In this article for Practical Dermatology, Clint Bundy, Managing Director of Bundy Group, breaks down how practice owners within the dermatology market can utilize consortium sales with complementary practices to increase overall value.

As an investment banking advisory firm, our group represents practice owners in business sales and capital raises. It is common for our team to be in confidential discussions with multiple owners in the same healthcare segment at the same time, including in the dermatology market. These owners are contemplating hiring our firm to represent them in a sale and often ask how they, as sellers, can drive the utmost value in a sale process. In certain situations, we propose a consortium sale to capture enhanced value. In short, this occurs by partnering with at least one other practice in a sale and engaging an experienced investment banking advisor to manage the consolidated sale process.

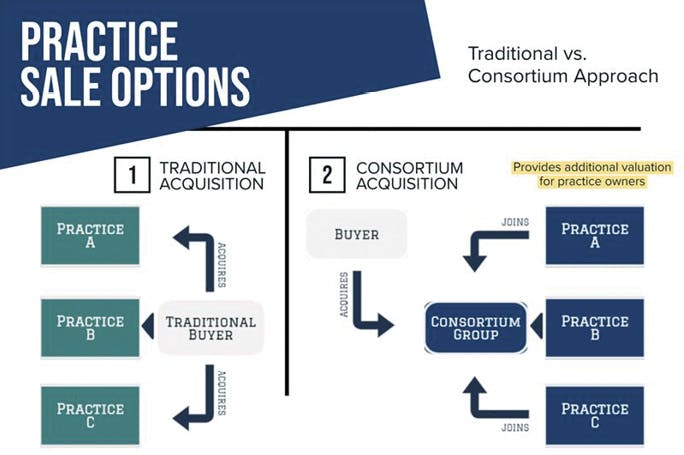

A consortium sale is taking two or more businesses in the same industry and presenting them together to the market of buyers. On the surface, presenting two or more practices in a sale can appear straightforward and simple. However, a material amount of preparation, communication, and vision are required of all key parties to execute on this strategy. As an investment banking advisor who has successfully executed this playbook, we understand these key steps and outline them for readers below.

First, candidates need to be selected for the consortium. Consortiums have been formed not just along industry lines but also based on pre-existing relationships that owners had with one another. It is easier to get excited about teaming up with another practice in a sale if you, as an owner, have a lot of respect and affection for the other consortium candidate(s) and have a complementary, not competitive, fit with the other practice(s).

While we might suggest a strong candidate based on our experience and knowledge of the situation, the consortium parties decide who is included in the collective sale. It is important to note that in a consortium sale the candidates will not formally merge or integrate prior to a transaction. Instead, they will be presented together as one platform acquisition opportunity that could be formally merged and integrated after the close of a consortium transaction.

To successfully execute and deliver enhanced value in a consortium sale, the following key positioning points must be addressed:

To answer this question, we will reference the typical financial sponsor playbook for acquisitions. A financial sponsor’s goal is to buy a platform (ie, first investment) at a buyer-friendly valuation and to complete add-on acquisitions at even lower valuation multiples. This arbitrage strategy allows financial sponsors to create enhanced returns, though at the expense of the sellers.

With a consortium strategy, we are flipping the financial sponsor approach on its head to benefit both business owners and sellers in the following ways:

In 2023, two dermatology and aesthetic practices based in the Western US formed a consortium with the goal of a consolidated sale. As highlighted earlier, these practices fit the recommended rule of thumb: they had complementary service offerings, operated in a similar region through multiple locations, and did not compete. In addition, each of the practices had similar organizational cultures and values. The owners of each practice had a long-time relationship and had profound respect for each other’s business. Individually, these practices were being frequently approached by buyers already active in the dermatology and aesthetics industry.

These two consortium members, operating under the same organizational structure post-close, would realize a tremendous amount of growth, revenue, and cost cooperation. The story of why these practices made sense together was very compelling.

Our firm had existing relationships with both practices through our tenured experience in the dermatology and aesthetics sector. In 2023, a comprehensive sale process was begun with the consortium members, which included strategic buyer and financial sponsors in the pool of buyers. The goals of the transaction have been to focus on a group of strong-fit buyers, which the practice owners approve of, and to obtain a premium valuation for all consortium members. As of October 2023, there was strong interest and offers from a range of quality buyers, and a targeted closed transaction in the first quarter of 2024.

With proprietary experience in the consortium approach and successful client transactions of this structure, we are focusing on executing on the following goals:

In summary, our end goals are to fully represent the consortium clients and their interests, to drive value, and to find a best-fit buyer for the consortium’s future benefit.

While the consortium approach may not be a reliable opportunity for every practice, there are many healthcare practices that could benefit from this strategy. It can be a tremendous way for a practice owner who is considering a sale to obtain a significantly enhanced value. Give thought to other practices that may be candidates for a consortium partnership with you, consider contacting those owners to begin a conversation, and schedule an informal discussion with an experienced investment banker to explore this potential opportunity.

In this article for Plant Engineering Magazine, Bundy Group provides insight into the influx of mergers and acquisitions occurring in the automation, industrial technology, manufacturing, and plant management fields as 2023 draws to a close.

The automation, industrial technology and services M&A market shows no loss in momentum in 2023. From recently closed Bundy Group transactions (Ultimation; Avanceon; Metal Tech), our team continues to see strong interest from a range of strategic buyers and financial sponsors in the industrial technology and services segments. Further evidence of the strong M&A activity in markets relevant to Plant Engineering readers is provided by the below list of transactions.

Recent transactions to note include Addtronics’ acquisition of Sirius Automation, MCE’s acquisition of Nova Hydraulics, INNIO Group’s acquisition of Western Energy Systems, and Bain Capital’s acquisition of Harrington Process Solutions. Bundy Group anticipates several other automation, industrial technology and services transactions to be completed before the end of the year, and we will keep Plant Engineering readers posted.

