In this article for Control Engineering Magazine, Bundy Group reports 13 notable automation transactions for the month of January and notes the continued growth-oriented nature within the manufacturing and plant management fields.

The automation market continues to experience a tremendous amount of mergers & acquisitions (M&A) and capital markets activity. Drivers of this activity include the growth-oriented nature of the automation market, the consolidation opportunities within the industry, and the strength of many of the companies operating within it. Furthermore, the automation market has attracted a critical mass of strategic buyers and financial sponsors (i.e. private equity groups, family offices, institutional investors) that are looking to own or invest in companies in the industry. From such, Bundy Group closed automation transactions as Ultimation and MR Systems, our team continues to see strong interest from a range of qualified buyers in the automation segment. Further evidence of the robust M&A and capital placement activity in automation is provided in the below list of transactions.

Bundy Group’s current engagements and owner relationships include control system integration, robotics, automated material handling, automation distribution, artificial intelligence, and cybersecurity. This serves as a leading indicator for submarkets our team anticipates closed transactions in over the coming months. We look forward to providing these relevant updates and transaction announcements to Control Engineering magazine readers.

1/17/24

Assystem, an international engineering, digital services and project management company, has acquired 100% of the shares of KEOPS Automation, a French company specializing in the integration of industrial operating platforms and the enhancement of their data (industrial OT and IT, automated systems, supervision systems, BI applied to manufacturing). Learn more.

1/16/24

Synopsys, known primarily for electronic design automation tools used by the semiconductor industry, has acquired Ansys, a maker of complementary simulation and analysis software, for $35 billion, marking the first really big chip sector deal of 2024. This acquisition combines Synopsys’ semiconductor electronic design automation expertise with Ansys’ simulation and analysis portfolio, creating a leader in silicon to systems design solutions. Learn more.

1/11/24

Allient Inc. a global designer and manufacturer of precision and specialty Motion, Controls and Power products and solutions for targeted industries and applications, acquired SNC Manufacturing Co., Inc. SNC a premier designer and global manufacturer of electrical transformers serving blue-chip customers in defense, industrial automation, alternative power generation and energy, including electric utilities and renewable energy. Learn more.

1/11/24

ABB has acquired Swiss start-up Sevensense, a leading provider of AI-enabled 3D vision navigation technology for autonomous mobile robots (AMRs). Sevensense was founded in 2018 as a spin-off from Swiss technical University, ETH Zurich. Learn more.

1/10/24

Neocis, the global leader in robot-assisted dental implant surgery, has raised $20M in additional funding. This latest round of financing included Mirae Asset Capital/Mirae Asset Venture Investment, venture capital firms affiliated with the Mirae Asset Financial Group that invest in growth-stage healthcare and technology businesses, and NVentures, NVIDIA’s venture capital arm. Learn more.

1/9/24

Burro, a Philadelphia-based autonomous mobility company, closed a $24 million Series B co-led by New York City-based growth equity firm Catalyst Investors and Translink Capital, along with existing investors S2G Ventures, Toyota Ventures, F-Prime Capital, and Cibus Capital. Learn more.

1/9/24

Hastings Equity Partners, a preferred capital partner to founders of lower middle market businesses has acquired JSET Automated Technologies.Founded in 2020 by Eric Tyo and John Sloan, JSET specializes in building automation systems, installation and repairs, and electronic engineering services for data centers. Learn more.

1/8/24

V2X pioneer Danlaw has acquired Australia-based competitor Cohda Wireless, marking a significant milestone in Danlaw’s global expansion initiative, aimed at advancing connected vehicle safety and smart city solutions. Learn more.

1/8/24

Card-Monroe Corp. has acquired Greenville, South Carolina-based automation company Everworks Automation in what proves to be a strategic step forward for both companies. Card-Monroe Corp, based out of Chattanooga, Tennessee, is a leader in tufting technology. Learn more.

12/20/23

Hudson Robotics and Art Robbins Instruments, a global laboratory automation solutions provider, and Argosy Healthcare Partners portfolio company, has acquired Tomtec Inc. Tomtec is a provider of automated liquid handling instruments primarily used for sample preparation in mass spectrometry. Learn more.

12/19/23

First Reserve, a leading global private equity investment firm exclusively focused on investing across diversified energy, infrastructure, and general industrial end-markets, has acquired AP Group LLC a global full-service provider of critical power plant and turbomachinery maintenance services. Financial terms of the transaction were not disclosed. Learn more.

12/15/23

Sukup Manufacturing Co. has acquired Ramco Innovations, a leading automation distributor in the Midwest. The strategic partnership brings together the expertise and resources of the two industry leaders. Sheffield based Sukup is known as an innovator in reliable grain storage, drying and handling solutions. Learn more.

12/1/23

Argosy Private Equity, a lower middle market private equity firm, acquired a controlling interest in Wize Solutions. Wize is a full-service warehouse racking, automation, and lock & door installation company. Founded in 2007 and based in Salt Lake City, Utah, Wize serves manufacturers and distributors across all 50 states as well as Canada, Mexico, Japan and Australia. Learn more.

ONLINE extra

Bundy Group is a boutique investment bank that specializes in representing controls and automation, Internet of Things, and cybersecurity companies in business sales, capital raises, and acquisitions. Over the past 33 years, Bundy Group has advised and closed on over 250 transactions, which includes numerous automation-related transactions. You can learn more at www.bundygroup.com or by contacting Clint Bundy.

Bundy Group, an industry-focused investment bank, is pleased to announce that it has successfully advised Relay Fire and Safety and its private equity owner, The Riverside Company, in the acquisition of Metro Fire Inspection, a fire protection firm providing comprehensive services across all five boroughs of New York City, in addition to Suffolk County and Nassau County.

Established in 2023, Relay Fire and Safety is a Baltimore-based commercial fire protection and life safety firm providing unparalleled customer service and technological control over fire and life safety systems. The Company was formed through the merger of Advanced Fire Protection Systems and American Service Company, both of which have a combined history of over 100 years in the Fire and Life Safety industry.

