Charlotte, NC - Bundy Group, a 32-year-old investment bank, announces that it has advised a consortium of three Western U.S.-based companies (collectively known as “Pacific”) in a consolidated sale to Integrated Power Services (“IPS”), a North American leader in service, repair, and engineering for electric motors and generators. IPS is a portfolio company of Searchlight Capital Partners, a global private equity group. The three companies are Industrial Electric Machinery (“IEM”), Reed Electric & Field Service (“Reed Electric”), and A+ Electric Motor ("A+"). The Pacific transaction was led by Clint Bundy and Stewart Carlin, Managing Directors with Bundy Group. Lorenc Biqiku and Megan Hagemann, Vice Presidents with Bundy Group, also worked on the Pacific transaction team.

Pacific consists of complementary electrical apparatus, automation, industrial equipment repair, and field services organizations that deliver solutions across the Western U.S. Furthermore, it includes seven facilities, over 100 employees, a service region covering 12 states, and client end markets that include the wind, solar, hydro, and geothermal renewables segments.

Founded in 1988, IEM, headquartered in Longview, WA with branch operations in Visalia and Carson, CA, is a leading provider of electrical apparatus repair, control systems integration, and distribution solutions. Reed Electric, a 93-year-old, fourth-generation family-owned company that specializes in the repair and sale of motors, pumps, and generators, has facilities in Los Angeles, CA and Reno, NV. Founded in 1999, A+ Electric Motor offers complete pump and motor repair services for clients in Montana, Wyoming, Idaho, and the Dakotas through its two repair facilities in Billings and Butte, MT.

Spencer Wiggins, President of IEM, stated, “After Clint Bundy and I developed the idea of the Pacific consortium, the Bundy Group team worked flawlessly and in a collaborative fashion with respective Pacific firms to manage a highly competitive sale process.” Spencer added, “The end result was a great new partner in IPS and a Pacific valuation that was higher for each shareholder as a result of selling as a group versus selling the companies individually. We could not have been happier with the outcome that the Bundy Group team delivered.”

Roy Richard, President of Reed Electric, commented, “The Reed team has had great respect for IEM, A+, and Bundy Group for many years, and we were excited to join the Pacific consortium. Bundy Group did an outstanding job of coordinating all Pacific members from beginning to end and treating the collective group as one team, which created fluid decision-making and an outstanding result.” Roy continued, “The value delivered for the shareholders by Bundy Group was phenomenal, and the team at Reed Electric will have an ideal future partner in IPS.”

Joe Perry, General Manager of A+, stated, “Bundy Group was thorough in all phases of the sale process, worked non-stop, and had a relentless focus on delivering value for its clients.” Joe elaborated, “The Pacific sale provided A+ shareholders a premium value, and it gave us the opportunity to reinvest into IPS and realize additional gains.”

Clint Bundy stated, “Bundy Group is a specialist in the energy & power, automation, and industrial services industries, and the success of the Pacific engagement is a major achievement for our firm.” Clint further added, “This was a complex engagement, due, in no small part, to our coordinating three separate companies with the goal of acting as one group. We could not have executed and closed on this transaction without outstanding clients and a Bundy Group team that is among the best in the investment banking profession.”

Stewart Carlin with Bundy Group said, “Our work on behalf of the three clients included helping to articulate the vision of what a combined Pacific entity could look like and the steps to integrate the entities, all with the goal of demonstrating to the market that Pacific demanded a platform-worthy valuation.” Stewart added, “We enjoyed working in partnership with the Pacific clients to achieve such an outstanding outcome.”

Bundy Group has significant experience in the energy & power, automation, industrial services, and business services sectors, and has previously advised clients including MR Systems, RAM Industrial Services, and Dorsett Controls. For more information about our industry expertise and other recent transactions, visit Industry Expertise - Bundy Group.

About Bundy Group

Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The team of highly experienced investment bankers leverages extensive industry knowledge and experience to provide hands-on guidance to clients through every phase of the transaction. With over 250 closed deals over the past 32 years, Bundy Group’s primary goals are to provide high quality options and actionable insights and to deliver an optimal strategic fit at a premium value for our clients.

Bundy Group Securities, LLC, is a registered broker-dealer and member of FINRA and SIPC. Check the background of Bundy Group Securities, LLC at FINRA's BrokerCheck. Testimonials may not be representative of the experience of other customers and are no guarantee of future performance or success.

In this article for Control Engineering, Bundy Group provides an update on mergers & acquisitions and capital placement activity in the automation market.

The second half of 2021 has continued to witness a tremendous amount of mergers and acquisition and capital raise activity in the automation sector. Strategic buyers, private equity groups, family offices and fundless sponsors have been attracted to the industry segment for a variety of reasons. This includes the projected growth of the automation market, the opportunity for consolidation in the segments, and the ability to own proprietary hardware and software systems.

A supporting statistic from the recent J.P. Morgan report on the automation industry indicates that approximately 88% of control system integrators surveyed anticipate growth in demand for automation solutions over the next 12 months [ J.P. Morgan – Automation Industry Report; November 12, 2021]. As demonstrated by the plethora of transactions that occurred in 2021, buyers and investors are bullish about the trajectory of the automation space, and there are no signs of letting up for the buying and selling of, or investing in, automation companies.

Two representative transactions to note are Inframark’s acquisition of MR Systems and Sverica Capital Management’s investment in Automated Control Concepts (“ACC”). MR Systems, a leading automation and cybersecurity solutions provider focused on the water and wastewater sector, was acquired by Inframark, an industry leader in the operations, maintenance, and management of water and wastewater facilities (see below case study). Sverica, a private equity investment firm, acquired a majority position in ACC, a systems integrator specializing in process control, manufacturing intelligence and cyber security & industrial networking.