Bundy Group’s current engagements and owner relationships include control system integration, automated material handling, automation distribution, industrial services, and electrical services. This serves as a leading indicator for industries our team anticipates closed transactions in over the coming months. We look forward to providing these relevant updates to Plant Engineering magazine readers.

10/16/23

Addtronics, LLC, a mission-driven holding company dedicated to acquiring, empowering, and growing leading robotic automation solution providers, has acquired Sirius Automation, a leading developer of laboratory robotic systems for blue-chip biotech and pharmaceutical companies. Learn more.

10/10/23

PULS, technology and market leader in DIN rail power supplies, has acquired the business of wireless charging specialist Wiferion. Wiferion’s leading technology is now enhanced with the capabilities of PULS, a technology-driven company based in Munich, with a revenue of 250 million euros in 2022. Wiferion customers benefit from a global presence in production and application support. Learn more.

10/6/23

Hoskin Scientific has acquired Durham Instruments. Based in Pickering, Ontario, Durham Instruments is a leading supplier of test & measurement instrumentation, data acquisition and control systems. The business offers custom system measurement solutions, including hardware and software integration and on-site technical service. Learn more.

9/25/23

Motion & Control Enterprises has acquired Nova Hydraulics, Inc. its fifth acquisition of 2023. Headquartered in Indianapolis, IN, Nova is an independent hydraulics solutions provider, specializing in the repair, remanufacture and supply of hydraulics parts to end-users, resellers, repair houses and OEMs. Founded in 1951, MCE is a supplier of technical fluid power, automation, flow control, compressed air, process pumps, products, service, and repair solutions. Learn more.

9/25/23

INNIO Group has acquired Northeast-Western Energy Systems (NES-WES) from Penn Power Group, a prominent power systems integrator in the U.S. This acquisition aligns with INNIO’s growth strategy in the U.S., enabling the company to expand its presence and establish a comprehensive nationwide offering for new installations and energy services. Learn more.

9/7/23

Harrington Process Solutions a leading specialty distributor of industrial flow control process solutions, has entered into a definitive agreement to be acquired by Bain Capital Private Equity. Harrington will continue to operate as a standalone company and be led by its current management team. Learn more.

In this article for Control Engineering Magazine, Bundy Group analyzes the various automation transactions and ongoing mergers & acquisition and capital placements for the month of October.

The automation market continues to show resiliency and strength in terms of activity and interest from a diversified group of strategic buyers and financial sponsors. From our recently closed transactions in the sector (Avanceon; Ultimation), Bundy Group continues to see strong interest from a range of qualified buyers in the automation segment. Further evidence of the robust M&A activity in automation is provided by the below list of transactions.

Recent transactions to note include Bain Capital’s acquisition of Harrington Process Solutions, Rockwell’s acquisition of Clearpath Robotics, Accenture’s acquisition of ATI Solutions Group, and Automata’s $40 million capital raise. Bundy Group anticipates several other automation transactions to be completed before the end of the year, and we will keep Control Engineering readers posted.

Bundy Group’s current engagements and owner relationships include control system integration, robotics, automated material handling, automation distribution, artificial intelligence, and cybersecurity. This serves as a leading indicator for submarkets our team anticipates closed transactions in over the coming months. We look forward to providing these relevant updates and transaction announcements to Control Engineering magazine readers.

10/16/23

Triton funds have partnered with Wavelynx Technologies, a leader in mobile-first identity and access control solutions, to support the company’s next growth phase. The details of the transaction, where Triton and Wavelynx’s co-founders and management invest together, have not been disclosed. Wavelynx will operate as an independent portfolio company under Triton. Learn more.

10/10/23

IAR Group from Zofingen, which specializes in automation systems, is taking over SONTEC AG from Hochdorf, which is active in the fields of automated testing technology, assembly automation, robotics and image processing, with immediate effect. With this acquisition, the IAR Group strengthens its position in the global market for industrial automation and increases its production capacity in Switzerland. Learn more.

10/10/23

PULS, technology and market leader in DIN rail power supplies, has acquired the business of wireless charging specialist Wiferion. Wiferion’s leading technology is now enhanced with the capabilities of PULS, a technology-driven company based in Munich, with a revenue of 250 million euros in 2022. Wiferion customers benefit from a global presence in production and application support. Learn more.

10/6/23

Hoskin Scientific has acquired Durham Instruments. Based in Pickering, Ontario, Durham Instruments is a leading supplier of test & measurement instrumentation, data acquisition and control systems. The business offers custom system measurement solutions, including hardware and software integration and on-site technical service. Learn more.

10/3/23

Automata Technologies, a leading automation company powering life sciences labs, has raised $40m to accelerate its rapid growth and industry presence across the US, UK and EMEA. Dimension led the round and was joined by A.P. Moller Holding and others. Learn more.

10/3/23

E Tech Group, a major player in automation solutions, has acquired Automation Group, a leading provider of automation services across various industries. With a strong focus on sectors like Life Sciences and Food & Beverage, E Tech Group continues to expand its expertise through strategic acquisitions, enhancing its capabilities in delivering cutting-edge automation solutions. Learn more.

10/2/23

Rockwell Automation, Inc. the world’s largest company dedicated to industrial automation and digital transformation, completed its acquisition of Ontario, Canada-based Clearpath Robotics Inc., a leader in autonomous robotics, including autonomous mobile robots (AMRs) for industrial applications. Learn more.

9/26/23

Advantive, a mission-critical software provider for specialty manufacturing and distribution businesses, has acquired Proplanner, a leader in Product Lifecycle Management (PLM) solutions and Manufacturing Execution Systems (MES). This acquisition further advances Advantive’s commitment to driving innovation in the manufacturing and distribution lifecycle. Learn more.