“Metro Fire Inspection has been an industry leader in the fire protection industry, and the company’s impressive growth further validates the organization’s strength and value proposition,” said Mullens. “The partnership with Relay Fire and Safety, a well-respected market leader, will offer Metro Fire Inspection substantial new resources and opportunities as the company continues to grow.”

The transaction was led by Jim Mullens, Managing Director with Bundy Group.

“Jim and the Bundy Group team are recognized as investment banking specialists in the Fire and Life Safety sector. Bundy Group was instrumental in introducing our organization to Metro Fire and assisting us throughout the process,” said Jeff Abboud with The Riverside Company. “We were highly impressed with the Bundy Group team, and we are excited to find more ways to work with them in the future.”

Bundy Group has an extensive track record in the Fire and Life Safety sector, which includes advising such clients as Sisco Safety, Roanoke Sprinkler, Systems Electronics, and SuperHero Fire Protection. For more information about Bundy Group’s industry expertise and recent transactions, visit bundygroup.com.

About Bundy Group

Established in 1989, Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The team of highly experienced investment bankers leverages extensive industry knowledge and skill to provide hands-on guidance to clients through every phase of the business transaction. Bundy Group has been a trusted partner in more than 250 closed deals over the past 34 years, providing high quality options, actionable insights, and delivery of optimal strategic fit at a premium value for our clients.

Bundy Group Securities, LLC is a registered broker-dealer and member of FINRA and SIPC. More information on the background of Bundy Group Securities, LLC is available at FINRA's BrokerCheck.

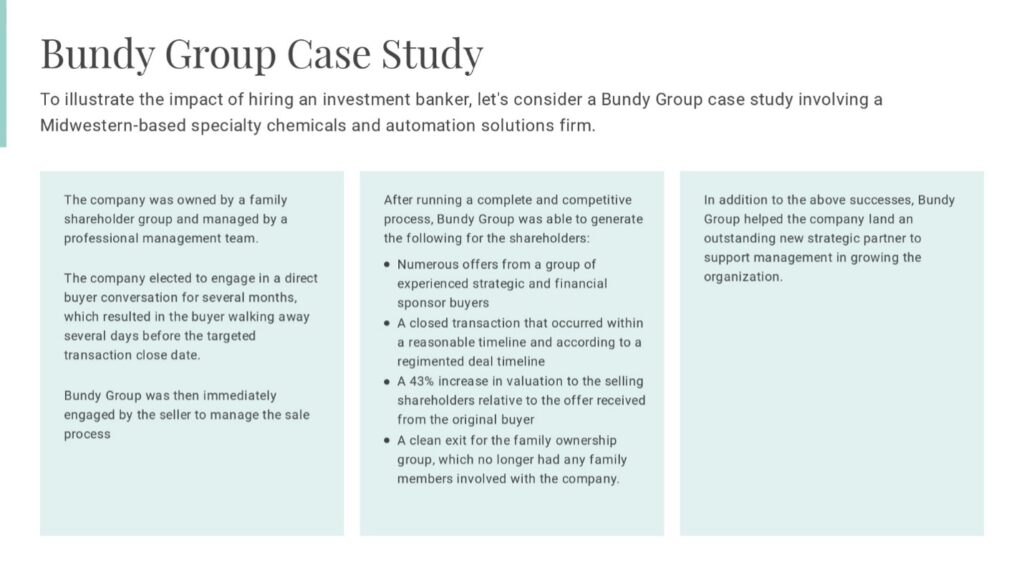

We are in a business environment where an abundance of strategic buyers and financial sponsors exists, resulting in a constant wave of inbound calls, emails, and requested face-to-face visits to business owners from the buyer community. The proposition that these groups offer is they want to engage in direct, one-on-one conversations with business owners about an acquisition or investment. They are eager to avoid the presence of any other competition, or intermediaries, in those conversations. These seasoned buyers pitch such themes to owners as the following:

The underlying, subtle theme that buyers are really saying to owners and executives is “Trust us. We are your friend.” The truth is that the buyer is not your friend but instead a business party that is focused on achieving two main objectives in an acquisition or investment:

However, a reputable investment banking advisor, who operates with the intent of doing what is best for a client, can provide many advantages to the owner in a sale or capital raise process. For owners that are planning for a sale or capital raise, there are several key criteria they should contemplate when deciding if they should hire an investment banker versus engaging in direct conversations with a buyer.

Defining and Quantifying What an Investment Banker Delivers

A key question owners should ask themselves is how an investment banker financially benefits both their company and personal financial position in a sale. There are several value-added, measurable offerings that can be analyzed by an owner when weighing the pros versus cons of hiring an investment banker.

Measurable Investment Banker Offerings

When selecting an investment bank, a shareholder group should work to understand how the investment banker can deliver value and the ways the advisor can demonstrate a positive impact on the above areas.

Defining The Services an Investment Banker Offers

There are many phases, milestones, and deliverables that an investment banker’s services can be broken into. When a business owner is interviewing an investment banker, it is important to request the advisor to provide details on these services. For the sake of simplifying for this piece, we have broken an investment banker’s services down into three core areas:

Takeaways

In conclusion, deciding whether to hire an investment banker is not solely a matter of cost but rather a question of value. Business owners should recognize that quality, industry-focused investment bankers can bring an irreplaceable combination of expertise, trust, and the ability to create competitive options.

While some owners may consider navigating the sale process independently, the track record of investment bankers, who have demonstrated experience and industry specialization in securing higher valuations and more seller-favorable structures for their clients, speaks volumes. It is recommended that an owner analyzes both the tangible and intangible benefits that an investment banker can deliver in a sale process. An experienced investment banker will be able to provide you with the necessary information to complete that analysis on an advisor’s value-add.

In this article for Plant Engineering Magazine, Bundy Group provides an update on the nine defining transactions from December 2023 and what they mean for the automation, industrial technology and plant management industry.

