Bundy Group, an industry-focused investment bank, is pleased to announce that it has successfully advised EPIC Systems Group, LLC (“EPIC”), a comprehensive automation, systems integration and engineering solutions firm backed by Compass Group Equity Partners (“Compass Group”), in a sale to VINCI Energies, a leading international firm specializing in multi-technical solutions and services across energy, transport, communication infrastructure, buildings, factories, and IT systems. The transaction, which closed in March 2025, highlights Bundy Group’s continued track record and specialization in the automation, systems integration, engineering, and industrial technology sectors.

Founded in 1995 and headquartered in St. Louis, MO, EPIC is a best-in-class automation and systems integration provider serving its process-driven clients with highly customized industrial automation solutions. For nearly 30 years, EPIC has helped some of the world’s most recognized companies overcome complex production challenges. The company is led by an experienced management team, which will remain in place following the close of the transaction.

“We’ve enjoyed longstanding relationships with both the EPIC and Compass Group teams, and it was an honor to advise them on this exceptional transaction,” said Clint Bundy, Managing Director at Bundy Group. He added, “The sale of EPIC to an international strategic buyer delivered an outstanding outcome, reflecting Bundy Group’s ability to drive value and position clients for success—even in the face of uncertainty in the markets.”

“EPIC has established itself as a leader in the automation industry by delivering innovative solutions across multiple end-markets, supported by comprehensive engineering,” said Jordan Frickle, Vice President at Bundy Group. “We are excited to watch the EPIC leadership team continue to grow in partnership with VINCI and couldn’t have been more pleased to work with such a quality group of professionals.”

“We selected Bundy Group due to their intimate knowledge of the automation industry and connections in the space. The team delivered on expectations by providing multiple high quality potential partners, which helped put us in a position to choose a great fit for our business,” said Mike Higgins, CEO of EPIC. “In addition to managing a competitive process, the relationships Bundy Group has developed over the years helped facilitate the diligence and closing processes to enable a quick close and successful transaction for all parties.”

“We met Bundy Group several years ago and were always impressed by their industry knowledge and relationships developed from their participation in numerous industry conferences,” said Ryan Roepke, Director at Compass Group Equity Partners. “They were always willing to have discussions with Compass Group and EPIC on the industry landscape well before a decision was made on starting a sale process. Bundy Group was able to utilize the industry knowledge and relationships to identify the best buyer and manage an overall successful transaction for all parties.”

The Bundy Group client engagement team included Jordan Frickle, Clint Bundy, Lorenc Biqiku, and Stewart Carlin.

This transaction highlights Bundy Group’s continued success and significant experience in the automation, industrial technology, and system integration sectors. For more information about Bundy Group’s industry expertise and recent transactions, visit bundygroup.com.

###

About Bundy Group

Established in 1989, Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The team of highly experienced investment bankers leverages extensive industry knowledge and skill to provide hands-on guidance to clients through every phase of the business transaction. Bundy Group has been a trusted partner in more than 250 closed deals over the past 36 years, providing high quality options, actionable insights, and delivery of optimal strategic fit at a premium value for our clients.

Bundy Group Securities, LLC, is a registered broker-dealer and member of FINRA and SIPC. More information on the background of Bundy Group Securities, LLC is available at FINRA's BrokerCheck.

Charlotte, NC (April 2025) – Bundy Group, an industry-focused investment bank, is pleased to announce that it has successfully advised Alta Protection Services, LLC, a premier life safety and security solutions provider, in a sale to Summit Fire & Security, a subsidiary of SFP Holding, Inc. The transaction, which closed in March 2025, represents another key milestone in Bundy Group’s growing track record and expertise in the Fire, Security, & Safety industry.

Founded in 2010 and headquartered in Ashland, OH, Alta Protection Services has established itself as a trusted provider of code-compliant life safety services for healthcare, senior living, and educational facilities across Ohio, Pennsylvania, and Indiana. The company offers a comprehensive suite of services including installation, testing, maintenance, and repair of sprinklers, fire alarms, nurse call systems, access control, and emergency call systems.

“It was an absolute privilege to represent Alta Protection Services in the sale of their business. Their reputation for integrity, operational excellence, and deep industry knowledge made them a standout company, which helped drive strong buyer interest in the acquisition opportunity,” said Jim Mullens, Managing Director at Bundy Group. “The success of this transaction is a direct reflection of the incredible business they have built, and Bundy Group is honored to have played a role in helping them achieve this milestone.”

“Working with Bundy Group was one of the best decisions I made during the entire process of selling my business,” said Jim Bayerl, owner of Alta Protection Services. “Their expertise in the fire protection industry, strategic guidance, and relentless commitment led to a phenomenal outcome that exceeded my expectations. They didn’t just get the deal done, but they maximized the value and found a great partner for the future success of Alta Protection Services.”

