After 18 months of industry conferences being postponed, the recent Electrical Apparatus Service Association (EASA) Convention in Fort Worth, Texas was especially welcomed by Clint Bundy, Managing Director with Bundy Group. For over 32 years, Bundy Group has been active in advising business owners and management teams in the Energy & Power, Electromechanical, and Automation sectors. It was great to be back at the industry conference! As Bundy Group has done for over a decade at EASA shows, meeting with business owners and our buyer relationships, stopping by booths of many of our friends and running into long-time colleagues was a reminder of the value to our team of attending this conference.

COVID Didn't Stop the Industry Momentum

While the pandemic impacted Bundy Group’s attendance at trade shows like EASA, it did not stop our work with companies and owners in the Energy & Power, Electromechanical and Automation sectors. Our “Closed Deal” completion work over the past year with transactions such as Custom Controls Unlimited and E-Merge are prime examples of this activity during the pandemic. At this time, Bundy Group is working on six engagements in this market, with a focus on business sales and capital raises. We also maintain an ongoing dialogue with our strategic and private equity buyer relationships, some of whom were also in attendance at the EASA conference. These buyer relationships stress their desire to stay in a strong working relationship with Bundy Group, which allows them the opportunity to participate in engagements we are actively representing.

Positioned for Growth

The universal takeaway from business owners at the EASA Conference is that the industry is expecting a strong runway for the next few years. Because of the critical services many in the EASA sector provide, none of the firms were “brought to their knees” by the pandemic. Instead, the consensus was some repair and maintenance work, as well as system integration assignments, had been delayed due to lockdowns. While this negatively impacted 2020 performance for some industry players, the rebound is occurring, as client work that would have normally been completed in 2020 is now being addressed in 2021.

Furthermore, many owners have worked hard over the past ten years to diversify industries they service. By taking this step, their companies have weathered volatile markets, including the pandemic. This will allow companies to accelerate their performance in a post-pandemic era. Excitement and optimism are certainly in the air for these service providers for the future as a productive next 18 months (and longer) is expected.

Talented Employees and Servicing Clients

Finding skilled and motivated employee talent is very challenging for most businesses today, and our meetings at EASA affirmed that concern within this specific niche. For a variety of complex reasons, companies are constantly evaluating how to balance this reality with the needs of their businesses and clients. As the employment picture evolves, companies are leaning on their nucleus of experienced employees more than ever. Companies are continuing to look to automation and technology solutions to help fill in the gap of employee talent, gain operating leverage and find means to increase margins without sacrificing quality client service.

As Brian Beaulieu, Chief Economist with ITR Economics, stated in his keynote presentation at the EASA conference, businesses should focus on three fundamentals in order to successfully rebound from the pandemic and meet client demand expectations:

It's a Seller's Market

As is evident from Bundy Group’s current client engagements, as well as the active conversations at the EASA Conference, there is a tremendous amount of buyer interest in the Electromechanical, Energy & Power, and Automation sectors. Owners are receiving more calls from buyers than ever. Bundy Group receives frequent requests from buyers to review our client engagements. The Bundy Group-led engagement process focuses on delivering maximum value and options to our business owner clients. Buyers understand that they will have to be more aggressive in their valuations when buying a company represented by Bundy Group. However, they also acknowledge that they will acquire a company with strong attributes, that is in a “ready state” to close on a transaction and begin integration.

The consolidated feedback from the owners we met at the EASA Conference, coupled with our own experience, indicate M&A markets are well positioned for the next couple of years. Furthermore, with transaction tax rate uncertainties on the horizon for 2022, Bundy Group expects to announce a number of closed deals, including with companies active in EASA, by the end of 2021.

About Us

Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The 32-year-old firm has closed more than 250 transactions, specializing in several industries, including energy and infrastructure, healthcare and life sciences, industrials and manufacturing, and controls and automation. For more information about our industry expertise and other recent transactions, visit https://bundygroup.com/industry-expertise/.

Securities offered through Bundy Group Securities, LLC, a registered broker-dealer and member of FINRA. Check the background of Bundy Group Securities, LLC at FINRA's BrokerCheck.

Bundy Group announces that is has advised United Air Temp, Air Conditioning and Heating ("UAT") and its private equity owner Summit Park in an acquisition of Albemarle Heating & Air.

Headquartered in Charlottesville, Virginia, Albemarle provides heating, ventilation and air conditioning (“HVAC”) services, including installation, repair and maintenance to residential and commercial customers. Headquartered in Lorton, Virginia, UAT provides HVAC maintenance and replacement services to residential homeowners.

Michael Giordano, CEO of UAT, said, “We are excited to partner with the management team and employees of Albemarle and look forward to building upon the excellent reputation they’ve built in the Charlottesville market. Albemarle is a natural extension of our operations in Virginia and consistent with our strategy of building a business of leading brands in attractive markets.”

Ralph Sachs, General Manager of Albemarle, added, “We look forward to our partnership with UAT and Summit Park. We have always prided ourselves on our culture of integrity and customer service and we are thrilled to have found partners that share our values.”

Bundy Group advised Summit Park and United Air Temp in the transaction.

United Air Temp, Air Conditioning and Heating LLC ("UAT") is a leading provider of residential heating, ventilation, and air conditioning (“HVAC”) services. Headquartered in Lorton, Virginia, UAT provides HVAC maintenance and replacement services to residential homeowners. Its primary operations are in Washington D.C and the surrounding area in Northern Virginia and Maryland, with additional operations in North Carolina, Georgia, and Florida. UAT has built a large, loyal customer base through its best-in-class service and responsiveness, as well as consistent, high-quality work from its skilled technicians.