The automation and industrial technology markets continue to experience a tremendous amount of mergers & acquisitions (M&A) and capital markets activity. Drivers of this activity include the growth-oriented nature of the automation and industrial technology markets, the consolidation opportunities within these industries, and the strength of many of the companies operating within them. Furthermore, the automation and industrial technology sectors have attracted a critical mass of strategic buyers and financial sponsors (i.e. private equity groups, family offices, institutional investors) that are looking to own or invest in companies in the industries. From such, Bundy Group closed transactions as Ultimation and Industrial Electric Machinery, our team continues to see strong interest from a range of qualified buyers in the automation, industrial technology and plant management segments. Further evidence of the robust M&A and capital placement activity is provided in the below list of transactions.

Bundy Group’s current engagements and owner relationships include control system integration, automated material handling, automation distribution, industrial services, and electrical services. This serves as a leading indicator for industries our team anticipates closed transactions in over the coming months. We look forward to providing these relevant updates to Plant Engineering magazine readers.

12/7/23

BECO Holding Company, an H.I.G. Capital Portfolio Company, has finalized the acquisition of Grease Lock. Developed in 2004, Grease Lock is an innovative product line designed to capture up to 98% of airborne kitchen grease, streamlining hood maintenance and enhancing fire safety in commercial kitchens. Learn more.

12/7/23

BECO Holding Company, an H.I.G. Capital Portfolio Company, has successfully acquired Electronic Supply Company. Headquartered in Mobile, AL, Electronic Supply Company, established in 1956, is a top wholesale distributor of low voltage and security products, offering monitoring station services through seven locations in the Southeastern United States. Learn more.

12/5/23

Tower Arch Capital has formed S&N Infrastructure Services, LLC in partnership with Allen Powell and the S&N leadership team, to complete the recapitalization of S&N Communications, a Louisa, VA-based specialty infrastructure services provider primarily focused on maintenance, repair, upgrade, and new construction services for communications and electric utilities infrastructure. Learn more.

12/5/23

DwyerOmega, a leading manufacturer and global provider of innovative sensors and instrumentation solutions, acquired Automation Components, Inc., further extending DwyerOmega’s sensor and instrumentation expertise in the building automation and environmental markets. DwyerOmega is a portfolio company of Arcline Investment Management. Learn more.

12/5/23

Shorehill Capital LLC sold Power Grid Components, Inc. to Blackstone Energy Transition Partners, a private equity fund affiliated with Blackstone. Power Grid serves electric utilities, original equipment manufacturers and other customers with mission-critical products used on the U.S. electric utility grid. Learn more.

12/4/23

Motion & Control Enterprises has acquired Filter Resources, Inc., an indirect subsidiary of Parker Hannifin Corporation. Filter Resources, Inc. is a distributor of mission-critical process filtration products for downstream oil and gas, petrochemical, and specialty chemical markets, operating from locations in Lake Charles, LA, and Pasadena, TX. Learn more.

12/4/23

IPS, North America’s leading solution provider for electromechanical equipment, rotating equipment, and power management systems, has acquired Wind Solutions LLC. The company, based in Sanford, North Carolina, specializes in repair upgrades, accessory components, and patent-protected yaw system components. Wind Solutions works with owner-operators and utilities across North America. Learn more.

11/30/23

RLE Technologies, a Fort Collins, CO-based provider of facility environment monitoring, fluid leak detection, and airflow management products, has been acquired by May River Capital, a Midwest-based private equity firm focused on helping high-caliber industrial businesses grow and prosper. Learn more.

11/28/23

Main Street Capital Corporation completed a new portfolio investment to facilitate the recapitalization of Compass Systems & Sales, LLC, a leading provider of end-to-end material handling systems employing innovative, custom-engineered solutions integrated with traditional conveyance systems. Learn more.

In this article for Control Engineering Magazine, Bundy Group analyzes the 12 reported automation transactions that capped-off 2023 and notes the growth-oriented nature of the market heading into 2024.

The automation market continues to experience a tremendous amount of mergers & acquisitions (M&A) and capital markets activity. Drivers of this activity include the growth-oriented nature of the automation market, the consolidation opportunities within the industry, and the strength of many of the companies operating within it. Furthermore, the automation market has attracted a critical mass of strategic buyers and financial sponsors (i.e. private equity groups, family offices, institutional investors) that are looking to own or invest in companies in the industry. From such, Bundy Group closed automation transactions as Ultimation and MR Systems, our team continues to see strong interest from a range of qualified buyers in the automation segment. Further evidence of the robust M&A and capital placement activity in automation is provided in the below list of transactions.

Bundy Group’s current engagements and owner relationships include control system integration, robotics, automated material handling, automation distribution, artificial intelligence, and cybersecurity. This serves as a leading indicator for submarkets our team anticipates closed transactions in over the coming months. We look forward to providing these relevant updates and transaction announcements to Control Engineering magazine readers.

12/13/23

Chipotle Mexican Grill is investing in Greenfield Robotics, a company founded with the vision of making regenerative farming more efficient, cost-effective, and sustainable by leveraging the latest advances in AI, robotics, and sensing technologies. Greenfield Robotics provides regenerative agriculture solutions without chemicals. This minority investment is being made through Chipotle’s $50 million CULTIVATE NEXT venture fund. Learn more.

12/13/23

Chipotle Mexican Grill is investing in Nitricity, a company seeking to tackle greenhouse gas emissions by creating fertilizer products that are better for fields, farmers, and the environment. Inspired by the natural occurrence of lightning breaking down nitrogen in the air and rainwater bringing it to the soil as nitrate to create natural fertilizer, Nitricity has pioneered a practice of creating artificial lightning. This minority investment is being made through Chipotle’s $50 million CULTIVATE NEXT venture fund. Learn more.

12/7/23

Dublin-headquartered Invert Robotics has raised a further €2.5 million in investment to help grow its new research and development function in Dublin. The latest round, which is in addition to a previous €10 million investment raised last year, was led by Irish EIIS fund Business Venture Partners and US investor TechNexus Venture Collaborative. Learn more.

12/7/23

BECO Holding Company, an H.I.G. Capital Portfolio Company, has finalized the acquisition of Grease Lock. Developed in 2004, Grease Lock is an innovative product line designed to capture up to 98% of airborne kitchen grease, streamlining hood maintenance and enhancing fire safety in commercial kitchens. Learn more.

