As we quickly progress towards summer 2021, business owners have many reasons to be encouraged about the future, with pandemic recovery progressing and business valuations for many companies booming. With the future business environment looking much more positive than it has at any point in the past two years, many owners are subsequently facing critical decisions regarding whether or not 2021 is the year they want to realize liquidity from their business. A partial or full business sale process, or a leveraged recapitalization, can take six months or longer to achieve, which means that owners have a rapidly closing window to make a decision if they are focused on an outcome in 2021. As owners review a path forward for this year, there are a number of factors to consider.

MOTIVATION

It is critical and fundamentally significant for owners to realistically assess their desire to engage in and actively participate in a transaction process. Without active motivation from an owner, other factors driving a successful sale become less relevant. However, if an owner can sincerely justify exploring a transaction in the next 12 to 24 months, then it might be worthwhile to consider selling or completing a recapitalization in 2021.

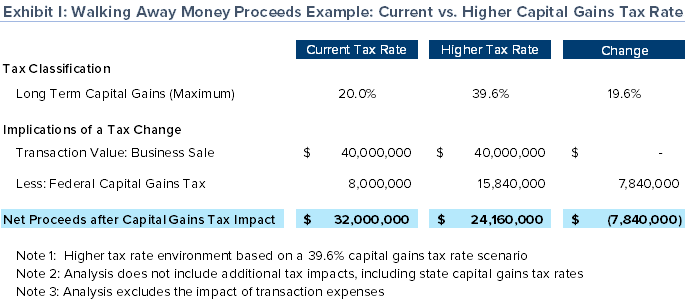

THREAT OF TAX RATE INCREASES

Whether or not a tax rate increase occurs in 2022, we are in an historically low tax rate environment, which is highly likely to change at some point in the future. The Biden administration and Congress continue to signal a desire to raise personal and business taxes. Proceeds available to an owner after taxes and transaction expenses, otherwise known as “walking away money” proceeds, could be massively impacted if, for instance, capital gains tax rates rise. The following scenario (Exhibit I) highlights both the potential and material impact on an owner’s “walking away money” should a tax rate increase incur.

CONFIDENCE IN THE ECONOMY

On April 11, 2021, ‘60 Minutes’ interviewed Federal Reserve Chairman Jerome Powell, and he stated that the U.S. economy is “at an inflection point” and is ready to “start growing much more quickly.” Furthermore, Powell added that the economy could grow at “6.0% or 7.0% in 2021,” which is the highest growth rate in “30 years.” From a market-timing standpoint, owners traditionally want to transact when both the economy and individual business performance are increasing and not when they are at their peaks or are declining. While the economic boom could continue well into 2022 and beyond, the remainder of 2021 appears to have the makings of a rebounding, strong economy.

CAPITAL AVAILABILITY

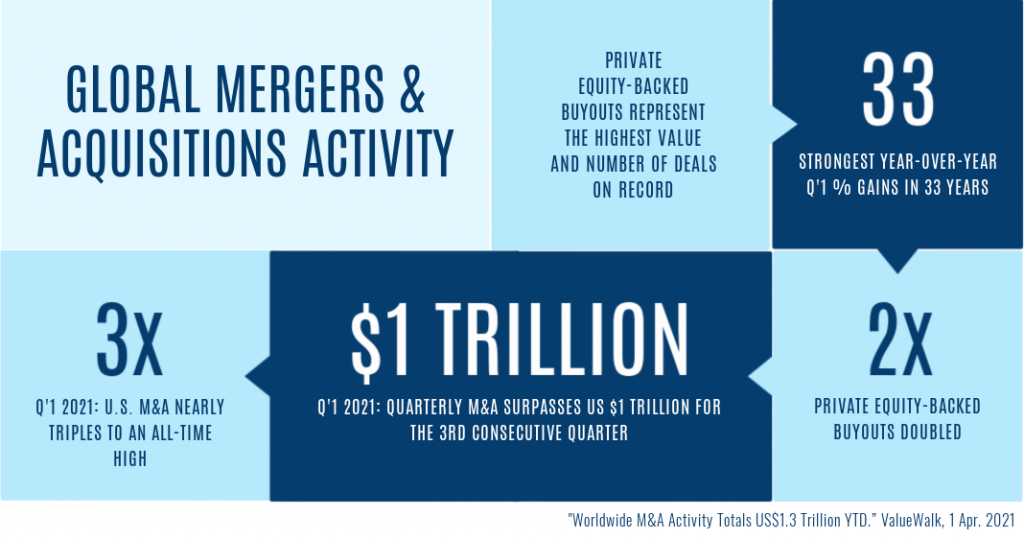

Whether capital is for acquisition financing or for a dividend recapitalization, there is a significant amount of equity and a low interest rate debt in the market. With over $1.45 trillion in unused private equity capital, and with private lenders eager to provide acquisition financing, there is no shortage of financial horsepower to consummate transactions in 2021.1 Due to missed investment targets in 2020, financing sources have tremendous pressure to put money to work, and the fertile economic recovery creates an additional stimulant to boost capital deployment.

COVID IMPACT

Many businesses have experienced an impact on their financial and operational profiles as a result of the pandemic. Owners frequently ask Bundy Group how the M&A market will respond to their COVID-impacted businesses. The answer primarily depends on the specific industry, the fundamentals of the sector, and the changes tied to the individualized company. That being said, many strategic buyers and private equity groups are prepared to treat the pandemic as an extraordinary event and not discount a company’s valuation for a COVID impact. The onus will certainly be on the business and its advisors to articulate how a company is either back to normalized performance, or on its way back, in order to maximize a valuation.