Greg Hylant, Vice President with Sverica, stated, “The systems integration ecosystem within the industrial automation space is extremely fragmented, with only a small handful of players having reached national scale. We identified ACC as a high-growth regional platform that could benefit from our capital and expertise in business-building to take full advantage of the wave of American manufacturers embracing the power of Industry 4.0.”

These two transactions capture the range of M&A and capital raise events that are occurring across automation, robotics, control system integration, software and Industrial Internet of Things (IIoT). A total of 19 automation transactions were made in the fourth quarter of 2021.

12/2/21

Yokogawa Electric Corporation (TOKYO: 6841) announces it has acquired all of the outstanding shares of PXiSE Energy Solutions LLC, a San Diego-based developer of software that enables utilities and other grid operators to deliver reliable and stable power by managing renewables and distributed energy resources (DERs) in real time. Through this acquisition, Yokogawa will build on its capabilities in the monitoring and control of power generation facilities and assist customers in the power transmission and distribution sectors to meet their clean energy goals. Learn more

11/23/21

Regal Rexnord, a global provider in the engineering and manufacturing of industrial powertrain solutions, power transmission components, electric motors and electronic controls, and specialty electrical components and systems, has announced that it has completed the strategic acquisition of Arrowhead Systems (“Arrowhead”), based in Oshkosh, Wis. Learn more.

11/16/21

Circonus, the full-stack monitoring and analytics platform built for the modern-day enterprise, today announced it has secured $10 million in Series B funding led by Baird Capital with participation from existing investors NewSpring Capital, Osage Venture Partners, and Bull City Venture Partners. The new funding will be used to accelerate growth, scale product innovation, and build upon the company’s record-setting performance in 2021. Learn more.

11/10/21

Middle market private equity firm One Equity Partners (OEP) has completed the acquisition of USNR, the world’s most comprehensive supplier of equipment and technologies for the wood processing industry, and Wood Fiber Group, a manufacturer and supplier of sawmill consumables, parts, and services. Learn more.

11/7/21

ATS Automation Tooling Systems Inc. (TSX: ATA) (“ATS” or the “Company”), an industry-leading automation solutions provider, announced it has entered into a definitive agreement to acquire SP Industries, Inc. (“SP”), a designer and manufacturer of high-grade biopharma processing equipment, life sciences equipment, and lab apparatus products for US$445 million (~C$550 million), subject to customary post-closing adjustments, representing 15.3x SP’s trailing 12 month adjusted EBITDA or 11.9x post synergies. Learn more.

11/4/21

Inframark, LLC, an industry leader in the operations, maintenance, and management of water and wastewater facilities, is pleased to announce that it has acquired MR Systems, Inc., an Atlanta-based company that specializes in providing automation, process controls, instrumentation, and supervisory control and data acquisition (SCADA) systems for the municipal water and wastewater market. The addition of MR Systems to Inframark’s existing SCADA division brings a level of scale that will enable Inframark and MR Systems to create an embedded SCADA offering throughout the Inframark portfolio, primarily consisting of water and wastewater contract operations and municipal utility district operations and maintenance (O&M) clients, in addition to their commercial and industrial customer base. Learn more.

11/3/21

Audax formed EIS in September 2019 through the carveout of a collection of distribution assets from Genuine Parts Company (NYSE: GPC) with the vision of creating a value-added distributor of process materials and supply chain solutions to customers that support critical electrical and power transmission infrastructure. Audax will continue to work with the EIS management team to drive further organic growth and accelerate its acquisition strategy to expand its distribution footprint, customer base, and portfolio of value-add offerings. Learn more.

11/2/21

Inphase is a complete E&I construction, commissioning and maintenance service provider with a strong customer base and presence across southern Alberta and Saskatchewan. They are a full-service electrical contractor for large industrial Solar projects and were the first electrical contractor to install an industrial-size solar farm in Western Canada. Learn more.

11/1/21

H.I.G. Capital, a leading global alternative investment firm with over $45 billion of equity capital under management, announced that its portfolio company, United Flow Technologies, a platform established to invest in the municipal and industrial water and wastewater market, has completed the acquisitions of Tesco Controls, Inc. (“TESCO”) and The Henry P. Thompson Company (“HPT”). TESCO and HPT represent UFT’s second and third acquisitions, respectively, following its initial acquisition of MISCOwater in July 2021. Learn more.

10/27/21

Sverica Capital Management LP (“Sverica”), a private equity investment firm, today announced that on October 22 it acquired a majority position in Automated Control Concepts, LLC (“ACC” or the “Company”), a systems integrator specializing in process control, manufacturing intelligence and cyber security & industrial networking. Learn more.

10/26/21

Fabric announced that it has closed a $200 million Series C funding round led by existing investor Temasek, with participation from Koch Disruptive Technologies, Union Tech Ventures, Harel Insurance & Finance, Pontifax Global Food and Agriculture Technology Fund (Pontifax AgTech), Canada Pension Plan Investment Board (CPP Investments), KSH Capital, Princeville Capital, Wharton Equity Ventures, and others. Learn more.

10/21/21

Industrial Flow Solutions, an industrial pumping solutions provider headquartered in New Haven, Conn., recently announced that it will acquire Clearwater Controls Ltd, a wastewater solutions provider based in Glasgow, Scotland. Clearwater Controls offers a broad line of wastewater products, including deragging intelligent and process advanced monitoring technology. Terms of the acquisition were not disclosed, but Clearwater Controls will retain its company name and brand. Learn more.

10/14/21

Kaman Distribution Group (“KDG”) announced that it has acquired Integro Technologies Corporation. Based in Salisbury, North Carolina, Integro Technologies is a nationally recognized and industry-leading vision integrator and inspection company. With over 50 employees and 30 degreed engineers, Integro develops turn-key productivity solutions through machine vision and robotics. Learn more.