Summit Park is a Charlotte, North Carolina-based private investment firm focused exclusively on the lower middle market. The firm invests across a range of industries, including business and consumer services, light manufacturing, and value-added distribution in the Eastern half of the United States. The firm’s capital can be used to facilitate a change in ownership, to support expansion and growth, to provide partial liquidity to existing owners, or to support an industry consolidation plan. For more information, visit www.summitparkllc.com.

Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The 32-year-old firm has closed more than 250 transactions, specializing in several industries, including energy and infrastructure, healthcare and life sciences, industrials and manufacturing, and controls and automation. For more information about our industry expertise and other recent transactions, visit https://bundygroup.com/industry-expertise/.

Securities offered through Bundy Group Securities, LLC, a registered broker-dealer and member of FINRA. Check the background of Bundy Group Securities, LLC at FINRA's BrokerCheck.

The pandemic brought unprecedented change to businesses and industries across the globe and the Fire, Security & Safety industry was no exception. Players in this industry experienced constraints, obstacles, rebounds, and renewed growth. As the segment has evolved over the last several years, including during the pandemic, it continues to garner the attention of strategic buyers and financial sponsors that are either active in this market today or want to be.

“2020 NSCA Electronics Systems Outlook: Winter Edition.” NSCA.

The Fire, Security & Safety Industry: A Macro Perspective

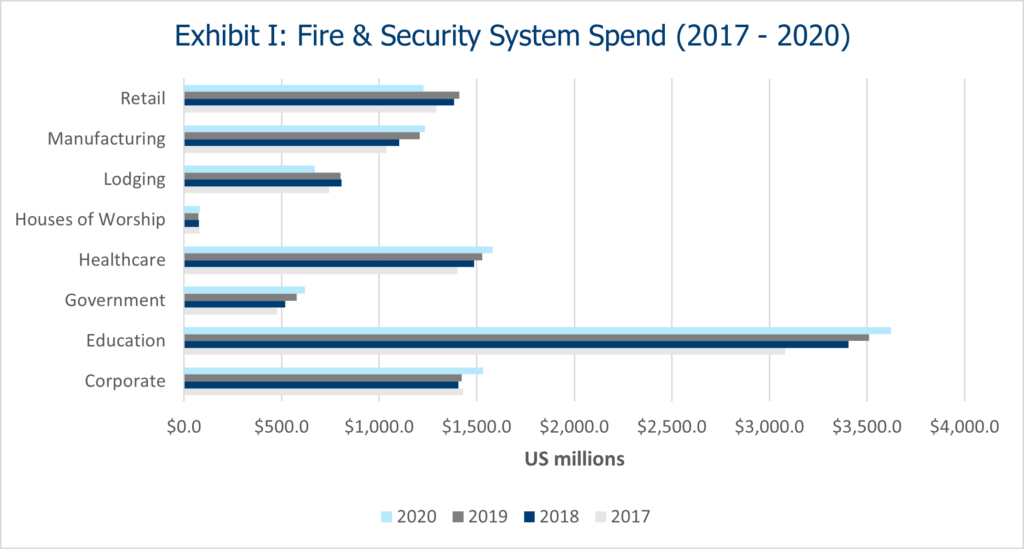

In 2020, restrictions and mandates resulted in limited access to facilities, including healthcare, government, and commercial buildings. The inability to enter client sites impacted the ability of industry players to complete inspections and installations.

Fortunately, as restrictions have eased, companies are resuming a largely normal schedule. As a result, there is now a strong and prompt rebound with testing, inspections, installation and service work. This resurgence in activity, which has been partially driven by spring and summer 2020 work shifting to the latter part of 2020 and into 2021, has resulted in increased revenue for companies starting in Q3 2020 and continuing through today.

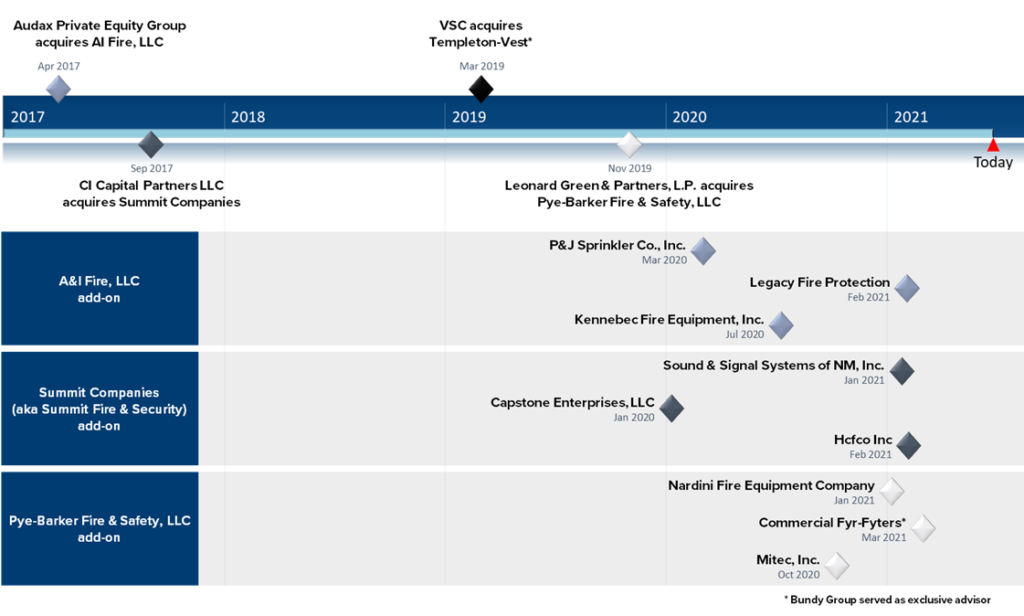

While the pandemic may have caused an operational impact on some Fire, Security & Safety organizations, what was not challenged was the continued pace of consolidation. The last five years have realized a wave of financial sponsor investment activity and strategic buyer acquisitions, and the momentum continued throughout 2020. The pandemic tested and proved the resilience of the Fire, Security & Safety market, which further fueled mergers and acquisitions activity in the space.