BUYER COMPETITION

Owners across many industries, including technology, automation, healthcare, life sciences, industrials, and business services, continue to receive unsolicited calls from strategic buyers and private equity groups. Inbound calls from buyers do not always translate into quality discussions, but this is yet another indication that we are in an active seller’s market in 2021. A business owner, or an owner’s advisors, who knows how to drive and manage buyer competition will be able to maximize value, as well as strategic fit, for a company and its shareholders.

As owners evaluate strategic alternatives, possibilities for monetizing value, and maximizing “walking away money” from a business transaction, there are opportunities for the remainder of 2021 to earnestly consider and explore. The Bundy Group team is happy to further discuss options and opportunities with business owners regarding optimal ways valuation and “walking away money” proceeds can be maximized.

SOURCES:

(1) Sraders, Anne. “Private equity firms are sitting on $1.5 trillion in unspent cash, and looking to raise more.” Fortune January 2020.

Securities offered through Bundy Group Securities, LLC, Member FINRA

Check the background of Bundy Group Securities, LLC at FINRA's BrokerCheck

Bundy Group, a 32-year-old, industry-focused investment bank, announces that it has advised Bio-Cide International (Bio-Cide), a leading specialty chemicals and disinfectants manufacturing organization, in a sale to Kemin Industries, a global ingredient manufacturer that serves such markets as food safety and animal health. The transaction was led by Clint Bundy, Stewart Carlin, and Jim Mullens, Managing Directors with Bundy Group.

Within the chemicals market, providers of antimicrobial and antiviral specialty chemicals have seen their market potential and value increase substantially since the outbreak of COVID-19. With the global economy’s heightened focus on disinfectants and hygiene solutions, those producers retain an outsized attractiveness in a volatile market.

“We enjoyed working with the Danner Family, majority owners of Bio-Cide, and managing the sale process, which resulted in strong domestic and international buyer interest,” stated Stewart Carlin from the Bundy Group team. “We were excited to see such a quality strategic buyer recognize the strong value that Bio-Cide offers to a new owner and to be the selected party.”

Clint Bundy stated, “Over its nearly 50-year history, Bio-Cide has become a leader in the fields of disinfectants and chemicals, as the company’s products are critical for the food safety and animal health markets. Kemin Industries offers Bio-Cide an expanded platform for growth, and we are excited to see what the future holds for our client within the Kemin organization.”

Jeff Danner, Chief Executive Officer and Chairman of the Board of Directors for Bio-Cide, indicated that the company hired Bundy Group “based on the team’s experience in the chemical industry, ability to understand and best position clients, and strong reputation.” Mr. Danner further added, “We were nothing but impressed with Bundy Group’s thorough and competitive-driven process, as well as its management of complex matters, all of which resulted in a premium valuation for the shareholders and a great new home for the company and employees. We were more than pleased with your team’s work and the exceptional outcome that you delivered.”

Bio-Cide International, headquartered in Norman, Oklahoma, has been a leading, multi-specialty source of chlorine dioxide based antimicrobial technology for over 49 years. The company has pioneered processes that have revolutionized disinfection and sanitation practices around the globe and manufactures a versatile line of chemical disinfectants, sanitizers, deodorizers, and preservatives.

Bio-Cide International has been the leader in stabilized chlorine dioxide and acidified sodium chlorite applications instrumental in the elimination of microorganisms found in the medical professions, water treatment, food processing plants, dairy and bottling plants, the seafood industry, air duct ventilation systems, the oil field industry, and the animal health industry.

Kemin Industries is a global ingredient manufacturer that strives to sustainably transform the quality of life every day for 80 percent of the world with its products and services. The company supplies over 500 specialty ingredients for human and animal health and nutrition, pet food, aquaculture, nutraceutical, food technologies, crop technologies, textile, biofuels, and animal vaccine industries.

For over half a century, Kemin has been dedicated to using applied science to address industry challenges and offer product solutions to customers in more than 120 countries. Kemin provides ingredients to feed a growing population with its commitment to the quality, safety, and efficacy of food, feed, and health-related products.

Established in 1961, Kemin is a privately held, family-owned-and-operated company with more than 2,800 global employees and operations in 90 countries, including manufacturing facilities in Belgium, Brazil, China, India, Italy, Russia, San Marino, Singapore, South Africa, and the United States.

Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The 32-year-old firm has closed more than 250 transactions, specializing in several industries, including chemicals, healthcare and life sciences, technology, energy and power, and infrastructure. For more information about our industry expertise and other recent transactions, visit https://bundygroup.com/industry-expertise/.

Securities offered through Bundy Group Securities, LLC, a registered broker-dealer and member of FINRA. Check the background of Bundy Group Securities, LLC at FINRA's BrokerCheck. Testimonials may not be representative of the experience of other customers and are no guarantee of future performance or success.

Bundy Group, a 32-year-old, industry-focused investment bank, announces that it has advised Commercial Fyr-Fyters, a full-service fire protection company, in a sale to Pye-Barker, an industry-leading fire protection company with over 70 locations nationwide. The transaction was led by Jim Mullens, Managing Director with Bundy Group, and marks the company’s fourth Fire, Security & Safety transaction within the past three years.

David Harrison, President of Commercial Fyr-Fyters, commented, “We are excited to partner with Pye-Barker and feel it’s in the best interests of our customers and employees for continued long term success of the company. We feel Pye-Barker, with its long history and successful acquisition strategy, will continue the legacy that we have built over the years.”

“Commercial Fyr-Fyters has built an outstanding company over the last 60 years of operation,” commented Jim Mullens. “The company has continually demonstrated its ability to form lasting relationships with customers and to deliver timely results. Bundy Group was excited to have advised the Commercial Fyr-Fyters team and to have closed yet another transaction in the fire, security & safety sector.”

