Bundy Group is proud to reflect on another successful year, delivering strong performance and representing clients in business sales across our core verticals. In 2024, we welcomed talented new team members and deepened our industry specialization, further enhancing our capabilities. Looking ahead, we’re excited about a robust pipeline of quality client engagements for 2025.

As we move into the new year, the M&A landscape is ever evolving. Whether you're considering selling your business now or in the future, or contemplating a capital raise, understanding the current state of the market to best prepare your company for a liquidity event is critical. We've outlined key trends and insights that will help you navigate 2025 with confidence:

After a down 2022 and 2023, and a renewal in 2024, the M&A market is poised for further growth in 2025. Below are some additional thoughts from the Bundy Group team:

While buyer interest is strong, the competitive sale process, led by an investment banker and experienced advisory team, is as critical as ever. There are some important steps to take as a part of this process:

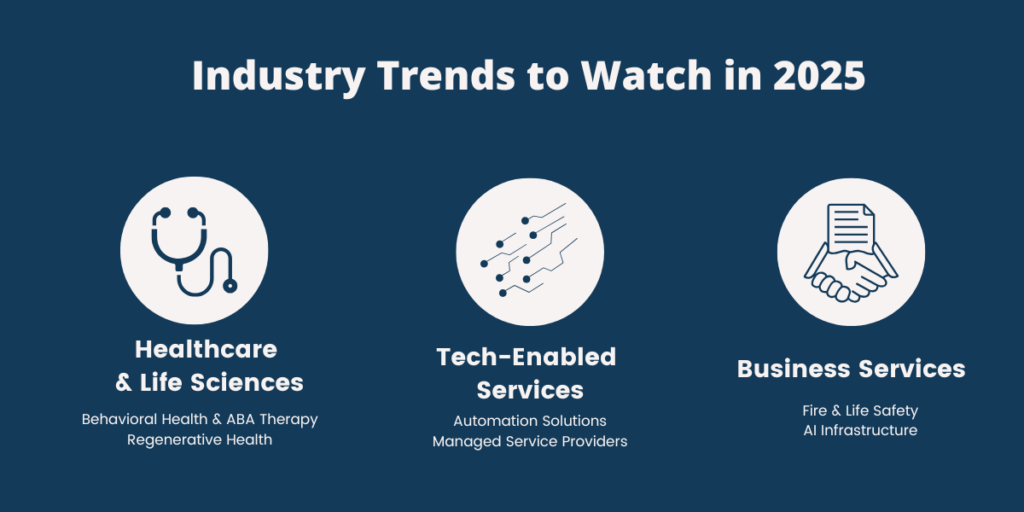

Several sectors are expected to see strong M&A activity in 2025. Specific areas to note include:

As 2025 unfolds, the M&A market shows great opportunity but requires careful navigation. Whether you're selling or acquiring, understanding key market dynamics, preparing your business, and leveraging competition will be essential tools for success.

If you have any questions or want to discuss how Bundy Group can assist in your M&A journey, please explore our website or contact our team directly for more information.

We’ll be attending several conferences this year and we'd love to meet with you! Be on the lookout for additional information on where we’ll be this year. If you're planning to attend, or if you’d prefer to speak to us virtually or by phone, you can contact one of our team members here, or email us at info@bundygroup.com.

We're excited for Season 2 of Bundy Group Insights, a podcast that takes you behind the scenes of the latest developments in mergers & acquisitions, capital raises, economic, business, and industry-specific trends.

We recently recorded an episode where we reviewed 2024 and discussed trends for 2025.

Whether you’re a practice owner, investor, or industry enthusiast, this podcast is your ultimate guide to navigating the intricate world of mergers and acquisitions.

Follow along on the following channels to never miss an episode:

Thank you to our clients, networking partners, and industry relationships for the confidence you have placed in Bundy Group. We will keep you posted on our progress in 2025!

About Bundy Group

Established in 1989, Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The team of highly experienced investment bankers leverages extensive industry knowledge and skill to provide hands-on guidance to clients through every phase of the business transaction. Bundy Group has been a trusted partner in more than 250 closed deals over the past 36 years, providing high quality options, actionable insights, and delivery of optimal strategic fit at a premium value for our clients.

Bundy Group Securities, LLC, is a registered broker-dealer and member of FINRA and SIPC. More information on the background of Bundy Group Securities, LLC is available at FINRA's BrokerCheck.