The Bundy Group transaction team was led by Jim Mullens. This transaction reinforces Bundy Group’s commitment to delivering value-driven outcomes and providing premium advisory services for business owners in the Fire, Security, & Safety sector.

For more information about Bundy Group’s expertise and recent transactions, visit bundygroup.com.

###

About Bundy Group

Established in 1989, Bundy Group is an industry-focused investment bank that specializes in representing privately held companies in business sales, acquisitions, and capital raises. The team of highly experienced advisors leverages extensive industry knowledge and skills to provide hands-on guidance to clients through every phase of the business transaction. Bundy Group has been a trusted partner in more than 250 closed deals over the past 36 years, providing high quality options, actionable insights, and delivery of optimal strategic fit at a premium value for our clients.

Bundy Group Securities, LLC is a registered broker-dealer and member of FINRA and SIPC. More information on the background of Bundy Group Securities, is available at FINRA's BrokerCheck.

Charlotte, NC (February 2025) – Bundy Group, a leading industry-focused investment bank, is pleased to announce that it has successfully advised Akers Fire Protection, a premier fire sprinkler protection company, in its sale to Sciens Building Solutions, a leading fire-life safety and security integrator. The transaction, which closed in February 2025, highlights Bundy Group’s continued advisory work and closed transaction experience in the fire, security, and safety industry as well as its commitment to delivering value-driven outcomes for its clients.

Founded in 2012 by Bill Akers and headquartered in Lorton, VA, Akers Fire Protection built a reputation for providing state-of-the-art fire sprinkler installation, retrofits, and testing services across Washington, D.C., Virginia, and Maryland. The company serves a variety of sectors including commercial office, government, and industrial, with a strong focus on reliability and customer service.

“Akers Fire has built an outstanding company over the last 13 years of operation, and Bundy Group was excited to be a part of this transaction and work with such a quality client,” said Jim Mullens, Managing Director at Bundy Group. “The Akers Fire team has demonstrated its ability to provide outstanding solutions to its clients and be a market leader – these reasons helped Bundy Group drive such strong buyer interest in a competitive process.”

“I hired Bundy Group based on its experience in the fire protection industry, our existing relationship dating back to 2017, and this advisory firm’s strong reputation,” said Akers. “Having sold a business before, I knew I needed an experienced investment banking group on my team to help ensure a strong valuation and efficient process, both of which Bundy Group delivered.”

The Bundy Group transaction team was led by Jim Mullens.

This transaction underscores Bundy Group’s expertise in advising companies in the fire, security, and safety sector. For more information about Bundy Group’s industry expertise and recent transactions, visit bundygroup.com.

###

About Bundy Group

Established in 1989, Bundy Group is an industry-focused investment bank that specializes in representing privately held companies in business sales, acquisitions, and capital raises. The team of highly experienced advisors leverages extensive industry knowledge and skills to provide hands-on guidance to clients through every phase of the business transaction. Bundy Group has been a trusted partner in more than 250 closed deals over the past 36 years, providing high quality options, actionable insights, and delivery of optimal strategic fit at a premium value for our clients.

Bundy Group Securities, LLC, is a registered broker-dealer and member of FINRA and SIPC. More information on the background of Bundy Group Securities, LLC is available at FINRA's BrokerCheck.

Charlotte, NC (February 2025) – Bundy Group, an industry-focused investment bank, is pleased to announce that it has successfully advised Joliet Electric Motors, LLC (“Joliet”), a full service electrical apparatus solutions firm and portfolio company of Argosy Private Equity, in a sale to Hitachi, Ltd., a leading international firm specializing in digital transformation, green energy & mobility, and digital technology solutions. The transaction, which closed in January 2025, underscores Bundy Group’s continued advisory work and closed transaction experience in the energy & power solutions, industrial services, and business services sectors.

Founded in 1934 and headquartered in Joliet, IL, Joliet has become a leading electrical apparatus solutions firm within the oil & gas sector, as well as the broader industrials market, delivering innovative rotating equipment repair, rebuild, field service, and sales solutions. The firm has been a trailblazer in the electro-mechanical industry, providing cutting-edge electrification solutions to a global roster of blue-chip oil & gas and industrial clients.

“Bundy Group has maintained a professional collaboration with Joliet and Argosy for over 12 years, and we are honored to have been selected as the exclusive advisor for this transaction, a testament to our longstanding relationship and deep expertise in Joliet’s industries,” said Clint Bundy, Managing Director at Bundy Group. “Our team valued the opportunity to partner with Joliet’s management and the Argosy investment team throughout this process. We look forward to seeing Joliet continue to thrive and expand as part of a strong international organization.'"

“Joliet is a dominant electrical apparatus solutions provider within the oil & gas industry, and the Company’s management team is second to none,” said Jordan Frickle, Vice President at Bundy Group. “Our team appreciated the opportunity to represent Joliet, and we are excited to see the Joliet leadership team grow in partnership with Hitachi.”