David Harrison indicated that the company hired Bundy Group “based on the team's experience in the fire protection industry, ability to understand and best position clients, and strong reputation.” He added, “I am very pleased with the strong valuation that you helped obtain--30% higher than the original offer--and a new owner that will help to support the management team with future growth. Thank you again for your tremendous work in the successful sale of Commercial Fyr-Fyters. The sale to Pye-Barker…was exactly the kind of result we were hoping for when we engaged Bundy Group. The due diligence and negotiation processes were artfully managed by Jim Mullens, which helped to reduce friction during these steps and move this forward to a quick deal close. I was delighted with the work of Jim Mullens, Managing Director, and the exceptional outcome that Bundy Group delivered.”

Commercial Fyr-Fyters is a full-service fire protection company that offers comprehensive fire protection services, including fire extinguishers, fire suppression systems, fire alarm systems, fire sprinkler systems, exit/emergency lighting, and hood cleaning. The company also handles SCBA and SCUBA hydrotesting in its DOT testing facility.

Pye-Barker Fire & Safety is a leading provider of fire and life safety protection services, with headquarters in Atlanta, Georgia and over 70 locations spanning the Continental US. Since its founding in 1946, Pye-Barker Fire’s core values have been unwavering in providing honest and reliable service through its highly trained and dedicated employees. Pye-Barker Fire invests heavily in providing best-in-class training for its team while offering industry competitive benefits.

Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The 32-year-old firm has closed more than 250 transactions, specializing in several industries, including fire, security & safety; chemicals; healthcare and life sciences; technology; energy and power; and infrastructure. For more information about our industry expertise and other recent transactions, visit https://bundygroup.com/industry-expertise/.

Securities offered through Bundy Group Securities, LLC, Member FINRA. Check the background of Bundy Group Securities, LLC at FINRA's BrokerCheck. Testimonials may not be representative of the experience of other customers and are no guarantee of future performance or success.

As investment bankers that specialize in representing controls & automation firms in business sales and capital raises, Bundy Group has seen first-hand the resiliency of the industry over the past year. Even in the midst of the pandemic, strategic and financial buyers continue to pay robust valuations for controls & automation providers, including control system integrators. Based on the client engagements that Bundy Group is working on in 2021, we continue to see numerous industry indicators that buyer demand will remain strong.

Key players in the automation community are also eager to understand longer term implications of the pandemic on this essential industry, especially as relates to the impact on valuations of companies. The controls & automation market resides in an influential position as society and business transition through this phase of creative destruction resulting from the pandemic. The manufacturers, technology companies and service providers offering controls & automation solutions will benefit as the international business community evaluates, reviews and redefines progress into the future.

To broaden our perspective, several industry experts and leaders offer their thoughts on the impact of COVID-19 on the automation segment and what the future holds for this important industry.

James Gillespie - Chief Executive Officer, GrayMatter

Founded in 1991 and based in Pittsburgh, GrayMatter curates the best processes and technologies to drive industrial, digital transformations and co-innovate with companies across North America in manufacturing, food and beverage, consumer packaged goods, water/wastewater services and other industries. www.graymattersystems.com

Many of GrayMatter’s clients run essential businesses or operate critical infrastructure, so they experienced a surge in demand for foods and beverages, paper products, cleaning supplies, drinking water and much more. Our priority is always to help organizations find ways to transform their operations and empower their people. COVID-19 focused us on helping clients plan, build and sustain a secure environment for their remote employees.

We expect there to be tailwinds in the manufacturing sector, in particular, as companies evaluate their supply with bias toward the Americas. The next challenge for organizations is to keep making progress on the digital transformation initiatives that they either started or accelerated in 2020-21 as a response to the pandemic. That could mean looking for opportunities to make predictions with data and machine learning through advanced industrial analytics, enhancing plant-floor productivity with high-performance HMI/SCADA or making sure their operational technology networks are truly secure. Organizations will meet with success in doing this if they find the right partners to help, get executive sponsorship and work with experienced team members to build buy-in and find valuable solutions.

Michael Calabrese - President, Control Systems Integrators

Founded in 1992, Control Systems Integrators manages, designs and builds innovative automation solutions to solve the most complex problems facing companies around the world. CSI | (csiadvantage.com)

In the years leading up to the pandemic, we worked with many customers who decided on an automation strategy with a medium-to-long term view. COVID-19 was the catalyst for many clients to accelerate their business plans and condense their timelines to implement automation solutions. CSI has seen a tremendous uptick in our work with logistics and ecommerce companies, each industry experiencing their own explosive growth spurred by stay-at-home restrictions. In those industries, our teams are doing everything from designing brand new facilities to upgrading existing sites. Many of our clients outside of the logistics and ecommerce industries are also accelerating their automation upgrades, but for different reasons. These companies may have faced restrictions on how many people could be on the plant floor at any given time, so they came to us asking for solutions to minimize downtime.

As a result, many project upgrades (PLC firmware upgrades, IT upgrades, PLC upgrades) that had previously been pushed off were scheduled for 2020 and 2021. And of course, work from home policies are forcing companies to decide what may be permanent behavior changes post-pandemic. These clients are investing aggressively in plant-floor IT and business analytics, so that troubleshooting can be done from anywhere.

Gary Mintchell - Founder, The Manufacturing Connection

Gary Mintchell leveraged a career in manufacturing becoming an independent blogger, podcaster, and analyst whose writing can be found at www.themanufacturingconnection.com.

Designing systems considering the safety of personnel has been best practices for many years. A podcast interview on that topic I did some six years ago remains a top-ten download every month. We have learned the hard way about a safety problem beyond the machine. How we can design machine and factory layouts to allow for social distancing and contact tracing to keep personnel safe from each other has become the new discipline. Should these new requirements be programmed into the automation system or the MES? Or where? Integrators must study deeply and determine a new best practice for design and application.

Robots have displaced personnel from dangerous tasks. Perhaps the new dangerous task is proximity to other humans. The new breed of collaborative robots may be the answer to both improving productivity and safety. If integrators have not been exploring this technology, it is time to do so.