9/25/23

INNIO Group has acquired Northeast-Western Energy Systems (NES-WES) from Penn Power Group, a prominent power systems integrator in the U.S. This acquisition aligns with INNIO’s growth strategy in the U.S., enabling the company to expand its presence and establish a comprehensive nationwide offering for new installations and energy services. Learn more.

9/22/23

ATS Corporation, a top automation solutions provider, has acquired Avidity Science, LLC, a leading designer and manufacturer of automated water purification solutions for biomedical and life science applications. The deal, subject to post-closing adjustments, aims for significant synergies, with $1.5 million expected by year 3 and $2.6 million by year 5. Learn more.

9/18/23

Indie Semiconductor has acquired EXALOS AG, a Swiss photonics firm, expanding its advanced driver assistance and user experience portfolio. The deal enhances Indie’s offerings with near-infrared and visible superluminescent LED products and semiconductor optical amplifier products, strengthening its position in automotive technology applications. Learn more.

9/18/23

Industrial Automation Group has acquired Delta Automation in Richmond, Virginia, marking its inaugural acquisition. The move enhances their expertise in industrial electronics remanufacturing and field service, aligning with their focus on mature, legacy, and end-of-life industrial replacement parts and repairs. Learn more.

9/15/23

PCE Automation has acquired Adapt Engineering Ltd, a Dublin-based company specializing in automated machine design and manufacturing. This acquisition grants PCE Automation multinational status for the first time in its 62-year history. Adapt Engineering has a strong track record, collaborating with leading medical device brands and delivering over 700 machines since its founding in 1986. Learn more.

9/13/23

Brixey & Meyer Capital has sold Guardian Access Solutions to Dallas-based private equity firm CenterOak Partners. Guardian, headquartered in Nashville, also with offices in Atlanta and Orlando, specializes in design, installation, and maintenance of access control systems, including commercial gates, overhead doors, parking systems, and access control/CCTV. Learn more.

9/8/23

Emerson today has acquired Afag Holding AG , an innovative leader in electric linear motion, feeding and handling automation solutions. The electric linear motion segment expands Emerson’s served market by more than $9 billion and is expected to grow mid-single digits annually, supporting Emerson’s long-term, profitable organic growth. Learn more.

9/7/23

Star Cutter Company has acquired Tru Tech CNC grinding systems from Resonetics, assuming all design and manufacturing of the Tru Tech high precision CNC grinding machines currently performed at the Michigan facilities in Mt. Clemens and Lewiston. Additionally, Star Cutter secures the service, training and spare parts support for Tru Techs’ vast installation base across North America and Europe. Learn more.

9/7/23

Harrington Process Solutions a leading specialty distributor of industrial flow control process solutions, has entered into a definitive agreement to be acquired by Bain Capital Private Equity. Harrington will continue to operate as a standalone company and be led by its current management team. Learn more.

8/29/23

Accenture has acquired ATI Solutions Group , a Perth-based consulting service provider to the mining, energy and rail industries. ATI will enhance Accenture’s capabilities in West Australia, where specialized digital and industrial talent is in high demand. Learn more.

8/14/23

Bentley Systems, Incorporated, the infrastructure engineering software company, has acquired Blyncsy provider of breakthrough artificial intelligence services for departments of transportation to support operations and maintenance activities. The digital twin ecosystem focus of Bentley’s iTwin Ventures portfolio is bolstered by accelerating the development and propagation of such broadly valuable infrastructure asset analytics. Learn more.

6/5/23

Tramec, LLC has acquired CS Automation located in Ontario, New York. Tramec and CS Automation have been long-time business associates as both a customer and supplier to each other. The two companies share very similar corporate values and vision, being committed to growth. Both companies will continue to make a heavy commitment investing in growth. Learn more.

5/31/23

H&P Technologies, Inc has acquired Youngblood Automation. Youngblood Automation, headquartered in Grand Rapids, Michigan, specializes in wholesale distribution, representing leading automation equipment manufacturers, and providing automation manufacturing services, featuring a portfolio of over 40 well-known industry brands. The deal closed on May 15, 2023. Learn more.

Bundy Group is a boutique investment bank that specializes in representing controls and automation, Internet of Things, and cybersecurity companies in business sales, capital raises, and acquisitions. Over the past 33 years, Bundy Group has advised and closed on over 250 transactions, which includes numerous automation-related transactions. You can learn more at www.bundygroup.com or by contacting Clint Bundy.

Clint Bundy and Stewart Carlin discuss the crucial reasons why business owners should consider hiring an investment banker instead of engaging directly with buyers. Learn how investment bankers can enhance the value of your business sale, provide measurable benefits, and offer a wealth of services, including information, advice, and options that can ultimately lead to more profitable and secure transactions.

Related Articles

About Bundy Group

Established in 1989, Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The team of highly experienced investment bankers leverages extensive industry knowledge and skill to provide hands-on guidance to clients through every phase of the business transaction. Bundy Group has been a trusted partner in more than 250 closed deals over the past 33 years, providing high quality options, actionable insights, and delivery of optimal strategic fit at a premium value for our clients. Bundy Group is headquartered in Charlotte, NC and has additional offices in New York and Virginia.

Bundy Group Securities, LLC, is a registered broker-dealer and member of FINRA and SIPC. More information on the background of Bundy Group Securities, LLC is available at FINRA's BrokerCheck.

Clint Bundy and Stewart Carlin discuss the essential aspects of competitive sales and capital raise processes. They cover the four key stages: preparation, Indication of Interest (IOI), Letter of Intent (LOI), and due diligence and closing. This video provides valuable insights for business owners on understanding these processes and navigating them effectively.

In this video, business owners will gain insights into the importance of distinguishing between potential buyers who want their business and those who truly need it. Clint Bundy and Stewart Carlin discuss the current state of the M&A market, the influence of a competitive sales process, and how to discern buyers' genuine motivations. By emphasizing the significance of educated decision-making and the dynamics of competitive offers, this discussion provides valuable guidance for business owners navigating the complexities of selling their company.