“While the Argosy and Joliet teams were aware of other investment banks with experience in the electrical apparatus and industrial sectors, choosing Bundy Group was an easy decision that required little internal discussion or debate,” said Tim Tibbott, CEO of Joliet. “Bundy Group delivered professionalism and attentiveness throughout the entire process, and I couldn’t have been more satisfied with the outstanding work and results that our advisor delivered. We absolutely made the right decision by hiring Bundy Group.”

The Bundy Group client engagement team was led by Jordan Frickle, Stewart Carlin, and Clint Bundy.

This transaction highlights Bundy Group’s continued success and significant experience in the energy & power, industrial services, and business services sectors. For more information about Bundy Group’s industry expertise and recent transactions, visit bundygroup.com.

###

About Bundy Group

Established in 1989, Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The team of highly experienced investment bankers leverages extensive industry knowledge and skill to provide hands-on guidance to clients through every phase of the business transaction. Bundy Group has been a trusted partner in more than 250 closed deals over the past 36 years, providing high quality options, actionable insights, and delivery of optimal strategic fit at a premium value for our clients.

Bundy Group Securities, LLC, is a registered broker-dealer and member of FINRA and SIPC. More information on the background of Bundy Group Securities, LLC is available at FINRA's BrokerCheck.

Bundy Group is proud to reflect on another successful year, delivering strong performance and representing clients in business sales across our core verticals. In 2024, we welcomed talented new team members and deepened our industry specialization, further enhancing our capabilities. Looking ahead, we’re excited about a robust pipeline of quality client engagements for 2025.

As we move into the new year, the M&A landscape is ever evolving. Whether you're considering selling your business now or in the future, or contemplating a capital raise, understanding the current state of the market to best prepare your company for a liquidity event is critical. We've outlined key trends and insights that will help you navigate 2025 with confidence:

After a down 2022 and 2023, and a renewal in 2024, the M&A market is poised for further growth in 2025. Below are some additional thoughts from the Bundy Group team:

While buyer interest is strong, the competitive sale process, led by an investment banker and experienced advisory team, is as critical as ever. There are some important steps to take as a part of this process:

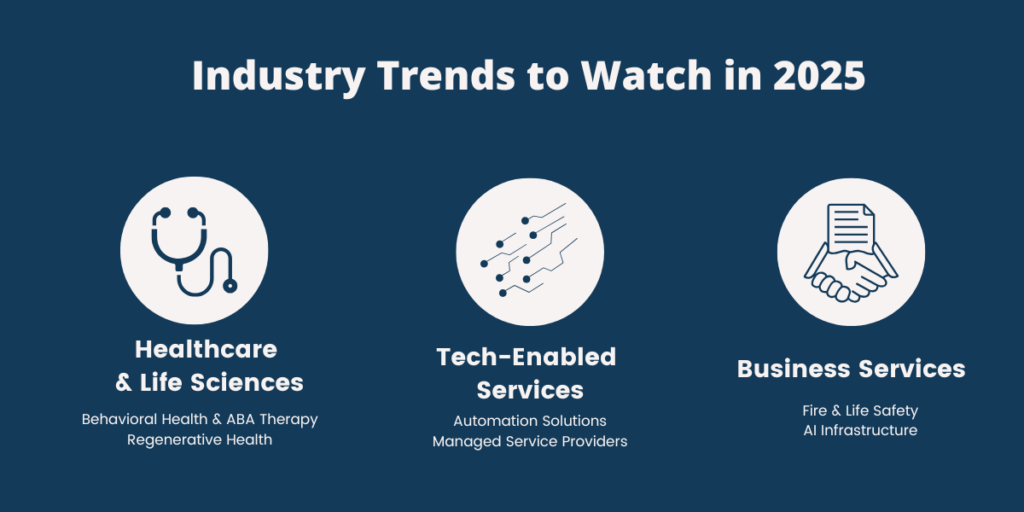

Several sectors are expected to see strong M&A activity in 2025. Specific areas to note include:

As 2025 unfolds, the M&A market shows great opportunity but requires careful navigation. Whether you're selling or acquiring, understanding key market dynamics, preparing your business, and leveraging competition will be essential tools for success.

If you have any questions or want to discuss how Bundy Group can assist in your M&A journey, please explore our website or contact our team directly for more information.

We’ll be attending several conferences this year and we'd love to meet with you! Be on the lookout for additional information on where we’ll be this year. If you're planning to attend, or if you’d prefer to speak to us virtually or by phone, you can contact one of our team members here, or email us at info@bundygroup.com.

We're excited for Season 2 of Bundy Group Insights, a podcast that takes you behind the scenes of the latest developments in mergers & acquisitions, capital raises, economic, business, and industry-specific trends.