Surviving and Exiting the Pandemic Storm

A review of the Fire, Security & Safety Mergers and Acquisitions (M&A) market for the past 18 months provides a more comprehensive picture of the market today and the future.

Spring 2020 became a moment of reflection for buyers as the impact of state shutdowns had to be evaluated and considered. A Fire, Security & Safety acquisition candidate not only had to be assessed based on the ongoing impact of restrictions, but its financial performance during the pandemic also had to be reviewed through this same lens. Correctly valuing a company, and even closing on a transaction, became more challenging for buyers as the volatility of financials introduced additional complexity to transactions.

By Fall 2020, buyer confidence rose substantially as the monthly performance of many acquisition targets gravitated back to pre-pandemic norms. This acceleration was related to acquisition candidates demonstrating how they were able to navigate the restrictions and regain access to client facilities. An increase in inspections, which are vital to clients and their operating standards, built confidence throughout the industry. In addition, companies were able to work through a pre-existing backlog for new installations, which had also been delayed as a result of the pandemic.

By the beginning of 2021, many companies in the Fire, Security & Safety market had fully adjusted to the “new normal” and were succeeding, which the buyers recognized. A transaction example is Bundy Group’s recent representation of a Southeastern-based, full-service fire protection company, which was acquired by a financial sponsor-backed strategic buyer. The company experienced an operational and financial impact in the spring of 2020, but it was back to full performance by Q4 2020. The company attracted strong interest from the market, and Bundy Group was able to obtain a 30% transaction value premium for the seller relative to an offer previously submitted.

An Industry Built on Value

The value drivers and core fundamentals of the Fire, Security & Safety industry allowed companies to persevere and ultimately succeed during the pandemic.

Consolidation Activity: Continued Momentum Through the Pandemic

The aggressive pace of consolidation can be referenced by numerous case studies. For example, Summit Companies, owned by CI Capital, has completed 41 acquisitions since 2017. Another prime example is Pye-Barker, owned by Leonard Green, which now has over 80 locations and already closed nine acquisitions in 2021.

Mergermarket. “Fire Safety A Hot-Bed Of M&A Activity.” Forbes, 8 Mar. 2021.

Looking Ahead to 2022 and Beyond

The renewed strength of the Fire, Security & Safety industry is expected to continue as companies execute on client service and find new means for growth.

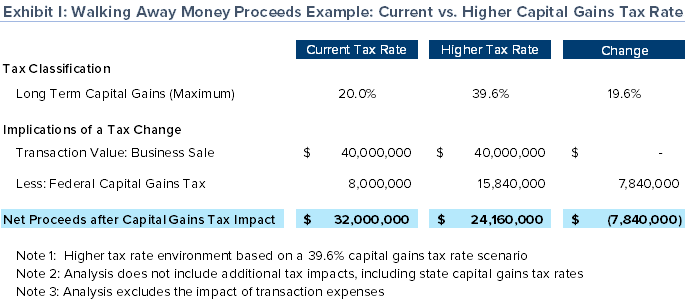

We are in a historically low tax rate environment, but this is expected to change as the Biden administration and Congress continue to signal a desire to raise personal and business taxes. If changes are made, it is possible, and likely probable, that most business owners will owe additional taxes in a sale event. The following scenario demonstrates how a capital gains tax rate increase from 20.0% to 39.6% could lead to a nearly 25.0% decrease in walking away money to a business owner.

In addition to transaction tax concerns, owners have made note of the continual and increasing calls they are receiving from strategic buyers and financial sponsors. Regardless of geography and size, owners in the Fire, Security & Safety market have multiple buyer options to consider, whether they know it or not. Based on Bundy Group’s experience in the sector and numerous buyer relationships, we believe this much buyer demand should create a fertile environment for the foreseeable future for owners interested in a liquidity event. If owners are able to use information, competition, and seasoned advisors to their advantage, then achieving a successful and lucrative wealth creation event through a partial or full sale is possible.

Conclusion

While 2020 brought temporary upheaval to operations for Fire, Security & Safety companies, industry players were able to adapt successfully and were largely back to pre-pandemic performance levels by the end of 2020. This resilience has been recognized by the M&A market, and, as a result, buyers have additional confidence in paying attractive valuations for investments and acquisitions in the Fire, Security & Safety market. Most companies considering a sale or recapitalization will have numerous options and be in a great position to demand value – especially with the use of competitive pressure on buyers in a sale process.

About Us

Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The 32-year-old firm has closed more than 250 transactions, specializing in several industries, including Fire, Security & Safety; Controls & Automation; Healthcare and Life sciences; Technology; Energy and Power; and Infrastructure. For more information about our industry expertise and other recent transactions, visit https://bundygroup.com/industry-expertise/. Securities offered through Bundy Group Securities, LLC, a registered broker-dealer and member of FINRA. Check the background of Bundy Group Securities, LLC at FINRA's BrokerCheck.