Garrett Butcher - Managing Partner, Simply Driven Executive Search

Garrett started and leads the Robotics and Automation Recruiting Group at Simply Driven where he focuses on recruiting robotics and automation talent. https://sanfordrose.com/simplydrivensearch/

At Simply Driven, we focus on recruiting automation talent across a variety of industries. COVID-19 has certainly not eased the challenges of finding and hiring good automation talent and the talent pool remains as competitive as it did pre-pandemic. A key component to this insight is our diverse client portfolio. Essential businesses - food, beverage, consumer goods, packaging, etc. ramped up, which soaked up any excess talent that did hit the market. We don't see it slowing down. Automotive seems to be back in full gear, among other industries that struggled through the early months of the pandemic. In fact, almost all of our clients are back at normal hiring rates besides Oil & Gas. Long story short, finding, qualifying, and winning the best talent in the market remains as challenging, if not more challenging, for our clients than pre-Covid, and we're expecting it to get worse.

There are positives. It means companies are hiring and automation is booming, but two significant changes are underway. One is the consistency of remote work capabilities companies have adopted, which allows them to circumvent previous hiring constraints created by their physical location and talent pool. Unless you're sitting in a plant, most automation jobs can be done, at least in part, remotely. Companies are adopting this approach and easing their hiring pains. The second change that is still evolving, and only the future holds the answer, is the anticipated increase in automation spending. Plants see a need to reduce unreliable labor via automation, industries that once lacked automation now see a need, and the need to increase automation has never been more present. How will this impact actual spend? Only time will tell for the industry.

In summary, the controls & automation market is well positioned to accelerate its growth as a result of the COVID-19 pandemic. The feedback of the above experts validates the attractiveness of the controls & automation segment. In addition, as investment bankers, we continue to receive powerful interest from a deep pool of an industry and financial investor buyers, which are willing to pay attractive valuations, in Bundy Group-led automation business sale engagements. This is further reinforcement that the automation sector is a highly lucrative end-market. Assuming control system integrators can manage the challenges that are inherent with growth, such as finding employee talent, these firms should continue to generate widespread buyer interest.

Clint Bundy is a Managing Director with Bundy Group, a boutique investment bank that specializes in representing controls and automation and internet of things companies in business sales, capital raises and acquisitions. Over the past 32 years, Bundy Group has closed over 250 transactions, which includes numerous controls & automation-related transactions.

Bundy Group, a boutique investment banking firm, has selected DealCloud for client relationship management, deal management, reporting, and marketing.

“Making the transition to DealCloud was a critical step necessary to keep up with the increasing demands on our growing organization,” said Stewart Carlin, Managing Director at Bundy Group. “After reviewing multiple options, we chose DealCloud based on its state-of-the-art reporting capabilities, value-added analytics, and a system architecture that allowed us to tailor it to our specific needs.”

Founded in 1989, Bundy Group offers mergers and acquisitions advisory, capital raising, and corporate advisory services. The firm caters to multiple sectors, including Controls & Automation, Healthcare & Life Sciences, Technology, Energy & Infrastructure, and Industrials.

“With over 32 years of experience and 250+ successful transactions completed, we’re excited to work with Bundy Group to continue their success,” said Ben Harrison, President of Financial Services at DealCloud. “Bundy Group remains dedicated to obtaining superior outcomes for its clients, and we believe DealCloud is the right solution to help them manage their client engagements more effectively.”

About DealCloud

DealCloud, an Intapp company, provides a single-source deal, relationship, and firm management platform to enable over 1,000 clients to power their deal-making process from strategy to origination to execution. We offer fully configurable solutions purpose-built for the complex relationships and structures of private equity and growth capital firms, investment banks, private and publicly traded companies, debt capital providers, and other investors. For more information, please visit www.dealcloud.com.

About Bundy Group

Bundy Group is a boutique investment bank with offices in Charlotte, NC, New York, NY, and Roanoke, VA. The company specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The 32-year-old firm has closed over 250+ transactions and specializes in numerous industries, including Healthcare & Life Sciences, Technology, Energy & Power, and Infrastructure. For more information, please visit bundygroup.com.

Bundy Group, a boutique investment bank focused on the advisory needs of clients for over 32 years, announces that it has promoted two team members, Stewart Carlin and Lorenc Biqiku. Stewart was promoted to Managing Director, and Lorenc was promoted to Vice President. Their promotions are in recognition of their work for and contributions to Bundy Group over the past several years.

As a senior team member, Stewart Carlin has been responsible for both industry coverage and deal execution, which includes leading several recently announced closed Bundy Group transactions. Industries of focus for Stewart include Healthcare & Life Sciences, Chemicals, Controls & Automation, and Technology. Clint Bundy, Managing Director, stated, “Stewart is a tremendous investment banker that has been a critical part of our success.” Clint added, “his prior operational and senior executive experience have helped our company expand our capabilities and service focus when advising our clients on Mergers & Acquisitions and capital raise events.” Further information on Stewart can be found at Team - Bundy Group.

Lorenc Biqiku, a team member since 2014, has focused on industry research and deal execution across many industries and client engagements. Lorenc has an international business background, and his industry experience includes Controls & Automation, Healthcare & Life Sciences, Infrastructure, and Technology. Clint Bundy stated, “Lorenc has been an invaluable part of our team for a long time, and his dedication and contributions to both Bundy Group and our clients are second to none.” Further information on Lorenc can be found at Team - Bundy Group.

These promotions also represent Bundy Group’s continued growth as a company and goal of providing our clients with industry leading experience.