10/13/21

Dexterity, the creators of intelligent robotic systems for logistics, warehouses, and supply chain, today announced that it raised an additional US$140M in Series B equity funding and debt. Major existing investors Lightspeed Venture Partners and Kleiner Perkins greatly expanded their commitment to Dexterity by leading the Series B, with additional participation from Obvious Ventures, B37 Ventures and Presidio Ventures. Dexterity will use the new capital to support the growth of the company as its first thousand robots are deployed into production. Learn more.

10/13/21

HBM Holdings (“HBM”) announced it has acquired Control Devices, LLC of Fenton, MO. Control Devices, a portfolio company of Goldner Hawn founded in 1963, is a leading designer and manufacturer of highly engineered flow-control products utilized in niche applications across a diverse array of end markets. The acquisition expands HBM’s portfolio in the industrial components space, adding Control Devices to the existing roster of Mississippi Lime Company, Aerofil Technology, HarperLove, and Schafer Industries. Learn more.

10/11/21

Emerson to Receive 55% Stake of New AspenTech. AspenTech Shareholders to Receive Approximately $87 Per Share in Cash and 0.42 Shares of New AspenTech for each AspenTech Share, Providing Upside through 45% Stake. New AspenTech Expected to Drive Double-Digit Annual Spend Growth, Best-in-Class Profitability, Strong Free Cash Flow and Be Positioned to Pursue and Complete Strategic Transactions. Learn more.

10/6/21

IES Holdings, Inc. (“IES”) (NASDAQ: IESC) announced that it has invested in Automation Intellect, a Charlotte, NC-based Software as a Service (“SaaS”) company that provides machine performance analytics to manufacturing companies. Automation Intellect’s leading Industrial Internet of Things (“IIoT”) platform provides actionable insights to plant managers to help to reduce downtime and increase manufacturing efficiency and throughput. Learn more.

10/5/21

Nintex, the global standard for process management and automation, announced a definitive agreement to sell a majority stake in the company to TPG Capital, the private equity platform of global alternative asset firm TPG. Across its platforms, TPG has invested in leading software companies including C3 AI, Planview, ThycoticCentrify, WellSky, and Zscaler. Nintex’s current majority investor, Thoma Bravo, a leading software investment firm, plans to make a new equity investment in the company and maintain a significant minority interest. The transaction is expected to be completed by the end of 2021, subject to customary closing conditions. Learn more.

10/1/21

ECS Solutions, Inc. founded in 1977, and dedicated to performance improvement and innovation in batch manufacturing, has acquired the assets of LPR Automation, LLC of Bowling Green, KY. LPR Automation, founded in 2003, specialized in a wide range of control engineering and automation services. Learn more.

Bundy Group is a CFE Media and Technology content partner.

Bundy Group, a 32-year-old, industry-focused investment bank, announces that it has advised MR Systems, a leading automation and cybersecurity solutions provider, in a sale to Inframark, an industry leader in the operations, maintenance, and management of water and wastewater facilities. Inframark is a portfolio company of New Mountain Capital, a New York-based private equity group. The transaction was led by Clint Bundy and Stewart Carlin, Managing Directors with Bundy Group. Lorenc Biqiku and Megan Hagemann, Vice Presidents with Bundy Group, also worked on the MR Systems transaction team.

MR Systems has been a services leader in the water and wastewater segment for nearly 30 years, and it maintains a first-class organization in the form of a skilled base of employees and multiple locations throughout the Eastern U.S. Key solutions offered by MR Systems include control system integration, cybersecurity, process controls, artificial intelligence, and process visualization.

Clint Bundy commented, “MR Systems has been the industry standard in the automation and cybersecurity solutions segment for municipal water and wastewater operations since 1994, and the company’s impressive growth over the past few years further validates the strength and value-proposition to its clients.” Clint added, “The partnership with Inframark, one of the largest water and wastewater operators in North America, will offer MR Systems substantial new resources and opportunities as the company continues to grow.”

Stewart Carlin stated, “Tom Hopkins and the MR Systems leadership team were outstanding to work with throughout the process.” Stewart further added, “From the start, we developed a strong collaborative relationship that enabled us to clearly articulate and support MR System’s unique value proposition, inclusive of developing new analytical tools that will benefit management in the long-term. Bundy Group’s experience working with companies at the forefront of innovation, coupled with our deep industry relationships, allowed us to deliver an outcome that will be transformative for both MR Systems and Inframark.”

Tom Hopkins, Chief Executive Officer and Chairman of the Board of Directors for MR Systems, commented, “We engaged Clint and the Bundy Group team because of their relationship building efforts with the MR Systems team and impressive track record in the automation, cybersecurity, and technology segments. The Bundy Group team provided a full commitment to MR Systems, delivered a full rolodex of highly attractive buyers, and managed a competitive sales process, all of which resulted in our selecting a strong-fit partner and receiving an outstanding outcome for the shareholders.” Furthermore, Tom added, “Simply put, we could not have been happier with Bundy Group as our investment banking advisor.”

Bundy Group has significant experience in the automation, technology and business services sectors and has previously advised clients including GrayMatter, Dorsett Controls, and Custom Controls Unlimited, among others. For more information about our industry expertise and other recent transactions, visit Controls & Automation - Bundy Group.

About Bundy Group

Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The team of highly experienced investment bankers leverages extensive industry knowledge and experience to provide hands-on guidance to clients through every phase of the transaction. With over 250 closed deals over the past 32-years, Bundy Group’s primary goals are to provide high quality options and actionable insights and to deliver an optimal strategic fit at a premium value for our clients.

Bundy Group Securities, LLC, is a registered broker-dealer and member of FINRA and SIPC. Check the background of Bundy Group Securities, LLC at FINRA's BrokerCheck. Testimonials may not be representative of the experience of other customers and are no guarantee of future performance or success.