We recently recorded an episode where we reviewed 2024 and discussed trends for 2025.

Whether you’re a practice owner, investor, or industry enthusiast, this podcast is your ultimate guide to navigating the intricate world of mergers and acquisitions.

Follow along on the following channels to never miss an episode:

Thank you to our clients, networking partners, and industry relationships for the confidence you have placed in Bundy Group. We will keep you posted on our progress in 2025!

About Bundy Group

Established in 1989, Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The team of highly experienced investment bankers leverages extensive industry knowledge and skill to provide hands-on guidance to clients through every phase of the business transaction. Bundy Group has been a trusted partner in more than 250 closed deals over the past 36 years, providing high quality options, actionable insights, and delivery of optimal strategic fit at a premium value for our clients.

Bundy Group Securities, LLC, is a registered broker-dealer and member of FINRA and SIPC. More information on the background of Bundy Group Securities, LLC is available at FINRA's BrokerCheck.

Charlotte, NC (January 2025) – Bundy Group, an industry-focused investment bank, is pleased to announce that it has successfully advised CITI, INC., a leading automation solutions and systems integration organization, in a sale to Gryphon Investors-backed Vessco Water, a leading distribution and services platform providing process equipment, flow control, pump and pump repair, industrial processes, and automation & controls across the fragmented water and wastewater treatment equipment and services industry. The transaction, which closed in December 2024, underscores Bundy Group’s continued advisory work and closed transaction experience in the automation and technology-enabled services industries, along with its delivery of quality advice and a competitive edge that drives value for clients.

Founded in 1995 and headquartered in Charlotte, NC, CITI has become a leading systems integrator serving commercial and government entities across the Eastern United States within the water and wastewater industries. Majority owned by founder Marco Varela and partially owned through an employee stock ownership plan (ESOP), the company is a high-growth organization delivering control systems, network infrastructure, and maintenance services to its clients.

Clint Bundy, Managing Director with Bundy Group, stated, “We are honored to have represented the CITI shareholders in the sale of the company. It was a privilege to contribute to such a strong outcome that benefits Marco, the ESOP, and the company as a whole.” Jordan Frickle, Vice President, added, “This Bundy Group-managed competitive process generated substantial interest, and we are excited for the company as it transitions to its next phase with Vessco Water, a recognized leader in the infrastructure automation sector.”

“I hired Bundy Group because because of its extensive experience in the automation and technology services sectors, as well as the firm’s reputation for delivering ‘high touch’ service to its clients,” Marco said. He further added, “I was incredibly happy with the team’s representation of our work, especially their ability to navigate the complexities of an ESOP-owned firm, and I was thrilled with the premium results Bundy Group delivered.”

The Bundy Group transaction team included Jordan Frickle, Stewart Carlin, Lorenc Biqiku and Clint Bundy.

This transaction highlights Bundy Group’s continued success and significant experience in the automation and technology-enabled services sectors. For more information about Bundy Group’s industry expertise and recent transactions, visit bundygroup.com.

###

About Bundy Group

Established in 1989, Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The team of highly experienced investment bankers leverages extensive industry knowledge and skill to provide hands-on guidance to clients through every phase of the business transaction. Bundy Group has been a trusted partner in more than 250 closed deals over the past 35 years, providing high quality options, actionable insights, and delivery of optimal strategic fit at a premium value for our clients.

Bundy Group Securities, LLC is a registered broker-dealer and member of FINRA and SIPC. More information on the background of Bundy Group Securities, LLC is available at FINRA's BrokerCheck.

In a recent article for Automation World, Clint Bundy sits down with Tim Dawson, vice president of industrial automation research at Interact Analysis, to discuss the major trends driving growth in the automation industry, the role of emerging technologies such as artificial intelligence and machine learning, and how companies can leverage these developments to stay competitive heading into the new year.

Key excerpts from the conversation are highlighted below.

Q: What do you see as the key drivers of growth in the automation market?

Dawson: The fundamentals of the automation industry have remained very strong, even through challenging periods like the 2009-2010 economic downturn and the COVID-19 pandemic. While these were tough years for manufacturing, the industry’s long-term growth rate has held steady at around 5-6% on average over the past 15-20 years. Recently, overall manufacturing growth has slowed slightly due to factors like the economic slowdown in China.

However, automation growth tends to outpace general manufacturing growth, driven by increasing adoption in manufacturing processes.

Several factors are fueling automation growth. Technological advancements, such as improved sensor technology and the integration of IoT for smarter manufacturing, have significantly enhanced machinery and robotics, making them more efficient and versatile.

Additionally, AI and machine learning are helping to make automation more accessible, simplifying programming and implementation.