About Bundy Group

Bundy Group is a boutique investment bank with offices in Charlotte, NC, New York, NY and Roanoke, VA. The company specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The 32-year old firm is an investment banking specialist in numerous industries, including Healthcare & Life Sciences, Technology, Energy & Power, and Water & Wastewater. Bundy Group has closed over 200 transactions.

For additional information, please contact:

Clint Bundy

704-503-9464

clint@bundygroup.com

Bundy Group, a boutique investment bank focused on the advisory needs of clients for over 31 years, announces that it has advised GrayMatter and its private equity partner, Hamilton Robinson Capital Partners, in its acquisition of Richmond, VA-based E-Merge Systems. "Industrial companies in 2021 are prioritizing projects that were once on the back burner to equip facilities with IoT devices, leverage predictive analytics, and augment industrial cybersecurity," said GrayMatter Co-Founder and CEO James Gillespie. "The addition of E-Merge's capabilities gives us a more complete solution stack from instrumentation, control, industrial networking, and supervisory control, all the way up to analytics and other data solutions. We're also excited about adding an offshore engineering capability and an increased mid-Atlantic presence to our team.”

Furthermore, James added, "Our clients are telling us they want to better prepare their remote, industrial workforces to control costs and production as we move closer to a post-pandemic world."

Based near Pittsburgh, GrayMatter leverages Advanced Industrial Analytics, Industrial Cybersecurity, Brilliant Operations, and other software-as-a-service solutions to help companies transform their operations and empower their people.

E-Merge will add experienced engineers to GrayMatter's workforce and a portfolio of impressive industrial clients such as DuPont, Refresco, Air Liquide, W.L. Gore, and AstraZeneca. Municipal clients include NYC DEP, AlexRenew, Prince William County, Loudoun County, Henrico County, New Kent County, Hanover County, Chesterfield County, Spotsylvania County, and the Virginia cities of Norfolk, Suffolk and Richmond, among others.

Clients in the Water & Wastewater and Manufacturing industries have recognized the expertise at E-Merge since its founding in 1997. Joining with E-Merge's team advances GrayMatter's ability to meet customer demand for end-to-end operational visibility. That means putting powerful, relevant data from the sensor level to the cloud into the hands of decision makers.

E-Merge co-founders Inderdeep Huja and Thomas Lamb will take on key leadership roles under the agreement. In addition to offices in Richmond, Virginia Beach, and Fredericksburg in Virginia, E-Merge has offices in Savage, MD and Newark, DE.

"We're excited to partner with GrayMatter because it means our combined team has the experience to take on any challenge in the Industrial Intelligence and Automation space and the ability to deliver solutions for clients from concept to implementation," Huja said.

For the fifth consecutive year in 2020, GrayMatter earned a spot on Inc Magazine's list of the fastest-growing private U.S. companies.

This is GrayMatter's second acquisition in less than three years. In March 2018, GrayMatter acquired Colorado-based TMMI, Inc. A partnership in late 2017 with Hamilton Robinson Capital Partners, a private equity firm, has accelerated GrayMatter's ability to expand rapidly.

The E-Merge transaction represents the third Controls & Automation and Water & Wastewater deal Bundy Group has closed in the past 18 months.

About GrayMatter

GrayMatter is a technology consulting company that curates and implements digital transformation and cybersecurity solutions for industrial companies and organizations. Some of the biggest, industrial companies in the world lean on GrayMatter to protect and connect their critical assets to their teams so that every operator is empowered to be the best operator. For more information, please visit https://graymattersystems.com.

About Hamilton Robinson Capital Partners

Hamilton Robinson Capital Partners (“HRCO”) is a private equity firm with decades of hands-on experience making control investments in US-based Industrial IoT, process equipment and engineered systems, factory automation, distribution and specialty industrial manufacturing businesses. The Stamford, CT firm has completed over $1.5 billion in transactions supporting over 55 family businesses and corporate divestitures. Investors include leading financial institutions, funds, family offices and individuals in the U.S. and Europe. For more information, please visit https://hrco.com.

About E-Merge Systems

E-Merge Systems is a control systems integration firm that provides engineering and technology services to clients in the Water & Wastewater and Manufacturing industries. The company was founded in 1997 and has locations in Richmond, Virginia Beach, and Fredericksburg in Virginia. For more information, please visit www.emergesystems.com.

About Bundy Group

Bundy Group is a boutique investment bank with offices in Charlotte, NC, New York, NY, and Roanoke, VA. The company specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The 31-year-old firm is an investment banking specialist in the Controls & Automation and Water & Wastewater markets. Bundy Group has closed over 200 transactions.

For additional information, please contact:

Clint Bundy

704-503-9464

clint@bundygroup.com

Bundy Group, a boutique investment bank focused on the advisory needs of clients for over 31 years, announces that it has advised Custom Controls Unlimited (“CCU”) in a sale to Inframark, LLC, a national infrastructure services company focused on the operation and maintenance of water and wastewater systems, management of community infrastructure, and back-office services. Headquartered in Raleigh, NC, CCU is an industry-leading control systems integrator with focus on the Water & Wastewater market as well as several other mission-critical industries.

Founded in 2000, CCU is led by Devin Carroll and a talented group of engineering and technology-oriented professionals that have experience offering clients with industrial automation and process control solutions. CCU was focused on partnering with a larger strategic platform that could support CCU in its continued growth and expansion in the Water & Wastewater market.

Regarding the transaction, Devin Carroll stated, “Custom Controls is a leading automation solutions provider to clients over the past twenty years, and we are excited to further our growth through this new affiliation with a strategic provider in the infrastructure space.” Devin further added, “We have a strong pipeline of new client opportunities, and both CCU’s management and the new strategic partner project increasing market demand for the controls and automation solutions that our organization offers.”

After transaction close, the CCU management team will remain in place and continue to run the operations as a subsidiary of the new parent company.