Charlotte, NC – Bundy Group, LLC announces that Bundy Group Securities, LLC has been approved by FINRA as a securities broker-dealer, effective March 19, 2021. As a FINRA member, Bundy Group Securities will also join the Securities Investor Protection Corporation (SIPC).

Bundy Group Securities will specialize in providing advisory, mergers & acquisitions, and capital raise services for securities-related transactions. With the addition of its broker-dealer, the Bundy Group team will be able to offer a full range of investment banking services to its business, shareholder, and financial-sponsor clients.

Clint Bundy, Managing Director with Bundy Group and President of Bundy Group Securities, commented that “adding the securities broker-dealer demonstrates our group’s continued focus on servicing our clients with a full complement of mergers & acquisitions and capital raise services and our commitment to operating according to best practices established by the financial services industry.” Furthermore, Clint added, “Our 32-year history demonstrates a focus on delivering superior outcomes for our clients in a transparent, ethical manner. Our broker-dealer designation reinforces those principles.”

Bundy Group provides investment banking and transaction advisory services to clients across numerous markets, including healthcare, life sciences, technology, automation, energy, and infrastructure. The highly experienced team within Bundy Group includes transaction and operating professionals with a combined 100 years of experience in investment banking and corporate finance. As a 32-year-old boutique firm, the senior team leverages its specialized focus on our core markets to guide clients through the entire process of selling their company, raising capital, and pursuing acquisitions for growth. To learn more about our services, please visit Services - Bundy Group.

Securities offered through Bundy Group Securities, LLC, a registered broker-dealer and member of FINRA. Check the background of Bundy Group Securities, LLC at FINRA's BrokerCheck.

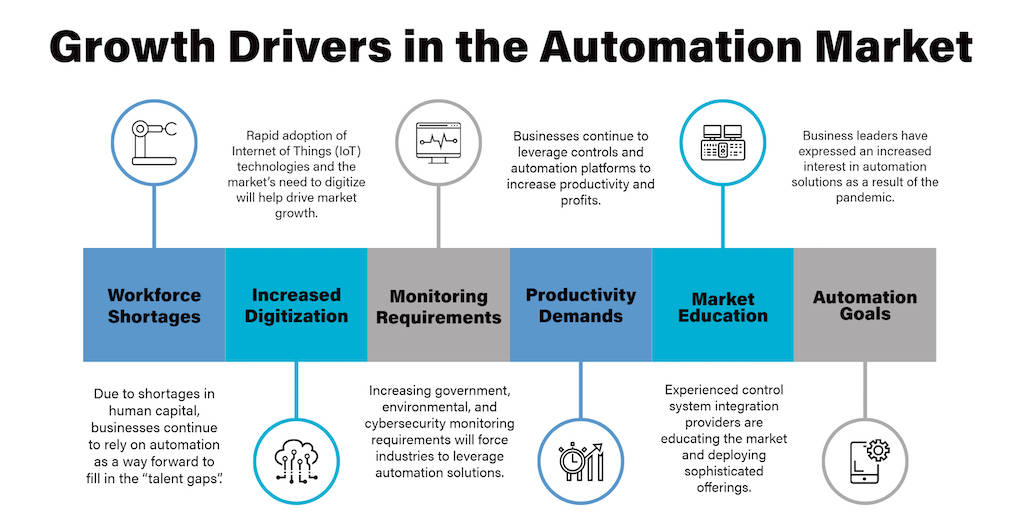

Global automation is expected to expand 51% from 2020 to 2025, driven by personal shortages, remote monitoring and increased records requirements and productivity demands. Robust mergers and acquisition investments to enhance margins validate the growth, explains the Bundy Group in this article for Control Engineering.

Automation markets, investments and mergers and acquisitions are hot globally to meet personnel shortages, monitoring requirements and productivity needs. Bundy Group, an investment bank and advisory firm, has followed robust mergers and acquisitions and capital placement activities in the automation market.

The automation sector is experiencing significant expansion, and the business community is noticing. A report on the dynamic industrial automation and market-compelling investment opportunities, Florian Funke, L.E.K. Consulting and Harris Williams said the global automation market is projected to increase 51% from $175 billion in 2020 to $265 billion in 2025.

Numerous drivers for the growth include companies filling in the void created by a shortage of personnel, managing monitoring requirements driven by regulation, and generating productivity improvements to enhance margins. This sizable and growing automation market’s value has been further validated by the robust mergers and acquisitions (M&A) activity in industrial automation markets.

While the automation market has experienced a significant amount of M&A and investment activity over the past decade, this continued pace of acquisitions and capital placements since the beginning of the COVID-19 pandemic has demonstrated the resilience of the industry. The pandemic reinforced the mission-critical nature of the automation market as controls and automation markets prepare for growth in the post-pandemic age. Automation end-users as well as buyers and investors are realizing opportunities.

Strategic buyers and financial sponsors (private equity, family offices and growth equity firms) have recognized the vital role the automation market plays in the global economy, which is further driving an appetite to acquire and invest in businesses that provide automation services, products and solutions.

Aggressive buyer and investor demands place automation-related business owners in a preferred category, and automation companies positioned in a sale or capital raise process maximize chances for significant interest and premium valuations.

Business sale and capital placement transactions through August 2021 are reflective of heightened interests in the automation industry.

An August 2021 control system integration transaction to note is Revere Control Systems’ acquisition of Florida-based Curry Controls, which solidifies Revere as an automation leader in the Southeast. A recent series of 2021 automation manufacturing acquisitions was led by Audax, a Boston-based financial sponsor, which started with the acquisition of SJE followed then by the immediate add-on acquisition of control systems manufacturer LW Allen.

In the robotics industry, a subsegment of the broader automation space, Zebra Technologies acquired Fetch Robotics in a $290 million transaction. The transaction value / revenue multiple for the Fetch Robotics deal was 30.0x, which further validates the premium value assigned to many companies in the robotics market.