Cost reductions and price pressures are also making automation more affordable, especially for small and medium-sized manufacturers. Although prices are gradually decreasing, the capabilities of these technologies are continually improving, enhancing their price-to-performance ratio. Labor shortages, particularly in developed economies, along with rising wages, are pushing more companies toward automation to maintain or further boost productivity.

Another key driver is sustainability. Automation helps manufacturers reduce energy consumption and waste, aligning with broader sustainability goals. Efficient technologies and processes contribute to energy savings, while improved manufacturing quality reduces waste, supporting companies' environmental objectives. In short, these trends suggest that automation and robotics will continue to grow in importance as they help industries remain competitive, efficient, and sustainable.

Q: What advice would you give to manufacturers as they look to grow their businesses?

Dawson: Even in a challenging market, like we’ve seen over the past couple of years, there are still bright spots of opportunity. My advice to business leaders looking for growth is to embrace innovation, even during uncertain times. Invest in your staff and in R&D and explore emerging technologies.

It’s also essential to stay informed on market trends and economic indicators. Adapting to the market and making informed choices is critical.

Another key point is retaining talent. Automation isn’t about replacing people; it’s about empowering your team to drive innovation and growth. You want the best people by your side as you navigate this journey.

Finally, leverage data and analytics to support decision-making, but do so thoughtfully. Not

all data is valuable, so it’s essential to do your due diligence and rely on trusted sources.

Q: What are your thoughts on mergers and acquisitions activity in the automation space.

Dawson: M&A activity has been vibrant, and we expect it to remain strong, though it’s evolving toward new industries and technologies. Mobile robotics, for example, has grown from a nascent market five years ago to a thriving one with hundreds of vendors — many of which have been or are being acquired. The same goes for vision technology, where fragmentation is leading to consolidation by larger players.

In the future, we’ll likely see more acquisitions of smaller, niche technology companies. Major players like Siemens and Rockwell Automation often acquire these small firms, sometimes just a handful of people, for their specialized expertise. Watching these smaller deals can be a strong indicator of where technology and market opportunities are headed. With ecosystems and app-like platforms, companies like Siemens can quickly spot promising innovations within their networks, making even small players valuable. Integrating into such ecosystems can be a smart move.

Bundy Group has had a busy 2024, and we have several important updates to share.

In July, we celebrated our 35th Anniversary, a landmark that few investment banks have achieved. Learn more about our history through an interview with the firm's founder, Bill Bundy, on our Bundy Group Insights podcast (see below).

We are also excited to share that Bundy Group was recognized as one of American's fastest growing companies by its inclusion on the Inc. 5000 list (see below).

Our team continues to adhere to our mission of empowering business owners to realize the full potential of their life's work by representing them in a business sale or capital raise. 2024 continues to be an active year in our core industries of Healthcare & Life Sciences, Technology-Enabled Services, and Business Services. Scroll down to see our year-to-date update.

If you would like to speak further with a Bundy Group team member to learn more about our firm and advisory services, then you can contact us at info@bundygroup.com or by reaching out to a specific team member here.

Recent episodes include:

Follow along on the following channels to never miss an episode:

Apple podcast: https://lnkd.in/ddyrjrB7

Spotify: https://lnkd.in/dfE8hFSN

YouTube: https://lnkd.in/efgdjDkD

We are honored to share that Bundy Group was rewarded with a spot on the Inc. 5000 list. Curated by Inc. Magazine, this exclusive list names the 5,000 fastest growing companies in America. We are incredibly proud to be on this prestigious honor roll.

The achievement is another significant milestone and is a direct result of our team's hard work and dedication to provide the most value to privately-held companies and their owners in a business sale or capital raise event.

As we head into the last quarter of 2024, we are grateful for the past 35 years, our clients, industry partners and friends. Our successful history is driven by our senior team-driven approach and intense focus on providing first-class client service. See below for more details on two recently closed transactions:

The year 2024 is shaping up to be both interesting and dynamic, with several key economic factors at play. Elevated interest rates and the Federal Reserve’s next policy moves are driving much of the conversation, while concerns about a potential recession still loom large. At the same time, the mergers and acquisitions (“M&A”) market is showing signs of recovery after a sluggish 2023. Adding to this complexity is the fact that 2024 is also an election year, further intensifying the economic and political landscape.

To help make sense of these developments, Clint Bundy, Managing Director with Bundy Group, interviewed Alex Chausovsky, Bundy Group’s Director of Analytics and Consulting as part of the Bundy Group Insights podcast. As an expert on the markets and the economy, Alex provided valuable insights into the current situation and what to expect moving forward.

Clint: Where do you see the economy heading in late 2024 and early 2025?

Alex: The economic outlook for late 2024 and early 2025 reflects increased uncertainty due to recent data. In early August, a weaker-than-expected jobs report showed only 114,000 jobs added, falling short of the anticipated 175,000. This led to a shift in market sentiment: initially, bad news was seen as a sign of potential interest rate cuts, but now there is a growing fear of an imminent recession.