Clint Bundy and Stewart Carlin delve into the pivotal role of a "Sellside Quality of Earnings Report" (Sellside QofE) and how it can empower business owners to maximize the value of their company during a sale. Gain valuable insights on how a Sellside QofE bolsters credibility, safeguards against retrades, and drives up the worth of a business in a highly competitive market.

Related Articles:

Driving Business Value in a Sale or Capital Raise: The Sellside Quality of Earnings Report

About Bundy Group

Established in 1989, Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The team of highly experienced investment bankers leverages extensive industry knowledge and skill to provide hands-on guidance to clients through every phase of the business transaction. Bundy Group has been a trusted partner in more than 250 closed deals over the past 33 years, providing high quality options, actionable insights, and delivery of optimal strategic fit at a premium value for our clients. Bundy Group is headquartered in Charlotte, NC and has additional offices in New York and Virginia.

Bundy Group Securities, LLC, is a registered broker-dealer and member of FINRA and SIPC. More information on the background of Bundy Group Securities, LLC is available at FINRA's BrokerCheck.

Bundy Group, an industry-focused investment bank, is pleased to announce that it has successfully advised Metal Tech of Murfreesboro (“Metal Tech”), a custom metal fabrication facility that provides equipment maintenance and repair services to various manufacturing industries, in a sale to Keswick Partners, a private equity firm that specializes in majority and minority equity investments in niche manufacturing, specialty services, and value-added distribution companies across the United States. The transaction, which closed in August of this year, highlights Bundy Group’s quality advisory work and closed deal experience in the industrial and equipment repair services sectors.

Metal Tech was founded over 38 years ago in Murfreesboro, North Carolina, and operated as a privately held, family-owned company that supported clients through full in-shop and field service divisions, with an emphasis on safety and overall product quality. Today, Metal Tech’s services extend to a diverse set of markets, including pulp and paper, steel, chemicals, signing, food and beverage, infrastructure, and more.

“Metal Tech is a leader in the industrial maintenance and repair services sectors, and the company’s impressive growth and blue-chip client base are key reasons for the strong buyer interest we had in this company,” said Clint Bundy, Managing Director with Bundy Group. “We appreciated the opportunity to represent the Felton family and the company in the sale process, and we are excited to see what the future holds for Metal Tech under new ownership.”

The Bundy Group client engagement team included Clint Bundy, Jim Mullens, Stewart Carlin, Jordan Frickle and Megan Hagemann.

"After speaking with some buyers on our own, we decided to hire Bundy Group as our investment banking advisor. Our reasons for selecting Bundy Group were because of its industry experience and reputation for delivering strong outcomes for its clients,” said Brock Felton, Shareholder and Executive with Metal Tech. “We were very pleased with the Bundy Group process, their attention to our needs, and the outcome. Keswick Partners is a strong fit for our organization, and the value that Bundy Group delivered was far above my original expectations.”

This transaction underscores Bundy Group’s continued success and significant industry experience to provide quality advice to clients, deliver strategic buyers and financial sponsor options through competitive processes, and drive overall client value in the business services and industrial sectors. The investment bank has previously advised such clients as Avanceon, Catawba Research, Custom Controls Unlimited, Dorsett Controls, Industrial Electric Machinery, MR Systems, among others. For more information about Bundy Group’s industry expertise and recent transactions, visit bundygroup.com.

About Bundy Group

Established in 1989, Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The team of highly experienced investment bankers leverages extensive industry knowledge and skill to provide hands-on guidance to clients through every phase of the business transaction. Bundy Group has been a trusted partner in more than 250 closed deals over the past 33 years, providing high quality options, actionable insights, and delivery of optimal strategic fit at a premium value for our clients.

Bundy Group Securities, LLC, is a registered broker-dealer and member of FINRA and SIPC. More information on the background of Bundy Group Securities, LLC is available at FINRA's BrokerCheck.

In this article for Modern Aesthetics, Bundy Group assesses how medical spas, as well as dermatology, plastic surgery and cosmetic practices, can utilize a consortium sale with complementary practices to increase overall business value.

As an investment banking advisory firm, Bundy Group specializes in representing practices, which includes dermatology, medical spa, plastic surgery and cosmetic, in business sales and capital raises. It is common for the Bundy Group team to be in confidential discussions with multiple owners in this same healthcare segment at the same time. These owners are contemplating hiring our firm to represent them in a sale and often ask how they, as sellers, can drive the utmost value in a sale process. In certain situations, the team proposes a consortium sale to capture enhanced value. In short, this occurs by partnering with at least one other practice in a sale and engaging an experienced investment banking advisor to manage the consolidated sale process.

A consortium sale is taking two or more businesses in the same industry and presenting them together to the market of buyers. On the surface, presenting two or more practices in a sale can appear straightforward and simple. However, a material amount of preparation, communication, and vision are required of all key parties to execute on this strategy. As an investment banking advisor that has successfully executed this playbook, we understand these key steps and wanted to outline them below.

First, candidates need to be selected for the consortium. In our prior transactions, consortiums were formed not just along industry lines but also based on pre-existing relationships that owners had with one another. It is easier to get excited about teaming up with another practice in a sale if you, as an owner, have a lot of respect and affection for the other consortium candidate(s) and have a complementary, not competitive, fit with the other practice(s). It is certainly possible to have practices of different profiles partner up for a consortium. For example, a medical spa practice can join with plastic surgery or cosmetic-focused dermatology practice in pursuing a consortium sale.

While we might suggest a strong candidate based on our experience and knowledge of the situation, the consortium parties decide who is included in the collective sale. It is important to note that in a consortium sale the candidates will not formally merge or integrate prior to a transaction. Instead, they will be presented together as one platform acquisition opportunity that could be formally merged and integrated after the close of a consortium transaction.