The Custom Controls Unlimited transaction represents the second Controls & Automation and Water & Wastewater deal Bundy Group has closed in the past year.

About Custom Controls Unlimited

Founded in 2000 and headquartered in Raleigh, NC, Custom Controls Unlimited is a leading control systems integrator, primarily for the Water& Wastewater sector. CCU’s offerings include industrial automation systems, process control systems, cybersecurity solutions, and industrial control panel design and manufacturing.

About Inframark

Inframark, LLC is a standalone American infrastructure services company focused on operation and maintenance of water and wastewater systems, management of community infrastructure, and back-office services.

With more than 40 years of experience in managing water-related infrastructure, the company employs in excess of 1,500 people serving more than 300 clients in 19 states. Its North American operations manages facilities that can treat over a billion gallons of drinking water and wastewater daily. It also manages more than 8,000 miles of wastewater collection and water distribution networks. Its infrastructure management services group serves 220 clients with financial, administrative and specialized support services.

About Bundy Group

Bundy Group is a boutique investment bank with offices in Charlotte, NC; New York; and Roanoke, VA. The company specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The 31-year-old firm is an investment banking specialist in the Controls & Automation and Water & Wastewater markets. Bundy Group has closed over 250 transactions.

Charlotte, NC, October 8, 2020 – Bundy Group, a healthcare and life sciences-focused investment bank focused on the advisory needs of clients for over 31 years, is pleased to announce that Catawba Research has partnered with a financial investment firm focused on control investments in the life sciences sector. Catawba Research is a premier international, full-service contract research organization (“CRO”) that provides clinical management services to pharmaceutical and biotechnology companies. The investment will support Catawba Research’s next phase of growth and strengthen its position within the life sciences market.

This transaction represents the first institutional capital placed into Catawba Research. The new partnership will serve as an important milestone in Catawba Research’s goal of becoming a leading international pharmaceutical services organization. Following the acquisition, Zaidoon A. Al-Zubaidy, Founder and Chief Executive Officer, and the existing senior management team will continue to operate Catawba Research while the new financial partner will offer additional resources and board-level support.

Zaidoon A. Al-Zubaidy commented, “Catawba Research is excited to take this journey with our partners who share our ‘people first’ values. This is an exciting time for our team and our loyal sponsors. With this partnership, we are confident that Catawba will become one of the premier global clinical research providers.”

“Catawba Research has built an outstanding foundation of talent and operational excellence,” commented Stewart Carlin, Director with Bundy Group. “The company has continually demonstrated its ability to form lasting relationships with pharmaceutical sponsors and deliver superior results through consistent innovation and vertical integration. We are thrilled to have advised on this transaction, and we believe this new partnership will allow Catawba Research to accelerate its growth and value creation in the future.”

Bundy Group served as exclusive financial advisor in the transaction. Bundy Group was retained by Catawba Research based on the investment bank’s experience in the healthcare and life sciences sectors. Bundy Group managed a thorough process, which yielded significant buyer interest in the CRO and resulted in the Catawba Research shareholders achieving their financial and strategic goals. This successful transaction marks Bundy Group’s third healthcare transaction since April of this year.

About Catawba Research

Catawba Research is a vertically integrated contract research organization providing clinical management services to pharmaceutical and biotechnology companies globally. The Company focuses on Phase II – IV trials across the dermatology, women’s health, ophthalmology and gastroenterology therapeutic areas. Catawba Research manages clinical end point trials for New Drug Applications (NDA) and Abbreviated New Drug Applications (ANDA). The Company has established a global footprint with site relationships across the U.S., Central America and India. Since 2014, Catawba Research has engaged in nearly 50 clinical trials in 13 indications, achieving 15 agency approvals in the USA and Canada. The Company is headquartered in Charlotte, NC with additional locations in Texas, New Mexico and Michigan. The Company also provides data management, biostatistics, medical writing, and clinical CRO services through its location in Mumbai, India.

About Bundy Group

Bundy Group provides investment banking and transaction advisory services to clients across numerous markets, including healthcare and life sciences. The highly experienced team within Bundy Group includes transaction and operating professionals with a combined 100 years of experience in investment banking and corporate finance. As a 31-year-old boutique firm, the senior team leverages its specialized focus on our core markets to guide clients through the entire process of selling their company, raising capital, and pursuing acquisitions for growth.

Due to the COVID-19 pandemic, we are now in an ever-changing paradigm, which is creating tectonic shifts in our personal lives, businesses and global economy. The current environment involves healthcare workers placing their lives on the line caring for patients, companies shuttering their doors and employees either working from home or being placed on furlough. We are all living in a period of uncertainty, and it is unclear as to when and how a sense of normalcy will return for us all.

For business owners and executives, whether they are thinking of an exit in the near future or not, there are many areas for consideration during these challenging times. As this situation evolves, we want to offer our perspectives to business owner and management team relationships, trusted referral partners and friends. Ultimately, as a friend of Bundy Group recently said, “we are all looking to help each other out in any way possible.”

Prioritize the health and safety of all your company team members, from the shareholders down to the individual employee. These individuals are the assets of your organization, and they won’t forget your continued efforts to protect their health, safety and job!

Fortify your company’s balance sheet to the best degree possible. Evaluate your expense burn and the strength of your company’s cash position. “Cash is king” during a recession. If possible, try to procure a loan from your bank or extend an existing line of credit in order to provide access to additional liquidity.

We would encourage all businesses to evaluate the just passed CARES Act to see if they qualify for government assistance during this challenging time frame. There are good resources to review on this legislation, but your best starting point will likely be your existing commercial bank. Those businesses that are prepared with loan documentation, and are vocal with their commercial banks, stand the best chance of receiving funds. Based on the feedback we have received from our commercial banking relationships, the government and the banks are furiously working to make loans available. This is one resource that explains the CARES Act and provides additional information: The Small Business Owner's Guide to the CARES Act

If your company has the time and ability, help contribute to the COVID-19 fight in any way you can. Examples of current contributions include companies retrofitting their operations to produce needed protective gear for healthcare workers and businesses donating meals to hospitals and testing facilities. In addition, many other companies continue to operate on normal schedules in the midst of this pandemic in order to provide essential goods and services.

