipse. Learn more.

7/12/23

Hexagon AB, the global leader in digital reality solutions, combining sensor, software and autonomous technologies, acquired HARD-LINE, a fast-growing, global leader in mine automation, remote-control technology and mine production optimization. Learn more.

7/11/23

nVent Electric plc, a global leader in electrical connection and protection solutions, has acquired TEXA Industries, which will operate within its Enclosures business segment. The acquisition of TEXA Industries and its highly complementary portfolio strengthens nVent’s position as a global systems provider. Learn more.

7/7/23

Tricentis, a global leader in continuous testing and quality engineering, acquired Waldo, a SaaS-based, no-code, zero-footprint mobile test automation platform. Waldo complements and extends Tricentis’ mobile testing offerings with new test automation capabilities, including native, hybrid, and web mobile application testing using virtual devices supporting iOS simulators and Android emulators. Learn more.

7/6/23

Digital Monitoring Products Inc. (DMP), the world’s leading manufacturer of security solutions, announces a strategic investment in iENSO Inc, the world’s leading developer and supplier of intelligent and connected embedded vision platforms. This strategic investment strengthens DMP’s capabilities by combining iENSO’s video expertise with DMP’s track record of innovation and customer service in the security industry, poised for significant growth in both commercial and residential video security markets. Learn more.

7/6/23

nami, a leading multi-sensing platform and ecosystem enabler for the Internet of Things (IoT) industry, announced the close of its Series A financing round, raising $10.5 million from strategic investors including Verizon Ventures, Amavi Capital, INSPiRE and Aconterra. Learn more.

7/5/23

GrayMatter announces its largest strategic merger to date with the addition of Automation & Control Concepts, a leading St. Louis-based industrial control systems integrator. GrayMatter is a technology and consulting company focused on helping manufacturing and critical infrastructure companies optimize production with digital operations. Learn more.

7/5/23

Abracon, a leading supplier of Frequency Control, Timing, Power, Magnetics, RF and Antenna solutions, acquired NEL Frequency Controls, Inc., a US-based manufacturer of ultra-low phase noise crystal oscillators and modules headquartered in Burlington, Wisc. Learn more.

6/26/23

Nordson Corporation (Nasdaq: NDSN) today announced that it has entered into a definitive agreement to acquire ARAG Group and its subsidiaries (“ARAG”) in an all-cash transaction that values ARAG at an enterprise value of €960 million. Headquartered in Rubiera, Italy, ARAG is a global market and innovation leader in the development, production and supply of precision control systems and smart fluid components for agricultural spraying. Learn more.

6/26/23

Staple Street Capital a leading middle-market private equity firm with approximately $900 million of capital under management, announced the sale of Mid States Supply to Ilion Capital Partners (“Ilion Capital”). Headquartered in Kansas City, Mid States is a value-added distributor of valves, pipes, and fittings and offers process control solutions. Learn more.

Bundy Group is a boutique investment bank that specializes in representing controls and automation, Internet of Things, and cybersecurity companies in business sales, capital raises, and acquisitions. Over the past 33 years, Bundy Group has advised and closed on over 250 transactions, which includes numerous automation-related transactions. You can learn more at www.bundygroup.com or by contacting Clint Bundy.

In this article for Plant Engineering Magazine, Bundy Group provides an update on mergers & acquisitions and capital placement activity for companies that address the manufacturing and plant management fields.

2023 is continuing to show strength and consistency in terms of mergers & acquisitions and capital placement activity in the automation and industrial technology markets. We witnessed continued M&A activity by such seasoned buyers as IPS and GrayMatter, and new financial sponsors entered the space, which included Golden Gate Capital and Ilion Capital Partners.

Companies that were recently involved in transactions had such capabilities as high-voltage solutions, frequency control, electric motors, artificial intelligence, and precision control systems. This credible list of buyers and investors highlights the attractiveness of the automation and industrial technology markets.