Some 2021 automation transactions follow, newest to oldest.

8/10/2021

Systems Controls, a designer and manufacturer of control panels owned by Comvest Partners, acquired Keystone Electrical Manufacturing, an Iowa-based control systems manufacturing firm.

8/5/21

SJE, an automation manufacturing firm owned by Audax, acquired LW Allen, a designer, manufacturer, distributor and installer of water and wastewater control systems and treatment pump systems to municipal and industrial customers.

7/1/2021

Zebra Technologies, an industrial software provider, acquired Fetch Robotics, a developer of autonomous mobile robots.

7/1/2021

enVista, a global software, consulting, managed services and automation solutions firm, acquired long-time partner HCM Systems, a systems integrator, specializing in customized, complex highly integrated conveyor and control systems for manufacturing and distribution-centric organizations.

6/28/21

Audax, a private equity group, acquired SJE, a manufacturer and system integrator of control solutions for the water and wastewater sector.

6/9/2021

Semios, the leading precision-farming platform for permanent crops, acquired Altrac, developers of an agriculture automation platform enabling farmers to monitor and control important agricultural systems required to produce high-value crops from their computer or mobile device.

6/2/2021

ATS Automation Tooling Systems, an automation solutions provider, acquired Control and Information Management, an industrial automation system integrator based in Ireland.

5/4/2021

Revere Controls, an engineering system integration and construction services firm, acquired Florida-based Curry Controls, an engineering, panel assembly, and installation services firm.

4/26/2021

Publicly-traded Brooks Automation acquired Precise Automation, a developer of collaborative robots and automation systems.

4/7/2021

Actemium, a division of international conglomerate Vinci Energies, has acquired Outbound Technologies, a Midwestern-based control systems integrator.

3/1/2021

Accenture, an international consulting firm, acquired Pollux, a Brazilian-based industrial robotics and automation solutions firm.

2/17/2021

Gray, a fully integrated service provider, acquired Stone Technologies, a control systems integrator that provides complete industrial automation and information services.

2/17/2021

KKR, an international private equity group, acquired Flow Control Group, a leading distributor of flow control and industrial automation solutions.

2021 continues as a robust year for M&A and capital placement activity in the automation segment. Additional closed transaction announcements are expected through the end of the year and into 2022, and the Bundy Group team sees buyer and investor demand continuing to build for automation firms. Independent companies are in an enviable position for strategic options to consider and attractive business valuations to realize.

Author Bio: Clint Bundy is managing director, Bundy Group, which helps with mergers, acquisitions and raising capital. Bundy Group is a Control Engineering content partner. Edited by Mark T. Hoske, content manager, Control Engineering, CFE Media and Technology, mhoske@cfemedia.com.

KEYWORDS: Automation mergers and acquisitions

CONSIDER THIS

How are you advising your company to fill in its automation, controls and instrumentation needs?

Through the late summer of 2021, mergers & acquisitions (M&A) and capital markets activity in the automation industry has continued to demonstrate the strength and attractiveness of this rapidly growing segment. The resilience of the industry through the COVID-19 pandemic further reinforced the mission-critical nature of the automation market (see the Bundy Group article entitled “The Controls & Automation Market: Preparing for Growth in the Post-Pandemic Age”). Furthermore, strategic buyers and financial sponsors (i.e. private equity, family offices, growth equity) have recognized the vital role the automation market plays in the global economy, which is driving their appetite to acquire and invest in businesses that provide automation services, products, and solutions. This aggressive buyer and investor demand places business owners in a preferred category, and automation companies that are positioned correctly in a sale or capital raise process maximize their chances for significant interest and premium valuations.

Business sale and capital placement transactions that have occurred through August 2021 are reflective of the heightened interest in the automation industry. An August 2021 control system integration transaction to note is Revere Control Systems’ acquisition of Florida-based Curry Controls, which solidifies Revere as an automation leader in the Southeast. A recent series of 2021 automation manufacturing acquisitions was led by Audax, a Boston-based financial sponsor, which started with the acquisition of SJE followed then by the immediate add-on acquisition of control systems manufacturer LW Allen. In the robotics industry, a subsegment of the broader automation space, Zebra Technologies acquired Fetch Robotics in a $290MM transaction. The transaction value / revenue multiple for the Fetch Robotics deal was an eye-popping 30.0x, which further validates the premium value assigned to many companies in the robotics market. For additional examples, please see below a list of noteworthy 2021 automation transactions.

In summary, 2021 has been a robust year for M&A and capital placement activity in the automation segment. Additional closed transaction announcements are expected through the end of the year and into 2022, and the Bundy Group team sees buyer and investor demand continuing to build for automation firms. The end-result is that independent companies are in an enviable position in terms of strategic options to consider and attractive business valuations to realize.

Bundy Group is a boutique investment bank that specializes in representing controls and automation, Internet of Things, and cybersecurity companies in business sales, capital raises, and acquisitions. Over the past 32 years, Bundy Group has advised and closed over 250 transactions, which includes numerous automation-related transactions.

From Bundy Group client engagements in the dermatology and aesthetics industries, we have seen firsthand the continued growth of these markets and the corresponding premium valuations that can accompany independent physician practices. Clint Bundy, Managing Director with Bundy Group, shares key market insights in this article for Practical Dermatology.

PD0921_CF_Retained-Value-1After 18 months of industry conferences being postponed, the recent Electrical Apparatus Service Association (EASA) Convention in Fort Worth, Texas was especially welcomed by Clint Bundy, Managing Director with Bundy Group. For over 32 years, Bundy Group has been active in advising business owners and management teams in the Energy & Power, Electromechanical, and Automation sectors. It was great to be back at the industry conference! As Bundy Group has done for over a decade at EASA shows, meeting with business owners and our buyer relationships, stopping by booths of many of our friends and running into long-time colleagues was a reminder of the value to our team of attending this conference.