To successfully execute and deliver enhanced value in a consortium sale, the following key positioning points must be addressed:

To answer this question, we will reference the typical financial sponsor playbook for acquisitions. A financial sponsor’s goal is to buy a platform (ie, first investment) at a buyer-friendly valuation and to complete add-on acquisitions at even lower valuation multiples. This arbitrage strategy allows financial sponsors to create enhanced returns, though at the expense of the sellers.

With a consortium strategy, we are flipping the financial sponsor approach on its head to benefit both business owners and sellers in the following ways:

In 2023, two dermatology and aesthetic practices based in the Western US formed a consortium with the goal of a consolidated sale. As highlighted earlier, these practices fit the recommended rule of thumb: they had complementary service offerings, operated in a similar region through multiple locations, and did not compete. In addition, each of the practices had similar organizational cultures and values. The owners of each practice had a long-time relationship and had profound respect for each other’s business. Individually, these practices were being frequently approached by buyers already active in the dermatology and aesthetics industry.

These two consortium members, operating under the same organizational structure post-close, would realize a tremendous amount of growth, revenue, and cost cooperation. The story of why these practices made sense together was very compelling.

Bundy Group had existing relationships with both practices through our tenured experience in the dermatology and aesthetics sector. In 2023, our team started a comprehensive sale process with the consortium members, which included strategic buyer and financial sponsors in the pool of buyers. The goals of the transaction have been to focus on a group of strong-fit buyers, which the practice owners approve of, and to obtain a premium valuation for all consortium members. As of October 2023, we have generated strong interest and offers from a range of quality buyers. We are targeting a closed transaction in the first quarter of 2024.

With proprietary experience in the consortium approach and successful client transactions of this structure, we are focusing on executing on the following goals:

In summary, our end goals are to fully represent the consortium clients and their interests, to drive value, and to find a best-fit buyer for the consortium’s future benefit.

While the consortium approach may not be a reliable opportunity for every practice, there are many healthcare practices that could benefit from this strategy. It can be a tremendous way for a practice owner that is considering a sale to obtain a significantly enhanced value. Give thought to other practices that may be candidates for a consortium partnership with you, consider contacting those owners to begin a conversation, and schedule an informal discussion with an experienced investment banker to explore this potential opportunity.

In this article for Control Engineering Magazine, mergers and acquisitions in the automation industry show no signs of slowing down as Bundy Group analyzes 17 reported transactions for the month of September.

While numerous industries are witnessing a lower volume of closed mergers and acquisitions transactions due to higher interest rates and other macroeconomic challenges, the automation M&A market shows no loss in momentum. From a recently closed transaction (Bundy Group represented Ultimation in a sale to MCE), our team continues to see strong interest from a range of strategic buyers and financial sponsors in the automation segment. Further evidence of the strong M&A activity in automation is provided by the below list of transactions.

Business sales to note include Valstone’s acquisition of Matrix Industrial Control System, Graham Partners’ acquisition of Barcoding, and AMETEK’s acquisition of United Electronic Industries. Bundy Group anticipates several other automation transactions to be completed before the end of the year, and we will keep Control Engineering readers posted.

Bundy Group’s current engagements and owner relationships include control system integration, robotics, automated material handling, automation distribution, artificial intelligence, and cybersecurity. This serves as a leading indicator for submarkets our team anticipates closed transactions in over the coming months. We look forward to providing these relevant updates and transaction announcements to Control Engineering readers.

9/22/23

ATS Corporation a leading automation solutions provider, has acquired Avidity Science, LLC, a designer and manufacturer of automated water purification solutions for biomedical and life science applications. The acquisition is expected to bring significant synergies by year 3 and year 5, subject to customary post-closing adjustments. Learn more.

9/21/23

Valstone Corporation Inc. an international software and technology solutions provider for the industrial vertical, acquired Matrix Industrial Control System, a pioneer in the food industry, based in Brampton, Ontario, Canada since 1977. This acquisition fortifies Valstone’s strategic entry into the Food & Beverage industry. Learn more.

9/20/23

Machinery Services Co. and Rapid Pump & Meter Service Co. a Hidden Harbor Capital Partners portfolio company and leading provider of maintenance, repair, and installation services to water facilities and critical infrastructure, acquired Delta-Electro Power, Inc. The acquisition expands Rapid Pump’s geographic footprint into Rhode Island and Massachusetts and further expands its service capabilities. Learn more.

9/13/23

Robinson Engineering, Inc. has merged with Jewett Automation of Richmond, further enhancing our ability to provide comprehensive automation solutions. This strategic partnership strengthens our position in delivering turn-key automation solutions, with a focus on improving efficiency and effectiveness in your assembly and packaging operations. Learn more.

9/12/23

CenterOak Partners LLC, a Dallas-based private equity firm, has completed a majority recapitalization of Guardian Access Solutions. Guardian provides maintenance, repair, and installation of exterior access control equipment in the Southeast U.S. The current management team will continue to lead Guardian following CenterOak’s investment. Learn more.

9/12/23

Ascento Robotics, a Zurich, Switzerland-based company building autonomous security robots, raised $4.3 million in pre-seed funding. Wingman Venture and Playfair led the round and were joined by Tim Kentley-Klay, Ryan Gariepy, Daniel Kottlarz, Tobias Redlin, and others. Learn more.

9/11/23

DRT Holdings, LLC, which provides specialized manufacturing solutions to the metal packaging, aerospace, and precision industrial segments, has acquired Custom Machining Corporation. CMC is a leading provider of high-speed, high-precision liner systems and parts for metal packaging applications serving the end markets for food, beverage and household products. Learn more.

9/7/23

Barcoding, Inc., the leader in efficiency, accuracy, and connectivity, has joined Graham Partners, a private investment firm investing in technology-driven companies that are spurring innovation in advanced manufacturing. Learn more.