Bundy Group’s current engagements and owner relationships include control system integration, automated material handling, automation distribution, industrial services, and electrical services. This serves as a leading indicator for industries our team anticipates closed transactions in over the coming months. We look forward to providing these relevant updates to Plant Engineering magazine readers.

7/19/23

Vance Street Capital’s Micronics Engineered Filtration Group, a global provider of aftermarket and OEM filtration equipment and consumables, acquired AFT, a filter media division of FLSmidth. AFT was started by FLSmidth in 1999 and was known previously as Advanced Filtration Technologies. Learn more.

7/13/23

Simbe Robotics, Inc., the company leveraging AI and robotics to elevate the performance of retailers with real-time insights into inventory and operations, announced a Series B equity financing round of $28 million, led by Eclipse. Learn more.

7/11/23

nVent Electric plc, a global leader in electrical connection and protection solutions, has acquired TEXA Industries, which will operate within its Enclosures business segment. The acquisition of TEXA Industries and its highly complementary portfolio strengthens nVent’s position as a global systems provider. Learn more.

7/6/23

nami, a leading multi-sensing platform and ecosystem enabler for the Internet of Things (IoT) industry, announced the close of its Series A financing round, raising $10.5 million from strategic investors including Verizon Ventures, Amavi Capital, INSPiRE and Aconterra. Learn more.

7/5/23

GrayMatter announces its largest strategic merger to date with the addition of Automation & Control Concepts, a leading St. Louis-based industrial control systems integrator. GrayMatter is a technology and consulting company focused on helping manufacturing and critical infrastructure companies optimize production with digital operations. Learn more.

7/5/23

Abracon, a leading supplier of Frequency Control, Timing, Power, Magnetics, RF and Antenna solutions, acquired NEL Frequency Controls, Inc., a US-based manufacturer of ultra-low phase noise crystal oscillators and modules headquartered in Burlington, Wisc. Learn more.

7/1/23

Golden Gate Capital, a global private equity firm, has announced a majority acquisition of DMC Power, a leading designer and manufacturer of connector technology systems for high-voltage power infrastructure. Learn more.

6/26/23

Nordson Corporation (Nasdaq: NDSN) today announced that it has entered into a definitive agreement to acquire ARAG Group and its subsidiaries (“ARAG”) in an all-cash transaction that values ARAG at an enterprise value of €960 million. Headquartered in Rubiera, Italy, ARAG is a global market and innovation leader in the development, production and supply of precision control systems and smart fluid components for agricultural spraying. Learn more.

6/26/23

Staple Street Capital a leading middle-market private equity firm with approximately $900 million of capital under management, announced the sale of Mid States Supply to Ilion Capital Partners (“Ilion Capital”). Headquartered in Kansas City, Mid States is a value-added distributor of valves, pipes, and fittings. Learn more.

6/26/23

IDEAL ELECTRIC COMPANY of Mansfield, Ohio, acquired Louis Allis Large Synchronous Machines and Louis Allis Large Induction Motors, product lines of the former Louis Allis Company of Milwaukee, Wisconsin. In addition, the acquisition grants IDEAL rights to certain Intellectual Property related to Beloit Power Systems Motors and Generators, Fairbanks Morse Motors and Generators, and Colt Industries Motors and Generators. Learn more.

6/23/23

IPS, North America’s leading solution provider for electromechanical equipment, rotating equipment, and power management systems, has acquired Surplec. Headquartered in Sherbrooke, Quebec, Canada, Surplec is an industry leader in the management and remanufacturing of surplus medium and high-voltage transformers. Learn more.

– Bundy Group is a CFE Media and Technology content partner.

In this article for Industrial Cybersecurity Pulse, Bundy Group provides an update on mergers & acquisitions and capital placement activity in the cybersecurity market.

Spring 2023 is continuing to show strength and consistency in terms of cybersecurity mergers & acquisitions and capital placement activity in the market. Transactions to note through June include Cisco’s acquisition of Armorblox, CACI’s acquisition of Bitweave and Crosspoint Capital’s acquisition of Absolute Software.