COVID Didn't Stop the Industry Momentum

While the pandemic impacted Bundy Group’s attendance at trade shows like EASA, it did not stop our work with companies and owners in the Energy & Power, Electromechanical and Automation sectors. Our “Closed Deal” completion work over the past year with transactions such as Custom Controls Unlimited and E-Merge are prime examples of this activity during the pandemic. At this time, Bundy Group is working on six engagements in this market, with a focus on business sales and capital raises. We also maintain an ongoing dialogue with our strategic and private equity buyer relationships, some of whom were also in attendance at the EASA conference. These buyer relationships stress their desire to stay in a strong working relationship with Bundy Group, which allows them the opportunity to participate in engagements we are actively representing.

Positioned for Growth

The universal takeaway from business owners at the EASA Conference is that the industry is expecting a strong runway for the next few years. Because of the critical services many in the EASA sector provide, none of the firms were “brought to their knees” by the pandemic. Instead, the consensus was some repair and maintenance work, as well as system integration assignments, had been delayed due to lockdowns. While this negatively impacted 2020 performance for some industry players, the rebound is occurring, as client work that would have normally been completed in 2020 is now being addressed in 2021.

Furthermore, many owners have worked hard over the past ten years to diversify industries they service. By taking this step, their companies have weathered volatile markets, including the pandemic. This will allow companies to accelerate their performance in a post-pandemic era. Excitement and optimism are certainly in the air for these service providers for the future as a productive next 18 months (and longer) is expected.

Talented Employees and Servicing Clients

Finding skilled and motivated employee talent is very challenging for most businesses today, and our meetings at EASA affirmed that concern within this specific niche. For a variety of complex reasons, companies are constantly evaluating how to balance this reality with the needs of their businesses and clients. As the employment picture evolves, companies are leaning on their nucleus of experienced employees more than ever. Companies are continuing to look to automation and technology solutions to help fill in the gap of employee talent, gain operating leverage and find means to increase margins without sacrificing quality client service.

As Brian Beaulieu, Chief Economist with ITR Economics, stated in his keynote presentation at the EASA conference, businesses should focus on three fundamentals in order to successfully rebound from the pandemic and meet client demand expectations:

It's a Seller's Market

As is evident from Bundy Group’s current client engagements, as well as the active conversations at the EASA Conference, there is a tremendous amount of buyer interest in the Electromechanical, Energy & Power, and Automation sectors. Owners are receiving more calls from buyers than ever. Bundy Group receives frequent requests from buyers to review our client engagements. The Bundy Group-led engagement process focuses on delivering maximum value and options to our business owner clients. Buyers understand that they will have to be more aggressive in their valuations when buying a company represented by Bundy Group. However, they also acknowledge that they will acquire a company with strong attributes, that is in a “ready state” to close on a transaction and begin integration.

The consolidated feedback from the owners we met at the EASA Conference, coupled with our own experience, indicate M&A markets are well positioned for the next couple of years. Furthermore, with transaction tax rate uncertainties on the horizon for 2022, Bundy Group expects to announce a number of closed deals, including with companies active in EASA, by the end of 2021.

About Us

Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The 32-year-old firm has closed more than 250 transactions, specializing in several industries, including energy and infrastructure, healthcare and life sciences, industrials and manufacturing, and controls and automation. For more information about our industry expertise and other recent transactions, visit https://bundygroup.com/industry-expertise/.

Securities offered through Bundy Group Securities, LLC, a registered broker-dealer and member of FINRA. Check the background of Bundy Group Securities, LLC at FINRA's BrokerCheck.

Bundy Group announces that is has advised United Air Temp, Air Conditioning and Heating ("UAT") and its private equity owner Summit Park in an acquisition of Albemarle Heating & Air.

Headquartered in Charlottesville, Virginia, Albemarle provides heating, ventilation and air conditioning (“HVAC”) services, including installation, repair and maintenance to residential and commercial customers. Headquartered in Lorton, Virginia, UAT provides HVAC maintenance and replacement services to residential homeowners.

Michael Giordano, CEO of UAT, said, “We are excited to partner with the management team and employees of Albemarle and look forward to building upon the excellent reputation they’ve built in the Charlottesville market. Albemarle is a natural extension of our operations in Virginia and consistent with our strategy of building a business of leading brands in attractive markets.”

Ralph Sachs, General Manager of Albemarle, added, “We look forward to our partnership with UAT and Summit Park. We have always prided ourselves on our culture of integrity and customer service and we are thrilled to have found partners that share our values.”

Bundy Group advised Summit Park and United Air Temp in the transaction.

United Air Temp, Air Conditioning and Heating LLC ("UAT") is a leading provider of residential heating, ventilation, and air conditioning (“HVAC”) services. Headquartered in Lorton, Virginia, UAT provides HVAC maintenance and replacement services to residential homeowners. Its primary operations are in Washington D.C and the surrounding area in Northern Virginia and Maryland, with additional operations in North Carolina, Georgia, and Florida. UAT has built a large, loyal customer base through its best-in-class service and responsiveness, as well as consistent, high-quality work from its skilled technicians.

Summit Park is a Charlotte, North Carolina-based private investment firm focused exclusively on the lower middle market. The firm invests across a range of industries, including business and consumer services, light manufacturing, and value-added distribution in the Eastern half of the United States. The firm’s capital can be used to facilitate a change in ownership, to support expansion and growth, to provide partial liquidity to existing owners, or to support an industry consolidation plan. For more information, visit www.summitparkllc.com.

Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The 32-year-old firm has closed more than 250 transactions, specializing in several industries, including energy and infrastructure, healthcare and life sciences, industrials and manufacturing, and controls and automation. For more information about our industry expertise and other recent transactions, visit https://bundygroup.com/industry-expertise/.