12/7/23

BECO Holding Company, an H.I.G. Capital Portfolio Company, has successfully acquired Electronic Supply Company. Headquartered in Mobile, AL, Electronic Supply Company, established in 1956, is a top wholesale distributor of low voltage and security products, offering monitoring station services through seven locations in the Southeastern United States. Learn more.

12/5/23

Siemens has acquired BuntPlanet, a technology company based in San Sebastian, Spain. BuntPlanet’s award winning software has been deployed around the world to support customers with smart metering solutions, water quality, asset management, and integration of hydraulic models and artificial intelligence for detecting leaks and other anomalies in water networks. Learn more.

12/5/23

DwyerOmega, a leading manufacturer and global provider of innovative sensors and instrumentation solutions, acquired Automation Components, Inc., further extending DwyerOmega’s sensor and instrumentation expertise in the building automation and environmental markets. DwyerOmega is a portfolio company of Arcline Investment Management. Learn more.

11/30/23

RLE Technologies, a Fort Collins, CO-based provider of facility environment monitoring, fluid leak detection, and airflow management products, has been acquired by May River Capital, a Midwest-based private equity firm focused on helping high-caliber industrial businesses grow and prosper. Learn more.

11/30/23

DynTek and rSolutions Corporation, a leading provider of professional IT services, cybersecurity, and risk management solutions throughout North America, has acquired Arctiq, a leading Cloud, DevOps, and Automation Solution Integrator. This strategic investment builds upon the merger of DynTek and rSolutions under the Gallant Capital Partners portfolio in August 2023. It highlights the mutual commitment of the companies to broaden their presence in the cloud-based solutions industry and enhance their service offerings for clients. Learn more.

11/28/23

Main Street Capital Corporation completed a new portfolio investment to facilitate the recapitalization of Compass Systems & Sales, LLC, a leading provider of end-to-end material handling systems employing innovative, custom-engineered solutions integrated with traditional conveyance systems. Learn more.

11/22/23

Blackstone, the world’s largest alternative asset manager, announced that private equity funds managed by affiliates of Blackstone have entered into a definitive agreement to acquire Civica, a global leader in public sector software solutions, from Partners Group, a leading global private markets firm, acting on behalf of its clients. Learn more.

11/20/23

ProMach, a global leader in processing and packaging solutions, has acquired Sentry Equipment & Erectors Inc., a prominent North American manufacturer of conveyor and container handling machines. This acquisition enhances ProMach’s product offerings and reinforces its position as a major provider of systems integration solutions in North America. Learn more.

Bundy Group is a boutique investment bank that specializes in representing controls and automation, Internet of Things, and cybersecurity companies in business sales, capital raises, and acquisitions. Over the past 33 years, Bundy Group has advised and closed on over 250 transactions, which includes numerous automation-related transactions. You can learn more at www.bundygroup.com or by contacting Clint Bundy.

Bundy Group, an industry-focused investment bank, proudly announces its role as the exclusive advisor in guiding Compass Systems & Sales, Inc. (“Compass” or the “Company”) through a majority equity recapitalization. This transaction underscores Bundy Group's continued commitment to delivering exceptional advisory services and expertise in facilitating successful transactions for privately held companies. Furthermore, the transaction, which closed in December 2023, highlights Bundy Group’s continued specialization and track record in the automation and industrial technology sectors.

Compass was founded in 1998 and offers a broad range of automation and material handling solutions such as engineering services, system audits, construction management, operator training and system maintenance. Headquartered in Barberton, OH, the Company specializes in end-to-end automated material handling systems employing innovative, custom-engineered solutions integrated with traditional conveyance systems. Compass is led by an experienced management team that will remain in place following the transaction’s close.

“Bundy Group was hired because of our industry experience, network of strategic and financial sponsor buyers, and relationship with the owners of Compass. We were happy to assist our client in achieving such a successful outcome” said Clint Bundy, a Managing Director at Bundy Group. “This was our second automated material handling transaction of 2023, and our third automation transaction in 2023, and we couldn’t have been more pleased to work with such a quality group of professionals aligned with the Compass platform. We wish the management team all the best for the future.”

The Bundy Group client engagement team included Clint Bundy, Jordan Frickle, Stewart Carlin, and Megan Hagemann.

The selling shareholders included Alston Capital and Plexus Capital, two financial sponsors that invested in the Company, as well as Compass Systems founder, Bob Sherrod. Main Street partnered with Compass’ existing senior management team, which reinvested in the Company, to facilitate the transaction. Main Street funded the transaction with a combination of first lien, senior secured term debt, and a direct equity investment.

"Bundy Group delivered persistence and professionalism throughout our entire process. Not only did they deliver a successful outcome during a difficult financial market environment, but also in a time when a majority of our customer base was facing a historic UAW strike,” said Bob Egan, Founding Partner at Alston Capital and Shareholder/ Board Member at Compass. “I am more than thankful Bundy Group led the effort to get us over the finish line."

Bob Sherrod, Founder and CEO of Compass, stated, “We sought an investment bank that was capable of representing an organization owned by institutional and founder shareholders, had tenured experience in the automation and industrial technology sectors, and had a proven ability to close a transaction within a tight timeline. We interviewed multiple investment banks before deciding on Bundy Group, and I couldn’t have been more pleased with the outstanding work and results that our advisor delivered. We absolutely made the right decision by hiring Bundy Group.”

About Compass Systems & Sales

Founded in 1998 and headquartered in Barberton, Ohio, Compass Systems & Sales is a leading provider of end-to-end material handling systems employing innovative, custom-engineered solutions integrated with traditional conveyance systems. Compass offers a broad range of material handling solutions, including shredding, sorting, weighing, and conveying, complemented by the company's design, fabrication, installation, service, and support capabilities. Compass has developed unmatched expertise in pneumatic conveyance systems and has entrenched its position as a market leader with complete offerings of pneumatic and mechanical conveyance solutions. For more information, please visit Compass Systems' Website.