In collaboration with the Controls System Integrators Association (CSIA), Bundy Group presented by webinar a mergers & acquisitions update for business owners, executives and industry professionals active in the automation and control system integration markets. A replay of this webinar has been made available by CSIA at the link below.

Watch a Recording of the Webinar

Clint Bundy and Stewart Carlin, Managing Directors with Bundy Group, shared information about the following important topics:

Bundy Group, a 32-year-old, industry-focused investment bank, announces that it has advised Bio-Cide International (Bio-Cide), a leading specialty chemicals and disinfectants manufacturing organization, in a sale to Kemin Industries, a global ingredient manufacturer that serves such markets as food safety and animal health. The transaction was led by Clint Bundy, Stewart Carlin, and Jim Mullens, Managing Directors with Bundy Group.

Within the chemicals market, providers of antimicrobial and antiviral specialty chemicals have seen their market potential and value increase substantially since the outbreak of COVID-19. With the global economy’s heightened focus on disinfectants and hygiene solutions, those producers retain an outsized attractiveness in a volatile market.

“We enjoyed working with the Danner Family, majority owners of Bio-Cide, and managing the sale process, which resulted in strong domestic and international buyer interest,” stated Stewart Carlin from the Bundy Group team. “We were excited to see such a quality strategic buyer recognize the strong value that Bio-Cide offers to a new owner and to be the selected party.”

Clint Bundy stated, “Over its nearly 50-year history, Bio-Cide has become a leader in the fields of disinfectants and chemicals, as the company’s products are critical for the food safety and animal health markets. Kemin Industries offers Bio-Cide an expanded platform for growth, and we are excited to see what the future holds for our client within the Kemin organization.”

Jeff Danner, Chief Executive Officer and Chairman of the Board of Directors for Bio-Cide, indicated that the company hired Bundy Group “based on the team’s experience in the chemical industry, ability to understand and best position clients, and strong reputation.” Mr. Danner further added, “We were nothing but impressed with Bundy Group’s thorough and competitive-driven process, as well as its management of complex matters, all of which resulted in a premium valuation for the shareholders and a great new home for the company and employees. We were more than pleased with your team’s work and the exceptional outcome that you delivered.”

Bio-Cide International, headquartered in Norman, Oklahoma, has been a leading, multi-specialty source of chlorine dioxide based antimicrobial technology for over 49 years. The company has pioneered processes that have revolutionized disinfection and sanitation practices around the globe and manufactures a versatile line of chemical disinfectants, sanitizers, deodorizers, and preservatives.

Bio-Cide International has been the leader in stabilized chlorine dioxide and acidified sodium chlorite applications instrumental in the elimination of microorganisms found in the medical professions, water treatment, food processing plants, dairy and bottling plants, the seafood industry, air duct ventilation systems, the oil field industry, and the animal health industry.

Kemin Industries is a global ingredient manufacturer that strives to sustainably transform the quality of life every day for 80 percent of the world with its products and services. The company supplies over 500 specialty ingredients for human and animal health and nutrition, pet food, aquaculture, nutraceutical, food technologies, crop technologies, textile, biofuels, and animal vaccine industries.

For over half a century, Kemin has been dedicated to using applied science to address industry challenges and offer product solutions to customers in more than 120 countries. Kemin provides ingredients to feed a growing population with its commitment to the quality, safety, and efficacy of food, feed, and health-related products.

Established in 1961, Kemin is a privately held, family-owned-and-operated company with more than 2,800 global employees and operations in 90 countries, including manufacturing facilities in Belgium, Brazil, China, India, Italy, Russia, San Marino, Singapore, South Africa, and the United States.

Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The 32-year-old firm has closed more than 250 transactions, specializing in several industries, including chemicals, healthcare and life sciences, technology, energy and power, and infrastructure. For more information about our industry expertise and other recent transactions, visit https://bundygroup.com/industry-expertise/.

Securities offered through Bundy Group Securities, LLC, a registered broker-dealer and member of FINRA. Check the background of Bundy Group Securities, LLC at FINRA's BrokerCheck. Testimonials may not be representative of the experience of other customers and are no guarantee of future performance or success.

Bundy Group, a 32-year-old, industry-focused investment bank, announces that it has advised Commercial Fyr-Fyters, a full-service fire protection company, in a sale to Pye-Barker, an industry-leading fire protection company with over 70 locations nationwide. The transaction was led by Jim Mullens, Managing Director with Bundy Group, and marks the company’s fourth Fire, Security & Safety transaction within the past three years.

David Harrison, President of Commercial Fyr-Fyters, commented, “We are excited to partner with Pye-Barker and feel it’s in the best interests of our customers and employees for continued long term success of the company. We feel Pye-Barker, with its long history and successful acquisition strategy, will continue the legacy that we have built over the years.”

“Commercial Fyr-Fyters has built an outstanding company over the last 60 years of operation,” commented Jim Mullens. “The company has continually demonstrated its ability to form lasting relationships with customers and to deliver timely results. Bundy Group was excited to have advised the Commercial Fyr-Fyters team and to have closed yet another transaction in the fire, security & safety sector.”