Despite this initial reaction, the economy remains robust. Key indicators demonstrate resilience: layoffs are low, hiring is steady (though slower than in previous years), and the rate of job quitting has decreased compared to 2021 and 2022. Furthermore, Q2 GDP growth exceeded expectations, reinforcing the economy’s strength into Q3 2024. Retail sales, which significantly impact GDP since personal consumption comprises about two-thirds of overall economic activity, also surpassed expectations, further illustrating the economy's solid footing.

Looking ahead to late 2024 and early 2025, some economic headwinds are anticipated, but improvement, particularly in the industrial sector, is expected. This optimism is based on potential interest rate cuts by the Federal Reserve, with a forecast of a 25 basis-point reduction in September and possibly one or two more cuts by the end of the year. These reductions should lower borrowing costs, boost capital expenditures (CapEx), and stimulate a rebound in economic activity. Leading indicators such as the ISM Purchasing Managers Index (PMI), industry capacity utilization, and copper prices suggest a cyclical economic rise into at least early 2025, countering widespread fears of a recession.

Clint: What advice would you give listeners, especially business owners and executives, with that outlook in mind?

Alex: Business owners and executives are advised to approach the next 6 to 18 months with a realistic yet optimistic mindset, particularly in the B2B and industrial sectors. Many businesses in these areas may not have experienced significant growth this year, with underlying data indicating flat growth or mild declines. However, the overall trend has been positive when considering the recovery from the pandemic in 2022 and 2023.

It is important to be data-driven rather than reacting out of anxiety, emotion, or fear. Business leaders should lead their organizations with optimism and plan for growth in 2025 and 2026. They are encouraged to consider what they might need more of as the economy likely accelerates—whether it’s production capacity, headcount, or a more resilient and diversified supply chain.

There is also a need for scenario planning and having contingency plans in place, especially considering potential increases in protectionist policies and tariffs in 2025. Such changes could raise costs, which would be passed on to consumers and potentially affect demand. By preparing for these possibilities, businesses can better navigate potential challenges and continue to grow.

Clint: What are the implications of the upcoming election on the economy, and what should business leaders do to prepare?

Alex: The macro economy is generally robust and not overly affected by presidential or congressional election outcomes. However, policy uncertainty leading up to and following an election could slightly reduce GDP growth in the subsequent quarters. The overall economic impact is likely to be minimal, regardless of whether President Trump wins back the White House or Vice President Harris takes office.

Specific policies to watch for under each potential administration are highlighted. For President Trump, proposed tariffs—10% on all imports and 60% on goods from China—could significantly impact costs for U.S. families and businesses. Business leaders are advised to assess their vulnerability to these tariffs, whether through direct product impacts or supply chain components. For Vice President Harris, potential policies could include price controls, subsidies, and guaranteed income, which would also be inflationary.

To prepare, it is essential to maintain profitability, watch margins, and understand what drives profit. Business leaders should engage in scenario planning and simulations to prepare for various potential policy outcomes. This approach allows companies to be proactive rather than reactive to any new legislation.

In closing, it is important to remember that policy changes typically take time to implement and impact the economy. Business leaders should focus on running their businesses well, emphasizing the importance of fundamentals such as profitability, growth, diversification, talent acquisition, scalability, infrastructure, and succession planning. These are critical elements of a strong business that creates value over the long term.

Clint: I see positive trends through our work at Bundy Group, where we specialize in representing privately held businesses in sales and capital raises, particularly core industry verticals of healthcare & life sciences, technology-enabled services and business services. Companies that are stable, profitable, and growing consistently attract buyers or capital partners, which is a pattern we have observed over Bundy Group's 35-year history.

Although the overall M&A market experienced a downturn in 2023, Bundy Group had a strong year. According to global M&A data, both deal count and deal value were up approximately 10 to 15% through Q2 of 2024. Based on this data, I am optimistic that this momentum will continue into 2025. What are your thoughts on the M&A market today, Alex? Are you bullish on it over the next 12 months?

Alex: Buyers in the M&A market have become more discerning, with a higher threshold for excellence compared to the era of cheap money. They are now more meticulous in calculating return on investment (ROI) and are looking for companies that can sustain their recent growth, rather than those that only thrived due to pandemic-related factors. With higher borrowing costs, buyers seek acquisitions that justify capital investment and ensure sustainable growth. Strategic buyers have been more active recently than financial sponsors and private equity buyers.

For business owners contemplating an exit, it is important to consider a competitive bidding process. Engaging multiple buyers can often lead to better deals than selling directly to a single strategic acquirer. Business owners are advised to consider this strategy to maximize their transaction outcomes.