Securities offered through Bundy Group Securities, LLC, a registered broker-dealer and member of FINRA. Check the background of Bundy Group Securities, LLC at FINRA's BrokerCheck.

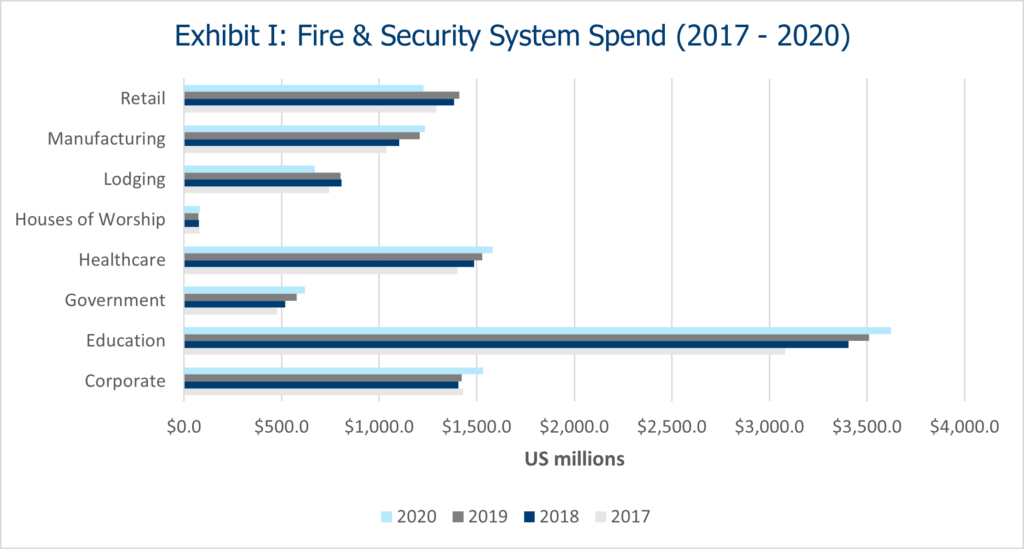

The pandemic brought unprecedented change to businesses and industries across the globe and the Fire, Security & Safety industry was no exception. Players in this industry experienced constraints, obstacles, rebounds, and renewed growth. As the segment has evolved over the last several years, including during the pandemic, it continues to garner the attention of strategic buyers and financial sponsors that are either active in this market today or want to be.

“2020 NSCA Electronics Systems Outlook: Winter Edition.” NSCA.

The Fire, Security & Safety Industry: A Macro Perspective

In 2020, restrictions and mandates resulted in limited access to facilities, including healthcare, government, and commercial buildings. The inability to enter client sites impacted the ability of industry players to complete inspections and installations.

Fortunately, as restrictions have eased, companies are resuming a largely normal schedule. As a result, there is now a strong and prompt rebound with testing, inspections, installation and service work. This resurgence in activity, which has been partially driven by spring and summer 2020 work shifting to the latter part of 2020 and into 2021, has resulted in increased revenue for companies starting in Q3 2020 and continuing through today.

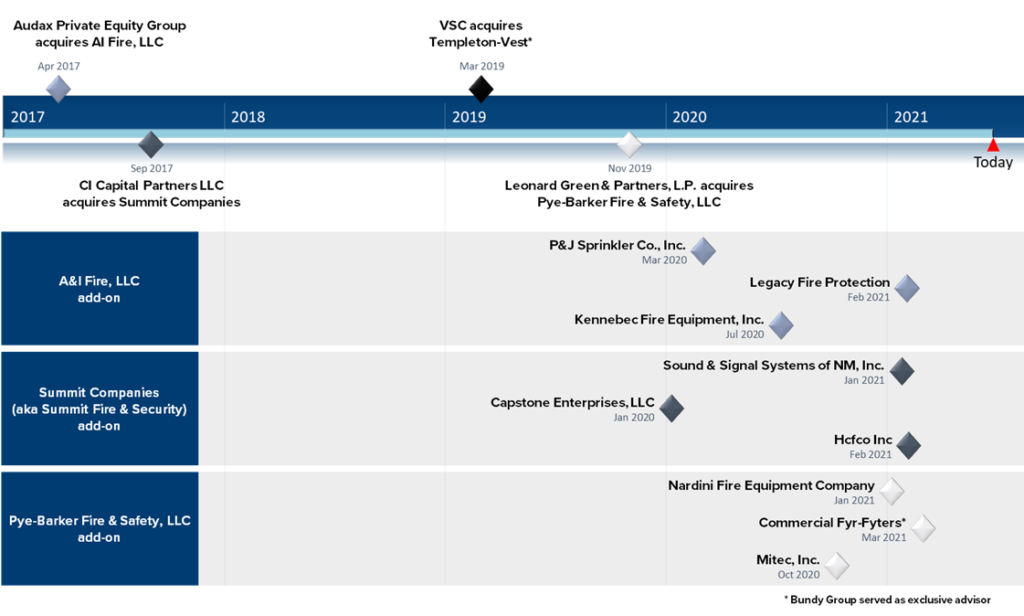

While the pandemic may have caused an operational impact on some Fire, Security & Safety organizations, what was not challenged was the continued pace of consolidation. The last five years have realized a wave of financial sponsor investment activity and strategic buyer acquisitions, and the momentum continued throughout 2020. The pandemic tested and proved the resilience of the Fire, Security & Safety market, which further fueled mergers and acquisitions activity in the space.

Surviving and Exiting the Pandemic Storm

A review of the Fire, Security & Safety Mergers and Acquisitions (M&A) market for the past 18 months provides a more comprehensive picture of the market today and the future.