David Harrison indicated that the company hired Bundy Group “based on the team's experience in the fire protection industry, ability to understand and best position clients, and strong reputation.” He added, “I am very pleased with the strong valuation that you helped obtain--30% higher than the original offer--and a new owner that will help to support the management team with future growth. Thank you again for your tremendous work in the successful sale of Commercial Fyr-Fyters. The sale to Pye-Barker…was exactly the kind of result we were hoping for when we engaged Bundy Group. The due diligence and negotiation processes were artfully managed by Jim Mullens, which helped to reduce friction during these steps and move this forward to a quick deal close. I was delighted with the work of Jim Mullens, Managing Director, and the exceptional outcome that Bundy Group delivered.”

Commercial Fyr-Fyters is a full-service fire protection company that offers comprehensive fire protection services, including fire extinguishers, fire suppression systems, fire alarm systems, fire sprinkler systems, exit/emergency lighting, and hood cleaning. The company also handles SCBA and SCUBA hydrotesting in its DOT testing facility.

Pye-Barker Fire & Safety is a leading provider of fire and life safety protection services, with headquarters in Atlanta, Georgia and over 70 locations spanning the Continental US. Since its founding in 1946, Pye-Barker Fire’s core values have been unwavering in providing honest and reliable service through its highly trained and dedicated employees. Pye-Barker Fire invests heavily in providing best-in-class training for its team while offering industry competitive benefits.

Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The 32-year-old firm has closed more than 250 transactions, specializing in several industries, including fire, security & safety; chemicals; healthcare and life sciences; technology; energy and power; and infrastructure. For more information about our industry expertise and other recent transactions, visit https://bundygroup.com/industry-expertise/.

Securities offered through Bundy Group Securities, LLC, Member FINRA. Check the background of Bundy Group Securities, LLC at FINRA's BrokerCheck. Testimonials may not be representative of the experience of other customers and are no guarantee of future performance or success.

As investment bankers that specialize in representing controls & automation firms in business sales and capital raises, Bundy Group has seen first-hand the resiliency of the industry over the past year. Even in the midst of the pandemic, strategic and financial buyers continue to pay robust valuations for controls & automation providers, including control system integrators. Based on the client engagements that Bundy Group is working on in 2021, we continue to see numerous industry indicators that buyer demand will remain strong.

Key players in the automation community are also eager to understand longer term implications of the pandemic on this essential industry, especially as relates to the impact on valuations of companies. The controls & automation market resides in an influential position as society and business transition through this phase of creative destruction resulting from the pandemic. The manufacturers, technology companies and service providers offering controls & automation solutions will benefit as the international business community evaluates, reviews and redefines progress into the future.

To broaden our perspective, several industry experts and leaders offer their thoughts on the impact of COVID-19 on the automation segment and what the future holds for this important industry.

James Gillespie - Chief Executive Officer, GrayMatter

Founded in 1991 and based in Pittsburgh, GrayMatter curates the best processes and technologies to drive industrial, digital transformations and co-innovate with companies across North America in manufacturing, food and beverage, consumer packaged goods, water/wastewater services and other industries. www.graymattersystems.com

Many of GrayMatter’s clients run essential businesses or operate critical infrastructure, so they experienced a surge in demand for foods and beverages, paper products, cleaning supplies, drinking water and much more. Our priority is always to help organizations find ways to transform their operations and empower their people. COVID-19 focused us on helping clients plan, build and sustain a secure environment for their remote employees.

We expect there to be tailwinds in the manufacturing sector, in particular, as companies evaluate their supply with bias toward the Americas. The next challenge for organizations is to keep making progress on the digital transformation initiatives that they either started or accelerated in 2020-21 as a response to the pandemic. That could mean looking for opportunities to make predictions with data and machine learning through advanced industrial analytics, enhancing plant-floor productivity with high-performance HMI/SCADA or making sure their operational technology networks are truly secure. Organizations will meet with success in doing this if they find the right partners to help, get executive sponsorship and work with experienced team members to build buy-in and find valuable solutions.

Michael Calabrese - President, Control Systems Integrators

Founded in 1992, Control Systems Integrators manages, designs and builds innovative automation solutions to solve the most complex problems facing companies around the world. CSI | (csiadvantage.com)

In the years leading up to the pandemic, we worked with many customers who decided on an automation strategy with a medium-to-long term view. COVID-19 was the catalyst for many clients to accelerate their business plans and condense their timelines to implement automation solutions. CSI has seen a tremendous uptick in our work with logistics and ecommerce companies, each industry experiencing their own explosive growth spurred by stay-at-home restrictions. In those industries, our teams are doing everything from designing brand new facilities to upgrading existing sites. Many of our clients outside of the logistics and ecommerce industries are also accelerating their automation upgrades, but for different reasons. These companies may have faced restrictions on how many people could be on the plant floor at any given time, so they came to us asking for solutions to minimize downtime.

As a result, many project upgrades (PLC firmware upgrades, IT upgrades, PLC upgrades) that had previously been pushed off were scheduled for 2020 and 2021. And of course, work from home policies are forcing companies to decide what may be permanent behavior changes post-pandemic. These clients are investing aggressively in plant-floor IT and business analytics, so that troubleshooting can be done from anywhere.

Gary Mintchell - Founder, The Manufacturing Connection

Gary Mintchell leveraged a career in manufacturing becoming an independent blogger, podcaster, and analyst whose writing can be found at www.themanufacturingconnection.com.

Designing systems considering the safety of personnel has been best practices for many years. A podcast interview on that topic I did some six years ago remains a top-ten download every month. We have learned the hard way about a safety problem beyond the machine. How we can design machine and factory layouts to allow for social distancing and contact tracing to keep personnel safe from each other has become the new discipline. Should these new requirements be programmed into the automation system or the MES? Or where? Integrators must study deeply and determine a new best practice for design and application.