The fundamentals of the M&A market remain strong. Expected cuts to the federal funds rate could lower borrowing costs, making more capital available for acquisitions. Additionally, a generational shift with more baby boomer business owners retiring will create significant opportunities for mergers and acquisitions in the latter half of this decade. These structural forces are expected to keep the M&A market robust heading into 2025 and 2026.

The entire interview can be found on the Bundy Group Insights podcast, which is on Apple Podcasts, Spotify and Youtube. Readers can also follow Alex’s economic analysis through his LinkedIn profile (Alex Chausovsky | LinkedIn).

Established in 1989, Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The team of highly experienced investment bankers leverages extensive industry knowledge and skill to provide hands-on guidance to clients through every phase of the business transaction. Bundy Group has been a trusted partner in more than 250 closed deals over the past 35 years, providing high quality options, actionable insights, and delivery of optimal strategic fit at a premium value for our clients.

Bundy Group Securities, LLC is a registered broker-dealer and member of FINRA and SIPC. More information on the background of Bundy Group Securities, LLC is available at FINRA's BrokerCheck.

This content is for informational purposes only and is not intended as investment advice or a recommendation to buy or sell any security.

Bundy Group, an industry-focused investment bank, is pleased to announce that it has successfully advised Behavior Consultation & Psychological Services (BCPS) in a sale to Behavioral Framework, a portfolio company of Renovus Capital. The transaction highlights Bundy Group’s continued advisory work and closed deal experience in the healthcare services sector while demonstrating the ability to effectively guide clients through the complexities of a sale, deliver strategic buyers and financial sponsor options through a competitive process, and drive premium value for the client.

Founded in 2010, BCPS is a premier provider of clinic, home, and school-based Applied Behavior Analysis (ABA) therapy and autism diagnostic services for children in North Carolina. The company focuses on an individualized approach to care delivered by professionals with extensive training and experience in the field, with the goal of providing the best care to each client.

Owned by Renovus Capital, a private equity fund, Behavioral Framework is a leading family-owned provider of ABA therapy in Maryland, Virginia, and Washington, D.C., with a vision of providing exceptional care and better client outcomes for children diagnosed with autism and their families. Behavioral Framework was founded out of a strong desire to deliver consistent and superior care with a holistic and collaborative approach that serves the whole family.

“BCPS is a leader in autism therapy and diagnostic services in the Southeast, and the organization’s impressive growth and experienced professionals are key reasons for the strong buyer interest we had in this client engagement,” said Jim Mullens, Managing Director with Bundy Group. “We appreciated the opportunity to represent Jason Cone and the company in the sale process, and we are excited to see what the future holds for BCPS under new ownership.”

The BCPS transaction team was led by Jim Mullens and Stewart Carlin, Managing Directors, and Lorenc Biqiku, Vice President.

“After speaking with our trusted advisors, we decided to hire Bundy Group as our investment banking advisor because of its healthcare practice experience and reputation for delivering strong outcomes for healthcare clients,” said Jason Cone, President, and Shareholder of BCPS. “We were very pleased with the Bundy Group process, the team’s attention to our needs, and the outcome. Behavioral Framework is a strong fit for our practice, and the value that Bundy Group delivered was far above my original expectations.”

This transaction underscores Bundy Group’s continued success and significant experience in the healthcare services sector, with an emphasis on quality advice and a competitive edge to drive value for clients. For more information about Bundy Group’s industry expertise and recent transactions, visit bundygroup.com.

About Bundy Group

Established in 1989, Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The team of highly experienced investment bankers leverages extensive industry knowledge and skill to provide hands-on guidance to clients through every phase of the business transaction. Bundy Group has been a trusted partner in more than 250 closed deals over the past 35 years, providing high quality options, actionable insights, and delivery of optimal strategic fit at a premium value for our clients.

Bundy Group Securities, LLC, is a registered broker-dealer and member of FINRA and SIPC. More information on the background of Bundy Group Securities, LLC is available at FINRA's BrokerCheck.

Bundy Group, an industry-focused investment bank, is pleased to announce that it has successfully advised First Coast Dermatology Associates (FCDA), a medical and cosmetic dermatology practice, in a sale to a financial sponsor-backed dermatology group practice. The transaction highlights Bundy Group’s continued advisory work and closed deal experience in the dermatology and aesthetics sector, with an emphasis on quality advice and a competitive edge to drive value for clients.

First Coast Dermatology Associates was founded in 2003 as a medical and cosmetic dermatology practice owned and operated by Dr. Alison Moon, a board-certified specialist in dermatology and dermatologic surgery, in Jacksonville Beach, FL.

"Dr. Alison Moon has built an outstanding dermatology and aesthetics practice, and First Coast Dermatology is recognized as a leading provider in the Jacksonville region,” said Clint Bundy, Managing Director at Bundy Group. “The Bundy Group team thoroughly appreciated the opportunity to represent Dr. Moon in this highly successful sale process. We wish Dr. Moon and the First Coast Dermatology organization all the best with their new partner."