9/6/23

BARTEC acquired the British IIoT specialist Extronics. The company is a leading global developer and manufacturer of connectivity and IIoT infrastructure as well as asset and people tracking systems for hazardous areas. Learn more.

9/6/23

SimpleClosure, has raised $1.5 million in pre-seed funding. Co-led by Michael Vaughan and Jon Pomeranz of Vera Equity and Rex Salisbury of Cambrian Ventures, with strong participation from a slew of high-profile SMB-focused startup founders and executives, the funding comes amidst an uptick in startup closures as the economy shifts and raising venture capital becomes more challenging. Learn more.

9/6/23

AMETEK, Inc. acquired United Electronic Industries (UEI), a leading provider of data acquisition and control solutions for the aerospace, defense, energy and semiconductor industries. UEI specializes in the design and manufacture of high-performance test, measurement, simulation and control solutions that enable customers to build smart, reliable, flexible and rugged systems. Learn more.

9/5/23

Numeral, the subledger for high-volume businesses, announced the closing of its oversubscribed seed round. The company has raised $3,000,000 in this recent round led by Bienville Capital with participation from AngelList Quant Fund, executives from Kruze Consulting, and accounting leaders at high-volume businesses. Numeral is a San Francisco-based company providing modern accounting automation technology for high-volume businesses. Learn more.

8/31/23

KGM, a prominent distributor specializing in regulators, valves, and measuring equipment for residential and commercial utility companies, has been on a remarkable growth journey since joining forces with Compass Group in 2021. Their recent expansion has led to the acquisition of Bartlett Controls, based in North Carolina, further broadening their presence across the United States. Learn more.

8/31/23

IFS, the global cloud enterprise software company, acquired Falkonry, Inc. a California-based Industrial AI software company that provides automated, high-speed data analysis to the manufacturing and defense industries. Learn more.

8/11/23

CKC Automation was acquired by Depatie Fluid Power Co. and subsequently merged with DST Controls Inc., both California-based automation firms. DST Controls, headquartered in the San Francisco Bay Area, has a nearly 50-year history of providing automation and industrial controls services to a wide range of customers, from large manufacturers to startups. Learn more.

6/20/23

One Rock Capital Partners, LLC, a value-oriented, operationally focused private equity firm, has entered into a definitive agreement to sell BRWS Parent LLC and its related subsidiaries “CentroMotion,” a leading designer and manufacturer of highly engineered systems and solutions for industrial and transportation applications across the globe, to affiliates of Lone Star Funds. Learn more.

3/21/23

Accenture acquired industrial artificial intelligence (AI) company Flutura, headquartered in Bangalore, India. Flutura will strengthen Accenture’s industrial AI services to increase the performance of plants, refineries, and supply chains while also enabling clients to accomplish their net zero goals faster. Learn more.

In this article of Plant Engineering Magazine, Bundy Group showcases various mergers and acquisitions in the industrial technologies and services market for the month of September.

While numerous industries are witnessing a lower volume of closed mergers and acquisitions transactions due to higher interest rates and other macroeconomic challenges, the industrial technology and services M&A market shows no loss in momentum. From a recently closed transaction (Bundy Group represented Ultimation in a sale to MCE), our team continues to see strong interest from a range of strategic buyers and financial sponsors in the industrial technology and services segment.

Further evidence of the strong M&A activity in markets relevant to Plant Engineering readers is provided by the below list of transactions. Business sales to note include DRT Holdings’ acquisition of Custom Machining Corporation, Pfingsten’s acquisition of Pacific Lasertec, AMETEK’s acquisition of United Electronic Industries and KGM’s acquisition of Bartlett Controls. Bundy Group anticipates several other industrial technology and services transactions to be completed before the end of the year, and we will keep Plant Engineering readers posted.

Bundy Group’s current engagements and owner relationships include control system integration, automated material handling, automation distribution, industrial services, and electrical services. This serves as a leading indicator for industries our team anticipates closed transactions in over the coming months. We look forward to providing these relevant updates to Plant Engineering magazine readers.

9/21/23

Valstone Corporation Inc. an international software and technology solutions provider for the industrial vertical, acquired Matrix Industrial Control System, a pioneer in the food industry, based in Brampton, Ontario, Canada since 1977. This acquisition fortifies Valstone’s strategic entry into the Food & Beverage industry. Learn more.

9/20/23

Machinery Services Co. and Rapid Pump & Meter Service Co. a Hidden Harbor Capital Partners portfolio company and leading provider of maintenance, repair, and installation services to water facilities and critical infrastructure, acquired Delta-Electro Power, Inc. The acquisition expands Rapid Pump’s geographic footprint into Rhode Island and Massachusetts and further expands its service capabilities. Learn more.

9/13/23

Robinson Engineering, Inc. has merged with Jewett Automation of Richmond, further enhancing our ability to provide comprehensive automation solutions. This strategic partnership strengthens our position in delivering turn-key automation solutions, with a focus on improving efficiency and effectiveness in your assembly and packaging operations. Learn more.

9/11/23

DRT Holdings, LLC, which provides specialized manufacturing solutions to the metal packaging, aerospace, and precision industrial segments, has acquired Custom Machining Corporation. CMC is a leading provider of high-speed, high-precision liner systems and parts for metal packaging applications serving the end markets for food, beverage and household products. Learn more.

9/7/23

Barcoding, Inc., the leader in efficiency, accuracy, and connectivity, has joined Graham Partners, a private investment firm investing in technology-driven companies that are spurring innovation in advanced manufacturing. Learn more.

9/6/23

BARTEC acquired the British IIoT specialist Extronics. The company is a leading global developer and manufacturer of connectivity and IIoT infrastructure as well as asset and people tracking systems for hazardous areas. Learn more.