About Bundy Group

Established in 1989, Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The team of highly experienced investment bankers leverages extensive industry knowledge and skill to provide hands-on guidance to clients through every phase of the business transaction. Bundy Group has been a trusted partner in more than 250 closed deals over the past 34 years, providing high quality options, actionable insights, and delivery of optimal strategic fit at a premium value for our clients.

Bundy Group Securities, LLC is a registered broker-dealer and member of FINRA and SIPC. More information on the background of Bundy Group Securities, LLC is available at FINRA’s BrokerCheck.

In this article for Practical Dermatology, Clint Bundy, Managing Director of Bundy Group, breaks down the competitive business sale process in the mergers & acquisition journey and how it relates to the dermatology and aesthetics industry.

In the world of mergers and acquisitions (M&A), the competitive business sale process is a complex yet essential part of the journey, including within the dermatology and aesthetics industry. If you are a practice owner considering a business sale or capital raise, understanding this process is crucial. In this piece, the competitive business sale process will be analyzed, the key stages defined, and insights offered to help a business owner better position for a sale or capital raise and a successful outcome.

1. Key Stages of the Competitive Business Sale Process

2. Indication of Interest (IOI) Round The IOI round is when potential buyers express their initial interest by submitting preliminary offers, or Indications of Interest. This phase helps the seller and its advisor determine which buyers are worth continuing conversations with. Key attributes of this round include:

3. Letter of Intent (LOI) Round The LOI is the formal offer, or the document that establishes the framework for the purchase agreement between the buyer seller. This phase is meant to be a much more intensive phase with the goal of driving buyer interest and attracting well-educated formal offers. Key elements of this phase include:

4. Due Diligence and Closing The due diligence stage is where buyers conduct comprehensive investigations, including legal, financial, and operational diligence. In short, the buyer or investor is ensuring that there are no surprises and that its underwriting assumptions for the LOI are sound. This is usually the phase where any company issues or weaknesses (example – financial; employee retention; etc.), which have not been addressed, are uncovered.

The entire process can typically take 6 to 12 months. However, the process timeline depends on a variety of factors such as the complexity of the business, the quality and accessibility of financial data, the extent of due diligence required, and the intensity of the negotiation phase. Furthermore, hiring an experienced investment banker that understands the best pool of buyers for that industry and can best position the company in a process will have a substantial impact on both the transaction terms and the timeline to close.

Navigating the competitive business sale process in M&A transactions involves a series of well-defined stages, from preparation to closing. A business owner is highly recommended to focus on the following in a competitive process:

A business sale, or capital raise, is a complicated process that could yield tremendous gains for a seller or result in significant amounts of money being left “on the table.” Furthermore, the outcome could produce a quality long-term partner or a new owner that tarnishes the reputation of the company. The best way for an owner to ensure a strong outcome is to run a competitive process, ideally managed by an experienced investment banker, which delivers multiple options to drive an educated decision-making process that minimizes risk and maximizes the quality of the outcome.

Bundy Group, an industry-focused investment bank, is pleased to announce that it has successfully advised Clarity Technology Group Inc. (“Clarity”), an expert-driven information technology service provider, in a sale to Custom Computer Specialists (“CCS”), an innovator for technology solutions that supports public and private sector clients to improve outcomes. The sale, which closed in November of this year, illustrates Bundy Group’s consistent advisory work and expert insight in the technology-enabled services sector.

Founded in 2009 by Zach Smathers, Clarity Technology Group is a customer-centric and expert-driven Managed Service Provider based in Raleigh, North Carolina. Over the last 15 years, the company has implemented business technology solutions across managed services, data, and voice spanning the Mid-Atlantic region. Clarity prioritizes customer support, providing IT solutions for a myriad of business goals.

“Zach and his team have built an amazing business, as evidenced by accelerating demand for Clarity’s services and continued expansion to new geographies,” said Stewart Carlin, Managing Director with Bundy Group. Stewart added, “The challenging macroeconomic environment created some headwinds for M&A processes this past year, and this engagement was no exception. The successful Clarity transaction is reflective of both the quality of our client’s organization and Bundy Group’s proven ability to deliver outstanding outcomes in any environment.”

The transaction was led by Stewart Carlin and Clint Bundy, Managing Directors with Bundy Group.

“Working with the Bundy Group team made what I expected to be a demanding and stressful experience into a streamlined process with clearly defined milestones and timetables,” said Zach Smathers, President of Clarity Technology Group. “Stewart Carlin and the rest of the Bundy Group team had a demonstrated knowledge of my industry and a depth of contacts, which produced a long list of solid buyer prospects. Furthermore, their advice and creative solutions created a great result for my team and me, even when the economic landscape had changed during the midst of our sale process. I will definitely work with Bundy Group on my next business venture!”

The transaction underscores Bundy Group’s ability to provide quality advisory services to clients, deliver strategic buyer and financial sponsor options through competitive processes, and drive client value in the technology-enabled services industry. For more information about Bundy Group’s industry expertise and recent transactions, visit bundygroup.com.

About Bundy Group

Established in 1989, Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The team of highly experienced investment bankers leverages extensive industry knowledge and skill to provide hands-on guidance to clients through every phase of the business transaction. Bundy Group has been a trusted partner in more than 250 closed deals over the past 33 years, providing high quality options, actionable insights, and delivery of optimal strategic fit at a premium value for our clients.

Bundy Group Securities, LLC, is a registered broker-dealer and member of FINRA and SIPC. More information on the background of Bundy Group Securities, LLC is available at FINRA's BrokerCheck.

In this article for Control Engineering Magazine, Bundy Group recounts the 18 reported automaton transactions from the past month and provides insight into the continued momentum and interest from strategic buyers and financial sponsors in the industry.

The automation market continues to show resiliency and strength in terms of activity and interest from a diversified group of strategic buyers and financial sponsors. From our recently closed transactions in the sector (Avanceon; Ultimation), Bundy Group continues to see strong interest from a range of qualified buyers in the automation segment. Further evidence of the robust M&A activity in automation is provided by the below list of transactions. Recent transactions to note include the ATS acquisition of Avidity Science, Novatech Automation’s acquisition of TestSwitch, and Hubbell’s acquisition of Systems Control. Bundy Group anticipates several other automation transactions to be completed before the end of the year, and we will keep Control Engineering readers posted.