This credible list of buyers and investors highlights the attractiveness and resiliency of the cybersecurity mergers market in an uncertain macroeconomic environment. Bundy Group’s current engagements and upcoming client opportunities include cybersecurity, managed service providers and control system integration, all of which are centered around the field of information security. We look forward to providing relevant updates and closed deal announcements to the Industrial Cybersecurity Pulse audience in the future.

6/1/23

iNovex, a provider of software development solutions focused on cybersecurity, Signals Intelligence (SIGINT), data analysis and robotic process automation (RPA) for the Intelligence Community, acquired Secure Innovations, a leading cybersecurity business serving the Intelligence Community and Department of Defense. Learn more.

6/7/23

Snyk, the leader in developer security, acquired Enso Security, pioneers of the industry’s first Application Security Posture Management (ASPM) solution. The acquisition is subject to customary closing conditions and is expected to close in Q2 2023. Learn more.

6/6/23

Cleveland, Ohio-based CBIZ acquired Pivot Point for $6.6 million. A significant investment underpinning the company’s ongoing commitment to the expansion of their cybersecurity services. Pivot Point has been offering its services to small and medium-sized enterprises since its inception in 2001. Learn more.

5/31/23

Cisco will acquire cybersecurity startup Armorblox Inc. to help protect email, cloud and office applications and enterprise communication systems. The networking giant will take advantage of Armorblox’s natural language processing, predictive and generative artificial intelligence capabilities to help its customers better understand the security risks they face. Learn more.

5/16/23

IBM acquired Polar Security, an innovator in technology that helps companies discover, continuously monitor and secure cloud and software-as-a-service (SaaS) application data — and addresses the growing shadow data problem. Learn more.

5/16/23

Exiger, a SaaS company, acquired Ion Channel, a top software supply chain risk management platform. This acquisition is a significant milestone for SCRM, as Exiger becomes the sole tech company illuminating all aspects of the supply chain, including relationships, products, processes, materials and software. Learn more.

5/10/23

Absolute Software Corp., a publicly traded cybersecurity provider, has agreed to be taken private by Crosspoint Capital Partners in a $657 million deal. Crosspoint is also absorbing the company’s $223 million debt. The acquisition values Absolute Software at $11.50 per share, a 34 percent premium to its May 10 closing price. Learn more.

5/10/23

Cyber security specialist Integrity360 is to expand into the Nordic region with the acquisition of Swedish cyber security company Netsecure for an undisclosed sum. Further acquisitions are also on the cards for the Irish company as it targets expansion across Europe this year. Learn more.

5/4/23

CACI Limited, a leading data and technology solutions company, has acquired Bitweave Limited. Bitweave provides software engineering, data analysis and cyber services to the national security sector. Established in 1975, CACI employs more than 1200 staff in the UK and Europe, providing business information systems to public and private sector clients. Learn more.

5/3/23

Databricks is acquiring the privately-held data governance platform vendor Okera. The plan is for Okera’s technology to be integrated into Databricks’ existing data governance solution, Unity Catalog, providing more AI-powered functionality. Learn more.

4/26/23

Mozilla has acquired Fakespot, a startup that offers a website and browser extension that helps users identify fake or unreliable reviews. The financial terms of the deal were not disclosed. Fakespot’s offerings can be used to spot fake reviews listed on various online marketplaces including Amazon, Yelp, TripAdvisor and more. Learn more.

4/26/23

Smile Identity, a KYC compliance and ID verification partner for many African fintechs and businesses, has acquired Appruve’s parent company (Inclusive Innovations, Inc.). This strategic acquisition will enable us to expand our footprint across Africa and solidify our position as the continent’s leading identity verification and digital KYC provider. Learn more.

4/25/23

Thrive, a premier provider of Cybersecurity, Cloud and Digital Transformation Managed Services, has acquired Storagepipe, a world-class Cloud, Data Protection, Managed Services and Cybersecurity provider based in Toronto, Ontario. Learn more.