Robots have displaced personnel from dangerous tasks. Perhaps the new dangerous task is proximity to other humans. The new breed of collaborative robots may be the answer to both improving productivity and safety. If integrators have not been exploring this technology, it is time to do so.

Garrett Butcher - Managing Partner, Simply Driven Executive Search

Garrett started and leads the Robotics and Automation Recruiting Group at Simply Driven where he focuses on recruiting robotics and automation talent. https://sanfordrose.com/simplydrivensearch/

At Simply Driven, we focus on recruiting automation talent across a variety of industries. COVID-19 has certainly not eased the challenges of finding and hiring good automation talent and the talent pool remains as competitive as it did pre-pandemic. A key component to this insight is our diverse client portfolio. Essential businesses - food, beverage, consumer goods, packaging, etc. ramped up, which soaked up any excess talent that did hit the market. We don't see it slowing down. Automotive seems to be back in full gear, among other industries that struggled through the early months of the pandemic. In fact, almost all of our clients are back at normal hiring rates besides Oil & Gas. Long story short, finding, qualifying, and winning the best talent in the market remains as challenging, if not more challenging, for our clients than pre-Covid, and we're expecting it to get worse.

There are positives. It means companies are hiring and automation is booming, but two significant changes are underway. One is the consistency of remote work capabilities companies have adopted, which allows them to circumvent previous hiring constraints created by their physical location and talent pool. Unless you're sitting in a plant, most automation jobs can be done, at least in part, remotely. Companies are adopting this approach and easing their hiring pains. The second change that is still evolving, and only the future holds the answer, is the anticipated increase in automation spending. Plants see a need to reduce unreliable labor via automation, industries that once lacked automation now see a need, and the need to increase automation has never been more present. How will this impact actual spend? Only time will tell for the industry.

In summary, the controls & automation market is well positioned to accelerate its growth as a result of the COVID-19 pandemic. The feedback of the above experts validates the attractiveness of the controls & automation segment. In addition, as investment bankers, we continue to receive powerful interest from a deep pool of an industry and financial investor buyers, which are willing to pay attractive valuations, in Bundy Group-led automation business sale engagements. This is further reinforcement that the automation sector is a highly lucrative end-market. Assuming control system integrators can manage the challenges that are inherent with growth, such as finding employee talent, these firms should continue to generate widespread buyer interest.

Clint Bundy is a Managing Director with Bundy Group, a boutique investment bank that specializes in representing controls and automation and internet of things companies in business sales, capital raises and acquisitions. Over the past 32 years, Bundy Group has closed over 250 transactions, which includes numerous controls & automation-related transactions.

Bundy Group, a boutique investment bank focused on the advisory needs of clients for over 31 years, announces that it has advised GrayMatter and its private equity partner, Hamilton Robinson Capital Partners, in its acquisition of Richmond, VA-based E-Merge Systems. "Industrial companies in 2021 are prioritizing projects that were once on the back burner to equip facilities with IoT devices, leverage predictive analytics, and augment industrial cybersecurity," said GrayMatter Co-Founder and CEO James Gillespie. "The addition of E-Merge's capabilities gives us a more complete solution stack from instrumentation, control, industrial networking, and supervisory control, all the way up to analytics and other data solutions. We're also excited about adding an offshore engineering capability and an increased mid-Atlantic presence to our team.”

Furthermore, James added, "Our clients are telling us they want to better prepare their remote, industrial workforces to control costs and production as we move closer to a post-pandemic world."

Based near Pittsburgh, GrayMatter leverages Advanced Industrial Analytics, Industrial Cybersecurity, Brilliant Operations, and other software-as-a-service solutions to help companies transform their operations and empower their people.

E-Merge will add experienced engineers to GrayMatter's workforce and a portfolio of impressive industrial clients such as DuPont, Refresco, Air Liquide, W.L. Gore, and AstraZeneca. Municipal clients include NYC DEP, AlexRenew, Prince William County, Loudoun County, Henrico County, New Kent County, Hanover County, Chesterfield County, Spotsylvania County, and the Virginia cities of Norfolk, Suffolk and Richmond, among others.

Clients in the Water & Wastewater and Manufacturing industries have recognized the expertise at E-Merge since its founding in 1997. Joining with E-Merge's team advances GrayMatter's ability to meet customer demand for end-to-end operational visibility. That means putting powerful, relevant data from the sensor level to the cloud into the hands of decision makers.

E-Merge co-founders Inderdeep Huja and Thomas Lamb will take on key leadership roles under the agreement. In addition to offices in Richmond, Virginia Beach, and Fredericksburg in Virginia, E-Merge has offices in Savage, MD and Newark, DE.

"We're excited to partner with GrayMatter because it means our combined team has the experience to take on any challenge in the Industrial Intelligence and Automation space and the ability to deliver solutions for clients from concept to implementation," Huja said.

For the fifth consecutive year in 2020, GrayMatter earned a spot on Inc Magazine's list of the fastest-growing private U.S. companies.

This is GrayMatter's second acquisition in less than three years. In March 2018, GrayMatter acquired Colorado-based TMMI, Inc. A partnership in late 2017 with Hamilton Robinson Capital Partners, a private equity firm, has accelerated GrayMatter's ability to expand rapidly.

The E-Merge transaction represents the third Controls & Automation and Water & Wastewater deal Bundy Group has closed in the past 18 months.