The FCDA transaction team was led by Jordan Frickle, Vice President with Bundy Group, with Clint Bundy and Stewart Carlin, Managing Directors, supporting the transaction team.

“I selected the Bundy Group team after several months of consideration and numerous conversations. Bundy Group’s transaction experience and industry knowledge were key reasons why I selected this investment banking organization,” said Dr. Alison Moon. “The final results of the Bundy Group sale process were well beyond my initial projections. I received a valuation for FCDA that was over triple what I initially anticipated when I hired Bundy Group. Furthermore, the strategic buyer that Bundy Group introduced me to, and that closed on the transaction, is a quality organization that will be able to offer FCDA numerous benefits and synergies as the future progresses.”

This transaction underscores Bundy Group’s continued success and significant experience in the dermatology and aesthetics sector. For more information about Bundy Group’s industry expertise and recent transactions, visit bundygroup.com.

About Bundy Group

Established in 1989, Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The team of highly experienced investment bankers leverages extensive industry knowledge and skill to provide hands-on guidance to clients through every phase of the business transaction. Bundy Group has been a trusted partner in more than 250 closed deals over the past 35 years, providing high quality options, actionable insights, and delivery of optimal strategic fit at a premium value for our clients.

Bundy Group Securities, LLC, is a registered broker-dealer and member of FINRA and SIPC. More information on the background of Bundy Group Securities, LLC is available at FINRA's BrokerCheck.

In a recent article for Control Engineering Magazine, Bundy Group recounts the notable transactions as the calendar year surpasses the halfway point and how each sale has contributed to the various growth and consolidation opportunities in the market.

The automation market continues to experience a tremendous amount of mergers & acquisitions (M&A) and capital markets activity. Drivers of this activity include the growth-oriented nature of the automation market, the consolidation opportunities within the industry, and the strength of many of the companies operating within it. Furthermore, the automation market has attracted a critical mass of strategic buyers and financial sponsors (i.e. private equity groups, family offices, institutional investors) that are looking to own or invest in companies in the industry. From such, Bundy Group closed automation transactions as Ultimation and MR Systems, our team continues to see strong interest from a range of qualified buyers in the automation segment. Further evidence of the robust M&A and capital placement activity in automation is provided in the below list of transactions.

Bundy Group’s current engagements and owner relationships include control system integration, robotics, automated material handling, automation distribution, artificial intelligence, and cybersecurity. This serves as a leading indicator for submarkets our team anticipates closed transactions in over the coming months. We look forward to providing these relevant updates and transaction announcements to Control Engineering magazine readers.

6/3/24

Thermal Technology Distribution Solutions has acquired Southwest Heater and Controls (SWHC), a Dallas-based distributor of industrial electric heaters, sensors, controls, and technical support. Led by Chris and David Hawkins, SWHC’s management team will stay with the company and retain a significant equity stake. The acquisition strengthens TTDS’s position in the industry. Learn more.

6/3/24

Motion & Control Enterprises has acquired Ives Equipment Corporation. Founded in 1954 and based in King of Prussia, PA, Ives is a distributor of process valves and instrumentation solutions. It serves various markets, including industrial gas, federal and defense, engineering and construction, food manufacturing, and pharma and biotech, across eastern and central Pennsylvania, Delaware, Maryland, southern New Jersey, Washington D.C. and Virginia. Learn more.

5/24/24

Tinicum, L.P. and affiliated funds managed by Tinicum Incorporated has acquired a controlling interest in KGM from Compass Group Equity Partners. Headquartered in Tulsa, Oklahoma, KGM is a leading value-added distributor of natural gas products, including control valves and instruments, to utilities and commercial & industrial customers. Learn more.

5/24/24

South Korea’s service robot company Everybot Inc. acquired AI robot mobility specialist hyCore to expand into the personal mobility sector. Everybot, a company listed on the Kosdaq, said on Monday that it secured management rights by acquiring 947,250 shares or 31.8% stake in hyCore. Learn more.

5/15/24

ATS Corporation a leading automation solutions provider, has entered into a definitive agreement to acquire Paxiom Group, a provider of primary, secondary, and end-of-line packaging machines in the food and beverage, cannabis, and pharmaceutical industries. Founded in 1978, ATS employs over 7,000 people at more than 65 manufacturing facilities and over 85 offices in North America, Europe, Southeast Asia and Oceania. Learn more.

Bundy Group is a boutique investment bank that specializes in representing controls and automation, Internet of Things, and cybersecurity companies in business sales, capital raises, and acquisitions. Over the past 33 years, Bundy Group has advised and closed on over 250 transactions, which includes numerous automation-related transactions. You can learn more at www.bundygroup.com or by contacting Clint Bundy.