Bundy Group’s current engagements and owner relationships include control system integration, robotics, automated material handling, automation distribution, artificial intelligence (AI) and cybersecurity. This serves as a leading indicator for submarkets our team anticipates closed transactions in over the coming months. We look forward to providing these relevant updates and transaction announcements to Control Engineering magazine readers.

11/21/23

Huizenga Automation Group acquired GSE Automation on November 21, 2023. GSE, a leading industrial automation services company in Lansing, Michigan, provides diverse services such as process development, FEA analysis, and system design. This strategic move strengthens Huizenga’s presence in industrial automation, leveraging GSE’s expertise to enhance their portfolio. Learn more.

11/17/23

ATS Corporation announced the successful completion of its acquisition of Avidity Science, LLC, a growing designer and manufacturer of automated water purification solutions for biomedical and life science applications. Learn more.

11/14/23

MCCi, a leading business process automation company and a portfolio company of Century Park Capital Partners, has acquired GovBuilt, a low-code/no-code case management platform specifically built for government agencies to provide citizens with a one-stop experience for multiple use cases. This acquisition of GovBuilt will undoubtedly strengthen MCCi’s portfolio and reinforce its position as a leader in GovTech. Learn more.

11/3/23

Valmet has successfully acquired Körber’s Business Area Tissue, marking the completion of the transaction announced on July 7, 2023. This strategic move combines the offerings and competencies of Valmet and the acquired business, establishing the industry’s broadest technology, automation, and services portfolio for the growing tissue sector, covering the entire value chain from fiber to finished products. Learn more.

11/1/23

NovaTech Automation, a global leader in automation and control solutions, acquired TestSwitch LLC line of products. TestSwitch is a renowned provider of electromechanical switches used in critical infrastructure testing. This strategic acquisition further solidifies NovaTech Automation’s position in the industry while enhancing its product portfolio, including TestSwitch’s flagship product, the W3TS Test Switch. Learn more.

11/1/23

Huizenga Group Automation acquired Adaptek Systems and API Alliance to its growing portfolio of automation companies. Adaptek Systems is a highly qualified, solutions-driven design and build engineering firm. API Alliance is a manufacturer of custom electronics, electronic controls and electro-mechanical assemblies. Both companies are headquartered in Fort Wayne, Indiana. Learn more.

10/31/23

Commure, Inc., a key healthcare technology company, has acquired Rx.Health, an intelligent clinical automation platform, into its solutions, now called Commure Engage. Rx.Health’s platform streamlines patient care efforts with low-code, no-code clinical coordination, benefiting health systems, payors, and life science organizations. Learn more.

10/30/23

Motion & Control Enterprises has acquired Buford, GA-based Applied Industrial Controls, Inc. and Engineered Systems Group, LLC. AIC is a distributor of motors, drives, and controls for industrial and municipal customers in the states of Georgia, South Carolina, North Carolina, Alabama, Tennessee, and Florida. ESG is a systems integrator and panel shop providing engineering, programming, and systems integration services. Learn more.

10/30/23

Hubbell Incorporated has acquired Systems Control, a key player in substation control solutions, for $1.1 billion in cash. This strategic move enhances Hubbell Utility Solutions’ industry leadership, offering vital solutions for grid reliability and substation automation. Systems Control’s expertise and proven track record will drive efficient operations of critical infrastructure, aligning with Hubbell’s growth objectives. Learn more.

10/30/23

Fairbanks Morse Defense has acquired American Fan, a leading expert in fan technology based in Fairfield, Ohio. With 50 years of expertise in aerodynamics, acoustics, vibration control, and motor performance, American Fan is a trusted supplier in maritime defense. This acquisition enhances FMD’s ability to provide OEM parts and turnkey service solutions to their core customers. Learn more.

10/26/23

Alpha II, a healthcare revenue cycle management (RCM) technology solutions provider, has acquired RCxRules, a healthcare revenue cycle automation innovator. This strategic move aims to combine Alpha II’s rules engine with RCxRules’ workflow and automatic claim correction features, creating a comprehensive denials management solution. Learn more.

10/24/23

Accenture has acquired Comtech Group, a consulting and program management company specializing in infrastructure projects in Canada and the United States. Headquartered in Toronto, Comtech Group serves clients in transportation, infrastructure, manufacturing, and power sectors, offering expertise in construction management, engineering and process control automation. Learn more.

10/24/23

7Rivers, a tech startup specializing in AI and machine learning for business tools, has acquired PerformanceG2 (PG2), a prominent performance management consultancy. This strategic move merges the expertise of PG2’s seasoned data engineers with 7Rivers’ industry insights to create impactful business solutions. Learn more.

10/24/23

uAvionix has acquired Iris Automation, a leading provider of optical Detect and Avoid (DAA) technology. This strategic move combines uAvionix’s expertise in communications, navigation, and surveillance with Iris’ leadership in computer vision-based systems for safe aircraft separation. The acquisition strengthens uAvionix’s capabilities, with Jon Damush, former CEO of Iris Automation, now serving as the CEO of uAvionix Corporation. Learn more.

10/23/23

Rockwell Automation, has acquired Verve Industrial Protection, a cybersecurity software and services company that focuses specifically on industrial environments, expanding the offerings of Rockwell with an industry-leading asset inventory system and vulnerability management solution. Learn more.

10/20/23

Holland & Knight represented Kaho Partners and its portfolio company Addtronics in the acquisition of Sirius Automation. Based in Buffalo Grove, Ill., Sirius Automation is a leading developer of laboratory robotic systems for blue-chip biotech and pharmaceutical companies. Learn more.

10/12/23

Stabilus SE, a supplier of motion control solutions for a wide range of industries, signed an agreement to acquire the business of DESTACO, which supplies industrial automation components, from Dover Corporation, a global diversified industrial manufacturer headquartered in the U.S. The purchase price amounts to $680 million, subject to customary post-closing adjustments, and will be paid in cash by Stabilus. Learn more.