9/6/23

Pfingsten acquired, Pacific Lasertec, a manufacturer of specialty lasers and related power supplies. Headquartered in San Marcos, CA, with an additional manufacturing facility in Colorado Springs, CO, PLT’s products support critical applications across medical diagnostics, semiconductor, scientific research and development, advanced manufacturing and life sciences end markets. Learn more.

9/6/23

AMETEK, Inc. acquired United Electronic Industries (UEI), a leading provider of data acquisition and control solutions for the aerospace, defense, energy and semiconductor industries. UEI specializes in the design and manufacture of high-performance test, measurement, simulation and control solutions that enable customers to build smart, reliable, flexible and rugged systems. Learn more.

8/31/23

KGM, a prominent distributor specializing in regulators, valves, and measuring equipment for residential and commercial utility companies, has been on a remarkable growth journey since joining forces with Compass Group in 2021. Their recent expansion has led to the acquisition of Bartlett Controls, based in North Carolina, further broadening their presence across the United States. Learn more.

8/31/23

IFS, the global cloud enterprise software company, acquired Falkonry, Inc. a California-based Industrial AI software company that provides automated, high-speed data analysis to the manufacturing and defense industries. Learn more.

8/11/23

CKC Automation was acquired by Depatie Fluid Power Co. and subsequently merged with DST Controls Inc., both California-based automation firms. DST Controls, headquartered in the San Francisco Bay Area, has a nearly 50-year history of providing automation and industrial controls services to a wide range of customers, from large manufacturers to startups. Learn more.

6/20/23

One Rock Capital Partners, LLC, a value-oriented, operationally focused private equity firm, has entered into a definitive agreement to sell BRWS Parent LLC and its related subsidiaries “CentroMotion,” a leading designer and manufacturer of highly engineered systems and solutions for industrial and transportation applications across the globe, to affiliates of Lone Star Funds. Learn more.

In this article for Practical Dermatology, Clint Bundy, Managing Director of Bundy Group, discusses how a deal's structure is the foundation to determine the total valuation of a transaction.

When a practice owner and advisors discuss a business sale or recapitalization, the starting topic is often transaction value. After all, the value is often the easiest component of a transaction to understand and compare against other deals in the market. Furthermore, the transaction value represents the “headline number,” which is easiest to understand and often the most marketable.

However, experienced transaction professionals recognize that the foundation of transaction value is the structure of the deal. A famous saying among mergers and acquisitions (M&A) professionals is, “You name the price; I’ll name the terms. I will win every time.” The structure of a deal can take on many forms, and its composition has a significant impact on the ultimate outcome that a client will realize. As practice owners begin analyzing offers, it is critical for them to understand the unique relationship of both value and structuring, and how the deal structure is the foundation of the offer.

The transaction value is the total consideration to the owners in a merger or acquisition. This total consideration have many different components, and each individual piece has its own attributes and value. The sum of each of the values for each of these individual structuring pieces is the total transaction value. While many assume that total transaction value equals upfront cash paid to the seller at transaction close, that is not always the case.

A transaction’s structure refers to how the buyer and seller organize the different forms of consideration to comprise the total valuation. The essential transaction structure elements are defined as follows:

When evaluating the various structures in an offer, an owner will find that the timing of payments, the probability of receiving these payments, and his own goals can collide, creating a great deal of complexity for the seller. Furthermore, there are numerous other factors to consider, including the role of the owners and employees post-closing and implementation of a practice’s strategic plan. An owner and his advisors should be thoughtful in their review and analysis of ideally multiple offers to determine the optimal structure.

Practice Net Income

+ Interest Expense

+ Income Taxes

+ Depreciation Expense

+ Amortization Expense

+ Excessive Physician Owner’s Compensation: Represents the difference between a physician owner’s current compensation and market compensation that the physician will be paid under a new owner

+ Non-Recurring Practice Expenses

+ Extraordinary Practice Expenses

+ Synergies with a Buyer’s Platform

Adjusted EBITDA For Practice

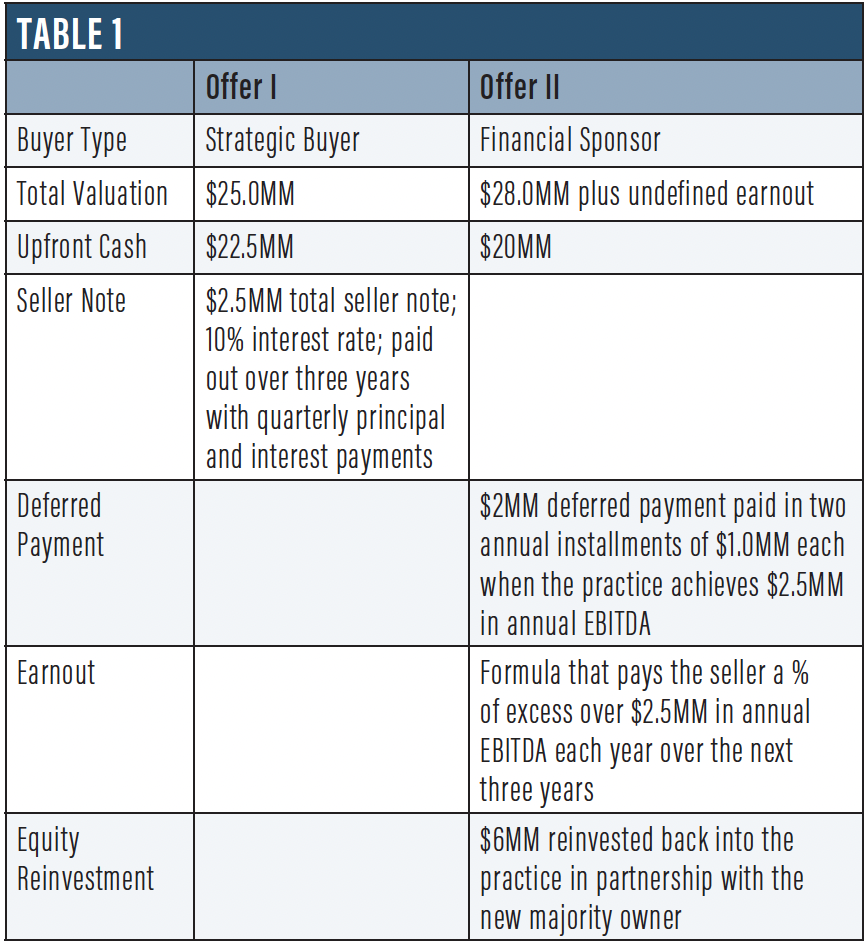

Because a decision on the optimal transaction structure is very situational dependent, we wanted to offer a scenario use (see Table 1).

