Global automation is expected to expand 51% from 2020 to 2025, driven by personal shortages, remote monitoring and increased records requirements and productivity demands. Robust mergers and acquisition investments to enhance margins validate the growth, explains the Bundy Group in this article for Control Engineering.

Automation markets, investments and mergers and acquisitions are hot globally to meet personnel shortages, monitoring requirements and productivity needs. Bundy Group, an investment bank and advisory firm, has followed robust mergers and acquisitions and capital placement activities in the automation market.

The automation sector is experiencing significant expansion, and the business community is noticing. A report on the dynamic industrial automation and market-compelling investment opportunities, Florian Funke, L.E.K. Consulting and Harris Williams said the global automation market is projected to increase 51% from $175 billion in 2020 to $265 billion in 2025.

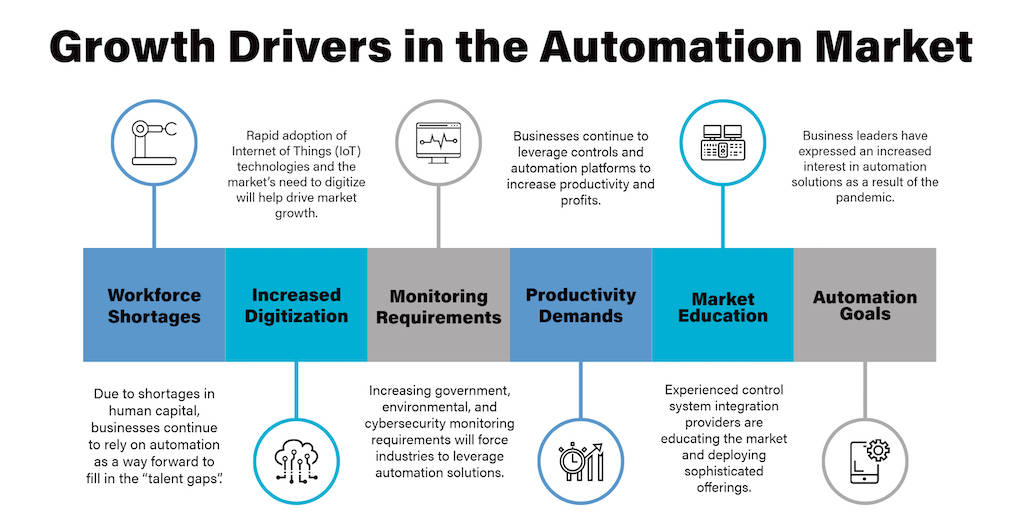

Numerous drivers for the growth include companies filling in the void created by a shortage of personnel, managing monitoring requirements driven by regulation, and generating productivity improvements to enhance margins. This sizable and growing automation market’s value has been further validated by the robust mergers and acquisitions (M&A) activity in industrial automation markets.

While the automation market has experienced a significant amount of M&A and investment activity over the past decade, this continued pace of acquisitions and capital placements since the beginning of the COVID-19 pandemic has demonstrated the resilience of the industry. The pandemic reinforced the mission-critical nature of the automation market as controls and automation markets prepare for growth in the post-pandemic age. Automation end-users as well as buyers and investors are realizing opportunities.

Strategic buyers and financial sponsors (private equity, family offices and growth equity firms) have recognized the vital role the automation market plays in the global economy, which is further driving an appetite to acquire and invest in businesses that provide automation services, products and solutions.

Aggressive buyer and investor demands place automation-related business owners in a preferred category, and automation companies positioned in a sale or capital raise process maximize chances for significant interest and premium valuations.

Business sale and capital placement transactions through August 2021 are reflective of heightened interests in the automation industry.

An August 2021 control system integration transaction to note is Revere Control Systems’ acquisition of Florida-based Curry Controls, which solidifies Revere as an automation leader in the Southeast. A recent series of 2021 automation manufacturing acquisitions was led by Audax, a Boston-based financial sponsor, which started with the acquisition of SJE followed then by the immediate add-on acquisition of control systems manufacturer LW Allen.

In the robotics industry, a subsegment of the broader automation space, Zebra Technologies acquired Fetch Robotics in a $290 million transaction. The transaction value / revenue multiple for the Fetch Robotics deal was 30.0x, which further validates the premium value assigned to many companies in the robotics market.

Some 2021 automation transactions follow, newest to oldest.

8/10/2021

Systems Controls, a designer and manufacturer of control panels owned by Comvest Partners, acquired Keystone Electrical Manufacturing, an Iowa-based control systems manufacturing firm.

8/5/21

SJE, an automation manufacturing firm owned by Audax, acquired LW Allen, a designer, manufacturer, distributor and installer of water and wastewater control systems and treatment pump systems to municipal and industrial customers.

7/1/2021

Zebra Technologies, an industrial software provider, acquired Fetch Robotics, a developer of autonomous mobile robots.

7/1/2021

enVista, a global software, consulting, managed services and automation solutions firm, acquired long-time partner HCM Systems, a systems integrator, specializing in customized, complex highly integrated conveyor and control systems for manufacturing and distribution-centric organizations.

6/28/21

Audax, a private equity group, acquired SJE, a manufacturer and system integrator of control solutions for the water and wastewater sector.

6/9/2021

Semios, the leading precision-farming platform for permanent crops, acquired Altrac, developers of an agriculture automation platform enabling farmers to monitor and control important agricultural systems required to produce high-value crops from their computer or mobile device.

6/2/2021

ATS Automation Tooling Systems, an automation solutions provider, acquired Control and Information Management, an industrial automation system integrator based in Ireland.

5/4/2021

Revere Controls, an engineering system integration and construction services firm, acquired Florida-based Curry Controls, an engineering, panel assembly, and installation services firm.

4/26/2021

Publicly-traded Brooks Automation acquired Precise Automation, a developer of collaborative robots and automation systems.

4/7/2021

Actemium, a division of international conglomerate Vinci Energies, has acquired Outbound Technologies, a Midwestern-based control systems integrator.

3/1/2021

Accenture, an international consulting firm, acquired Pollux, a Brazilian-based industrial robotics and automation solutions firm.

2/17/2021

Gray, a fully integrated service provider, acquired Stone Technologies, a control systems integrator that provides complete industrial automation and information services.

2/17/2021

KKR, an international private equity group, acquired Flow Control Group, a leading distributor of flow control and industrial automation solutions.

2021 continues as a robust year for M&A and capital placement activity in the automation segment. Additional closed transaction announcements are expected through the end of the year and into 2022, and the Bundy Group team sees buyer and investor demand continuing to build for automation firms. Independent companies are in an enviable position for strategic options to consider and attractive business valuations to realize.

Author Bio: Clint Bundy is managing director, Bundy Group, which helps with mergers, acquisitions and raising capital. Bundy Group is a Control Engineering content partner. Edited by Mark T. Hoske, content manager, Control Engineering, CFE Media and Technology, mhoske@cfemedia.com.

KEYWORDS: Automation mergers and acquisitions

CONSIDER THIS

How are you advising your company to fill in its automation, controls and instrumentation needs?