10/2/23

Metso has signed an agreement to acquire Tedd Engineering, a privately owned company specialized in automation, control systems, and electrical solutions for mobile equipment and aftermarket, primarily focusing on the aggregates business. Tedd Engineering employs approximately 70 employees and it’s based in Chesterfield, UK. Learn more.

In this article for Plant Engineering Magazine, Bundy Group reflects on the seven notable automation transactions of November and provides insight into key market trends as the year draws to a close.

The automation, industrial technology and services M&A market shows no loss in momentum in 2023. From recently closed Bundy Group transactions (Ultimation; Avanceon; Metal Tech), our team continues to see strong interest from a range of strategic buyers and financial sponsors in the industrial technology and services segments. Further evidence of the strong M&A activity in markets relevant to Plant Engineering readers is provided by the below list of transactions. Recent transactions to note include Stabilus’ acquisition of Destaco, Huizenga Group’s acquisition of Adaptek Systems and API Alliance, and Novatech Automation’s acquisition of TestSwitch. Bundy Group anticipates several other automation, industrial technology and services transactions to be completed before the end of the year, and we will keep Plant Engineering readers posted.

Bundy Group’s current engagements and owner relationships include control system integration, automated material handling, automation distribution, industrial services, and electrical services. This serves as a leading indicator for industries our team anticipates closed transactions in over the coming months. We look forward to providing these relevant updates to Plant Engineering magazine readers.

10/30/23

Motion & Control Enterprises has acquired Buford, GA-based Applied Industrial Controls, Inc. and Engineered Systems Group, LLC. AIC is a distributor of motors, drives, and controls for industrial and municipal customers in the states of Georgia, South Carolina, North Carolina, Alabama, Tennessee, and Florida. ESG is a systems integrator and panel shop providing engineering, programming, and systems integration services. Learn more.

10/30/23

Hubbell Incorporated has acquired Systems Control, a key player in substation control solutions, for $1.1 billion in cash. This strategic move enhances Hubbell Utility Solutions’ industry leadership, offering vital solutions for grid reliability and substation automation. Systems Control’s expertise and proven track record will drive efficient operations of critical infrastructure, aligning with Hubbell’s growth objectives. Learn more.

10/30/23

Fairbanks Morse Defense has acquired American Fan, a leading expert in fan technology based in Fairfield, Ohio. With 50 years of expertise in aerodynamics, acoustics, vibration control, and motor performance, American Fan is a trusted supplier in maritime defense. This acquisition enhances FMD’s ability to provide OEM parts and turnkey service solutions to their core customers. Learn more.

10/24/23

uAvionix has acquired Iris Automation, a leading provider of optical Detect and Avoid (DAA) technology. This strategic move combines uAvionix’s expertise in communications, navigation, and surveillance with Iris’ leadership in computer vision-based systems for safe aircraft separation. The acquisition strengthens uAvionix’s capabilities, with Jon Damush, former CEO of Iris Automation, now serving as the CEO of uAvionix Corporation. Learn more.

10/22/23

Metso has signed an agreement to acquire Tedd Engineering, a privately owned company specialized in automation, control systems, and electrical solutions for mobile equipment and aftermarket, primarily focusing on the aggregates business. Tedd Engineering employs approximately 70 employees and it’s based in Chesterfield, UK. Learn more.

10/20/23

Holland & Knight represented Kaho Partners and its portfolio company Addtronics in the acquisition of Sirius Automation. Based in Buffalo Grove, Ill., Sirius Automation is a leading developer of laboratory robotic systems for blue-chip biotech and pharmaceutical companies. Learn more.

10/12/23

Stabilus SE, a supplier of motion control solutions for a wide range of industries, signed an agreement to acquire the business of DESTACO, which supplies industrial automation components, from Dover Corporation, a global diversified industrial manufacturer headquartered in the U.S. The purchase price amounts to $680 million, subject to customary post-closing adjustments, and will be paid in cash by Stabilus. Learn more.

In this article for Automation World, Bundy Group shares thoughts and insights on the direction of the automation and industrial technology markets as the year draws to a close.

Bundy Group is a boutique investment bank that specializes in the automation and industrial technology sectors. In addition to our mergers and acquisitions and capital raise advisory services, we also offer keynote presentations and webinars on a range of topics—the economy, labor markets and talent strategy to name a few—as well as compensation analysis and consulting services.

We’re excited to add Alex Chausovsky to our team. Alex has more than 20 years’ experience evaluating the automation and industrial technology sectors. I asked for his insights on topics he feels are important for industrial business owners and executives to be aware of as we head into 2024.

Q: What are your thoughts on the growth and evolution of the automation and industrial technology markets over the past two decades?

A: One of the most significant evolutions has been the proliferation of connectivity, which comprises real-time device and process monitoring, advanced sensing and robust data reporting functions. Some call this Advanced Manufacturing, some Industry 4.0, while others refer to it as IIoT (Industrial Internet of Things). No matter what you call it, it’s been an absolute game-changer for the automation industry. The industry now has an immense treasure trove of data available at its fingertips. In the last couple of years, huge leaps forward in the generative AI space have only supercharged this trend, and the future is full of endless possibilities with new applications and use cases emerging daily.

Q: Are you bullish on the prospects for growth in automation and industrial technology?

A: In my opinion, the automation and industrial technology markets are poised for robust growth in the medium-to-long term future. How to deal with the ongoing lack of labor, particularly the skilled variety, is the most strategic decision facing business leaders. Which means it’s no longer a question about whether to automate or not, but how quickly and to what extent. In the near term, however, there are some headwinds for many companies in the automation sector. The substantial capital investment required for most automation and industrial technology projects is often financed by end users, and borrowing costs are much higher today. This is predominantly due to the aggressive interest rate hikes by the Fed over the last twelve months. Several machinery and heavy equipment markets are already in recession, and the downside pressure is likely to persist in 2024. When the next business cycle rising trend starts in earnest, which I expect will occur in 2025, then I believe automation OEMs will experience renewed growth. Bundy Group also has a pipeline of automation solutions providers, including system integrators, who are seeing no sign of a slowdown and have healthy backlogs.