Spring 2020 became a moment of reflection for buyers as the impact of state shutdowns had to be evaluated and considered. A Fire, Security & Safety acquisition candidate not only had to be assessed based on the ongoing impact of restrictions, but its financial performance during the pandemic also had to be reviewed through this same lens. Correctly valuing a company, and even closing on a transaction, became more challenging for buyers as the volatility of financials introduced additional complexity to transactions.

By Fall 2020, buyer confidence rose substantially as the monthly performance of many acquisition targets gravitated back to pre-pandemic norms. This acceleration was related to acquisition candidates demonstrating how they were able to navigate the restrictions and regain access to client facilities. An increase in inspections, which are vital to clients and their operating standards, built confidence throughout the industry. In addition, companies were able to work through a pre-existing backlog for new installations, which had also been delayed as a result of the pandemic.

By the beginning of 2021, many companies in the Fire, Security & Safety market had fully adjusted to the “new normal” and were succeeding, which the buyers recognized. A transaction example is Bundy Group’s recent representation of a Southeastern-based, full-service fire protection company, which was acquired by a financial sponsor-backed strategic buyer. The company experienced an operational and financial impact in the spring of 2020, but it was back to full performance by Q4 2020. The company attracted strong interest from the market, and Bundy Group was able to obtain a 30% transaction value premium for the seller relative to an offer previously submitted.

An Industry Built on Value

The value drivers and core fundamentals of the Fire, Security & Safety industry allowed companies to persevere and ultimately succeed during the pandemic.

Consolidation Activity: Continued Momentum Through the Pandemic

The aggressive pace of consolidation can be referenced by numerous case studies. For example, Summit Companies, owned by CI Capital, has completed 41 acquisitions since 2017. Another prime example is Pye-Barker, owned by Leonard Green, which now has over 80 locations and already closed nine acquisitions in 2021.

Mergermarket. “Fire Safety A Hot-Bed Of M&A Activity.” Forbes, 8 Mar. 2021.

Looking Ahead to 2022 and Beyond

The renewed strength of the Fire, Security & Safety industry is expected to continue as companies execute on client service and find new means for growth.

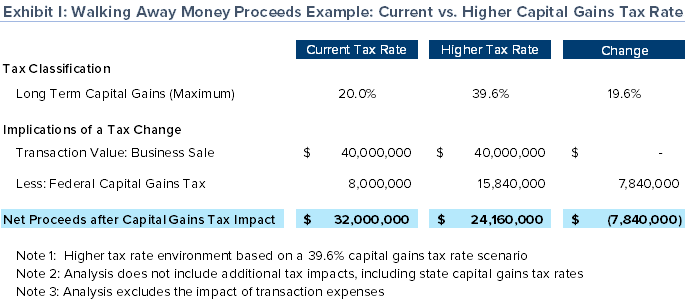

We are in a historically low tax rate environment, but this is expected to change as the Biden administration and Congress continue to signal a desire to raise personal and business taxes. If changes are made, it is possible, and likely probable, that most business owners will owe additional taxes in a sale event. The following scenario demonstrates how a capital gains tax rate increase from 20.0% to 39.6% could lead to a nearly 25.0% decrease in walking away money to a business owner.

In addition to transaction tax concerns, owners have made note of the continual and increasing calls they are receiving from strategic buyers and financial sponsors. Regardless of geography and size, owners in the Fire, Security & Safety market have multiple buyer options to consider, whether they know it or not. Based on Bundy Group’s experience in the sector and numerous buyer relationships, we believe this much buyer demand should create a fertile environment for the foreseeable future for owners interested in a liquidity event. If owners are able to use information, competition, and seasoned advisors to their advantage, then achieving a successful and lucrative wealth creation event through a partial or full sale is possible.

Conclusion

While 2020 brought temporary upheaval to operations for Fire, Security & Safety companies, industry players were able to adapt successfully and were largely back to pre-pandemic performance levels by the end of 2020. This resilience has been recognized by the M&A market, and, as a result, buyers have additional confidence in paying attractive valuations for investments and acquisitions in the Fire, Security & Safety market. Most companies considering a sale or recapitalization will have numerous options and be in a great position to demand value – especially with the use of competitive pressure on buyers in a sale process.

About Us

Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The 32-year-old firm has closed more than 250 transactions, specializing in several industries, including Fire, Security & Safety; Controls & Automation; Healthcare and Life sciences; Technology; Energy and Power; and Infrastructure. For more information about our industry expertise and other recent transactions, visit https://bundygroup.com/industry-expertise/. Securities offered through Bundy Group Securities, LLC, a registered broker-dealer and member of FINRA. Check the background of Bundy Group Securities, LLC at FINRA's BrokerCheck.

In collaboration with the Controls System Integrators Association (CSIA), Bundy Group presented by webinar a mergers & acquisitions update for business owners, executives and industry professionals active in the automation and control system integration markets. A replay of this webinar has been made available by CSIA at the link below.

Watch a Recording of the Webinar

Clint Bundy and Stewart Carlin, Managing Directors with Bundy Group, shared information about the following important topics:

| Clint Bundy, Managing Director and coverage lead for the Energy & Power and Electromechanical Services sectors, will be in attendance at the EASA 2021 Convention from June 27-29 in Fort Worth, Texas. Schedule to meet with Clint during or following the convention at the link below. |

Clint Bundy, Managing Director

Mergers & Acquisitions | Capital Raises

clint@bundygroup.com

(704) 942-8300

| For conference details, visit EASA's Annual Convention & Solutions Expo. Bundy Group is an industry-focused investment bank that specializes in representing business owners and management teams in business sales, acquisitions, and capital raises. The 32-year-old firm has closed more than 250 transactions, specializing in several industries, including Energy & Power, Electromechanical Services, Controls & Automation, and Industrials & Manufacturing. For more information about our industry expertise and recent transactions, visit Bundy Group - Industry Expertise. |