For business owners and management teams who are evaluating the “go-forward” strategy in this dynamic situation, the Bundy Group team wanted to offer some specific thoughts.

Goal: Stabilization

Unlike anything we have ever seen, we are entering an economic recession deliberately created to protect lives. The anticipation is that once the COVID-19 situation is under control, the economy will restart and do so quickly. As Dr. Tony Fauci, Director for National Institute of Allergy and Infectious Diseases, recently stated, “You don’t make the timeline; the virus makes the timeline.” That being said, many business owners and executives we have spoken with are anticipating weak performance in the second quarter of 2020 followed by a resurging economy sometime in the third and fourth quarters. Certainly the hope is that once the COVID-19 situation is under control, then the economy will reboot relatively quickly and a significant amount of pent-up demand for goods and services will be released.

Mergers & Acquisitions and Capital Raise Markets

Consistent with their reactions during other periods of economic shocks, strategic and private equity buyers have quickly become much more selective on where they will deploy capital for acquisitions. A number of these players will elect not to pursue acquisitions for now and instead focus on existing operations and portfolio companies until there is more certainty in regards to COVID-19. Compounding the change in the Mergers & Acquisitions (“M&A”) market are recent challenges in the debt markets. With so many companies rushing to get new loans or extending lines for credit, it makes it more challenging for a buyer to obtain acquisition financing in order to consummate a transaction.

Bundy Group is currently seeing a “flight to quality” in the M&A market, meaning that seasoned strategic buyers and private equity investors are gravitating to acquisitions where companies are not only recession resilient but are also deemed “virus proof.” As an example, Bundy Group is representing a pharmaceutical services company in a sale, which could assume new clinical trial testing opportunities for treatments related to COVID-19. Strategic and private equity buyer interest in opportunities of this nature will remain strong, regardless of the impact of COVID-19 on the M&A market.

For those companies considering a future sale or recapitalization that will be negatively impacted by COVID-19, we believe that strategic and private equity options will resurface relatively quickly after the virus is under control. Some business sale processes are being placed temporarily on hold until the COVID-19 threat has been tamed, with the tentative goal of restarting buyer conversations later in 2020. In other situations, business owners and management teams may need to be more patient before formally exploring a sale or recapitalization.

In what we hope to be a rapidly recovering economy, we anticipate that strategic buyers and private equity groups, both of which still have a significant amount of capital to deploy, will be searching for new ways to acquire growth and invest. As advisors to business owners, Bundy Group would always prefer for owners to speak with strategic and private equity buyers from a “position of strength.” How long a business should wait before formally pursuing those options is dependent on many factors related to each individual company.

In summary, many business owners we have spoken with are planning for a deep, relatively short recession, which will hopefully then be accompanied by a return to a more stable market. Many strategic and private equity buyers will be more prudent in their acquisition strategy for much of 2020, as “virus proof” businesses will garner a significant amount of attention in the M&A landscape over the next few months. As advisors to business owners and senior executives, Bundy Group recommends that owners stay informed on current events, take steps to protect the well-being of their employees, do their best to fortify company balance sheets and continue to strive to build value in their companies.

Please don’t hesitate to reach out to anyone on our team should you have questions.

Stay safe and healthy!

The Bundy Group Team

Water & Wastes Digest asked Bundy Group, an industry expert in both the Controls & Automation and Water & Wastewater segments, to write an article on the intersection of those markets and the corresponding increase in Mergers & Acquisitions activity.

The water and wastewater market continues to demonstrate and exhibit an increasing adoption of controls and automation solutions to address mission-critical needs. This market demand for technology and talent is creating a wave of investment and mergers and acquisitions activity, resulting in an evolving competitive landscape.

There are many examples of controls solutions that can be found in the water and wastewater market today. Furthermore, there are a range of cybersecurity systems constantly being developed and instituted to safeguard the control systems and other aspects of these networks. Technology-driven monitoring and security systems allow municipalities, private water management companies and other key players in the market to accomplish many goals.

This includes monitoring key systems within a water network, such as pump stations, elevated storage tanks, lift stations and floodgates; minimizing engineer and staff time devoted to commodity tasks, such as driving to a pump station to check its operating status; providing comprehensive cybersecurity measures, which allow a client to safeguard its network from external threats and meet regulatory obligations; and allowing a client to save money through energy management control systems.

“Automation is a key ingredient in driving efficiency and accuracy. SCADA can be a critical component in helping to drive a high-quality operation,” said John Freebody, chief financial officer for Inframark, a nationally focused water infrastructure operations company. “At Inframark, we are very keen to leverage these platforms wherever possible to complement our standard operating procedures to maintain a safe and secure environment for our most critical resource.”

The growing demand for controls, automation and cybersecurity measures also is creating a wave of investment and acquisitions in the water and wastewater space. Active entities seeking to acquire include both industry (i.e. strategic) buyers and financial investor (i.e. private equity) buyers. There are numerous reasons for the substantial increase in mergers and acquisitions activity for controls, automation and cybersecurity companies focused on the water & wastewater market.

Buyers usually are interested in investing in growth-oriented markets. The U.S. water and wastewater market—approximately $743.7 billion market in 2019—is anticipated to grow to $914.9 billion by 2023. Additionally, the global industrial automation market is expected to reach $352 billion in 2024 relative to a 2015 market size of $183 billion (i.e. a 6.6% compounded annual growth rate). Finally, cybersecurity markets globally are increasing at a 14.3% compounded annual growth rate from just over $3 billion in 2017 to approximately $4 billion in 2019, and it is projected to reach $6 billion in 2022.