About GrayMatter

GrayMatter is a technology consulting company that curates and implements digital transformation and cybersecurity solutions for industrial companies and organizations. Some of the biggest, industrial companies in the world lean on GrayMatter to protect and connect their critical assets to their teams so that every operator is empowered to be the best operator. For more information, please visit https://graymattersystems.com.

About Hamilton Robinson Capital Partners

Hamilton Robinson Capital Partners (“HRCO”) is a private equity firm with decades of hands-on experience making control investments in US-based Industrial IoT, process equipment and engineered systems, factory automation, distribution and specialty industrial manufacturing businesses. The Stamford, CT firm has completed over $1.5 billion in transactions supporting over 55 family businesses and corporate divestitures. Investors include leading financial institutions, funds, family offices and individuals in the U.S. and Europe. For more information, please visit https://hrco.com.

About E-Merge Systems

E-Merge Systems is a control systems integration firm that provides engineering and technology services to clients in the Water & Wastewater and Manufacturing industries. The company was founded in 1997 and has locations in Richmond, Virginia Beach, and Fredericksburg in Virginia. For more information, please visit www.emergesystems.com.

About Bundy Group

Bundy Group is a boutique investment bank with offices in Charlotte, NC, New York, NY, and Roanoke, VA. The company specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The 31-year-old firm is an investment banking specialist in the Controls & Automation and Water & Wastewater markets. Bundy Group has closed over 200 transactions.

For additional information, please contact:

Clint Bundy

704-503-9464

clint@bundygroup.com

Bundy Group, a boutique investment bank focused on the advisory needs of clients for over 31 years, announces that it has advised Custom Controls Unlimited (“CCU”) in a sale to Inframark, LLC, a national infrastructure services company focused on the operation and maintenance of water and wastewater systems, management of community infrastructure, and back-office services. Headquartered in Raleigh, NC, CCU is an industry-leading control systems integrator with focus on the Water & Wastewater market as well as several other mission-critical industries.

Founded in 2000, CCU is led by Devin Carroll and a talented group of engineering and technology-oriented professionals that have experience offering clients with industrial automation and process control solutions. CCU was focused on partnering with a larger strategic platform that could support CCU in its continued growth and expansion in the Water & Wastewater market.

Regarding the transaction, Devin Carroll stated, “Custom Controls is a leading automation solutions provider to clients over the past twenty years, and we are excited to further our growth through this new affiliation with a strategic provider in the infrastructure space.” Devin further added, “We have a strong pipeline of new client opportunities, and both CCU’s management and the new strategic partner project increasing market demand for the controls and automation solutions that our organization offers.”

After transaction close, the CCU management team will remain in place and continue to run the operations as a subsidiary of the new parent company.

The Custom Controls Unlimited transaction represents the second Controls & Automation and Water & Wastewater deal Bundy Group has closed in the past year.

About Custom Controls Unlimited

Founded in 2000 and headquartered in Raleigh, NC, Custom Controls Unlimited is a leading control systems integrator, primarily for the Water& Wastewater sector. CCU’s offerings include industrial automation systems, process control systems, cybersecurity solutions, and industrial control panel design and manufacturing.

About Inframark

Inframark, LLC is a standalone American infrastructure services company focused on operation and maintenance of water and wastewater systems, management of community infrastructure, and back-office services.

With more than 40 years of experience in managing water-related infrastructure, the company employs in excess of 1,500 people serving more than 300 clients in 19 states. Its North American operations manages facilities that can treat over a billion gallons of drinking water and wastewater daily. It also manages more than 8,000 miles of wastewater collection and water distribution networks. Its infrastructure management services group serves 220 clients with financial, administrative and specialized support services.

About Bundy Group

Bundy Group is a boutique investment bank with offices in Charlotte, NC; New York; and Roanoke, VA. The company specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The 31-year-old firm is an investment banking specialist in the Controls & Automation and Water & Wastewater markets. Bundy Group has closed over 250 transactions.

Charlotte, NC, October 8, 2020 – Bundy Group, a healthcare and life sciences-focused investment bank focused on the advisory needs of clients for over 31 years, is pleased to announce that Catawba Research has partnered with a financial investment firm focused on control investments in the life sciences sector. Catawba Research is a premier international, full-service contract research organization (“CRO”) that provides clinical management services to pharmaceutical and biotechnology companies. The investment will support Catawba Research’s next phase of growth and strengthen its position within the life sciences market.

This transaction represents the first institutional capital placed into Catawba Research. The new partnership will serve as an important milestone in Catawba Research’s goal of becoming a leading international pharmaceutical services organization. Following the acquisition, Zaidoon A. Al-Zubaidy, Founder and Chief Executive Officer, and the existing senior management team will continue to operate Catawba Research while the new financial partner will offer additional resources and board-level support.

Zaidoon A. Al-Zubaidy commented, “Catawba Research is excited to take this journey with our partners who share our ‘people first’ values. This is an exciting time for our team and our loyal sponsors. With this partnership, we are confident that Catawba will become one of the premier global clinical research providers.”

“Catawba Research has built an outstanding foundation of talent and operational excellence,” commented Stewart Carlin, Director with Bundy Group. “The company has continually demonstrated its ability to form lasting relationships with pharmaceutical sponsors and deliver superior results through consistent innovation and vertical integration. We are thrilled to have advised on this transaction, and we believe this new partnership will allow Catawba Research to accelerate its growth and value creation in the future.”