The selling practice has been marketed by an investment banking representative to a group of buyers in a competitive process. The practice generated $2.5MM in adjusted EBITDA in its most recent fiscal year (earnings before interest expense, taxes, depreciation, and amortization), and management has projected revenue and EBITDA growth for the next three years.1 The owner of the practice is at a stage where he needs to obtain liquidity for his shares and find a buyer that will best support practice providers in growing the organization. He is in his mid-50s and is very open to future performance returns so long as he doesn’t have to significantly sacrifice safer forms of consideration (ie, upfront cash and seller note).

If an owner is prioritizing upfront cash, has a lower risk tolerance, and wants a relatively clean break at transaction close, then Offer I (combo of upfront cash and seller note) could be the optimal choice for the seller. It has $25MM in relatively low-risk consideration due to the seller, and there are additional returns associated with the interest income payments. However, if an owner is more focused on total transaction returns and has a willingness to accept more risky structures like equity reinvestment or earnout, then Offer II might be worthy of consideration.

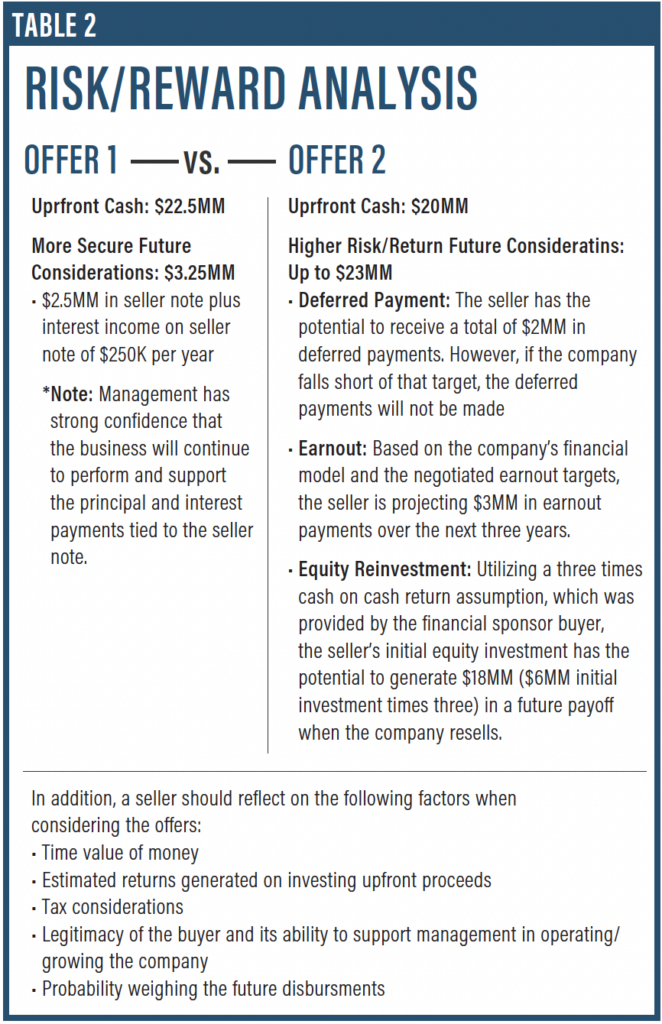

A more detailed analysis of the risk / reward profiles can be seen in Table 2.

For this situation, what is the best offer to take? The seller will have to be the final decision maker based on personal and business objectives and interpretation of the above offers and associated risks and returns. The job of a good investment banking advisor is to ensure that the client has the best quality, market-driven information available to make the most educated decision. Based on our experience with practice owners that fit the transaction scenario outlined above, it wouldn’t be surprising to see a client preference for Offer II over Offer I. From a macro perspective, sacrificing $5.75MM in more secure consideration could be worthwhile for the seller in exchange for the potential to realize an additional $15MM ($3MM of earnout and an estimated gain on equity reinvested of $12MM) in higher risk future consideration.

Once a seller has a full understanding of both value and structure, the next natural question is: how can you use deal structuring to make the deal even more seller friendly? This is a more complex, nuanced topic that can’t be addressed in one article or hypothetical transaction situation. There are two key mechanisms for a seller to ensure the optimal deal structure: competitive process and a client advisory team.

Competitive process creates multiple offers, which then offers the seller the opportunity to understand how the market would value and structure a deal for their practice. Furthermore, with competitive pressure, a seller can push the pool of buyers to the outer limits on optimal deal terms.

Because deal structuring is such an evolving landscape, it’s critical to have a client advisory team that fully understands trends in the current market, are experienced in evaluating scenarios and can coordinate and communicate with the seller client.

These concepts of value and structuring work hand-in-hand with one another, not as separate concepts. As multiple offers are submitted for a practice, and numerous structure components are included in the respective offers, the calculations can get more complicated, and the risk/reward analysis can become clouded. Each transaction is practice-specific and there are numerous ways to structure a deal, which is why it’s in the stakeholder’s best interest to use experienced advisors who can assist in evaluating the transaction structures and help the owner understand what best fits with their objectives.