Aging water infrastructure, increasing cybersecurity threats on water networks, and regulatory burdens placed on municipalities and private water management companies provide buyers with confidence in the long-term viability of controls and automation solutions for water and wastewater.

“The EPA has been driving mandatory water and wastewater upgrades in Ohio where I live. City engineers have been telling me about the search for control system integrators who are not only technology experts but who also can manage projects on time and on budget,” said Gary Mintchell, founder of The Manufacturing Connection, a controls-focused consulting company.

The fragmented nature of the controls and automation market for water and wastewater provides buyers with the opportunity to scale up by acquisition. Buyers can purchase other industry participants, which usually are smaller in size but plentiful in the market in terms of numbers, as add-on acquisitions to the buyer’s existing platform. There is a massive demand for technology and talent as it relates to controls and cybersecurity offerings, and companies that have developed proprietary technology systems and seasoned talent are especially valuable.

“Controls & automation needs are increasingly becoming more complex and customized. Very few providers have proficiency across the broad range of technology platforms and required services available in this market,” said Dave Thomas, President & CEO of SJE, a global manufacturing and services firm focused on the water space. “[It] has leveraged our recent acquisitions to add expertise and capabilities that would be nearly impossible to develop organically.”

With the continued growth of the water and wastewater market, and the industry’s adoption of controls and cybersecurity measures accelerating, the pace of mergers and acquisitions activity is anticipated to grow even further.

“The business strategy of water is changing from a focus on short term budget cycles and shifting to a more comprehensive approach that emphasizes life-cycle infrastructure costs, which in turn requires a more sophisticated approach to controls and automation, one that emphasizes data collection, analysis and management to assist with capital planning decisions,” said Mason Miller, CEO and investor for Dorsett Technologies, a controls and automation technology firm for the water and wastewater market. “As a result, the fragmented SCADA control market will increasingly be consolidated by value-added infrastructure companies like ourselves, who can pair the technology solutions with the capital and analytical capability to provide turn-key solutions to municipal, state and federal customers.”

Whether a company is a control system integration firm, an IoT sensor manufacturer, a controls and automation software-as-a-services company or a cybersecurity technology organization, the increasing presence of strategic and private equity buyers will have profound ramifications on the value of those potential acquisition and investment opportunities.

This article originally appeared in the October 2019 issue of Water & Wastes Digest as "Automation Takeover." Read the article at wwdmag.com

Due to controls and automation and Internet of Things (IoT) markets growing, buyers and investors are taking advantage.

The past four years have seen a rapidly changing landscape for potential buyers and investors in the controls and automation and Internet of Things (IoT) industry segments. The business world continues to focus on methods to improve productivity through the adoption of software, robotics and monitoring tools. The result has been rapid growth in the controls and automation and IoT markets, which is attracting a new group of private equity and growth equity investors, as well as industry, or strategic, buyers focused on taking advantage of this growth.

Whether a company is a pure control systems integrator, a controls and automation product manufacturer, or offers a technology-focused application, the options available to business owners for growth capital and/or selling a business have increased substantially over the past few years.

Private and growth equity

Private equity groups are private pools of capital, managed by investment professionals, which typically acquire a majority equity percentage, but not 100%, of a company. Growth equity groups are similar in profile, but usually are focused on completing minority equity investments, or a combination of debt and minority equity, in high-growth companies. Private and growth equity groups are focused on investing in growth markets and finding ways to help management expand through organic growth opportunities and add-on acquisitions. Within the past few years, a wave of private and growth equity groups has entered the market, validating the controls and automation segment as an attractive segment.

In addition, a critical mass of other private and growth equity groups are eager to break into the controls and automation market through a platform investment.

Classical versus new strategic buyers

Strategic buyers have been active and continue to be very relevant players in the controls and automation segment. The legacy, or classical, strategic buyers maintain a relatively consistent acquisition strategy that focuses on obtaining new market share and augmenting existing capabilities.

The rapidly evolving demand for quality technology offerings and engineering-driven technical services segment is producing a non-traditional, aggressive class of strategic buyers. These groups are using acquisitions to redefine their overall strategy.

The enormous opportunities that the controls and automation segment offers are motivating strategic buyers to redefine their strategy and consider any number of acquisitions, so they can stay ahead of the competitive business curve.

Internet of Things

The IoT emergence is driven by the market demand for more information, gathered through any manner of sensors, with the primary purpose of maintaining and improving productivity at the most basic level of a machine or piece of equipment. Plamen Nedelrchev, IT engineer with Cisco, stated that there were "1,000 internet devices in 1984, 1 million internet devices in 1992, and 10 billion in 2008. Fifty billion devices are expected to be connected by 2020."

Furthermore, Nedelrchev highlighted that in 2011, the number of new things connected to the internet exceeded the number of new users connected to the internet. The IoT explosion also has been driven by cloud computing and the technological ability to store, access, and interpret data at any given time. Recognizing that we are still in the early stages of the IoT market expansion, strategic buyers and growth equity investors are the key suitors for the burgeoning IoT technologies and companies currently in the market.

As the IoT market continues to grow and mature, there will likely be an acceleration of strategic buyer and investor activity.

Increased strategic, private equity and growth equity demand for acquisitions and investments in the controls and automation and IoT markets lead to stronger business valuations, which plays to the advantage of shareholders and managers active within these segments.

Clint Bundy is a managing director with Bundy Group, a boutique investment bank that specializes in representing controls and automation and IoT companies in business sales, capital raises and acquisitions.

This article appeared on controleng.com. Edited by Emily Guenther, associate content manager, Control Engineering, CFE Media, eguenther@cfemedia.com. Read the article at controleng.com