Bundy Group served as exclusive financial advisor in the transaction. Bundy Group was retained by Catawba Research based on the investment bank’s experience in the healthcare and life sciences sectors. Bundy Group managed a thorough process, which yielded significant buyer interest in the CRO and resulted in the Catawba Research shareholders achieving their financial and strategic goals. This successful transaction marks Bundy Group’s third healthcare transaction since April of this year.

About Catawba Research

Catawba Research is a vertically integrated contract research organization providing clinical management services to pharmaceutical and biotechnology companies globally. The Company focuses on Phase II – IV trials across the dermatology, women’s health, ophthalmology and gastroenterology therapeutic areas. Catawba Research manages clinical end point trials for New Drug Applications (NDA) and Abbreviated New Drug Applications (ANDA). The Company has established a global footprint with site relationships across the U.S., Central America and India. Since 2014, Catawba Research has engaged in nearly 50 clinical trials in 13 indications, achieving 15 agency approvals in the USA and Canada. The Company is headquartered in Charlotte, NC with additional locations in Texas, New Mexico and Michigan. The Company also provides data management, biostatistics, medical writing, and clinical CRO services through its location in Mumbai, India.

About Bundy Group

Bundy Group provides investment banking and transaction advisory services to clients across numerous markets, including healthcare and life sciences. The highly experienced team within Bundy Group includes transaction and operating professionals with a combined 100 years of experience in investment banking and corporate finance. As a 31-year-old boutique firm, the senior team leverages its specialized focus on our core markets to guide clients through the entire process of selling their company, raising capital, and pursuing acquisitions for growth.

Montgomery, AL, October 1, 2020 – Bundy Group is pleased to announce that Dermatology Associates of Montgomery, a leading dermatology practice based in the Southeast, has been acquired by Advanced Dermatology and Cosmetic Surgery (“ADCS”), the largest dermatology practice in the country. Bundy Group served as exclusive financial advisor to Dr. Steve Maddox, owner of Dermatology Associates of Montgomery, in the sale. Dr. Maddox retained Bundy Group based on the investment bank’s extensive experience in the healthcare and dermatology segments.

“It is an honor to welcome dermatologists of the caliber of Drs. Maddox and Mountcastle to our practice,” said Advanced Dermatology and Cosmetic Surgery’s Founder and Executive Chairman Dr. Matt Leavitt. “Dermatology Associates of Montgomery has earned a reputation for excellence for more than 50 years. They share our commitment to providing comprehensive dermatologic care to everyone in a welcoming environment that elevates the patient experience and adheres to the highest standards of quality and patient safety. We look forward to supporting their continuing service to families in the Montgomery area.”

ADCS CEO Brian Griffin said, “We extend a warm welcome to Drs. Maddox and Mountcastle and all the patients and staff of Dermatology Associates of Montgomery. Welcome to our family of practices dedicated to high quality and excellent service. We look forward to our continuing journey together.”

Dr. Maddox is board certified and holds a lifetime certificate from the American Board of Dermatology. A U.S. Navy veteran, he is a clinical associate professor of medicine at UAB Health Center Montgomery and is active in teaching medical students and residents. Dr. Maddox has been published in the Journal of the American Academy of Dermatology.

Dr. Mountcastle is board certified and was a flight surgeon in the U.S. Air Force. She has been with Dermatology Associates of Montgomery since 1990 and has been published in the Journal of the American Academy of Dermatology and the Archives of Dermatology.

They formulate individualized treatment plans for patients and take a systematic approach to monitoring their health with annual Total Body Skin Cancer Exams and other tools, which help to detect skin cancer and other concerns at the earliest, most treatable stages.

”We have admired the commitment to quality, service and integrity demonstrated by the team at ADCS and look forward to working more closely with them as we continue to serve our patients and build our practice with their support,” said Drs. Maddox and Mountcastle.

ABOUT BUNDY GROUP

Bundy Group is a boutique investment bank with offices in Charlotte, New York, and Virginia. Bundy Group has a deep track record in the healthcare segment, which includes advising physician practice providers. The highly experienced team within Bundy Group specializes in representing business and practice owners in business sales, capital raises, and acquisitions. To learn more about Bundy Group, please visit www.bundygroup.com.

ABOUT DERMATOLOGY ASSOCIATES OF MONTGOMERY

Based in Montgomery, Alabama, Dermatology Associates of Montgomery is recognized as a leading dermatology provider within the Southeast. Over its 50-year history, Dermatology Associates of Montgomery has been committed to providing the highest quality patient care.

ABOUT ADVANCED DERMATOLOGY AND COSMETIC SURGERY

Advanced Dermatology and Cosmetic Surgery is the largest premier dermatology practice in the country. With more than 140 offices in 14 states, Advanced Dermatology and Cosmetic Surgery is one of the nation’s premier providers of practice management services to dermatologists and has partnered with more than 50 practices since 2012. Advanced Dermatology’s mission is to increase access to high quality dermatologic care by providing exceptional business support services to practicing dermatologists.

To learn more about Advanced Dermatology or to inquire about opportunities to partner with us, visit www.advancedderm.com.

The Impact of COVID-19 on the Dermatology Market and Consolidation Activity

The consolidation race that had previously been accelerating in the dermatology market may have finally hit its first caution flag with the coronavirus pandemic and its impact on the space. Many dermatology practices are reporting temporary lower financial performance, which could risk the overall value of those businesses. While the dermatology sector continues to be an attractive market and generates a great deal of interest in terms of investment activity, 2020 will test the resiliency of the sector.