Alex Chausovsky

Q: There is a lot of capital in the market seeking growth through acquisitions, especially in automation. However, the rapid increase in the cost of capital due to rising interest rates can negatively impact business valuations. In assessing these two competing trends, give us your takeaways for privately held companies.

A: There is a clear and proven correlation between the ups and downs of the business cycle and company valuations in the industrial manufacturing sector. With the industrial economy firmly on the back side of the cycle (deceleration), and likely headed for a mild recession in 2024, it’s not surprising that business valuations in a number of segments are also down. The falling multiples in certain segments are being pressured by several factors; it’s not just the fact that the cost of capital is way up, it’s also a reflection of greater pessimism when it comes to the economic and profit outlook for businesses. Having said that, quality companies can sell above market valuations if they are positioned the right way in a competitive sale process. Furthermore, better prepared organizations that have stable revenue, are profitable and growing, and have scale, will stand a better chance of selling at a premium multiple no matter what the economic outlook is. Potential sellers also need to recognize that it takes time to adequately prepare their business for a sale or capital raise, so the sooner they start to work on getting their ducks in a row, the better off they will be when it’s time to go to the market for a competitive bidding process.

Q: Can you please provide some context on the lack of quality talent available to industry?

A: Despite the macroeconomic headwinds, access to sufficient skilled talent remains a major obstacle for many organizations today. In fact, it‘s highly likely that the mild recession expected in 2024 will, for the first time in history, occur without corresponding large-scale layoffs. Companies are doing everything they can to hold on to their employees, including being willing to accept lower profits, as the difficulty and cost of finding and onboarding workers is not something they want to repeat during the next business cycle rising trend. This means we remain firmly in a candidate-driven labor market. The latest jobs data supports this assertion. In the fourth quarter of 2023, there are more than 9.5 million job openings in the US, and only about 6 million people actively looking for work. This means a 3.5-million-person labor gap exists. We simply don’t have enough workers for all the open positions. In manufacturing specifically, there are currently over 600 thousand job openings. The competition for labor isn’t limited to a particular industry, it’s widespread among many vertical markets and geographies. So, while retention rates are stabilizing relative to the high-turnover period witnessed in 2021 and 2022, I am not seeing the pendulum swing back to the employer in a meaningful way.

A business sale transaction can be thought of as a war between the buyer and seller over the financial numbers of a company. For business owners and executives that are in exit planning mode and looking for methods to drive value in a business sale, there is an impressive tool that they can utilize: the sellside quality of earnings report (“Sellside QofE”). Prior to the development of this tool, business sellers and their investment banking advisors were often left exposed and relatively unprotected against the shrewd buyer corporate development teams and their buyside transaction accounting representatives. However, with the evolution of the Sellside QofE, companies that are selling and raising capital have a new line of defense, means to protect, and enhance value and ability to increase the chances of closing a transaction (i.e. “certainty to close”).

Understanding the Sellside Quality of Earnings Tool: The Sellside QofE term can be very confusing, so it is important to define what this offering is. In simple terms, it's a comprehensive analysis and review of a company’s financials, conducted by an external, independent and objective transaction accounting firm. In many ways, an owner can think of a Sellside QofE as an audit of a company’s financials but with a specific M&A objective and with the intent of benefiting the company that is selling or raising capital.

The Sellside QofE can be broken down into two parts, the quality of earnings data pack and the full quality of earnings report. Many transaction accounting firms can offer just the core financial analysis, known as the data pack, which is presented in an excel workbook. In addition, the transaction accountant can provide a full Sellside QofE report, which includes both the data pack and a thoroughly written report that provides additional context and details. If a client opts for just the quality of earnings data pack, then that can often be less expensive than the full Sellside QofE report.

Why Is It Important? The primary purpose of this report is to validate and strengthen the financial position of the selling company, making it more attractive to potential strategic buyers or financial sponsors (i.e. private equity, family office, institutional investor). The business valuation that a Letter of Intent stipulates, and the final terms that are included in the purchase agreement, are underwritten based on the target company’s performance. To provide further definition regarding a Sellside QofE and how it helps drive value, it is helpful to break down the specific attributes the SellSide QofE and the transaction accounting firm provide to the selling business and its investment banking advisor.

The Cost-Benefit Analysis: One common question business owners have is, "What will it cost me, and is it worth it?" Many factors drive the cost, including the complexity of the company, the accuracy of the financial systems in place, the size of the deal, and the capabilities of the in-house financial team that can work directly with the transaction accounting firm. Bundy Group has seen Sellside QofE’s go as low as $30,000 and as high as $300,000. A transaction accounting firm should be able to provide detailed pricing or an estimate prior to an owner engaging one of these accounting firms. Hiring a sellside transaction accounting firm can be considered an investment for several reasons, including:

Takeaways:

Owners of companies that are preparing for a sale or raising capital should remember that the buyer and its transaction accounting representative are not their friends. Their intent in due diligence is not benign but to use the company’s financials against the seller to gain an advantage on valuation and structure terms. It is essential to recognize the pivotal role that a Sellside QofE can play in driving value in a transaction. By investing in a Sellside QofE, in conjunction with an investment banking-led process, an owner can not only increase the credibility of the financials but also maximize the value of its business. Buyers are in the business of trying to acquire quality firms for low valuations, and Sellside QofE is one of several mechanisms that an owner can utilize to counter that buyer [play].

Don't hesitate to reach out to the Bundy Group team, who can provide further thoughts on how to drive value using competition and a Sellside QofE. With the right team and strategies in place, an owner can confidently navigate the complex world of business sales and achieve the best possible outcome.

Don't hesitate to reach out to the Bundy Group team, who can provide further thoughts on how to drive value using competition and a Sellside QofE. With the right team and strategies in place, an owner can confidently navigate the complex world of business sales and achieve the best possible outcome.

[1] Generally Accepted Accounting Procedures

[2] Earnings Before Interest Expenses, Taxes, Depreciation and Amortization. Adjusted for one-time and non-recurring expenses.

[3] Letter of Intent is the formal offer, negotiated out by the buyer and seller, which stipulates the key terms for the transaction to be underwritten on.